Is Pool TradingFx safe?

Business

License

Is Pool TradingFx A Scam?

Introduction

Pool TradingFx is a relatively new player in the forex market, aiming to attract traders with promises of competitive trading conditions and a user-friendly platform. As with any financial service, especially in the volatile realm of forex trading, it is crucial for traders to conduct thorough due diligence before engaging with a broker. The importance of evaluating a forex broker cannot be overstated, as many traders have fallen victim to scams or poorly regulated entities that can jeopardize their investments. This article aims to investigate whether Pool TradingFx is a safe option for traders or if it bears the hallmarks of a scam. Our investigation is based on a comprehensive analysis of the broker's regulatory status, company background, trading conditions, customer experiences, and risk factors.

Regulation and Legitimacy

The regulatory environment in which a forex broker operates is a key indicator of its legitimacy. Regulation serves to protect traders by ensuring that brokers adhere to strict operational standards and provide a level of transparency. Unfortunately, Pool TradingFx lacks proper regulation, which raises significant red flags about its trustworthiness.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The absence of regulatory oversight means that Pool TradingFx is not subject to the stringent requirements imposed by reputable financial authorities. This lack of regulation can expose traders to higher risks, including potential fraud and mismanagement of funds. Furthermore, the companys short history—having been established in January 2023—adds to the uncertainty surrounding its operations. Traders should be cautious and consider the implications of engaging with an unregulated broker, as they may have limited recourse in the event of disputes or financial losses.

Company Background Investigation

Pool TradingFx was founded recently, which inherently poses risks associated with lack of experience and established credibility. The company claims to offer a variety of trading services, but details about its ownership structure and management team remain vague. This lack of transparency can be concerning, as it leaves potential clients without a clear understanding of who is behind the operations.

The management team‘s qualifications and experience are also critical factors in assessing a broker's reliability. Unfortunately, information regarding the team at Pool TradingFx is scant, leaving traders in the dark about the expertise driving the platform. A transparent company typically provides insights into its management, including professional backgrounds and previous achievements in the financial sector. The absence of such information raises questions about the company’s commitment to integrity and customer service.

Trading Conditions Analysis

When evaluating the overall trading conditions offered by Pool TradingFx, several factors come into play, including spreads, commissions, and other fees. The broker claims to provide competitive trading costs, but without transparent information, it is difficult to ascertain the actual value offered.

| Fee Type | Pool TradingFx | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Unknown | 1.0 - 2.0 pips |

| Commission Model | Unknown | Varies |

| Overnight Interest Range | Unknown | 0.5% - 3% |

While the broker does not explicitly disclose its fee structure, the lack of clarity can be a significant drawback for traders. Unusual fees or hidden costs can quickly erode profits, and traders should be wary of any broker that does not provide comprehensive information about its pricing model. The absence of competitive spreads or high commissions could indicate that the broker is not operating in the best interests of its clients.

Client Funds Security

The security of client funds is paramount when assessing the safety of a forex broker. Pool TradingFx has not provided adequate information regarding its fund protection measures. Traders should look for brokers that implement strong security protocols, such as segregated accounts, investor protection schemes, and negative balance protection.

In the case of Pool TradingFx, the lack of disclosed policies on these critical security measures raises concerns. If a broker does not prioritize the safety of its clients' funds, it may be indicative of deeper issues within the organization. Historical controversies surrounding fund safety can also be telling; however, there are no significant reports available about Pool TradingFx at this time. Nevertheless, the absence of transparency in this area should make potential clients think twice.

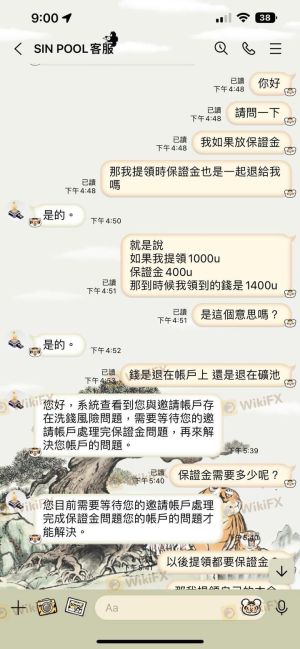

Customer Experience and Complaints

Customer feedback is an essential aspect of evaluating a broker's performance. While some reviews for Pool TradingFx are available, they are limited in number and often lack detail. Common complaints from traders can provide insight into the broker's responsiveness and overall service quality.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Unresponsive |

| Poor Customer Support | Medium | Slow Response |

One notable complaint revolves around withdrawal difficulties, where users reported challenges in accessing their funds. Such issues are significant as they directly impact a trader's ability to manage their investments. Additionally, if the company is slow to respond to inquiries or complaints, it can indicate a lack of commitment to customer service.

Platform and Execution

The trading platform is the primary interface through which traders interact with the market. A reliable platform should offer stability, user-friendliness, and efficient execution. Pool TradingFx claims to provide a robust trading environment, but without user testimonials and independent reviews, it is difficult to verify these claims.

Issues such as slippage, order rejections, and execution speed are critical in determining the overall trading experience. If traders frequently encounter problems in these areas, it may suggest that the broker is not adequately managing its trading infrastructure.

Risk Assessment

Engaging with Pool TradingFx presents several risks that potential clients should consider.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated broker with no oversight. |

| Fund Security Risk | Medium | Lack of clarity on fund protection measures. |

| Execution Risk | Medium | Potential issues with order execution and platform reliability. |

To mitigate these risks, traders should approach Pool TradingFx with caution. It is advisable to start with a small investment, if at all, and to conduct regular checks on the broker's performance and reputation.

Conclusion and Recommendations

In conclusion, while Pool TradingFx may offer some attractive features, the overall assessment suggests that it carries several risks that warrant caution. The lack of regulation, transparency regarding fees, and limited customer feedback indicate potential red flags.

For traders seeking a reliable and safe trading environment, it may be prudent to consider alternative brokers that are well-regulated and have a proven track record of customer satisfaction. Some recommended alternatives include brokers regulated by top-tier authorities such as the FCA or ASIC, which provide a higher level of investor protection.

In summary, is Pool TradingFx safe or a scam? The evidence leans towards caution, and potential clients should thoroughly evaluate their options before committing to this broker.

Is Pool TradingFx a scam, or is it legit?

The latest exposure and evaluation content of Pool TradingFx brokers.

Pool TradingFx Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Pool TradingFx latest industry rating score is 1.38, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.38 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.