Regarding the legitimacy of Novox forex brokers, it provides ASIC and WikiBit, (also has a graphic survey regarding security).

Is Novox safe?

Business

License

Is Novox markets regulated?

The regulatory license is the strongest proof.

ASIC Market Making License (MM)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

UnverifiedLicense Type:

Market Making License (MM)

Licensed Entity:

SIRIUS FINANCIAL MARKETS PTY LTD

Effective Date: Change Record

2013-09-26Email Address of Licensed Institution:

peter.aardoom@siriusau.comSharing Status:

No SharingWebsite of Licensed Institution:

www.cardiffglobal.comExpiration Time:

2022-08-23Address of Licensed Institution:

--Phone Number of Licensed Institution:

0283798980Licensed Institution Certified Documents:

Is Novox Safe or a Scam?

Introduction

Novox, a forex broker operating under the name Novox Capital Ltd, has gained attention in the trading community for its offerings in the forex market. Established in Cyprus, Novox positions itself as a market maker catering to both retail and institutional traders. However, the growing forex market also attracts numerous scams, making it essential for traders to conduct thorough evaluations of any broker before investing their hard-earned money. This article investigates the credibility of Novox by examining its regulatory status, company background, trading conditions, customer safety measures, and user experiences. Our investigation is based on a comprehensive analysis of online reviews, regulatory databases, and user feedback to provide a balanced perspective on whether Novox is safe or potentially a scam.

Regulation and Legitimacy

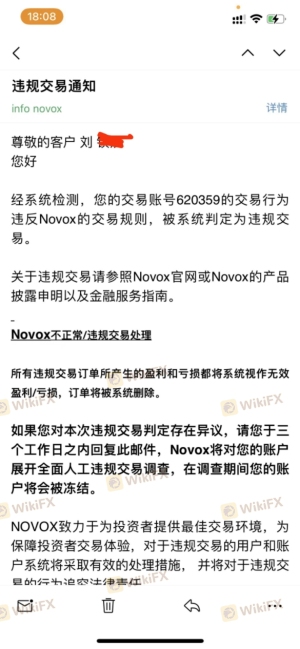

The regulatory framework within which a broker operates is crucial for assessing its legitimacy. Novox claims to be regulated by the Cyprus Securities and Exchange Commission (CySEC). However, reports indicate that its regulatory status is questionable, with unverified licenses and a history of operating under suspicious conditions. Below is a summary of Novox's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| CySEC | 224/14 | Cyprus | Unverified |

| ASIC | N/A | Australia | Revoked |

The importance of regulation cannot be overstated, as it serves as a safety net for traders, ensuring that brokers adhere to strict operational standards. In Novox's case, the lack of a verified regulatory license raises red flags. Reports suggest that the broker has previously been involved in dubious activities, including associations with other alleged scam brokers. This history of non-compliance and questionable practices warrants caution and further investigation into whether Novox is safe or a scam.

Company Background Investigation

To better understand Novox, it is essential to delve into its company history, ownership structure, and management team. Novox operates under Novox Capital Ltd, which has been in business for approximately 5 to 10 years. The companys ownership has links to individuals involved in other brokerage firms with questionable reputations. This connection raises concerns about the transparency and integrity of Novox's operations.

The management team at Novox is comprised of individuals with varying degrees of experience in the financial sector. However, the lack of publicly available information about their professional backgrounds and previous roles in the industry complicates the assessment of the company‘s credibility. Transparency in corporate governance is critical for building trust among traders, and the apparent opacity surrounding Novox’s management could be a cause for concern. Given these factors, traders must exercise caution when considering Novox as a trading partner, as the potential risks associated with the companys background could indicate that Novox is not entirely safe.

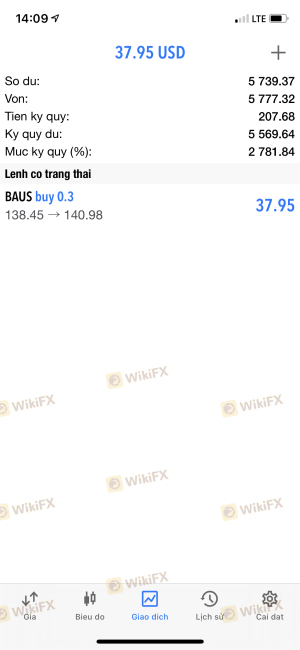

Trading Conditions Analysis

Understanding the trading conditions offered by Novox is essential for evaluating its overall appeal to traders. Novoxs fee structure includes spreads, commissions, and overnight interest rates. However, some reports indicate that the broker may impose unusual or hidden fees that could affect traders' profitability. Below is a comparison of Novox's core trading costs against industry averages:

| Fee Type | Novox | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 2.0 pips | 1.5 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | 0.5% | 0.3% |

While Novox advertises competitive spreads, the higher-than-average costs associated with major currency pairs may deter potential traders. Furthermore, the absence of a transparent commission structure raises questions about the broker's overall cost-effectiveness. Traders should be vigilant and fully understand the fee structure before engaging with Novox to determine if it is safe or potentially a scam.

Client Fund Security

The safety of client funds is paramount in the forex trading landscape. Novox claims to implement various security measures to protect client funds, including segregated accounts and investor protection policies. However, the effectiveness of these measures remains questionable due to the broker's unverified regulatory status. It is crucial for traders to assess the following safety measures:

- Segregated Accounts: Novox states that client funds are held in separate accounts to prevent misuse. However, the lack of regulatory oversight raises concerns about the enforcement of this practice.

- Investor Protection: Reports indicate that Novox may not offer adequate investor protection, which could leave traders vulnerable in case of insolvency or mismanagement of funds.

- Negative Balance Protection: The absence of clear information regarding negative balance protection policies further complicates the assessment of client fund safety.

Given these factors, traders must exercise caution when considering Novox as a trading partner, as the potential risks associated with fund security could indicate that Novox is not entirely safe.

Customer Experience and Complaints

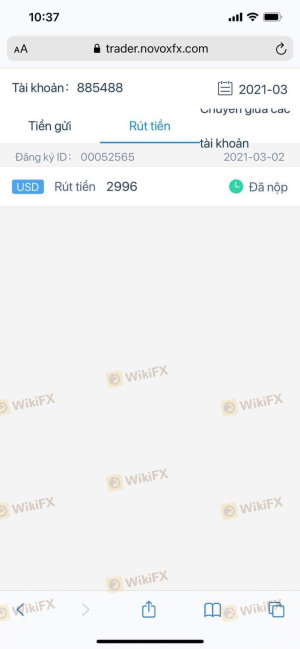

Customer feedback is an invaluable resource for assessing a broker's reliability. Reviews of Novox indicate a mix of positive and negative experiences, with many users highlighting issues related to withdrawal delays and unresponsive customer support. Common complaints include:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Unresponsive Customer Support | Medium | Fair |

| Account Verification Issues | High | Poor |

One typical case involves a trader who reported a significant delay in withdrawing funds, leading to frustration and distrust towards Novox. The lack of timely communication from the support team exacerbated the situation, raising concerns about the broker's commitment to resolving customer issues. Such patterns of complaints could indicate underlying operational inefficiencies, leading to the conclusion that Novox may not be entirely safe for traders.

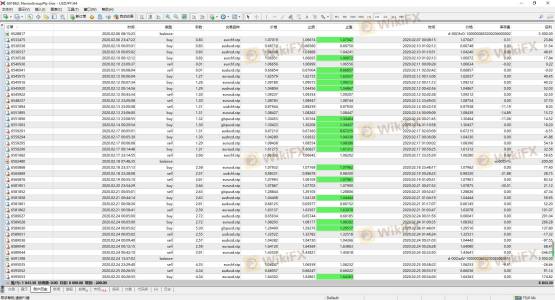

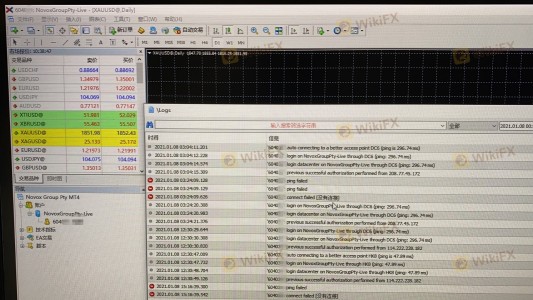

Platform and Execution

The trading platform offered by Novox is a critical aspect of the overall trading experience. Reports suggest that the platform is user-friendly, but concerns about execution quality, including slippage and order rejections, have been raised. Traders have reported instances of significant slippage during high-volatility periods, which could adversely affect trading outcomes. Additionally, the absence of transparency regarding platform performance metrics raises questions about potential manipulation or unfair practices.

Risk Assessment

Engaging with Novox involves various risks that traders should be aware of. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | High | Unverified regulatory status raises red flags. |

| Fund Security | High | Lack of clear investor protection measures. |

| Customer Support | Medium | Reports of unresponsive support and withdrawal delays. |

| Execution Quality | Medium | Concerns about slippage and order rejections. |

To mitigate these risks, traders should conduct thorough due diligence and consider alternative brokers with verified regulatory status and a proven track record of customer satisfaction.

Conclusion and Recommendations

In conclusion, the investigation into Novox raises several concerns regarding its legitimacy and safety. The unverified regulatory status, questionable company background, and mixed customer feedback suggest that Novox may not be a reliable trading partner. While some traders may find value in its offerings, the potential risks associated with trading with Novox warrant caution.

For traders seeking safer alternatives, consider brokers with strong regulatory oversight, transparent fee structures, and positive customer reviews. Conducting thorough research and selecting a reputable broker is crucial to ensuring a secure trading experience. Ultimately, it is essential to weigh the risks and benefits before deciding whether Novox is safe or a potential scam.

Is Novox a scam, or is it legit?

The latest exposure and evaluation content of Novox brokers.

Novox Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Novox latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.