Regarding the legitimacy of MC forex brokers, it provides HKGX, CYSEC, FSPR and WikiBit, (also has a graphic survey regarding security).

Is MC safe?

Business

License

Is MC markets regulated?

The regulatory license is the strongest proof.

HKGX Precious Metals Trading (AGN)

Hong Kong Gold Exchange

Hong Kong Gold Exchange

Current Status:

Clone FirmLicense Type:

Precious Metals Trading (AGN)

Licensed Entity:

香港紅獅集團有限公司

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

https://www.rlc9000.comExpiration Time:

--Address of Licensed Institution:

九龍尖沙咀漆咸道南87-105號百利商業中心15字樓1511室Phone Number of Licensed Institution:

23927848Licensed Institution Certified Documents:

CYSEC Market Making License (MM)

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

UnverifiedLicense Type:

Market Making License (MM)

Licensed Entity:

MAGIC COMPASS LTD

Effective Date:

2016-04-12Email Address of Licensed Institution:

info@magiccompass.comSharing Status:

No SharingWebsite of Licensed Institution:

www.magiccompass.comExpiration Time:

--Address of Licensed Institution:

Sarlo 9, Agios Athanasios, 4106, Limassol, CyprusPhone Number of Licensed Institution:

+357 25 023 880Licensed Institution Certified Documents:

FSPR Inst Forex Execution (STP)

Financial Service Providers Register

Financial Service Providers Register

Current Status:

UnverifiedLicense Type:

Inst Forex Execution (STP)

Licensed Entity:

Magic Compass New Zealand Limited

Effective Date:

2016-01-27Email Address of Licensed Institution:

george@magiccompass.co.nzSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

2019-03-07Address of Licensed Institution:

UniT 2, Level 1, 55 Barrys PoinT Road Takapuna AucklandPhone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is MC Trading A Scam?

Introduction

MC Trading is a relatively new player in the forex market, having been established in 2023. The broker claims to offer a wide range of trading services, including access to over 500 investment instruments across various asset classes, such as forex, commodities, indices, and cryptocurrencies. However, the burgeoning forex market is fraught with both legitimate opportunities and potential scams, making it imperative for traders to conduct thorough evaluations of brokers before committing their funds. This article aims to provide an objective assessment of MC Trading's credibility by analyzing its regulatory status, company background, trading conditions, safety measures for client funds, customer experiences, and the overall risk associated with trading on this platform.

To gather the necessary information for this evaluation, we utilized various sources, including expert reviews, regulatory databases, and user feedback. Our assessment framework encompasses several critical dimensions, including regulation, company history, trading conditions, client fund security, and customer service, ultimately addressing the pressing question: Is MC Trading safe?

Regulation and Legitimacy

The regulatory status of a broker is a fundamental aspect that determines its legitimacy and the safety of client funds. MC Trading claims to be regulated by various authorities; however, it lacks concrete evidence of legitimate regulatory oversight. Below is a summary of the broker's regulatory claims:

| Regulatory Authority | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| Commonwealth of Dominica | Unverified | Dominica | Unverified |

| Seychelles Financial Services Authority | Unverified | Seychelles | Unverified |

The absence of verified licenses from reputable regulatory bodies raises significant concerns regarding the broker's operational legitimacy and client protection. While MC Trading asserts compliance with various regulations, user reports indicate that these claims may be misleading. The lack of regulatory oversight means that traders may not have access to legal protections, compensation schemes, or segregated accounts, which are essential for safeguarding client funds.

Historically, the absence of regulation is a red flag that potential traders should consider seriously. Many complaints have surfaced regarding withdrawal issues and poor customer service, further casting doubt on the broker's reliability. This lack of regulatory compliance contributes to a heightened risk profile for MC Trading, leading to the conclusion that it may not be a safe choice for traders seeking a secure trading environment.

Company Background Investigation

MC Trading, although a new entrant to the forex market, has not provided sufficient transparency regarding its company history, ownership structure, or management team. Founded in 2023, the broker operates with limited public information available about its operational practices. Such opacity raises concerns about its credibility and trustworthiness.

The management team behind MC Trading is not prominently featured, which is a significant issue in assessing the broker's reliability. A well-defined leadership structure with experienced professionals typically enhances a broker's trustworthiness. However, the lack of information regarding the qualifications and experiences of MC Trading's management team leaves potential clients in the dark about who is running the operation.

Furthermore, the broker's website has faced accessibility issues, which can hinder potential clients' ability to conduct thorough due diligence. This lack of transparency and unclear ownership structure contributes to the uncertainty surrounding MC Trading's legitimacy and operational integrity. In conclusion, the insufficient information available about the company's background raises serious questions about whether MC Trading is safe for traders.

Trading Conditions Analysis

MC Trading offers a variety of trading conditions, including access to over 500 investment instruments. However, the specifics of its fee structure and trading costs remain ambiguous. Below is a comparison of core trading costs:

| Fee Type | MC Trading | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Vague | 1.0 - 2.0 pips |

| Commission Model | Vague | Variable |

| Overnight Interest Range | Vague | 0.5% - 2.0% |

The lack of transparency regarding spreads, commissions, and other trading costs is concerning. Traders may encounter hidden fees that could significantly impact their profitability. For instance, while MC Trading advertises competitive spreads, the absence of detailed information about commissions and overnight fees raises suspicions about potential costs that may not be immediately evident.

Moreover, the platform's claims of offering high leverage ratios, reportedly up to 1:400, can be appealing to experienced traders. However, such high leverage also increases the risk of significant losses, particularly for inexperienced traders. This duality of potential reward and risk underscores the importance of understanding the trading conditions fully before engaging with MC Trading.

Overall, the lack of clarity surrounding trading costs and conditions contributes to the perception that MC Trading may not be a safe option for traders. The absence of detailed information can lead to unexpected financial burdens, further emphasizing the need for caution when considering this broker.

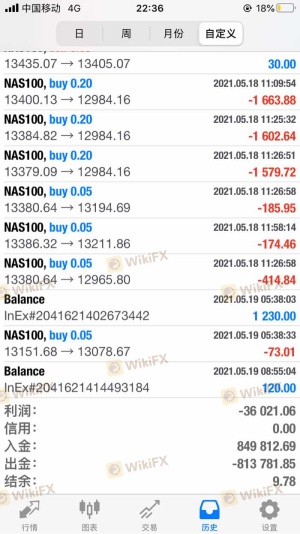

Client Fund Safety

The safety of client funds is paramount when selecting a broker, and MC Trading's measures in this regard raise significant concerns. The broker claims to implement various security measures, such as fund segregation and investor protection policies. However, the effectiveness of these measures is questionable given the broker's dubious regulatory status.

MC Trading does not provide clear information regarding its fund protection policies, leaving traders vulnerable. The lack of a robust regulatory framework means that there may be little recourse for clients in the event of disputes or if the broker becomes insolvent. This situation is compounded by historical reports of fund withdrawal issues and frozen accounts, further exacerbating concerns about the safety of client funds.

In summary, while MC Trading may profess to have security measures in place, the lack of transparency and regulatory oversight raises significant questions about the actual protection afforded to clients' funds. This uncertainty leads to the conclusion that MC Trading may not be a safe choice for traders concerned about the security of their investments.

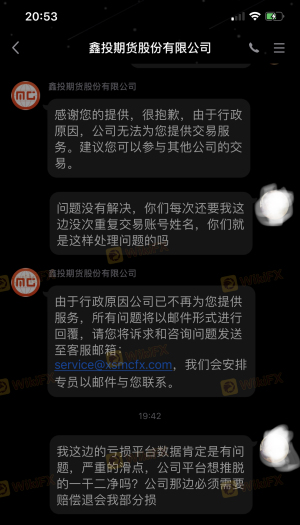

Customer Experience and Complaints

Customer feedback is a vital component in assessing the reliability of a broker. A review of user experiences with MC Trading reveals a pattern of complaints related to fund withdrawals, customer service responsiveness, and account freezes. Below is a summary of common complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Account Freezes | High | Poor |

| Customer Service | Medium | Slow |

Many users have reported difficulties in accessing their funds, with some alleging that their accounts were frozen without adequate explanations. These issues indicate a concerning trend that potential clients should take into account. Additionally, the company's response to complaints appears to be lacking, with many users reporting unresponsive customer service. This lack of support can be particularly detrimental in the fast-paced world of forex trading, where timely assistance is often crucial.

For example, one user reported that after opening an account, they faced significant challenges when attempting to withdraw their funds. Despite multiple attempts to resolve the issue, they were met with unresponsive customer service and ultimately felt that their investment was at risk. Such experiences underscore the importance of evaluating a broker's customer service capabilities before committing funds.

Overall, the mixed feedback regarding customer experiences with MC Trading raises serious concerns about the broker's reliability and responsiveness. The pattern of complaints and the perceived lack of support further contribute to the conclusion that potential traders should exercise caution when considering this broker.

Platform and Trade Execution

The performance of the trading platform is crucial for a trader's success, and MC Trading's platform has received mixed reviews regarding its stability and user experience. Users have expressed concerns about order execution quality, including instances of slippage and rejected orders. These factors can significantly impact trading outcomes, particularly for those employing high-frequency trading strategies.

While MC Trading supports the widely-used MT5 trading platform, the lack of detailed information about its functionality and performance raises questions about the overall trading experience. Reports of slippage and rejected orders suggest potential issues with the broker's execution capabilities, which can compromise the integrity of the trading experience.

Furthermore, any indications of platform manipulation should be taken seriously, as they can lead to significant financial losses for traders. The absence of transparent performance metrics and execution quality data makes it difficult for potential users to assess the reliability of MC Trading's platform.

In summary, while MC Trading offers access to a popular trading platform, the mixed user feedback regarding execution quality and stability raises concerns about whether the platform is safe for traders. The potential for issues with order execution and slippage underscores the importance of thorough evaluation before engaging with this broker.

Risk Assessment

Engaging with MC Trading entails various risks that potential clients should carefully evaluate. Below is a summary of key risk areas associated with trading with this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Lack of verified licenses raises concerns. |

| Fund Security Risk | High | Unclear protection policies and historical issues. |

| Customer Service Risk | Medium | Poor response to complaints can lead to unresolved issues. |

| Platform Execution Risk | High | Issues with order execution can lead to significant losses. |

The high regulatory risk is particularly alarming, as it indicates that traders may not have the necessary protections in place. Additionally, the potential for fund security issues amplifies the risks involved. To mitigate these risks, traders should consider using regulated brokers with a proven track record and transparent policies. Seeking out platforms that offer demo accounts and robust customer support can also help ensure a safer trading experience.

Conclusion and Recommendations

In conclusion, the evidence suggests that MC Trading may pose significant risks to traders. The lack of verified regulatory oversight, combined with numerous user complaints regarding fund security and customer service, raises serious concerns about the broker's legitimacy. Therefore, the question remains: Is MC Trading safe? Based on the available information, it leans heavily towards the latter, indicating potential scam-like behavior.

For those seeking safer alternatives, it is advisable to look for brokers regulated by top-tier authorities, such as the FCA or ASIC, which offer robust protections for client funds and transparent trading conditions. Ultimately, traders must prioritize their financial security by conducting thorough research and considering the risks before engaging with any broker, especially one like MC Trading that raises significant red flags.

Is MC a scam, or is it legit?

The latest exposure and evaluation content of MC brokers.

MC Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

MC latest industry rating score is 1.61, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.61 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.