Is MBG Markets safe?

Business

License

Is MBG Markets Safe or a Scam?

Introduction

MBG Markets is a forex broker that positions itself within the competitive landscape of online trading, offering a range of financial instruments including forex, commodities, and indices. As with any trading platform, it is crucial for traders to conduct thorough due diligence before committing their funds. The foreign exchange market is rife with opportunities, but it is equally fraught with risks, including the potential for scams. Therefore, assessing the credibility and safety of a broker like MBG Markets is essential for any trader looking to protect their investments.

This article aims to provide an objective analysis of MBG Markets, investigating its regulatory status, company background, trading conditions, customer safety measures, and user experiences. The evaluation is based on a comprehensive review of available data, including regulatory information, user reviews, and industry standards.

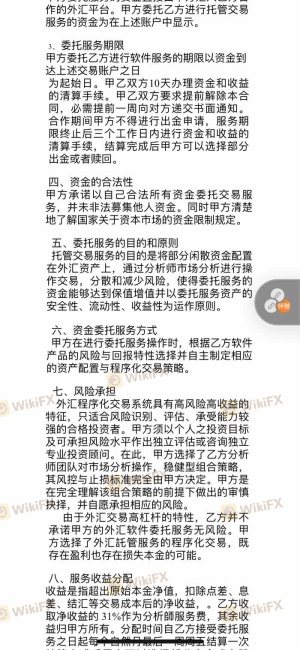

Regulation and Legitimacy

The regulatory framework under which a broker operates is one of the most critical factors in determining its legitimacy. Regulation serves as a safeguard for traders, ensuring that brokers adhere to specific standards and practices that protect clients' funds. Unfortunately, MBG Markets has been flagged for operating under dubious regulatory conditions.

| Regulatory Authority | License Number | Regulatory Area | Verification Status |

|---|---|---|---|

| Cayman Islands Monetary Authority (CIMA) | 1425303 | Cayman Islands | Unverified |

| British Virgin Islands Financial Services Commission (FSC) | SIBA/L/14/1068 | British Virgin Islands | Unverified |

| Australian Securities and Investments Commission (ASIC) | 416279 | Australia | Unverified |

The above table illustrates that while MBG Markets claims to be regulated by multiple authorities, the credibility of these licenses is questionable. Reports indicate that the broker operates without proper oversight, raising concerns about its compliance history. The lack of robust regulation can expose traders to significant risks, including the potential for fraud and mismanagement of funds.

Company Background Investigation

MBG Markets is part of the MultiBank Group, which was established in California, USA, in 2005. The company claims to have a paid-up capital of over $322 million and serves a global clientele. However, the opacity surrounding its ownership structure and management team raises red flags.

The management teams background and professional experience are not readily available, which diminishes transparency. Transparency is a crucial factor for any financial institution, as it fosters trust between the broker and its clients. The absence of clear information about the team behind MBG Markets makes it difficult for potential clients to gauge the broker's reliability.

Moreover, the level of information disclosure on the broker's website is minimal. Traders are often left in the dark about important aspects like operational procedures, risk management practices, and customer service protocols. This lack of transparency can be indicative of deeper issues within the organization.

Trading Conditions Analysis

MBG Markets offers a variety of trading conditions, but it is essential to scrutinize the fee structure and costs involved. A broker's fees can significantly impact a trader's profitability, making it imperative to understand the financial obligations before opening an account.

| Fee Type | MBG Markets | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 17 pips | 1.5 pips |

| Commission Model | Variable | Low to None |

| Overnight Interest Range | Not disclosed | 0.5% - 2.5% |

The spread for major currency pairs at MBG Markets is notably higher than the industry average, which can lead to increased costs for frequent traders. Additionally, the lack of transparency regarding commission structures and overnight interest rates raises concerns. Traders should be wary of hidden fees that could erode their capital over time.

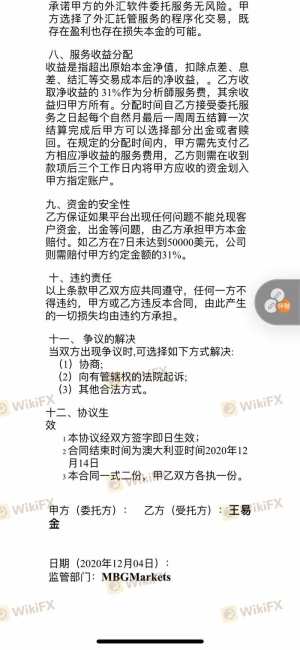

Customer Funds Security

When evaluating whether MBG Markets is safe, the security of customer funds is a paramount concern. Effective fund protection measures are critical for ensuring that traders can trust their broker.

MBG Markets claims to implement various safety measures, including segregated accounts for client funds and negative balance protection. However, the effectiveness of these measures has been called into question, especially given the numerous complaints regarding fund withdrawal issues. Historical disputes involving delayed or denied withdrawals further exacerbate concerns about the broker's financial integrity.

Traders should always ensure that their broker has a well-defined policy regarding fund segregation and investor protection. The absence of a solid track record in these areas can serve as a warning sign regarding the broker's reliability.

Customer Experience and Complaints

Customer feedback is a vital component in assessing the overall reliability of a broker. A review of user experiences with MBG Markets reveals a pattern of dissatisfaction and complaints.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Delays | Medium | Moderate |

| Misleading Information | High | Poor |

Common complaints include difficulties in withdrawing funds, unresponsive customer service, and allegations of misleading information regarding account features.

Several users have reported that they were unable to access their accounts or process withdrawals, leading to frustration and financial loss. These recurring issues indicate a systemic problem within MBG Markets, raising significant concerns about its operational integrity.

Platform and Trade Execution

The quality of a broker's trading platform can greatly influence a trader's experience. MBG Markets offers the popular MetaTrader 4 and MetaTrader 5 platforms, which are known for their robust features. However, the execution quality and reliability of these platforms have come under scrutiny.

Users have reported instances of slippage, delayed order executions, and even order rejections. Such issues can severely impact trading performance, especially for those employing high-frequency trading strategies. The presence of these problems raises the question of whether the broker is adequately managing its trading infrastructure.

Risk Assessment

Trading with MBG Markets entails a variety of risks that traders should be aware of.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated status increases the risk of fraud. |

| Financial Risk | Medium | High spreads and unclear fee structures can erode profits. |

| Operational Risk | High | Frequent complaints about withdrawal issues. |

To mitigate these risks, traders should exercise caution and consider diversifying their investments. It may also be prudent to explore alternative brokers with stronger regulatory oversight and better customer reviews.

Conclusion and Recommendations

In conclusion, the evidence suggests that MBG Markets is not a safe option for traders. The combination of questionable regulatory status, a lack of transparency, and numerous user complaints raises significant red flags. While the broker offers a range of trading instruments and platforms, the risks associated with trading through MBG Markets outweigh the potential benefits.

For traders seeking a reliable and secure trading environment, it is advisable to consider alternative brokers that are well-regulated and have a proven track record of customer satisfaction. Some recommended options include brokers regulated by top-tier authorities such as the FCA or ASIC, which offer greater security and peace of mind for traders.

Ultimately, due diligence is essential in the forex market, and traders should prioritize safety above all else.

Is MBG Markets a scam, or is it legit?

The latest exposure and evaluation content of MBG Markets brokers.

MBG Markets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

MBG Markets latest industry rating score is 1.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.