Is KING TRADE safe?

Pros

Cons

Is King Trade Safe or Scam?

Introduction

In the ever-evolving landscape of the forex market, King Trade has positioned itself as a player offering various trading options. However, the question that looms large for potential investors is: Is King Trade safe? Traders need to exercise caution when evaluating forex brokers, as the industry is rife with scams and unregulated entities. This article aims to provide a comprehensive analysis of King Trade, focusing on its regulatory status, company background, trading conditions, customer safety, and user experiences. The evaluation is grounded in data from multiple credible sources, including user reviews and regulatory databases.

Regulation and Legitimacy

The regulatory status of a forex broker is critical in determining its legitimacy and safety. King Trade operates without any valid regulatory oversight, which raises significant concerns about its trustworthiness.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The absence of regulation means that King Trade is not subject to any established framework designed to protect investors. This lack of oversight can lead to increased risks, making it challenging for traders to trust the broker's integrity. Historical compliance records indicate that King Trade has not been monitored by any recognized regulatory authority, which is a significant red flag. The potential for fraudulent activities is heightened in unregulated environments, making it crucial for traders to be aware of the risks associated with engaging with such platforms.

Company Background Investigation

King Trade was established in 2014 and is registered in China. The company claims to have a presence in various regions, yet it lacks transparency regarding its ownership structure and operational details. The management teams background is not well-documented, raising questions about their qualifications and experience in the financial sector.

Furthermore, the companys information disclosure is minimal, with little to no details about its operational practices or financial health available to potential clients. This lack of transparency is concerning, as it can lead to uncertainty regarding the company's reliability and the safety of customer funds. The absence of publicly available information about the management team further exacerbates concerns regarding the broker's legitimacy.

Trading Conditions Analysis

A thorough examination of King Trade's trading conditions reveals a mixed bag. The broker offers a minimum deposit of $20 for live trading, which may seem attractive to novice traders. However, the overall fee structure is less clear, and potential hidden costs could undermine the trading experience.

| Fee Type | King Trade | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1-2 Pips |

| Commission Model | None | Varies |

| Overnight Interest Range | N/A | Varies |

The variable spreads could lead to higher trading costs, especially during volatile market conditions. Additionally, the absence of a clear commission model raises concerns about potential undisclosed fees that could impact profitability. Traders should be particularly wary of any unusual fees that may not be immediately apparent, as they can significantly affect overall trading performance.

Customer Fund Safety

When assessing whether King Trade is safe, its essential to consider the measures in place for customer fund safety. Unfortunately, King Trade lacks robust security protocols to protect client funds. There is no indication of fund segregation, which means that client funds may not be held in separate accounts from the broker's operating funds.

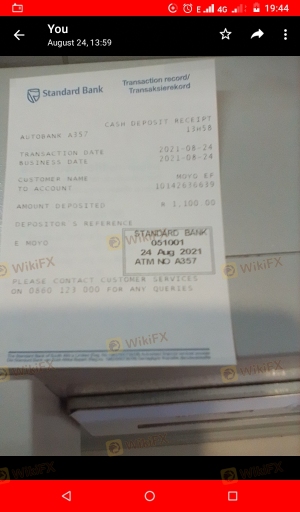

Moreover, there are no investor protection schemes in place, such as negative balance protection, which could leave traders vulnerable to significant losses. Historical complaints regarding withdrawal difficulties further suggest that the broker may not prioritize fund security, raising serious concerns about the safety of customer deposits.

Customer Experience and Complaints

User feedback regarding King Trade paints a troubling picture. Many clients report challenges with fund withdrawals and overall customer service quality.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Slow |

| Transparency | High | Lacking |

Common complaints include difficulties in accessing funds after withdrawal requests, which can take weeks to resolve. The company's response to these issues has been criticized as inadequate, with many users feeling ignored or unsupported. These patterns of complaints raise significant red flags regarding King Trade's commitment to customer satisfaction and service quality.

Platform and Trade Execution

The performance of King Trade's trading platform is another critical factor in evaluating its safety. The platform's stability and user experience are reportedly subpar, with users experiencing issues related to order execution quality, including slippage and rejected orders.

Traders have expressed concerns about potential signs of platform manipulation, which can undermine trust in the broker. A reliable trading environment should provide seamless execution and transparency, neither of which seems to be a hallmark of King Trade's offering.

Risk Assessment

Engaging with King Trade presents several risks that traders should carefully consider.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No oversight |

| Withdrawal Risk | High | Complaints reported |

| Trading Cost Risk | Medium | Variable spreads |

| Customer Support Risk | High | Poor response time |

Given the high-risk levels associated with King Trade, potential clients are advised to exercise extreme caution. Mitigation strategies include conducting thorough due diligence, avoiding large initial deposits, and seeking regulated alternatives for trading.

Conclusion and Recommendations

In light of the evidence gathered, it is clear that King Trade raises significant concerns regarding its safety and legitimacy. The lack of regulatory oversight, coupled with numerous complaints about customer service and withdrawal issues, suggests that traders should be wary of engaging with this broker.

For those considering forex trading, it is advisable to seek out regulated brokers with established reputations and transparent practices. Alternatives such as brokers regulated by the FCA or ASIC may offer more secure trading environments, ensuring that clients' funds are better protected. Ultimately, while King Trade may present enticing trading conditions, the potential risks outweigh the benefits, making it a questionable choice for serious traders.

Is KING TRADE a scam, or is it legit?

The latest exposure and evaluation content of KING TRADE brokers.

KING TRADE Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

KING TRADE latest industry rating score is 1.54, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.54 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.