Is LZJR safe?

Business

License

Is LZJR Safe or Scam?

Introduction

LZJR is a forex broker that has recently entered the market, positioning itself as a player in the competitive landscape of online trading. As with any financial service provider, it is crucial for traders to conduct thorough due diligence before engaging with LZJR. The forex market is notorious for its volatility and the presence of unscrupulous brokers, making it imperative for traders to assess the legitimacy and reliability of their chosen broker. This article aims to provide an objective analysis of whether LZJR is a scam or a safe option for forex trading. Our investigation is based on a comprehensive review of the broker's regulatory status, company background, trading conditions, customer feedback, and overall risk assessment.

Regulation and Legitimacy

One of the primary factors in determining the safety of a forex broker is its regulatory status. Regulation serves as a safeguard for traders, ensuring that brokers adhere to specific standards of conduct and financial practices. LZJR's regulatory environment has raised some concerns among industry observers. The following table summarizes the core regulatory information for LZJR:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Financial Services Provider Register (FSPR) | N/A | New Zealand | Suspicious Clone |

LZJR operates under the auspices of the FSPR in New Zealand; however, there are indications that it may be a "suspicious clone" of another entity. This term typically refers to brokers that mimic the branding and operations of legitimate firms without authorization. The lack of a valid license and the presence of clone warnings significantly undermine the broker's credibility and raise red flags for potential investors. In the absence of solid regulatory backing, traders should exercise caution when considering LZJR as their forex trading platform.

Company Background Investigation

Understanding the background of a broker is essential in assessing its reliability. LZJR is registered under the name Quantum Financial Limited, indicating a relatively recent establishment in the forex market. Information about the company's history and ownership structure is limited, which adds to the uncertainty surrounding its trustworthiness. The management team‘s qualifications and experience are also crucial factors in evaluating the broker’s credibility. Unfortunately, there is a scarcity of publicly available information regarding the key personnel at LZJR, which can be a cause for concern.

Transparency is a vital aspect of any financial service provider. LZJRs website lacks comprehensive disclosures about its operational practices, ownership structure, and management team. This lack of information can hinder traders from making informed decisions and raises questions about the broker's commitment to ethical trading practices. In summary, the limited company background information and lack of transparency about its operations contribute to the concerns regarding whether LZJR is safe for trading.

Trading Conditions Analysis

An essential aspect of evaluating any forex broker is understanding its trading conditions, including fees and spreads. LZJR claims to offer competitive trading conditions, but a closer examination reveals potential issues. The overall fee structure and trading costs are vital for traders aiming to maximize their profitability. Below is a comparison of LZJRs core trading costs with the industry average:

| Fee Type | LZJR | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable (not disclosed) | 1.0 - 2.0 pips |

| Commission Structure | Not specified | $5 - $10 per lot |

| Overnight Interest Range | Not disclosed | Varies by broker |

While LZJR does not provide clear information on its spreads and commission structure, the lack of transparency surrounding these costs may indicate potential hidden fees that could affect traders' bottom lines. This ambiguity is a common tactic among less reputable brokers, raising further doubts about whether LZJR is safe for traders.

Client Fund Safety

The safety of client funds is a critical concern for any trader. A reliable broker should implement robust security measures to protect client deposits. LZJR claims to adhere to standard practices for fund security, but specifics regarding the segregation of client funds, investor protection schemes, and negative balance protection policies are not well-documented.

In the absence of clear information, traders must be cautious. Historical reports of fund safety issues with similar brokers highlight the potential risks associated with trading with unregulated entities. If a broker does not have a proven track record of safeguarding client funds, it raises the question: is LZJR safe?

Customer Experience and Complaints

Customer feedback is a valuable indicator of a broker's reliability. An analysis of user experiences with LZJR reveals a range of sentiments, from dissatisfaction to outright frustration. Common complaints include difficulties in withdrawing funds, lack of responsive customer support, and issues with trade execution. The following table summarizes the primary complaint types and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

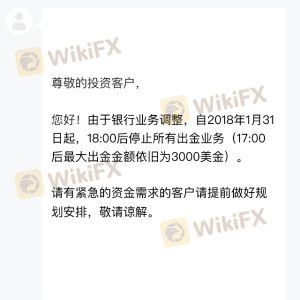

| Withdrawal Issues | High | Slow response, unresolved |

| Poor Customer Support | Medium | Inconsistent replies |

| Trade Execution Problems | High | Limited resolution offered |

Two notable cases include traders reporting extended delays in fund withdrawals and unsatisfactory responses from customer service representatives. These issues not only affect user experience but also raise significant concerns about the overall integrity of the broker. Such complaints are indicative of potential operational weaknesses, leading one to question whether LZJR is a safe choice for traders.

Platform and Trade Execution

The performance and reliability of a trading platform are crucial for successful trading. LZJR utilizes a trading platform that is generally regarded as user-friendly; however, reports of execution delays and slippage have surfaced. Traders have expressed concerns about the quality of order execution, with some claiming that their orders were not filled at the expected prices.

The absence of transparency regarding execution quality and slippage rates raises questions about the broker's operational integrity. If traders consistently experience issues with order execution, it could suggest that LZJR may not provide the level of service necessary for successful trading. This leads to the critical question: is LZJR safe for conducting trades?

Risk Assessment

Engaging with any broker involves inherent risks, particularly in the forex market. A comprehensive risk assessment of LZJR reveals several areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Lack of proper regulation raises concerns. |

| Fund Safety Risk | High | Unclear fund protection policies. |

| Execution Risk | Medium | Reports of slippage and execution delays. |

To mitigate these risks, traders should consider starting with a small investment, thoroughly reviewing all terms and conditions, and remaining vigilant about any unusual trading practices.

Conclusion and Recommendations

After a comprehensive analysis, it is clear that LZJR presents several red flags that warrant caution. The lack of robust regulatory oversight, transparency in operations, and a track record of customer complaints raise significant concerns about the broker's legitimacy. Therefore, potential traders must carefully weigh these factors before deciding to engage with LZJR.

For those seeking safer alternatives, it is advisable to consider brokers with solid regulatory backing, transparent operations, and positive customer feedback. Reputable options include well-established brokers regulated by authorities such as the FCA or ASIC, which provide a higher level of security and reliability. Ultimately, while LZJR may offer appealing trading conditions, the risks associated with its operations suggest that it may not be the safest choice for forex trading.

Is LZJR a scam, or is it legit?

The latest exposure and evaluation content of LZJR brokers.

LZJR Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

LZJR latest industry rating score is 1.61, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.61 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.