KILCOR Review 4

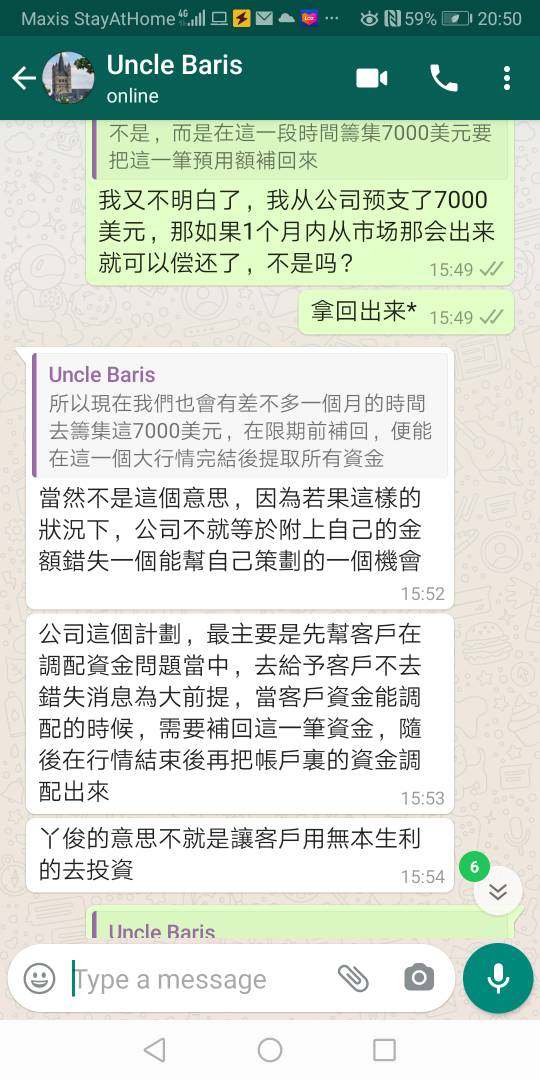

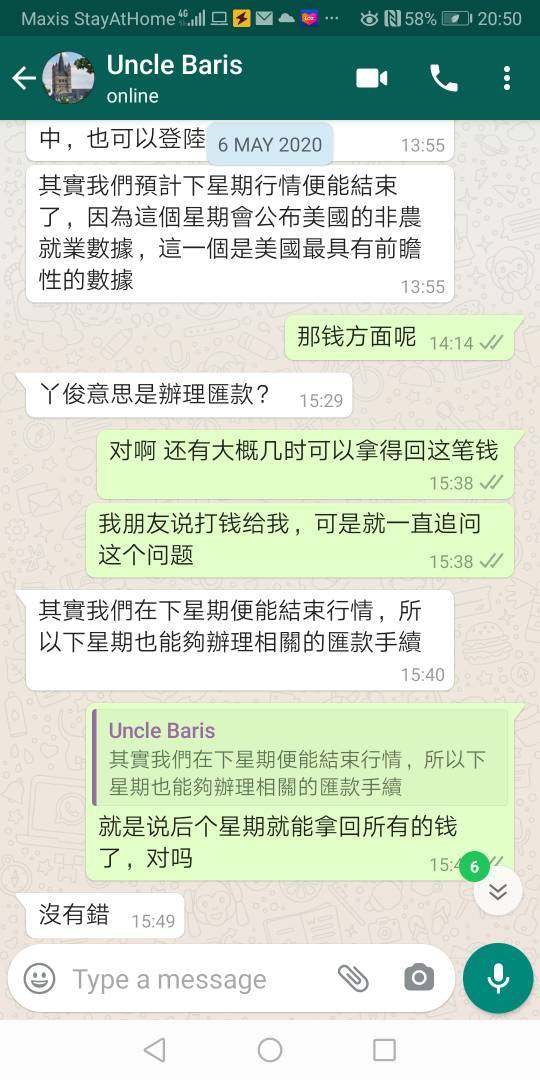

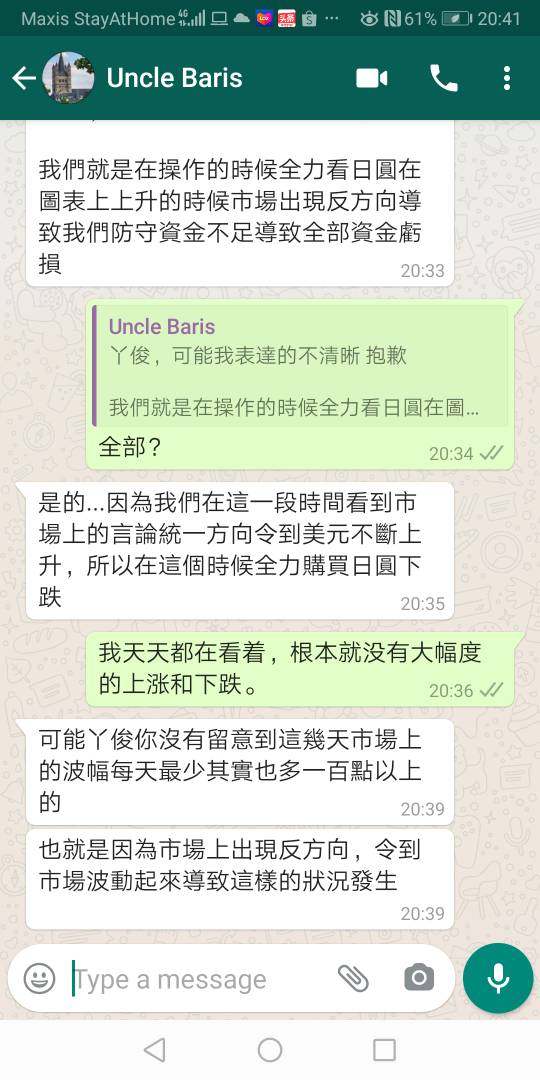

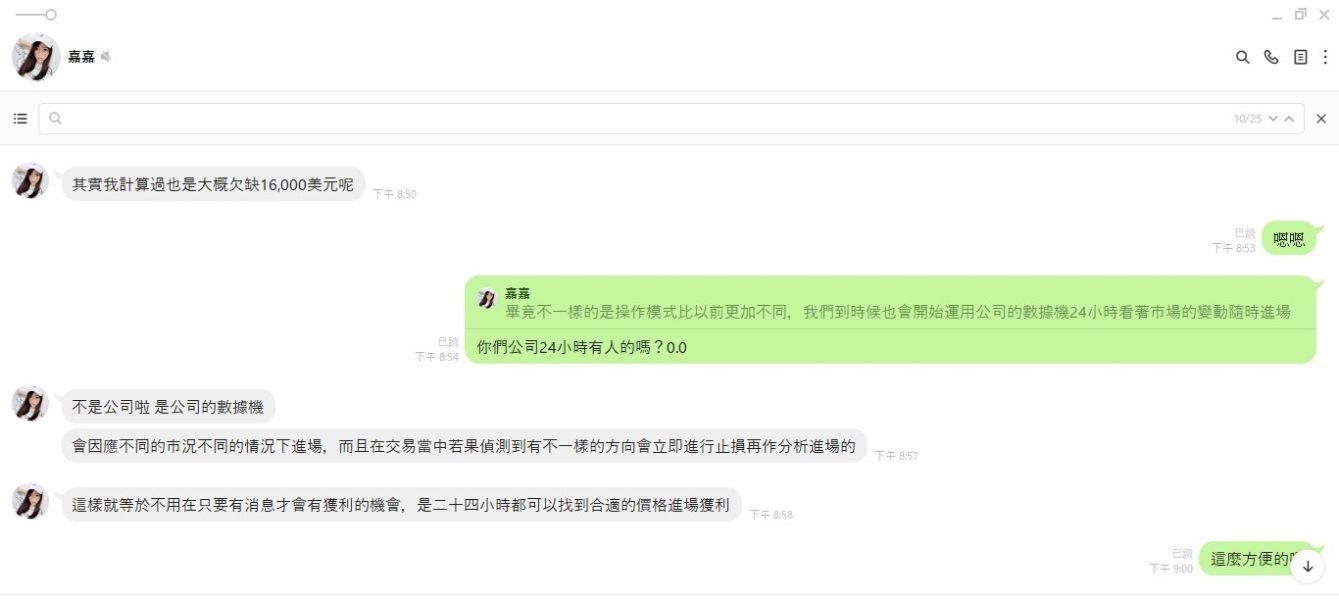

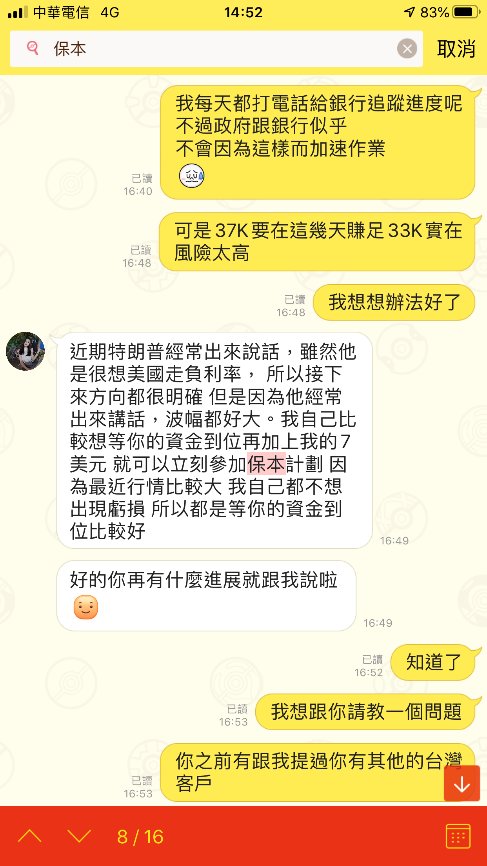

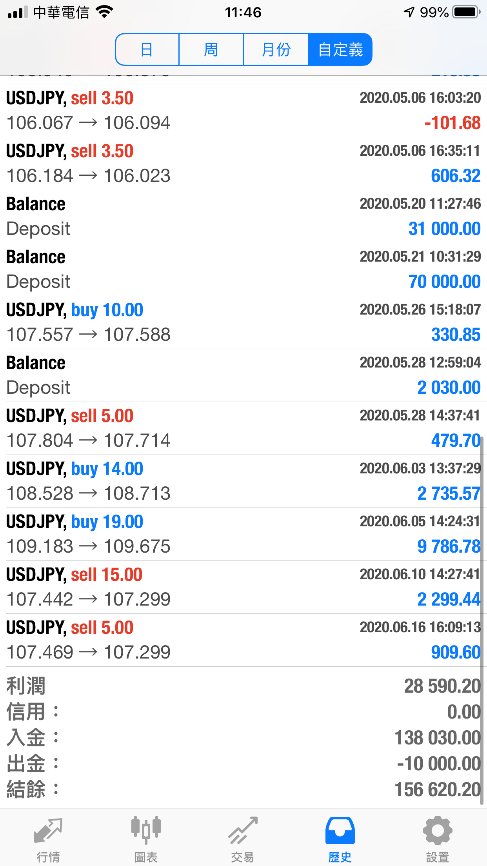

I knew a women via Tinder on February 26, 2020. She claimed she was from Malaysia, called Jiaxin Chen. We chatted on Line from 2/26. She said she worked in Malaysia as a forex financial advisor. She asked me whether I wanna invest from time to time. She cared about me during the covid-19 and win my trust. She recommended a forex trading platform called 111 to me and helped me opened an account with my guard down. She said she can manage my account for me. I deposited $2,010 on March 20, 2020 and gave my account to her. I deposited $7,500 again during her management. Then she made a loss on May 18, 2020 and induced me to add fund to upgrade my account to VIP for low risk. So I added $16,440 on June 3, 2020, my principal was $25,940 in total. Later, she reminded me I profited. Until the beginning of August, she said my account balance was up to $90,000. She bought 20 lots, making a loss of over $87,000. She usually bought 1.2 lots every time. But she said the market fluctuated greatly and asked me to add $30,000 for safe. I became suspicious so I refused. She threatened me, saying I would lose all my fund. Then my account balance was zero. I didn’t get any money and now I lost all my principal. Besides, her photos are from a model.

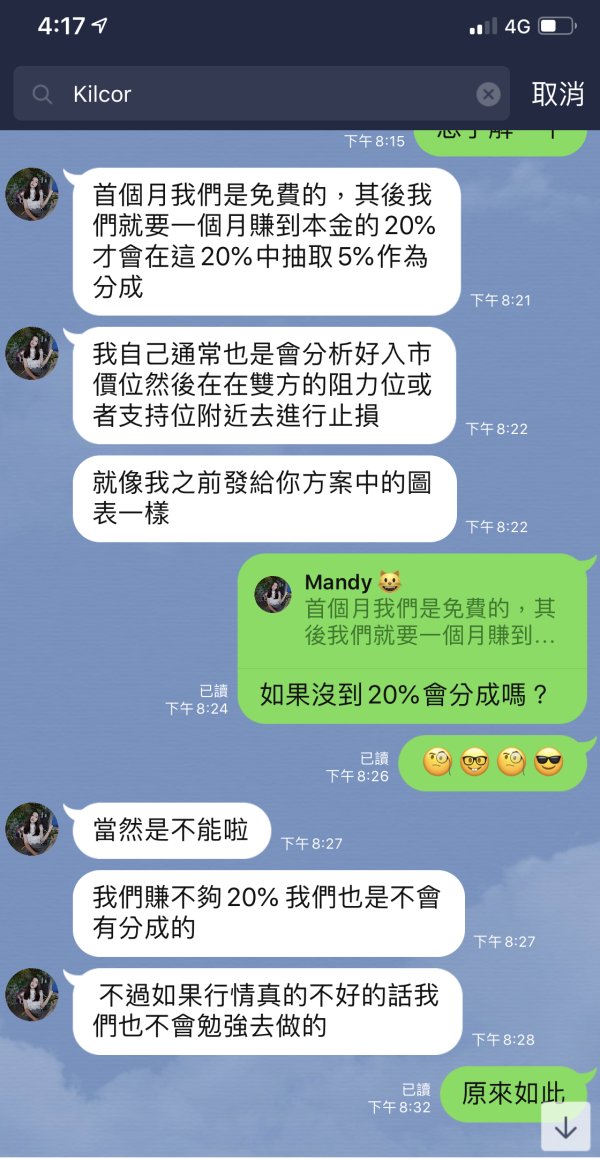

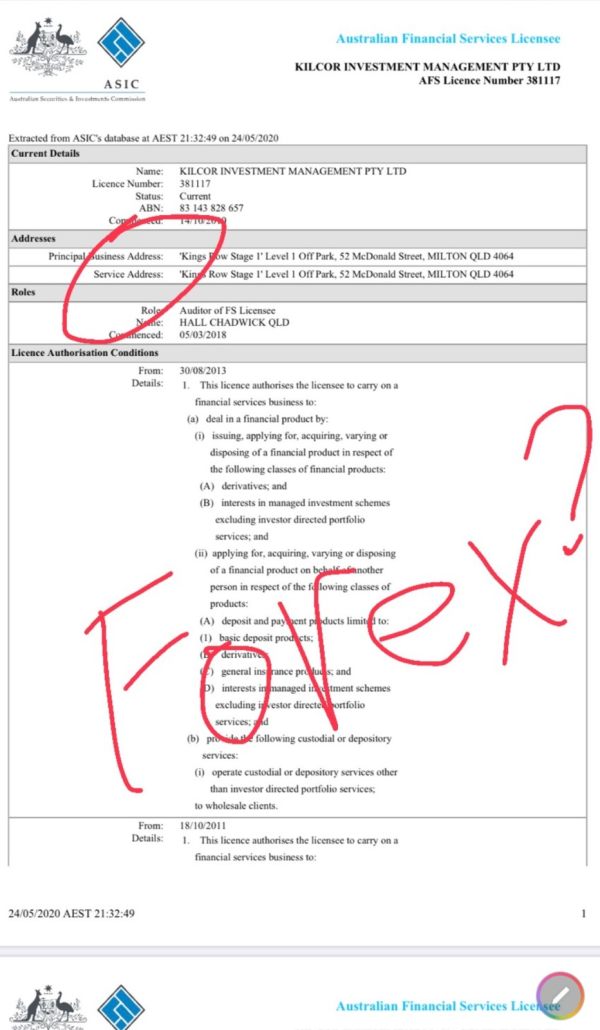

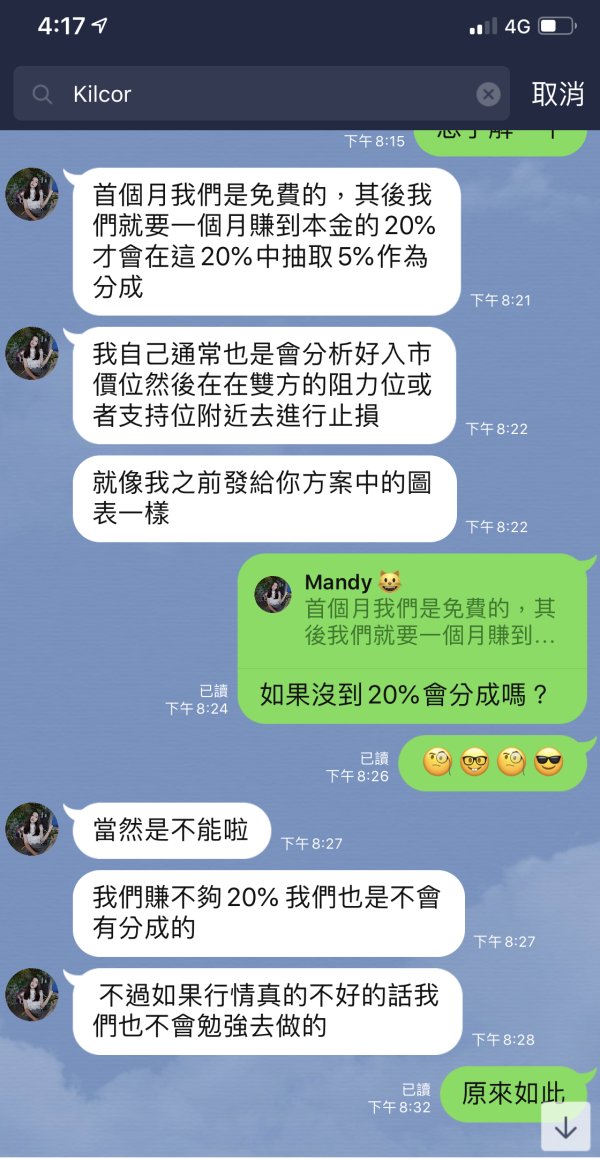

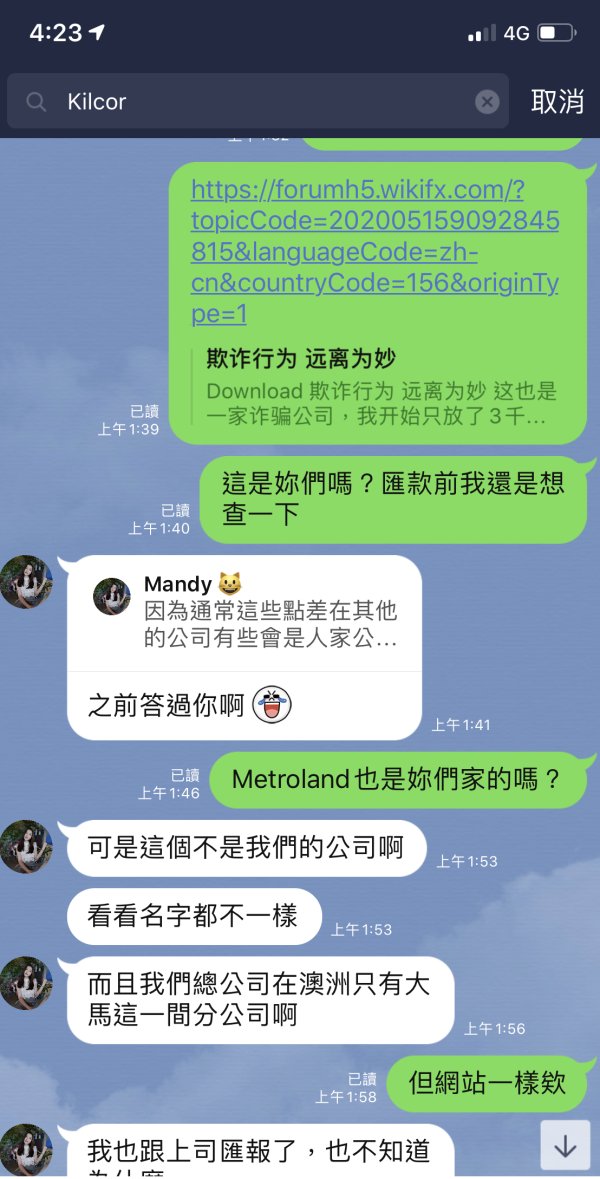

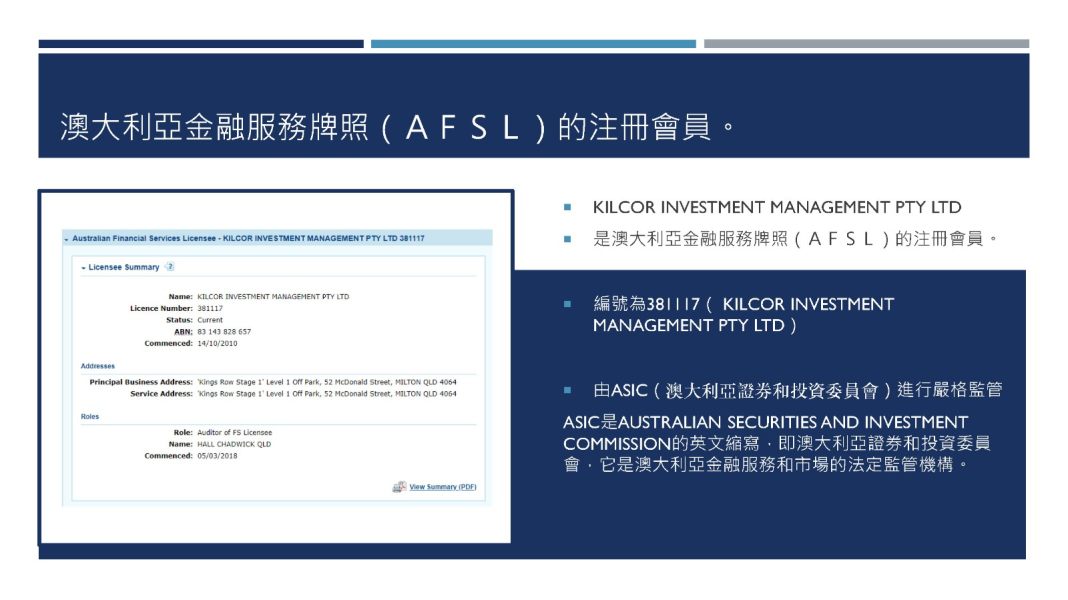

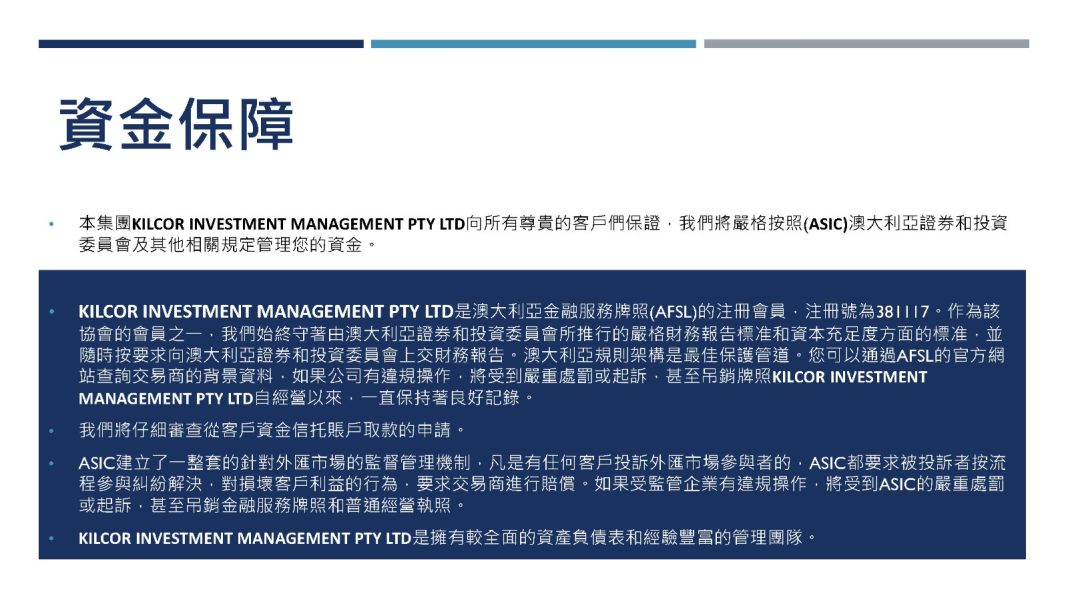

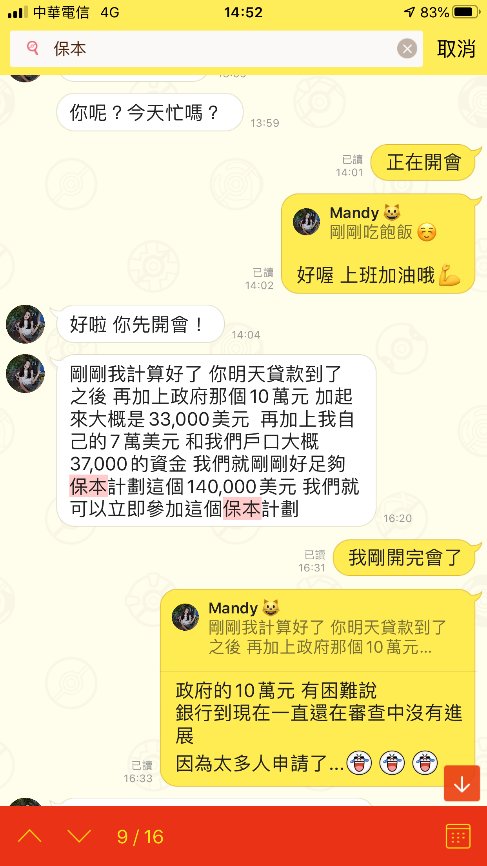

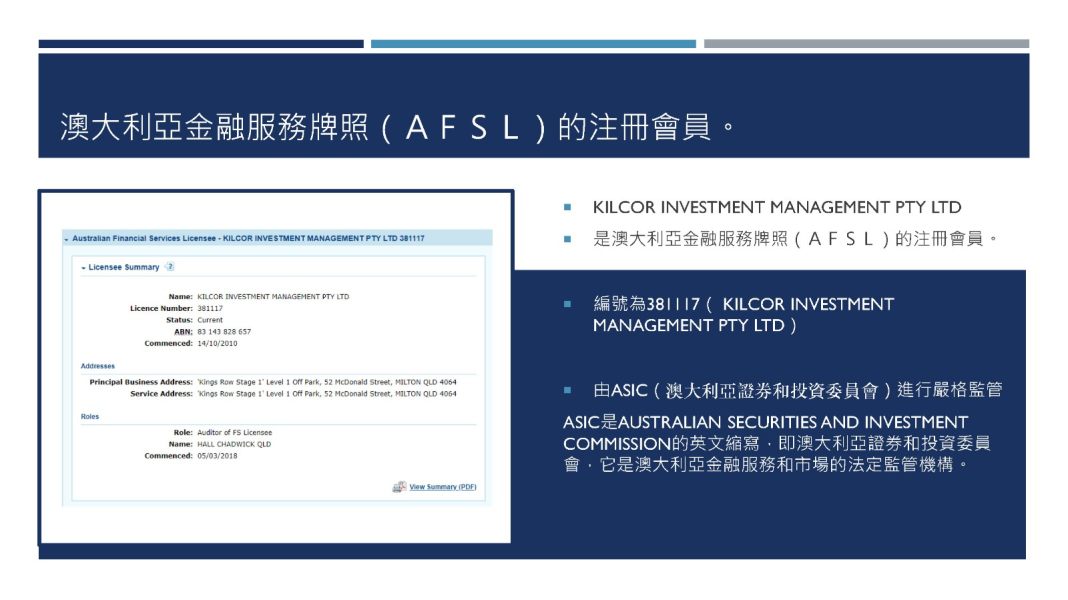

She said she was from Hong Kong and worked in Malaysia. She sent me a card, writing she was a senior business manager. She chatted with you everyday and sent you photos about her daily life, showing her profit. Then she asked you to give her money to manage. The plan she said is that you deposit NT$500,000 and help you profit 20%. Then she said there was a new plan and told you to borrow money. And this time I can’t withdraw, the account was invalid too. I suspected that she was a fraud but she said she would ignore me if she was a fraud. KILCOR was an Australian investment company but there was no forex in their investment programme. The Singapore government also said the company wasn’t regulated. Address :T3-13-15, 3 Towers, Jalan Ampang, Kampung Berembang, 55000 Kuala LumpurWebsite: https://www.kilcormanagementptyltd.com Email: cs@kilcormanagementptyltd.com

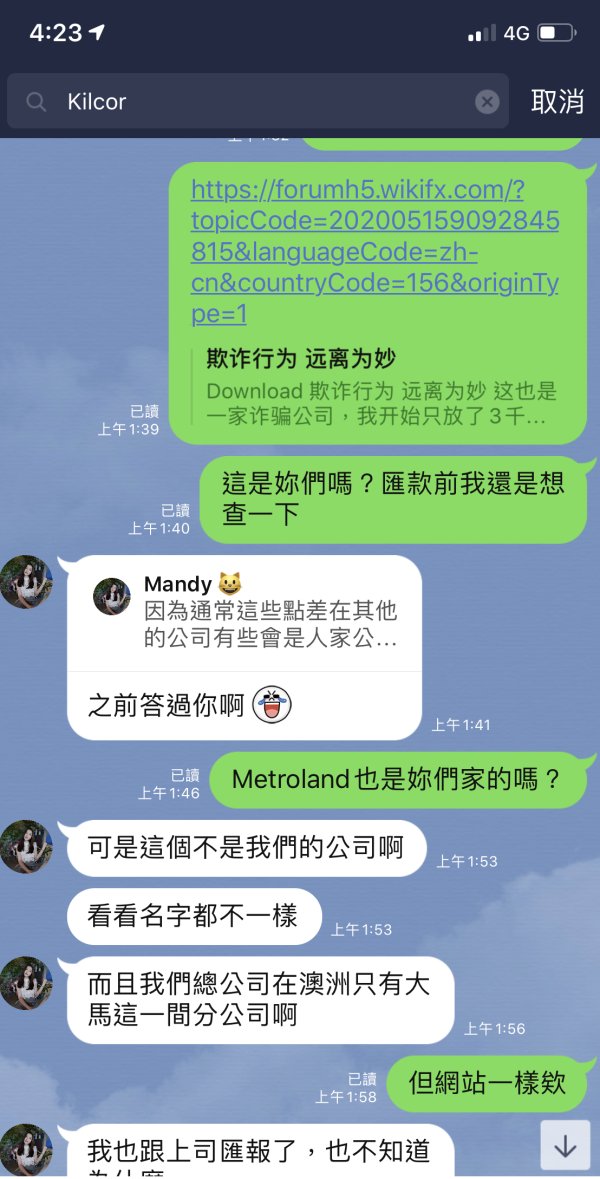

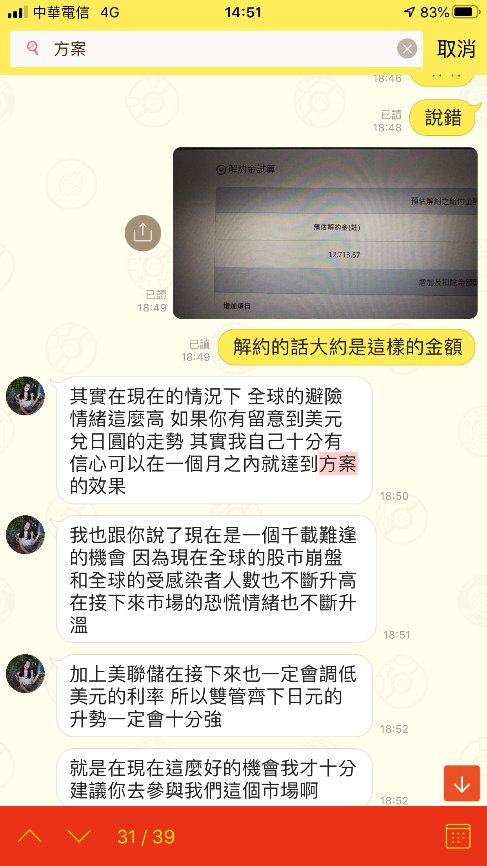

I knew the girl through Omi app. She said she came from Hong Kong and was trading in Malaysia now, working in KILCOR INVESTMENT MANAGEMENT PTY LTD. Then we chatted on Line. She tried her best to win your trust and then told you that you have to learn to earn money by money begets money, only in this way, can you get rich. I searched about her company, and the company said it was regulated. However, it turns out that the regulators were all fake. Don’t be cheated. Be cause I wanna make money to buy house and get married, making her have an opportunity. They used Mt4. At first, they would let you earn some money. She knew that I wanna make money very much so she recommended an investment plan for me which can earn double profit. She said she would deposit money in our account. You can see the amount in your account but she didn’t deposit the true money, what you can see just a number. I deposited about $58,000, of course I lost all. The money is from my credit loan. I realized I was cheated this June and called the police. They are so clever that it’s very difficult to get them. Then I can’t log in to my account, but they said they were hedging, and the withdraws were delayed until the middle of August. And then said, wait. What’s more, you would be convinced that the platform was true when you showed some negative information about this company. In a word, you have to be calm when facing this company. The company used the same website page as ETROLAND FUNDS MANAGEMENT PTY LTD, hilarious. Besides, their phone number doesn’t exist. Later, she said she was fired by the company because she lost all the money when investing. Obviously, I can’t withdraw. Mind to be careful when you use a dating app. An advice for you, don’t deposit money until you see the girl.

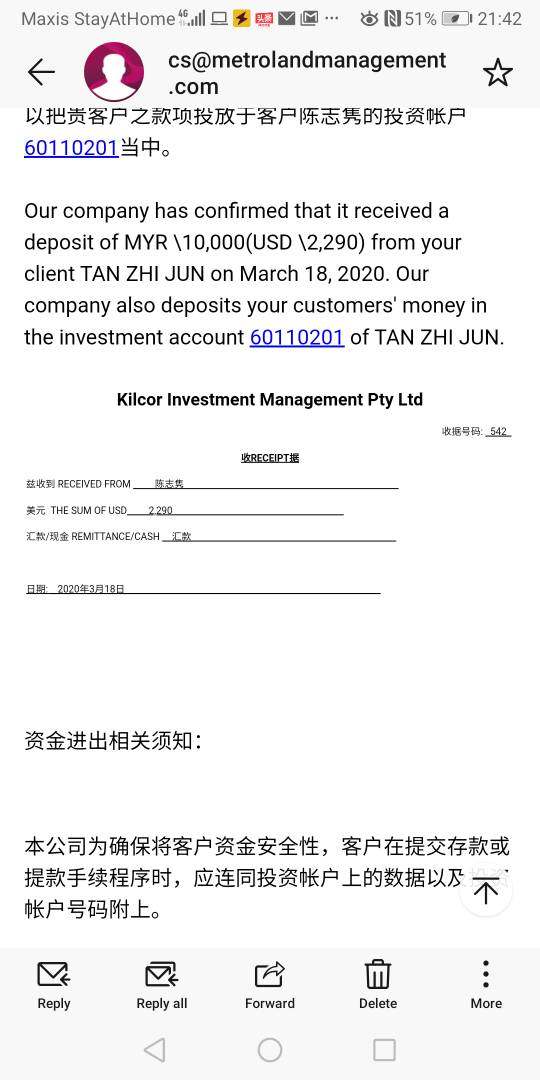

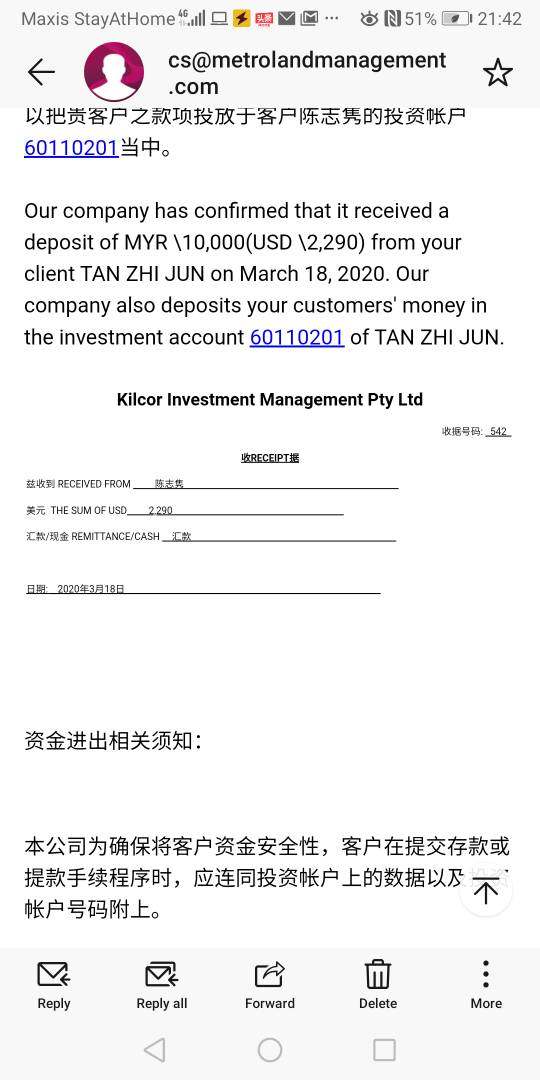

It is simply a fraud company. I deposited $3000. Then it informed me a good opportunity to earn money. So I signed the credit loan, albeit feeling it is a fraud. As long as I made up for the fund, I needn’t to pay the interest. What I want was to view the company profile, while the service only replied to me when it came to deposit. I figured out that the company opened its website 2 months ago. The receipt was from kilco. This 2 companies set up the website at the same time. I always believe what he said: 1. The so-called available is fake. As long as I wanted to withdraw fund, he would claim a failed process. He would sudden placed 31 lots to cause losses!