Is ITP Markets safe?

Business

License

Is ITP Markets Safe or Scam?

Introduction

ITP Markets is an online trading broker that positions itself as a provider of forex, CFDs, and cryptocurrency trading services. Operating from Saint Vincent and the Grenadines, it claims to offer competitive trading conditions, including high leverage and low minimum deposits. However, the lack of regulatory oversight raises red flags for potential investors. As the forex market is rife with unregulated entities and scams, traders must exercise caution when evaluating brokers like ITP Markets. This article aims to provide a comprehensive assessment of ITP Markets, examining its regulatory status, company background, trading conditions, customer fund security, customer experiences, platform performance, and overall risk profile.

Regulation and Legitimacy

The regulatory status of a broker is crucial in determining its legitimacy and safety for traders. ITP Markets claims to be regulated by the local Financial Services Authority (FSA) in Saint Vincent and the Grenadines. However, it is essential to note that this jurisdiction lacks a robust regulatory framework for forex trading. The FSA has explicitly stated that it does not issue licenses for forex trading or brokerage services, casting doubt on ITP Markets' claims of regulation.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FSA | N/A | Saint Vincent and the Grenadines | Not Verified |

The absence of legitimate regulation means that traders have little to no recourse if issues arise. This is a significant concern, as unregulated brokers often operate with minimal oversight, making it easier for them to engage in fraudulent activities without accountability. Given the lack of regulatory protection, it is prudent for traders to consider the risks associated with dealing with ITP Markets.

Company Background Investigation

ITP Markets operates under ITP Markets Ltd., which is registered in Saint Vincent and the Grenadines. The company does not provide extensive information about its ownership structure or management team, which raises transparency concerns. A lack of accessible information about the individuals behind the broker can be a warning sign, as reputable firms usually disclose their leadership and operational history.

The absence of a clear company history and the reliance on a jurisdiction known for housing unregulated brokers further complicate the assessment of ITP Markets' legitimacy. Without a track record or credible management team, potential clients may find it challenging to trust the broker.

Trading Conditions Analysis

ITP Markets advertises attractive trading conditions, such as a low minimum deposit requirement of $10 and high leverage of up to 1:500. However, the overall fee structure is not clearly outlined, which can be problematic for traders seeking transparency. The lack of detailed information about spreads, commissions, and other trading costs can lead to unexpected expenses.

| Fee Type | ITP Markets | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.5 pips | 1.0-1.2 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The potential for hidden fees or unfavorable trading conditions makes it imperative for traders to scrutinize the terms before committing funds. Furthermore, the promise of high leverage can amplify both gains and losses, increasing the risk of substantial financial loss.

Customer Fund Security

The safety of customer funds is a critical aspect of any trading platform. ITP Markets does not provide comprehensive information about its fund security measures. There is no mention of segregated accounts or investor protection policies, which are standard practices among reputable brokers. The absence of such measures indicates that traders' funds may not be secure, leaving them vulnerable to potential losses.

Historically, offshore brokers like ITP Markets have faced scrutiny for inadequate fund protection, leading to numerous complaints from clients who were unable to withdraw their funds. Without robust security protocols in place, traders should be cautious about depositing funds with ITP Markets.

Customer Experience and Complaints

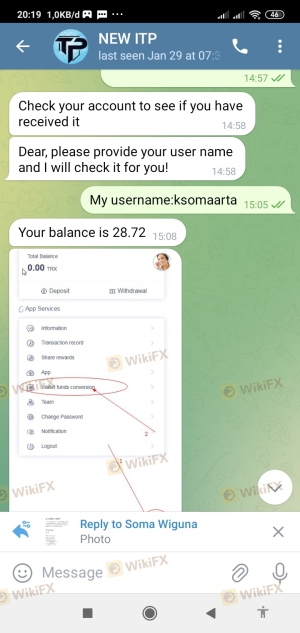

Customer feedback is a valuable resource for assessing a broker's reliability. Reviews of ITP Markets reveal a pattern of complaints regarding withdrawal issues and lack of customer support. Many users report difficulties in accessing their funds, which raises concerns about the broker's operational integrity.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Poor |

| Misleading Information | High | Poor |

Typical cases include clients who have been unable to withdraw their capital after multiple requests, leading to frustration and distrust. The company's lack of responsiveness to these complaints further exacerbates concerns about its reliability and safety.

Platform and Trade Execution

The trading platform offered by ITP Markets is purportedly MetaTrader 4 (MT4), a popular choice among traders. However, users have reported difficulties in accessing the platform, raising questions about the broker's operational capabilities. The quality of order execution, including slippage and rejection rates, is critical for traders, and any signs of manipulation can indicate a lack of trustworthiness.

Risk Assessment

Using ITP Markets presents several risks that potential traders should be aware of. The lack of regulation, unclear fee structures, and negative customer feedback contribute to a high-risk environment for trading.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated broker with no oversight |

| Fund Security Risk | High | No segregated accounts or protections |

| Operational Risk | Medium | Reports of platform accessibility issues |

Traders should consider these risks seriously and implement risk mitigation strategies, such as limiting the amount of capital invested and diversifying their trading activities across different, regulated brokers.

Conclusion and Recommendations

In conclusion, the evidence suggests that ITP Markets is not a safe trading option. The lack of regulatory oversight, transparency issues, and numerous customer complaints indicate that traders should exercise extreme caution. The potential for fraud and loss of funds is significant, making it essential for traders to seek alternatives that offer the necessary protections and regulatory compliance.

For those considering forex trading, it is advisable to choose brokers that are well-regulated in reputable jurisdictions. Reputable options include brokers regulated by authorities such as the FCA, ASIC, or CySEC, which provide a higher level of security and trustworthiness. Ultimately, when evaluating whether ITP Markets is safe, the overwhelming consensus points to the need for caution and a thorough assessment before engaging with this broker.

Is ITP Markets a scam, or is it legit?

The latest exposure and evaluation content of ITP Markets brokers.

ITP Markets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ITP Markets latest industry rating score is 1.42, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.42 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.