Is IFS market safe?

Business

License

Is IFS Markets A Scam?

Introduction

IFS Markets is an online forex and commodities broker that has been operating since 2008, with its headquarters in Australia. It positions itself as a provider of trading solutions for both novice and experienced traders, offering a range of instruments including forex, indices, and commodities. Given the volatile nature of the forex market, it is crucial for traders to carefully assess the credibility and reliability of their brokers. A broker's regulatory status, operational history, and customer feedback can significantly impact a trader's experience and financial safety. This article aims to evaluate whether IFS Markets is a safe trading platform or a potential scam by analyzing its regulatory compliance, company background, trading conditions, customer security measures, and user experiences.

Regulation and Legitimacy

The regulatory status of a broker is a critical factor in determining its legitimacy. IFS Markets claims to be regulated by the Australian Securities and Investments Commission (ASIC), which is known for its strict regulatory framework designed to protect investors. However, there are concerns regarding the current validity of this regulation.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 323193 | Australia | Suspected clone |

Despite its claims, IFS Markets has been flagged as a suspected clone of a legitimate broker, raising doubts about its regulatory compliance. The presence of negative disclosures from regulatory bodies and complaints from users further complicates its credibility. Regulatory quality is paramount; brokers under strict supervision are generally more reliable. However, the history of compliance for IFS Markets appears to be questionable, with reports suggesting that it may not be adhering to the necessary guidelines set forth by ASIC.

Company Background Investigation

Founded in 2008, IFS Markets has a relatively long history in the forex industry. However, the details surrounding its ownership structure and management team are often vague. A transparent company usually provides information about its founders, management team, and operational history, which can instill confidence in potential traders. Unfortunately, IFS Markets lacks clarity in this regard, as there is limited information available about its leadership and their professional backgrounds.

The companys transparency is further undermined by the absence of clear contact information, which can be a red flag for potential investors. In a well-regulated environment, companies are expected to maintain high levels of transparency and accountability. The lack of such information raises concerns about IFS Markets' legitimacy and operational integrity.

Trading Conditions Analysis

The trading conditions offered by a broker are crucial for traders' profitability and overall experience. IFS Markets provides two types of accounts: a standard account and a pro account. The standard account requires a minimum deposit of $100, while the pro account requires $300. However, the lack of clarity regarding spreads and commissions is concerning.

| Fee Type | IFS Markets | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | 1.1 pips | 1.0 pips |

| Commission Model | $7 per $10,000 | $5 per $10,000 |

| Overnight Interest Range | Varies | Varies |

The fees associated with IFS Markets appear to be on the higher side compared to industry averages, particularly with its commission structure. Additionally, the spread on major currency pairs is not competitive, which could eat into traders' profits. These factors warrant a careful examination of the broker's fee structure, as unusual or excessive fees can indicate potential issues.

Client Fund Safety

The safety of client funds is paramount in the forex trading environment. IFS Markets claims to employ several measures to protect clients' funds, including the segregation of client funds from the company's operational funds. This practice is essential for ensuring that clients can access their funds even in the event of company insolvency.

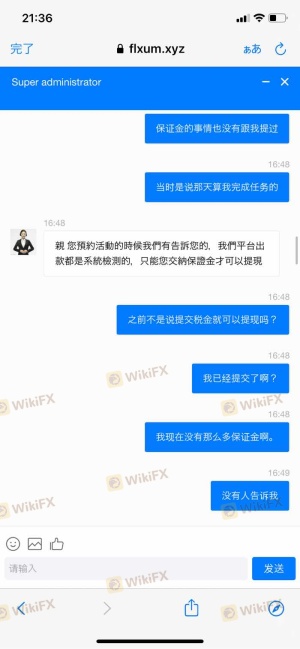

However, the effectiveness of these measures is questionable given the broker's regulatory status. There have been historical issues related to fund security, with reports of difficulties in processing withdrawals and other financial disputes. The absence of negative balance protection further increases the risk for traders, as they could potentially lose more than their initial investment.

Customer Experience and Complaints

Customer feedback is a vital indicator of a broker's reliability. Reviews of IFS Markets reveal a mixed bag of experiences, with numerous complaints reported by users.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow to respond |

| High Fees | Medium | Inconsistent |

| Poor Customer Support | High | Unresponsive |

Common complaints include issues with withdrawal processing and high fees, which have led many traders to question the broker's trustworthiness. Some users have reported being unable to withdraw their funds, which is a significant red flag. The overall sentiment among users leans towards caution, with many advising potential clients to think twice before engaging with this broker.

Platform and Trade Execution

The trading platform offered by IFS Markets is MetaTrader 4 (MT4), a widely recognized platform in the forex industry. While MT4 is generally reliable, the performance of the platform can vary based on the broker's execution quality.

Concerns have been raised regarding order execution, with reports of slippage and rejected orders. Such issues can significantly impact traders, especially those employing high-frequency trading strategies. Any signs of platform manipulation, such as unusual price movements or execution delays, could indicate deeper problems within the broker's operations.

Risk Assessment

Trading with IFS Markets involves several risks that potential clients should consider.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Suspected clone of a regulated broker |

| Financial Risk | Medium | Potential issues with fund withdrawals |

| Operational Risk | High | Complaints about platform reliability |

Given the high risk associated with IFS Markets, traders should approach with caution. It is advisable to conduct thorough research and consider alternative brokers with stronger regulatory backing and better user feedback.

Conclusion and Recommendations

Based on the analysis presented, it is evident that IFS Markets raises several red flags. The lack of clear regulatory verification, combined with numerous user complaints and concerns about fund safety, suggests that traders should exercise extreme caution when considering this broker.

For those seeking reliable trading options, it may be prudent to explore alternatives that offer robust regulatory oversight and a proven track record of positive customer experiences. Brokers such as those regulated by the FCA or ASIC with transparent operations and favorable trading conditions may provide safer trading environments. Ultimately, the decision to trade with IFS Markets should be made with careful consideration of the associated risks and the broker's overall credibility.

Is IFS market a scam, or is it legit?

The latest exposure and evaluation content of IFS market brokers.

IFS market Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

IFS market latest industry rating score is 1.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.