Is HconFX safe?

Business

License

Is HconFX Safe or Scam?

Introduction

HconFX is a forex broker that has gained attention in the trading community, primarily due to its claims of providing a wide range of trading services. As with any broker, it is crucial for traders to thoroughly evaluate its legitimacy and safety before committing their funds. The forex market is notorious for its volatility and the presence of unscrupulous operators, making it essential for traders to conduct due diligence. This article aims to provide a comprehensive assessment of HconFX, focusing on its regulatory status, company background, trading conditions, customer experience, and overall safety. The evaluation is based on multiple online sources, user reviews, and regulatory data to offer an objective analysis of whether HconFX is safe or a potential scam.

Regulation and Legitimacy

One of the primary indicators of a broker's trustworthiness is its regulatory status. Regulation serves as a safeguard for traders, ensuring that brokers adhere to strict operational standards and protect client funds. Unfortunately, HconFX has been flagged for having no valid regulatory information. According to sources, the broker operates without oversight from any recognized financial authority, which raises significant concerns about its legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The absence of regulation means that traders using HconFX are exposed to higher risks, including potential fraud and mismanagement of funds. A broker that lacks oversight can operate with little accountability, making it difficult for traders to seek recourse in case of disputes. Furthermore, the information available indicates that HconFX has a suspicious regulatory license and operates with a high potential risk. This lack of regulatory backing is a significant red flag when assessing whether HconFX is safe for trading.

Company Background Investigation

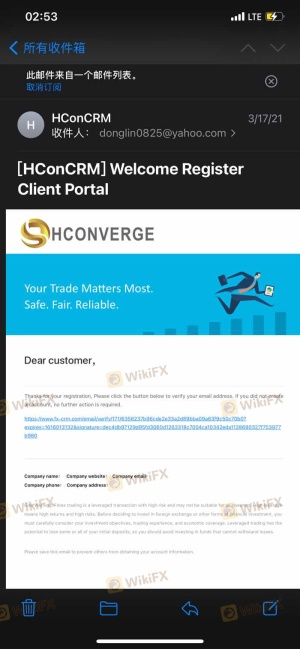

HconFX is registered under the name Hconverge International Ltd, with claims of operating for 5 to 10 years. However, the lack of transparency regarding its ownership structure and management team raises further questions about its credibility. The company is reported to be based in China, but there is little publicly available information about its history or operational practices.

The management team's qualifications and professional backgrounds are also unclear, which is concerning for potential clients. A reputable broker typically provides detailed information about its leadership and their experience in the financial markets. The absence of such information may indicate a lack of transparency, making it difficult for traders to trust the broker's intentions.

Overall, the limited information regarding HconFX's company background contributes to the skepticism surrounding its legitimacy. Without a clear understanding of the broker's operations and management, it becomes increasingly challenging to determine whether HconFX is safe or a scam.

Trading Conditions Analysis

When evaluating a broker, understanding its trading conditions is crucial. HconFX claims to offer competitive trading fees, but the specifics remain vague. The overall fee structure and potential hidden costs can significantly impact a trader's profitability.

| Fee Type | HconFX | Industry Average |

|---|---|---|

| Spread on Major Pairs | N/A | 1.0 - 2.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

Unfortunately, the lack of concrete information about HconFX's fees makes it difficult to assess its competitiveness compared to industry standards. Moreover, potential traders should be cautious of any unusual fees or commission structures that may not be explicitly stated. A broker that is not transparent about its fee structure may be attempting to exploit traders through hidden charges, further questioning whether HconFX is safe for trading.

Client Fund Safety

Ensuring the safety of client funds is paramount for any forex broker. HconFX's lack of regulation raises serious concerns about its fund security measures. A reputable broker typically implements strict protocols to safeguard client funds, including segregating client accounts from operational funds and providing investor protection schemes.

Unfortunately, the absence of verified information regarding HconFX's fund safety measures is alarming. Traders should be particularly wary of any broker that does not clearly communicate its policies on fund security, as this can lead to significant financial loss in the event of mismanagement or fraud.

Historically, brokers without robust fund security measures have faced issues, including insolvency and loss of client assets. Therefore, the lack of clarity surrounding HconFX's fund safety protocols adds to the skepticism regarding whether HconFX is safe for trading.

Customer Experience and Complaints

Customer feedback is a crucial aspect of evaluating a broker's reliability. HconFX has received mixed reviews from users, with some praising its trading platform while others express frustration over withdrawal issues and lack of customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Lack of Customer Support | Medium | Poor |

| Transparency Issues | High | Poor |

Common complaints include delays in processing withdrawals and inadequate customer service responses. Such issues can significantly impact a trader's experience and raise questions about the broker's operational integrity. The severity of these complaints should not be overlooked, as they may indicate deeper systemic problems within the brokerage.

Platform and Execution

The performance of a trading platform is essential for a smooth trading experience. HconFX claims to offer a user-friendly platform, but reports of execution issues, including slippage and order rejections, have been noted.

Traders have expressed concerns about the reliability of HconFX's platform, which can lead to missed trading opportunities and financial losses. Any signs of platform manipulation or technical difficulties should be taken seriously, as they can significantly affect a trader's ability to execute trades efficiently.

Risk Assessment

Using HconFX presents several risks that potential traders should be aware of.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No valid regulation. |

| Fund Safety Risk | High | Lack of fund protection measures. |

| Execution Risk | Medium | Reports of slippage and order issues. |

Given the high-risk levels associated with HconFX, it is crucial for traders to consider alternative brokers that offer greater security and regulatory oversight.

Conclusion and Recommendations

In conclusion, the evidence suggests that HconFX poses significant risks to traders. The lack of regulation, transparency issues, and mixed customer feedback raise serious concerns about its legitimacy. Therefore, it is advisable for traders to exercise caution when considering HconFX for their trading activities.

For those looking for safer alternatives, brokers regulated by top-tier authorities such as the FCA or ASIC are recommended. These brokers typically offer better fund protection, transparency, and overall reliability. In light of the findings, it is clear that HconFX may not be the safest option for traders seeking a trustworthy forex broker.

Is HconFX a scam, or is it legit?

The latest exposure and evaluation content of HconFX brokers.

HconFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

HconFX latest industry rating score is 1.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.