Is GlobalArabFX safe?

Business

License

Is GlobalArabFX A Scam?

Introduction

GlobalArabFX is a forex brokerage that claims to provide trading services in various financial instruments, including currencies, commodities, and indices. Established in 2007, the broker positions itself as an international entity aimed at attracting traders from around the globe. However, in the ever-evolving landscape of forex trading, it is crucial for traders to conduct thorough evaluations of brokers before committing their funds. Given the prevalence of scams and fraudulent operations in the forex industry, understanding the legitimacy of a broker like GlobalArabFX is essential. This article will employ a comprehensive assessment framework, analyzing the broker's regulatory status, company background, trading conditions, customer fund security, client experiences, platform performance, and associated risks.

Regulation and Legitimacy

The regulatory environment in which a broker operates is a fundamental indicator of its legitimacy. A well-regulated broker is subject to stringent oversight, which helps protect traders' interests. Unfortunately, GlobalArabFX does not appear to be regulated by any reputable financial authority, raising serious concerns about its operational legitimacy. The following table summarizes the core regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unregulated |

Without any valid regulatory oversight, traders must exercise extreme caution. The absence of regulation not only indicates a lack of accountability but also raises questions about the broker's operational practices. In the forex industry, brokers that operate without regulatory oversight are often associated with high-risk activities and potential scams. The lack of regulatory history and compliance further exacerbates concerns regarding the safety of funds and the integrity of trading practices at GlobalArabFX.

Company Background Investigation

Understanding the background of GlobalArabFX is essential to assess its credibility. According to available information, GlobalArabFX claims to have been established in 2007, backed by both Arab and foreign capital. However, details regarding its ownership structure and management team remain ambiguous. The absence of clear information about the individuals behind the broker is a significant red flag. A reputable broker typically provides transparency regarding its ownership and management, including the qualifications and experience of its leadership.

Furthermore, the company's website lacks comprehensive information about its history, which raises questions about its legitimacy. Transparency in operations and clear disclosures are vital for building trust with clients. The absence of such information makes it difficult for potential clients to ascertain the broker's reliability. Given these factors, the lack of transparency and the dubious background of GlobalArabFX contribute to the skepticism surrounding its operations.

Trading Conditions Analysis

When evaluating a broker, it is essential to consider the trading conditions they offer. GlobalArabFX presents various account types, including standard, gold, premium, and VIP accounts, each with varying minimum deposit requirements. However, the overall fee structure and trading conditions appear to be concerning. The following table compares the core trading costs associated with GlobalArabFX against industry averages:

| Fee Type | GlobalArabFX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1-2 pips |

| Commission Structure | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The absence of clear information regarding spreads, commissions, and overnight interest rates raises suspicion. Brokers that lack transparency in their fee structures often engage in practices that can be detrimental to traders, such as hidden fees or unfavorable trading conditions. Moreover, if traders encounter unexpected costs or fees, it can significantly impact their trading experience and profitability.

Client Fund Security

The safety of client funds is paramount in the forex trading environment. GlobalArabFX's lack of regulatory oversight raises significant concerns regarding the security measures it has in place. A reputable broker should segregate client funds from its operational funds, ensuring that clients' money is protected in the event of financial difficulties. Unfortunately, there is no information available regarding GlobalArabFX's fund segregation practices.

Additionally, the broker's website does not mention any investor protection schemes or policies regarding negative balance protection. This lack of information is alarming, as it suggests that traders may be at risk of losing their entire investment without any recourse. Historical data regarding fund security issues or disputes involving GlobalArabFX is also absent, further contributing to the skepticism surrounding the broker's commitment to safeguarding client assets.

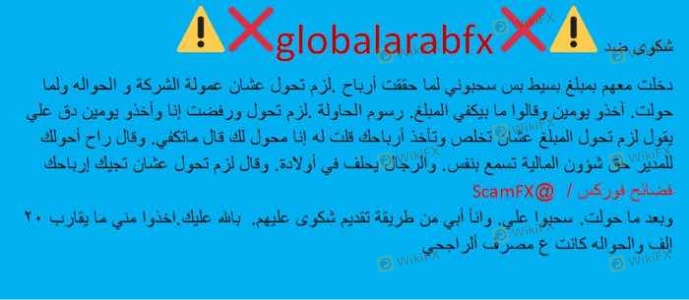

Customer Experience and Complaints

Analyzing customer feedback is vital for understanding the overall experience associated with a broker. Various online reviews and forums indicate that clients of GlobalArabFX have reported significant issues, particularly regarding withdrawal processes. The following table summarizes the primary complaint types and their severity ratings:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Lack of Communication | Medium | Poor |

| Misleading Information | High | Poor |

Common complaints include difficulties in withdrawing funds, lack of communication from customer support, and allegations of misleading information regarding trading conditions. These issues are serious indicators of a potentially fraudulent operation. Clients have expressed frustration over their inability to access their funds, which is a common tactic employed by scam brokers to retain clients' money. The lack of effective communication from the company further exacerbates these issues, leaving clients feeling unsupported.

Platform and Trade Execution

The trading platform is a crucial aspect of the trading experience. GlobalArabFX offers a platform that claims to provide a user-friendly interface and efficient trade execution. However, the absence of detailed information about the platform's performance, stability, and execution quality raises concerns. Traders have reported issues with order execution, including slippage and rejected orders, which can significantly impact trading outcomes.

Moreover, any indications of platform manipulation or irregularities in trade execution should be thoroughly investigated. A reliable broker should provide a transparent and stable trading environment, ensuring that trades are executed fairly and efficiently. Without clear evidence of the platform's reliability, potential clients should approach GlobalArabFX with caution.

Risk Assessment

Engaging with GlobalArabFX presents various risks that potential traders must consider. The following risk assessment summarizes key risk areas associated with this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status poses significant risks. |

| Fund Security Risk | High | Lack of fund segregation and protection. |

| Operational Risk | Medium | Complaints regarding withdrawal issues. |

| Platform Reliability Risk | Medium | Reports of execution issues and slippage. |

To mitigate these risks, potential clients should conduct thorough due diligence before engaging with GlobalArabFX. It is advisable to consider alternative brokers that are well-regulated and have a proven track record of reliable service.

Conclusion and Recommendations

In conclusion, the evidence suggests that GlobalArabFX raises several red flags that indicate it may not be a trustworthy broker. The lack of regulatory oversight, transparency regarding company information, and numerous client complaints about withdrawal issues all contribute to a concerning picture. While some traders may still consider using GlobalArabFX, it is crucial to approach this broker with caution.

For traders seeking a reliable trading experience, it is recommended to consider alternatives that are regulated by reputable authorities and have a history of positive client feedback. Brokers with strong regulatory frameworks, transparent fee structures, and effective customer support should be prioritized to ensure a safer trading environment.

In summary, is GlobalArabFX safe? The overwhelming evidence points to a high level of risk, and potential traders should be wary of engaging with this broker.

Is GlobalArabFX a scam, or is it legit?

The latest exposure and evaluation content of GlobalArabFX brokers.

GlobalArabFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

GlobalArabFX latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.