Is Glluck Limited safe?

Business

License

Is Glluck Limited A Scam?

Introduction

Glluck Limited, a relatively new player in the forex market, has been attracting attention since its inception in 2020. Positioned as a forex broker, it claims to offer various trading services, including access to the popular MetaTrader 4 platform. However, as with any financial service provider, it is crucial for traders to exercise caution and conduct thorough due diligence before engaging with such platforms. The forex market is rife with risks, and unregulated or poorly regulated brokers can potentially lead to significant financial losses. In this article, we will investigate whether Glluck Limited is a safe trading option or a potential scam. Our assessment will be based on a comprehensive review of regulatory compliance, company background, trading conditions, customer experiences, and risk factors.

Regulation and Legitimacy

The regulatory status of a forex broker is a critical factor in determining its legitimacy. Glluck Limited claims to be regulated by the National Futures Association (NFA) in the United States, but discrepancies arise when examining its actual compliance. The NFA has a reputation for enforcing strict regulations to protect traders, and being a member signifies a broker's adherence to these standards. However, a deeper investigation reveals that Glluck Limited is not listed as a member of the NFA, raising concerns about its regulatory claims.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| National Futures Association (NFA) | 0532834 | United States | Unauthorized |

The absence of proper regulatory oversight is alarming. It indicates that Glluck Limited operates without the necessary checks and balances that protect traders from fraud and malpractice. Furthermore, the broker has received negative disclosures from regulators, including being blacklisted by the Autorité des marchés financiers (AMF) in Canada. This lack of credible regulation is a significant red flag and suggests that traders should be wary of engaging with Glluck Limited.

Company Background Investigation

Glluck Limited's history is relatively short, having been established in 2020. The lack of transparency surrounding its ownership structure and management team raises further concerns. A reputable broker typically provides information about its founders and key personnel, along with their professional backgrounds. Unfortunately, Glluck Limited fails to disclose such information, making it difficult for potential clients to assess the integrity and expertise of those running the operation.

The company's website does not provide clear contact details or a physical address, which is another indicator of potential untrustworthiness. Transparency is essential in the financial industry, and the absence of this information suggests that Glluck Limited may not have the best interests of its clients at heart. Without a transparent operational structure and a credible management team, it is challenging to trust that Glluck Limited is a safe broker.

Trading Conditions Analysis

When evaluating a forex broker, understanding its trading conditions is vital. Glluck Limited claims to offer competitive spreads and no commission on trades, which may initially seem appealing. However, such offers often come with hidden costs or unfavorable trading conditions. A detailed analysis of the broker's fee structure reveals potential pitfalls that traders should be aware of.

| Fee Type | Glluck Limited | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.2 pips | 1.0 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | Not specified | Varies |

The exceptionally low spreads advertised by Glluck Limited could be indicative of a bait-and-switch tactic, where traders are lured in with attractive pricing but face difficulties when attempting to execute trades. Additionally, the lack of clarity on overnight interest rates raises concerns about potential hidden fees that could erode profits. Traders should approach Glluck Limited's trading conditions with caution, as they may not reflect the true cost of trading.

Client Fund Safety

The safety of client funds is paramount when choosing a forex broker. Glluck Limited's approach to fund safety is concerning, particularly due to its lack of regulatory oversight. A reputable broker typically segregates client funds into separate accounts to protect them in the event of insolvency. Additionally, regulatory bodies often require brokers to provide investor protection measures, such as compensation schemes for clients in case of broker failure.

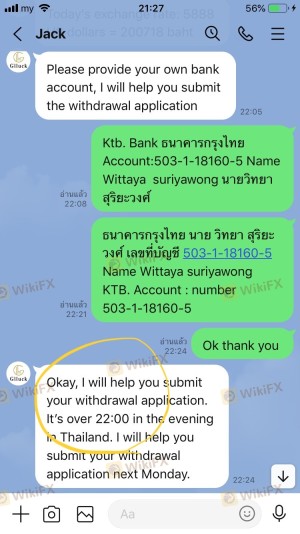

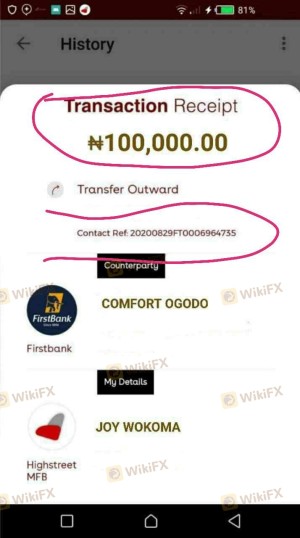

Unfortunately, Glluck Limited does not provide clear information regarding its fund protection policies. The absence of details on fund segregation and negative balance protection raises significant concerns about the safety of traders' investments. Furthermore, there have been reports of clients experiencing difficulties withdrawing their funds, which is a common complaint among unregulated brokers. This history of fund safety issues should serve as a strong warning for potential clients.

Customer Experience and Complaints

Analyzing customer feedback is essential in assessing the credibility of a broker. Glluck Limited has received numerous complaints from users, particularly regarding withdrawal issues and claims of being scammed. Many clients report that after depositing funds, they encountered significant challenges when attempting to withdraw their money. This pattern of complaints is alarming and suggests that Glluck Limited may not prioritize customer satisfaction.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Slow |

| Misleading Information | High | Unresponsive |

Two notable cases highlight the severity of complaints against Glluck Limited. In one instance, a client reported being unable to withdraw their funds after repeated requests, leading to frustration and financial loss. Another client claimed they were misled about the broker's regulatory status, only to discover that Glluck Limited was not authorized to operate. These cases exemplify the potential risks associated with trading through Glluck Limited.

Platform and Trade Execution

The trading platform is a critical component of a trader's experience. Glluck Limited offers the MetaTrader 4 platform, which is well-regarded in the industry. However, the performance and reliability of the platform are crucial factors to consider. Reports of slippage, execution delays, and rejected orders have surfaced among users, raising questions about the broker's trading execution quality.

Traders have expressed concerns about the possibility of price manipulation, with some claiming that the broker adjusts prices to favor its interests. Such practices are indicative of a broker that may not operate in good faith, further reinforcing the need for caution when considering Glluck Limited as a trading partner.

Risk Assessment

Engaging with Glluck Limited presents several risks that potential clients should carefully consider. The following risk assessment summarizes the key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | High | Unregulated, leading to potential fraud. |

| Fund Safety | High | Lack of fund protection measures. |

| Trading Conditions | Medium | Potential hidden fees and unfavorable spreads. |

| Customer Support | Medium | Slow response times and poor service. |

To mitigate these risks, potential clients are advised to conduct thorough research, seek regulated alternatives, and remain vigilant about their investments.

Conclusion and Recommendations

In conclusion, the evidence gathered raises significant concerns about the safety and legitimacy of Glluck Limited. The lack of credible regulation, coupled with a history of customer complaints and withdrawal issues, suggests that this broker may not be a safe option for traders. While the trading platform may offer some appealing features, the overall risk profile is too high to recommend Glluck Limited as a trustworthy broker.

For traders seeking safe and reliable forex trading options, it is advisable to consider well-regulated brokers with transparent practices and a proven track record. Alternatives such as brokers regulated by top-tier authorities like the FCA or ASIC may provide a more secure trading environment. Ultimately, exercising caution and conducting due diligence is paramount when selecting a forex broker.

Is Glluck Limited a scam, or is it legit?

The latest exposure and evaluation content of Glluck Limited brokers.

Glluck Limited Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Glluck Limited latest industry rating score is 1.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.