Is GLENBER safe?

Business

License

Is Glenber Safe or Scam?

Introduction

Glenber is a forex broker that has garnered attention in the trading community, primarily due to its claims of offering competitive trading conditions and advanced trading platforms. However, as with any financial service provider, it is crucial for traders to exercise caution and conduct thorough evaluations before committing their capital. The forex market, while lucrative, is also rife with potential scams and unregulated brokers that can jeopardize traders' investments. This article aims to provide an in-depth analysis of Glenber, assessing its regulatory status, company background, trading conditions, customer experiences, and overall safety. Our investigation is based on a comprehensive review of online sources, including user feedback, regulatory databases, and market analysis.

Regulation and Legitimacy

The regulatory status of a broker is a critical factor in determining its legitimacy and safety. A well-regulated broker is typically subject to strict oversight, ensuring that it adheres to industry standards and protects client funds. In the case of Glenber, the broker claims to be registered in the United Kingdom. However, our research indicates that it operates without proper licensing from recognized regulatory authorities.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| National Futures Association (NFA) | 0538758 (Unauthorized) | United States | Not Verified |

The lack of a valid regulatory license raises significant concerns regarding Glenber's operations. Not only does it fail to meet the compliance standards set by major regulatory bodies like the Financial Conduct Authority (FCA) or the Commodity Futures Trading Commission (CFTC), but it also has a history of negative user reviews and complaints. This absence of regulatory oversight is a major red flag for potential traders, indicating that their funds may not be safe with Glenber.

Company Background Investigation

Glenber's company history and ownership structure remain ambiguous. The broker's website provides minimal information about its founding, management team, or operational history. This lack of transparency is concerning, as reputable brokers typically offer detailed insights into their corporate structure and the qualifications of their management teams.

Moreover, the absence of publicly available information about the individuals behind Glenber further diminishes its credibility. Traders seeking to evaluate the safety of a broker should be able to access comprehensive details about the company's leadership and their professional backgrounds. In Glenber's case, the obscurity surrounding its ownership and management raises questions about its legitimacy and operational integrity.

Trading Conditions Analysis

When assessing the trading conditions offered by Glenber, it is essential to consider the overall fee structure and any unusual policies that may exist. Glenber claims to provide competitive spreads and leverage options; however, the specifics of these conditions are not clearly outlined on its website.

| Fee Type | Glenber | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Not Disclosed | 1.0 - 2.0 pips |

| Commission Model | Not Disclosed | Varies (typically 0 - 10 USD per lot) |

| Overnight Interest Range | Not Disclosed | Varies (typically 0.5 - 2.5%) |

The lack of transparency regarding trading costs is concerning. Potential clients may find themselves facing hidden fees or unfavorable terms that were not disclosed upfront. This opacity in fee structures can lead to unexpected losses, making it imperative for traders to fully understand the costs associated with trading on Glenber's platform.

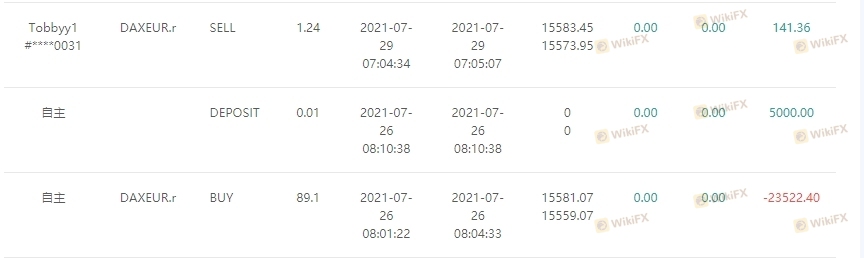

Client Fund Safety

The safety of client funds is a paramount concern for any trader. Glenber's policies regarding fund security and management practices are critical in evaluating whether it is safe to trade with this broker. While Glenber claims to implement measures to protect client assets, the absence of regulatory oversight raises doubts about the effectiveness of these measures.

Traders must inquire about fund segregation, investor protection schemes, and negative balance protection policies. The lack of clear information regarding these safety measures can signal a potential risk to client funds. Historical incidents involving fund mismanagement or disputes can also influence the assessment of Glenber's safety.

Customer Experience and Complaints

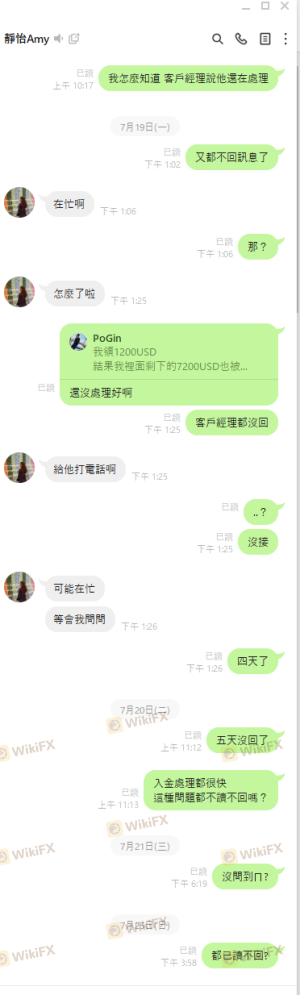

Customer feedback is a valuable indicator of a broker's reliability and service quality. In the case of Glenber, numerous complaints have surfaced online, highlighting issues such as withdrawal difficulties, lack of customer support, and misleading marketing practices.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor Response |

| Customer Support | Medium | Inconsistent |

| Misleading Claims | High | No Response |

Common complaints revolve around traders being unable to withdraw funds after making deposits, which is a significant concern for anyone considering trading with Glenber. The company's lack of responsiveness to these complaints further exacerbates the situation, suggesting a disregard for customer satisfaction and trust.

Platform and Trade Execution

The trading platform offered by Glenber is a crucial aspect of its service. A reliable and efficient trading platform is essential for executing trades effectively. Glenber claims to use the popular MetaTrader 4 platform; however, user reviews indicate potential issues with platform stability, order execution speed, and slippage.

Traders have reported instances of delayed order execution and frequent slippage during volatile market conditions. Such issues can severely impact trading performance and profitability, raising concerns about whether Glenber provides a trustworthy trading environment.

Risk Assessment

Using Glenber as a forex broker carries inherent risks, primarily due to its lack of regulation and numerous customer complaints.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated broker with no oversight. |

| Financial Risk | Medium | Potential for hidden fees and withdrawal issues. |

| Operational Risk | High | Reports of platform instability and poor execution. |

Traders should approach Glenber with caution, considering the significant risks involved. It is advisable to conduct thorough research and consider alternative, well-regulated brokers to mitigate these risks.

Conclusion and Recommendations

In conclusion, the evidence suggests that Glenber raises several red flags that warrant caution. The lack of regulatory oversight, ambiguous company background, and numerous negative customer experiences indicate that Glenber may not be a safe choice for traders.

For individuals considering trading with Glenber, it is essential to weigh these risks carefully. If you are a novice trader or someone looking to invest significant capital, it may be prudent to explore alternative brokers that are well-regulated and have a proven track record of customer satisfaction.

In summary, is Glenber safe? The available evidence leans toward a cautious approach, and traders should consider seeking out reputable alternatives to ensure the safety of their investments.

Is GLENBER a scam, or is it legit?

The latest exposure and evaluation content of GLENBER brokers.

GLENBER Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

GLENBER latest industry rating score is 1.51, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.51 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.