Is GCCM GROUP safe?

Business

License

Is GCCM Group Safe or Scam?

Introduction

GCCM Group is a relatively new player in the forex market, having been established in 2021. Based in China, it offers a variety of trading options, including forex, stocks, and CFDs. As the forex market continues to grow, the number of brokers increases, making it crucial for traders to carefully assess the reliability and safety of these platforms before investing their hard-earned money. The potential for scams and fraudulent activities in the unregulated trading environment necessitates a thorough evaluation of brokers like GCCM Group. This article employs a comprehensive investigative approach, analyzing regulatory status, company background, trading conditions, customer experiences, and risk assessments to determine whether GCCM Group is safe or a potential scam.

Regulation and Legitimacy

The regulatory landscape is a critical factor in assessing whether a broker is trustworthy. GCCM Group is currently unregulated, meaning it does not operate under the oversight of any recognized financial authority. This lack of regulation raises significant concerns about the safety and security of client funds, as well as the overall trustworthiness of the platform.

Here is a summary of the core regulatory information for GCCM Group:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | China | Unverified |

The absence of a regulatory framework means that GCCM Group is not subject to the stringent operational standards imposed by recognized authorities. This raises questions about the broker's adherence to ethical practices and its ability to protect traders. Without regulation, traders may face challenges in resolving disputes or recovering funds in the event of a broker's insolvency. Consequently, potential clients must approach GCCM Group with caution and conduct thorough research before engaging with the platform.

Company Background Investigation

GCCM Group was founded in 2021 and operates out of China. As a relatively new entity in the forex market, it lacks a long track record that could instill confidence among potential investors. The company's ownership structure remains unclear, and there is limited information available regarding its management team. This lack of transparency can be a red flag for traders seeking to understand the credibility of the broker.

The quality of management is often indicative of a broker's reliability. However, without detailed information about the qualifications and experience of GCCM Group's leadership, it is challenging to assess the company's operational integrity. Moreover, the absence of clear information on the company's website regarding its corporate structure and management team further complicates the evaluation process. Traders should be wary of platforms that do not provide adequate information about their background, as this can be a sign of potential deceit.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions is essential. GCCM Group advertises competitive trading conditions, including spreads as low as 0 and a minimum deposit requirement of 5,000 yuan. However, without regulatory oversight, these claims must be approached with skepticism.

The following table outlines the core trading costs associated with GCCM Group:

| Cost Type | GCCM Group | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | 0 pips | 1-2 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The promise of low spreads can be enticing, but traders should be aware that such conditions may not be applicable to all trading instruments or market conditions. Additionally, the lack of transparency regarding commission structures and overnight interest rates raises concerns about hidden fees that could impact profitability. Traders must carefully review the terms and conditions before committing to any broker, especially one that is unregulated.

Client Funds Safety

The safety of client funds is paramount when selecting a forex broker. GCCM Group's unregulated status presents significant risks in this regard. Without a regulatory body overseeing its operations, there are no guarantees regarding the safety of client deposits or the implementation of necessary security measures.

Traders should consider the following aspects of GCCM Group's client fund safety:

- Fund Segregation: It is unclear whether GCCM Group implements fund segregation practices, which are critical for protecting client funds from misappropriation.

- Investor Protection: As an unregulated entity, GCCM Group does not offer any investor protection schemes, leaving clients vulnerable in the event of insolvency.

- Negative Balance Protection: There is no information indicating that GCCM Group provides negative balance protection, which could expose traders to significant financial risks.

- Order Execution Quality: The speed and reliability of order execution are critical for traders, especially in volatile markets. Reports of slippage and rejections can negatively impact trading outcomes.

- Platform Manipulation: There have been concerns about potential platform manipulation, particularly in unregulated environments. Traders should remain vigilant and monitor their trades closely.

The absence of these critical safety measures raises serious concerns about the potential for loss of funds. Traders should be cautious when considering GCCM Group, as the lack of regulatory oversight can lead to severe financial repercussions.

Customer Experience and Complaints

Analyzing customer feedback is vital in assessing a broker's reliability. Reviews and experiences shared by traders can provide insight into the quality of service and the broker's responsiveness to complaints. However, GCCM Group has received mixed reviews, with several users expressing concerns about withdrawal issues and customer support.

The following table summarizes the primary complaint types related to GCCM Group:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Customer Support Quality | Medium | Inconsistent |

Common complaints include difficulties in withdrawing funds, which is a significant red flag for any broker. Traders have reported delays in processing withdrawal requests and inadequate responses from customer support. These issues can lead to frustration and financial loss, making it essential for potential clients to weigh these factors seriously.

Case Study

One trader reported attempting to withdraw funds after a successful trading period but faced repeated delays and unresponsive customer support. After multiple attempts to contact the broker, the trader was still unable to access their funds, leading to suspicions about the platform's integrity. Such experiences highlight the importance of choosing a broker with a solid reputation for customer service and reliability.

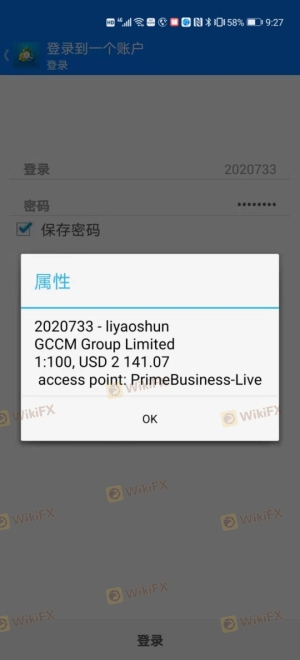

Platform and Trade Execution

The trading platform is a crucial aspect of the trading experience. GCCM Group utilizes the widely recognized MetaTrader 4 (MT4) platform, known for its functionality and user-friendly interface. However, the overall performance and reliability of the platform are essential for successful trading.

Traders should consider the following aspects of GCCM Group's platform:

While MT4 offers a robust trading environment, the lack of regulation raises questions about the broker's accountability and the integrity of its trading practices.

Risk Assessment

Using GCCM Group comes with inherent risks, primarily due to its unregulated status and the associated concerns regarding fund safety and customer service. Traders must be aware of these risks and take proactive measures to mitigate them.

The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight for client funds. |

| Withdrawal Risk | High | Complaints about delayed withdrawals. |

| Platform Risk | Medium | Potential for order execution issues. |

| Transparency Risk | High | Lack of information regarding management. |

To mitigate these risks, traders should conduct thorough research, consider starting with a small investment, and explore alternative brokers with robust regulatory frameworks and positive customer feedback.

Conclusion and Recommendations

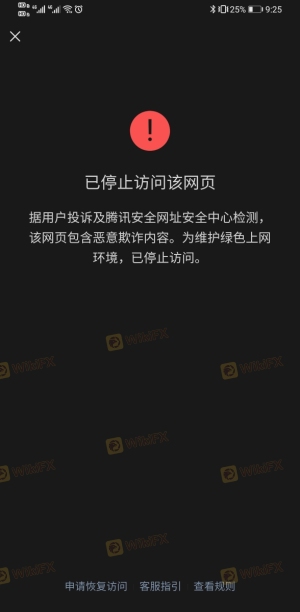

In conclusion, GCCM Group presents several red flags that warrant caution. The broker's unregulated status, lack of transparency, and numerous customer complaints raise serious concerns about its safety and reliability. While it offers competitive trading conditions, the absence of regulatory oversight and adequate fund protection measures make it a risky choice for traders.

For those considering trading with GCCM Group, it is crucial to weigh the potential risks against the benefits. Traders seeking a more secure trading environment may want to explore alternative brokers that are regulated by reputable authorities and have a proven track record of customer satisfaction. Some recommended alternatives include brokers regulated by the FCA in the UK or ASIC in Australia, which offer greater security and investor protection.

Ultimately, it is vital for traders to prioritize safety and conduct thorough due diligence before engaging with any forex broker, including GCCM Group.

Is GCCM GROUP a scam, or is it legit?

The latest exposure and evaluation content of GCCM GROUP brokers.

GCCM GROUP Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

GCCM GROUP latest industry rating score is 1.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.