Is FXRHS safe?

Business

License

Is FXRHS Safe or Scam?

Introduction

FXRHS is a forex broker that has positioned itself in the competitive online trading market since its establishment in 2017. Based in New Zealand, FXRHS offers various trading services, including access to popular trading platforms like MetaTrader 4 and 5. However, with the rapid growth of online trading, it is crucial for traders to carefully evaluate the trustworthiness of brokers before committing their hard-earned money. The forex market is notorious for scams and fraudulent activities, making due diligence essential for protecting investments. This article aims to provide an objective assessment of FXRHS, utilizing data from various sources, including regulatory information, user experiences, and financial analyses, to determine whether FXRHS is safe or a potential scam.

Regulatory and Legitimacy

The regulatory status of a forex broker is one of the most critical aspects to consider when assessing its legitimacy. FXRHS claims to operate under the Financial Service Providers Register (FSPR) in New Zealand. However, the broker has received a low score of 2.01 on WikiFX, indicating potential issues with its regulatory compliance and overall trustworthiness.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FSPR | 513806 | New Zealand | Suspicious Clone |

The importance of regulation cannot be overstated; it serves as a safeguard for traders, ensuring that brokers adhere to strict operational standards. In the case of FXRHS, its association with a low regulatory score raises red flags. Moreover, the lack of clear information regarding its compliance history and any previous regulatory issues makes it imperative for traders to approach FXRHS with caution.

Company Background Investigation

FXRHS was founded in 2017 and has since aimed to cater to various trading needs. However, the opacity surrounding its ownership structure and management team is concerning. Limited information is available regarding the backgrounds of key personnel, which can indicate a lack of transparency. A broker's credibility often hinges on the experience and qualifications of its management team. If traders cannot find reliable information about the individuals running the broker, it raises questions about the broker's legitimacy and operational integrity.

Furthermore, the company's history and development trajectory suggest a relatively short presence in the market, which may not provide adequate assurance of stability. Established brokers typically have a longer track record, demonstrating their ability to navigate market fluctuations. In the case of FXRHS, the absence of extensive historical data may further fuel skepticism among potential clients.

Trading Conditions Analysis

FXRHS offers various trading conditions, but a detailed analysis reveals potential issues. The broker's fee structure appears to be competitive at first glance; however, hidden fees and unclear policies could impact traders negatively.

| Fee Type | FXRHS | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1.0 - 2.0 pips |

| Commission Model | Unknown | $0 - $10 per lot |

| Overnight Interest Range | High | Low to Medium |

The lack of transparency in FXRHS's commission model and overnight interest rates can lead to unexpected costs for traders. Many brokers in the industry are upfront about their fee structures, allowing traders to make informed decisions. In contrast, FXRHS's vague policies may suggest a lack of commitment to fair trading practices, which is a significant concern when evaluating whether FXRHS is safe.

Customer Funds Safety

The safety of customer funds is paramount for any trading platform. FXRHS claims to implement various security measures to protect client deposits, such as segregated accounts. However, the effectiveness of these measures is questionable given the broker's low regulatory score and the lack of detailed information regarding its operational practices.

Traders should be particularly cautious if a broker does not provide clear information about how customer funds are handled. If funds are not held in segregated accounts, there is a risk that the broker could misuse client deposits. Moreover, FXRHS has not faced any major regulatory actions, but the absence of transparency regarding its fund management practices raises concerns about potential vulnerabilities.

Customer Experience and Complaints

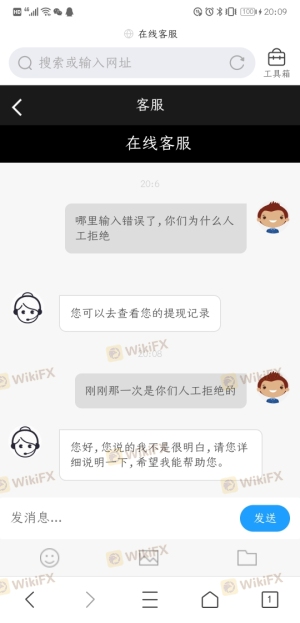

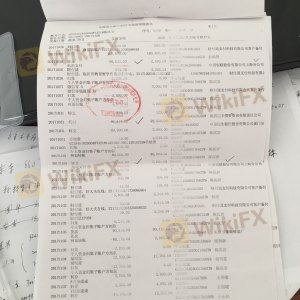

Customer feedback is an essential component of assessing a broker's reliability. Reviews of FXRHS reveal a mixed bag of experiences, with some users reporting difficulties in withdrawing funds and inadequate customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow Response |

| Customer Support | Medium | Unresponsive |

Common complaints include the inability to withdraw funds and slow customer service responses. Such issues can indicate deeper operational problems within the broker, leading to skepticism about whether FXRHS is safe for traders. In particular, the inability to access funds is a significant red flag, as it directly impacts a trader's ability to manage their investments effectively.

Platform and Trade Execution

The trading platform offered by FXRHS is based on popular software like MetaTrader 4 and 5, which are generally well-regarded in the industry. However, the performance of the platform, including order execution quality and slippage rates, is crucial for a positive trading experience. Reports of slippage and rejected orders can indicate potential manipulations or inefficiencies within the trading environment.

While FXRHS may provide a user-friendly interface, the execution quality needs thorough evaluation. If traders consistently experience slippage or order rejections, it could significantly affect their trading outcomes, leading to losses.

Risk Assessment

Using FXRHS involves various risks that traders should be aware of. The lack of transparency in regulatory compliance, potential hidden fees, and customer complaints can create an environment of uncertainty.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | High | Low regulatory score and unclear history |

| Fee Transparency | Medium | Potential hidden fees and vague policies |

| Fund Safety | High | Concerns about fund management practices |

To mitigate these risks, traders should conduct thorough research before engaging with FXRHS. Opening a demo account or starting with a small deposit can provide insights into the broker's operations without significant financial exposure.

Conclusion and Recommendations

In conclusion, while FXRHS presents itself as a viable option for forex trading, several factors suggest that caution is warranted. The low regulatory score, lack of transparency regarding fees, and mixed customer experiences raise significant concerns about the broker's safety.

For traders considering FXRHS, it is essential to weigh these risks carefully and consider alternative brokers with stronger regulatory backing and clearer operational practices. Recommended alternatives include well-established brokers that are regulated by top-tier authorities, which provide a safer trading environment. Ultimately, ensuring the safety of funds and the integrity of trading practices should be the top priority for any trader.

Is FXRHS a scam, or is it legit?

The latest exposure and evaluation content of FXRHS brokers.

FXRHS Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FXRHS latest industry rating score is 1.61, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.61 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.