Is FXG Invest safe?

Business

License

Is FXG Invest Safe or a Scam?

Introduction

FXG Invest is a forex and CFD broker that has garnered attention in the trading community for its offshore registration and the services it offers. Operating under the ownership of Grand Services Ltd, registered in the Marshall Islands, FXG Invest claims to provide a platform for trading various financial instruments. However, the legitimacy of such brokers is often questioned, especially given the potential for scams in the online trading landscape. Traders must exercise caution and conduct thorough research before engaging with any broker, particularly those that lack robust regulatory oversight. This article will analyze FXG Invest's regulatory status, company background, trading conditions, customer feedback, and overall safety to determine whether it is a safe trading option or a potential scam.

Regulation and Legitimacy

The regulatory environment is crucial when assessing the safety of a broker like FXG Invest. It is essential to know whether a broker is regulated by a reputable authority, as this often indicates a level of accountability and adherence to industry standards. Unfortunately, FXG Invest operates without any significant regulatory oversight.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unregulated |

The absence of regulation means that FXG Invest is not subject to the strict compliance requirements that regulated brokers must adhere to, such as maintaining segregated client accounts and ensuring transparency in operations. Moreover, the broker has been blacklisted by several regulatory bodies, including Italy's Consob and the UK's Financial Conduct Authority (FCA), raising further red flags about its legitimacy.

Regulatory quality is paramount in the trading industry, as it protects investors from fraud and malpractice. Given that FXG Invest operates from an offshore jurisdiction known for lax regulations, potential traders should be extremely cautious. The lack of oversight and the broker's history of being flagged by regulatory authorities suggest that it may not be safe to invest with FXG Invest.

Company Background Investigation

FXG Invest's ownership and operational structure are essential aspects to consider when evaluating its credibility. The broker is owned by Grand Services Ltd, which is registered in the Marshall Islands—a location notorious for its lack of stringent regulatory frameworks. While FXG Invest claims to have operations in Bulgaria through Nordic Pearl Limited, it is not regulated by the Bulgarian Financial Supervision Commission or any other credible authority.

The management teams background is another critical factor. Unfortunately, information regarding the executives at FXG Invest is scarce, making it difficult for potential investors to assess their experience and expertise in the financial sector. The lack of transparency regarding the company's ownership and management raises concerns about the reliability of FXG Invest. Without clear information and accountability, traders may find themselves at risk.

Furthermore, the information disclosure level is alarmingly low. Potential investors should be wary of companies that do not provide adequate information about their operations, ownership, or regulatory compliance. A broker's transparency is often a good indicator of its legitimacy, and FXG Invest fails to meet this standard.

Trading Conditions Analysis

When evaluating whether FXG Invest is safe, it is vital to consider its trading conditions, including fees and spreads. The broker offers a variety of trading instruments, but the cost structure may not be favorable for traders.

| Cost Type | FXG Invest | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 4.4 pips | 1-2 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | High | Moderate |

FXG Invest's spreads are significantly higher than the industry average, which can erode potential profits for traders. Additionally, the broker's commission structure is vague, leaving traders uncertain about the actual costs they may incur. High fees and spreads can deter traders from achieving their financial goals, making FXG Invest less appealing.

Moreover, the broker's minimum deposit requirement of $300 is also higher than many reputable brokers, which may be a barrier for new traders. These unfavorable trading conditions raise questions about the broker's commitment to providing a fair trading environment.

Customer Funds Safety

The safety of client funds is a critical aspect of any broker's credibility. FXG Invest's approach to fund security is concerning, as it lacks the necessary measures to protect client deposits. There is no indication that FXG Invest maintains segregated accounts, which are essential for ensuring that client funds are kept separate from the broker's operational funds.

Additionally, without regulatory oversight, there are no investor protection mechanisms in place, such as compensation schemes that would provide recourse in the event of broker insolvency. The absence of negative balance protection further exacerbates the risk for traders, as they could potentially lose more than their initial investment.

Historically, unregulated brokers like FXG Invest have been associated with various financial disputes and fund mismanagement issues. Traders should be aware of these risks and consider whether they can afford to lose their investments when dealing with such brokers.

Customer Experience and Complaints

Customer feedback is a valuable resource for assessing a broker's reliability. Reviews of FXG Invest reveal a range of negative experiences from users, with many expressing frustration over withdrawal issues and lack of customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Poor Customer Support | Medium | Average |

| Misleading Promotions | High | Poor |

Common complaints include difficulties in withdrawing funds, with many users reporting that their withdrawal requests were either ignored or delayed indefinitely. Additionally, the company's customer support has been criticized for being unresponsive, which can be particularly troubling for traders who may need immediate assistance.

One notable case involved a trader who attempted to withdraw their funds after several months of trading. The request was met with repeated excuses and delays, ultimately leading to the trader losing patience and seeking external help. Such experiences are indicative of a broader pattern of misconduct that potential investors should be wary of.

Platform and Execution

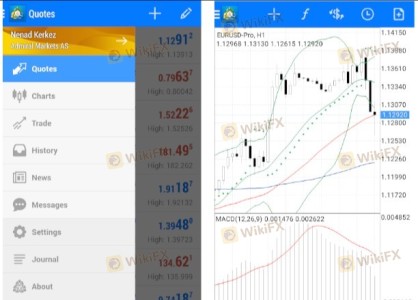

The performance of the trading platform is another crucial aspect of evaluating FXG Invest's safety. The broker offers the widely used MetaTrader 4 platform, which is known for its user-friendly interface and robust features. However, reports of execution issues, such as slippage and rejected orders, have been noted by users.

Traders have expressed concerns about the platform's reliability, with some indicating that they experienced significant delays during high volatility periods. This can be detrimental to traders who rely on timely execution to capitalize on market movements. Any signs of platform manipulation or execution discrepancies should raise alarms for potential investors.

Risk Assessment

Using FXG Invest comes with inherent risks, primarily due to its unregulated status and questionable operational practices.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No significant regulation or oversight. |

| Fund Security Risk | High | Lack of client fund protection measures. |

| Execution Risk | Medium | Reports of slippage and order rejections. |

To mitigate these risks, potential traders should consider investing only with well-regulated brokers that offer strong investor protections and transparent operations. Additionally, conducting thorough due diligence before opening an account can help identify potential red flags.

Conclusion and Recommendations

In conclusion, the evidence suggests that FXG Invest is not a safe trading option. Its lack of regulation, high fees, poor customer feedback, and questionable operational practices indicate that it could be a scam. Traders should exercise extreme caution when dealing with FXG Invest, as the risks associated with investing in an unregulated broker are significant.

For those seeking reliable alternatives, consider brokers regulated by reputable authorities such as the FCA in the UK or ASIC in Australia. These brokers typically provide better trading conditions, enhanced security for client funds, and a more transparent trading experience. Always prioritize safety and due diligence in your trading endeavors.

Is FXG Invest a scam, or is it legit?

The latest exposure and evaluation content of FXG Invest brokers.

FXG Invest Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FXG Invest latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.