Is FORE XF safe?

Business

License

Is Fore XF Safe or Scam?

Introduction

The foreign exchange (forex) market is a vast and intricate landscape, with numerous brokers vying for the attention of traders looking to capitalize on currency fluctuations. Among these brokers is Fore XF, which positions itself as a reliable platform for both novice and experienced traders. However, as the forex market is notorious for its lack of regulation and the potential for scams, it is crucial for traders to conduct thorough due diligence before engaging with any broker. This article aims to assess whether Fore XF is a safe trading option or if it raises red flags that warrant caution. Our investigation will utilize a comprehensive evaluation framework, focusing on regulatory compliance, company background, trading conditions, client fund safety, customer experiences, and overall risk assessment.

Regulation and Legitimacy

The regulatory status of a forex broker is one of the most significant indicators of its legitimacy and safety. A regulated broker is subject to strict oversight, which can help protect traders from fraud and malpractice. Fore XF claims to operate under the oversight of reputable financial authorities, but the specifics of their regulatory status must be examined closely.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | N/A | UK | Not Verified |

| ASIC | N/A | Australia | Not Verified |

| CySEC | N/A | Cyprus | Not Verified |

Upon investigation, it appears that Fore XF lacks clear documentation of its regulatory compliance. This absence of verifiable licenses raises concerns about the broker's legitimacy. Without proper regulation, traders may have limited recourse in the event of disputes or financial loss. In the forex industry, regulatory bodies like the Financial Conduct Authority (FCA) and the Australian Securities and Investments Commission (ASIC) are known for their stringent requirements, which include capital adequacy, fund segregation, and regular audits. The absence of such oversight for Fore XF suggests that traders should exercise caution when considering this broker.

Company Background Investigation

Understanding the company behind a forex broker is essential in determining its reliability. Fore XF has been operational for a limited period, and details regarding its ownership structure and management team are sparse. A thorough background check reveals that the broker's website lacks comprehensive information about its founding members, their qualifications, and their industry experience.

Transparency is a critical factor in establishing trust with a broker. Fore XF's website does not provide sufficient insight into its corporate governance or operational history, which is a significant red flag. A reputable broker typically offers detailed information about its founders and management team, showcasing their expertise and commitment to ethical practices. The lack of such disclosures from Fore XF raises concerns about its operational integrity and accountability.

Trading Conditions Analysis

Analyzing the trading conditions offered by a broker is vital for assessing its overall value proposition. Fore XF claims to provide competitive trading fees and a user-friendly platform, but a closer examination of its fee structure reveals potential pitfalls.

| Fee Type | Fore XF | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 2.0 pips | 1.2 pips |

| Commission Model | N/A | $5 per 100,000 |

| Overnight Interest Range | 0.5% | 0.3% |

The spread for major currency pairs at Fore XF appears to be significantly higher than the industry average, which could erode profit margins for traders. Additionally, the absence of a clear commission structure raises questions about hidden fees that could impact overall trading costs. Traders should be wary of any broker that lacks transparency regarding its fee structure, as this can lead to unexpected expenses.

Client Fund Safety

The safety of client funds is paramount when selecting a forex broker. Fore XF claims to implement various safety measures to protect client deposits, including fund segregation and negative balance protection. However, without concrete evidence of these practices, it is difficult to ascertain the true level of safety offered.

A reputable broker should have clear policies regarding fund segregation, ensuring that client funds are held in separate accounts from the broker's operational funds. This practice protects clients in the event of bankruptcy or insolvency. Moreover, negative balance protection ensures that clients cannot lose more than their initial investment, a crucial feature in the highly leveraged forex market.

However, Fore XF's lack of verifiable regulatory oversight raises concerns about the effectiveness of its safety measures. Traders should be cautious when dealing with brokers that do not provide transparent information regarding their client fund protection policies.

Customer Experience and Complaints

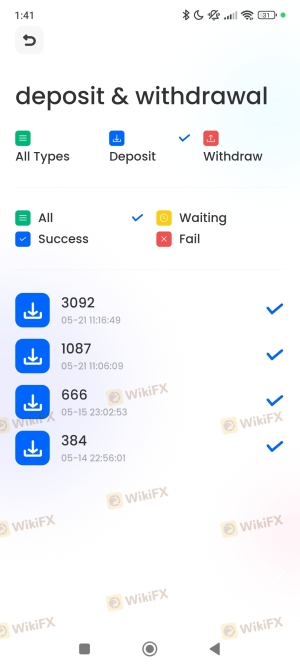

Customer feedback is a valuable resource when evaluating a broker's reliability. An analysis of user reviews for Fore XF reveals a mixed bag of experiences. While some traders report satisfactory trading conditions and responsive customer service, others have raised serious complaints regarding withdrawal issues and unresponsive support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Poor Customer Support | Medium | Fair |

| Account Manipulation | High | Unresolved |

Common complaints include significant delays in processing withdrawal requests, which is a major red flag for any broker. A broker's ability to facilitate timely withdrawals is a critical aspect of its credibility. Additionally, reports of poor customer support further exacerbate concerns about the broker's reliability. Traders should be cautious when selecting a broker that has a history of unresolved complaints, as this could indicate deeper systemic issues.

Platform and Trade Execution

The performance of a broker's trading platform is crucial for ensuring a smooth trading experience. Fore XF claims to offer a robust platform, but user experiences suggest that the platform may suffer from stability issues and execution delays. Traders have reported instances of slippage and rejected orders, which can significantly impact trading outcomes.

A reliable broker should provide a platform that is not only stable but also capable of executing trades swiftly and efficiently. Any signs of platform manipulation or technical glitches can undermine trader confidence and lead to financial losses. It is essential for traders to thoroughly test a broker's platform through demo accounts before committing real funds.

Risk Assessment

Engaging with any broker carries inherent risks, and Fore XF is no exception. A comprehensive risk assessment reveals several areas of concern that traders should be aware of.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Compliance | High | Lack of verifiable regulatory status |

| Fund Safety | High | Uncertainty regarding fund protection |

| Customer Support | Medium | Reports of poor response times |

| Trading Conditions | Medium | High spreads and unclear fee structure |

Traders should approach Fore XF with caution, particularly due to its lack of regulatory oversight and the mixed reviews regarding customer experiences. It is advisable for traders to consider alternative brokers with established reputations and robust regulatory frameworks to mitigate potential risks.

Conclusion and Recommendations

In conclusion, the evidence suggests that Fore XF may not be the safest choice for forex trading. The lack of verifiable regulatory oversight, combined with mixed customer reviews and concerns regarding fund safety, raises significant red flags. Traders should be cautious when considering this broker, as the potential for issues related to withdrawals and customer support may pose serious risks.

For traders seeking a more reliable option, it is recommended to explore brokers with established regulatory credentials, transparent fee structures, and positive customer feedback. Brokers such as IG, Forex.com, and OANDA have demonstrated a commitment to regulatory compliance and customer service, making them safer alternatives for forex trading.

Ultimately, the decision to engage with Fore XF should be made with careful consideration of the risks involved. It is crucial for traders to prioritize safety and transparency when selecting a forex broker to ensure a positive trading experience.

Is FORE XF a scam, or is it legit?

The latest exposure and evaluation content of FORE XF brokers.

FORE XF Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FORE XF latest industry rating score is 1.31, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.31 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.