Regarding the legitimacy of Finotec forex brokers, it provides FCA and WikiBit, (also has a graphic survey regarding security).

Is Finotec safe?

Pros

Cons

Is Finotec markets regulated?

The regulatory license is the strongest proof.

FCA Inst Forex Execution (STP)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

UnverifiedLicense Type:

Inst Forex Execution (STP)

Licensed Entity:

YCM-Invest Ltd

Effective Date:

2007-11-08Email Address of Licensed Institution:

compliance@ycm-invest.comSharing Status:

No SharingWebsite of Licensed Institution:

www.ycm-invest.comExpiration Time:

--Address of Licensed Institution:

Finotec Trading UK Ltd Mappin House 4 Winsley Street London Westminster W1W 8HF UNITED KINGDOMPhone Number of Licensed Institution:

+4402035145555Licensed Institution Certified Documents:

Is Finotec Safe or Scam?

Introduction

Finotec is a forex broker that has been operating since 1998, positioning itself as a prime brokerage for both retail and institutional traders. With its headquarters in London, UK, it claims to offer a range of trading services including forex, commodities, and contracts for difference (CFDs). As the forex market continues to grow, traders must exercise caution when choosing a broker, as the potential for scams and fraudulent activities is ever-present. This article aims to provide a comprehensive evaluation of Finotec, examining its regulatory status, company background, trading conditions, client fund safety, customer experience, platform performance, and associated risks. The information presented is based on various online reviews and data from credible financial sources.

Regulation and Legitimacy

One of the most critical factors in assessing whether Finotec is safe is its regulatory status. Finotec is regulated by the Financial Conduct Authority (FCA) in the UK, which is considered one of the most reputable regulatory bodies globally. Regulation by the FCA means that Finotec must adhere to strict guidelines designed to protect traders. Below is a summary of the regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | 470392 | United Kingdom | Active |

The FCA imposes stringent requirements on brokers, including maintaining client funds in segregated accounts and ensuring transparency in operations. However, some reviews have raised concerns about the quality of service provided by Finotec, suggesting that while the broker is regulated, it may not meet the high standards expected by professional traders. Historical compliance issues have also been noted, which could indicate potential risks for traders.

Company Background Investigation

Finotec was established in 1998 and has evolved over the years to cater to a diverse clientele, including hedge funds and retail traders. The company is owned by Finotec Trading UK Limited and operates as a prime broker, connecting clients with top-tier liquidity providers. The management team consists of experienced professionals in the financial services industry, contributing to the broker's credibility. However, the overall transparency regarding the company's operations and financial health appears to be somewhat lacking, as detailed information about the management team and their qualifications is not readily available. This raises questions about the level of trust traders can place in the broker.

Trading Conditions Analysis

When evaluating whether Finotec is safe, it is essential to consider the trading conditions offered. Finotec has a minimum deposit requirement of $200, which is relatively accessible for retail traders. However, the fee structure can be somewhat opaque. Below is a comparison of key trading costs:

| Fee Type | Finotec | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 0.0 pips | 1.0-2.0 pips |

| Commission Model | $3 per lot | Varies widely |

| Overnight Interest Range | Varies | Varies widely |

While the low spread is attractive, the commission structure may not be as competitive compared to other brokers. Additionally, traders have reported unexpected fees and charges, which could indicate a lack of clarity in the fee structure. Such practices can be a red flag for potential scams, leading traders to question whether Finotec is safe for their investments.

Client Funds Safety

The safety of client funds is paramount when determining if Finotec is safe. The broker claims to maintain client funds in segregated accounts, which is a standard practice among reputable brokers. Furthermore, Finotec is a member of the Financial Services Compensation Scheme (FSCS), providing additional protection for clients up to £85,000 in case of broker insolvency. However, there have been historical complaints regarding fund withdrawal issues, which raises concerns about the actual implementation of these safety measures. It is crucial for traders to verify the effectiveness of these protections before committing significant capital.

Customer Experience and Complaints

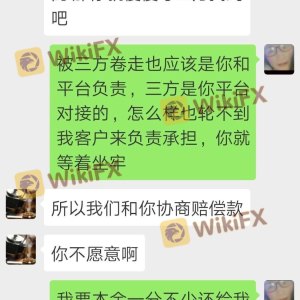

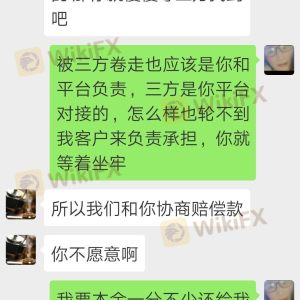

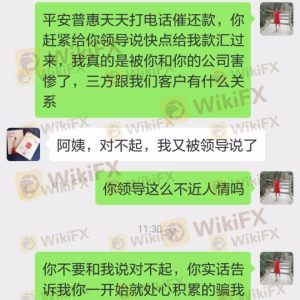

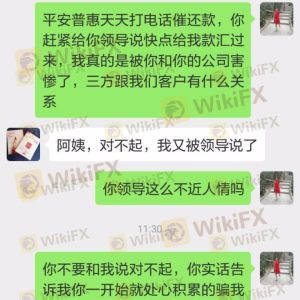

Analyzing customer feedback is essential in assessing whether Finotec is safe. Reviews indicate a mixed experience among traders, with some praising the broker for its competitive spreads and execution speed, while others have reported difficulties in withdrawing funds. Common complaint categories include:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow/Unresponsive |

| Customer Support | Medium | Mixed Feedback |

| Platform Reliability | Medium | Some Complaints |

For instance, one trader reported a frustrating experience when attempting to withdraw funds, citing a lack of communication from customer support. Such complaints could indicate underlying operational issues that might compromise the broker's reliability. Therefore, potential traders should weigh these experiences carefully when considering whether Finotec is safe for their trading activities.

Platform and Execution

The performance and reliability of the trading platform are crucial when evaluating Finotec's safety. The broker offers several platforms, including MetaTrader 4 and web-based solutions. While many users report satisfactory execution quality, instances of slippage and order rejections have been noted, which can significantly impact trading outcomes. Furthermore, there are no indications of platform manipulation, but the frequency of negative experiences raises concerns about the overall reliability of the trading environment.

Risk Assessment

Overall, using Finotec involves several risks that traders should consider. Below is a risk assessment summary:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | Medium | FCA regulated but with historical issues. |

| Operational Risk | High | Complaints about withdrawals and support. |

| Market Risk | Medium | Standard trading risks applicable. |

To mitigate these risks, traders should conduct thorough research, start with a demo account, and only invest capital they can afford to lose. It is also advisable to have a clear exit strategy and to monitor the broker's performance continuously.

Conclusion and Recommendations

In conclusion, while Finotec is regulated by the FCA, which adds a layer of credibility, there are significant concerns regarding its operational practices, customer service, and historical issues with fund withdrawals. Therefore, traders should exercise caution when considering whether Finotec is safe. For those seeking a more reliable trading environment, it may be prudent to explore alternative brokers with stronger reputations and better customer feedback. Recommended alternatives include brokers with a solid track record of customer service and transparent fee structures. Ultimately, the decision to trade with Finotec should be based on a thorough understanding of these risks and a careful evaluation of personal trading needs.

Is Finotec a scam, or is it legit?

The latest exposure and evaluation content of Finotec brokers.

Finotec Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Finotec latest industry rating score is 1.17, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.17 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.