Is Face Capital safe?

Business

License

Is Face Capital Safe or Scam?

Introduction

Face Capital, operating under the domain face-forex.com, positions itself as a forex and CFD broker targeting traders seeking to access the foreign exchange market. However, the influx of unregulated brokers in the forex space has raised significant concerns among traders, making it imperative to scrutinize the legitimacy and safety of such platforms. This article aims to assess whether Face Capital is a scam or a safe option for traders. Our investigation draws from various online resources, including reviews, regulatory information, and user experiences, to provide a comprehensive overview of Face Capital's operations.

Regulation and Legitimacy

One of the most critical factors in determining whether Face Capital is safe is its regulatory status. A well-regulated broker is typically more trustworthy, as regulatory bodies enforce strict compliance standards to protect investors. Unfortunately, Face Capital operates without any form of regulation, which raises substantial red flags.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

The absence of regulation means that Face Capital does not adhere to any established standards for client fund protection, transparency, or operational integrity. Furthermore, there are no guarantees for funds, no segregated accounts, and no negative balance protection. This lack of oversight increases the risk of potential fraud or mismanagement of client funds, making it crucial for traders to exercise caution when considering this broker.

Company Background Investigation

Face Capital claims to be based in Hong Kong, a jurisdiction known for its stringent regulatory framework. However, investigations reveal that the broker lacks any official registration in Hong Kong, casting doubt on its legitimacy. The company does not disclose its ownership structure or the identities of its management team, further complicating the transparency issue.

The lack of verifiable information about the company's history and ownership raises questions about its credibility. A transparent broker should provide clear details about its founders, management team, and corporate structure. Unfortunately, Face Capital fails to meet these expectations, leading to concerns regarding its operational integrity and commitment to ethical trading practices.

Trading Conditions Analysis

When evaluating whether Face Capital is safe, it is essential to consider its trading conditions, including fees and spreads. The broker offers trading with a leverage of up to 1:200, which is considerably higher than what most reputable brokers allow. Such high leverage can be risky for retail traders, often leading to significant losses.

| Fee Type | Face Capital | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 3 pips | 1-2 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The spreads offered by Face Capital are notably high, which could significantly impact trading profitability. Additionally, the absence of clear information regarding commissions and overnight interest raises concerns about hidden fees that could further erode traders' capital. Overall, the trading conditions at Face Capital do not align with industry standards, reinforcing the notion that it may not be a safe option for traders.

Client Funds Security

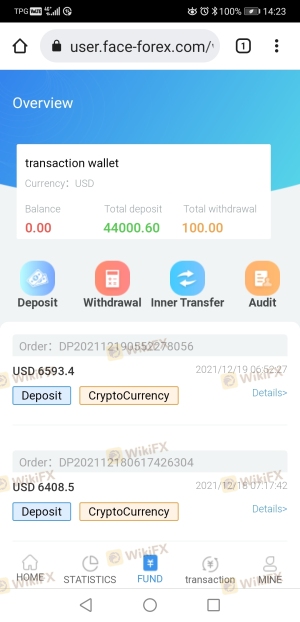

The security of client funds is paramount when assessing any broker's safety. Unfortunately, Face Capital does not provide adequate measures to safeguard client investments. The absence of segregated accounts means that client funds may be mingled with the broker's operational funds, increasing the risk of loss in the event of financial difficulties.

Moreover, there is no mention of investor protection schemes or compensation funds that would typically be available through regulated brokers. The lack of negative balance protection indicates that clients could potentially lose more than their initial investment, further raising concerns about the safety of trading with Face Capital.

Client Experience and Complaints

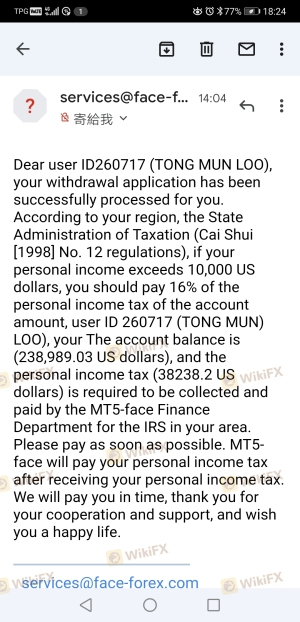

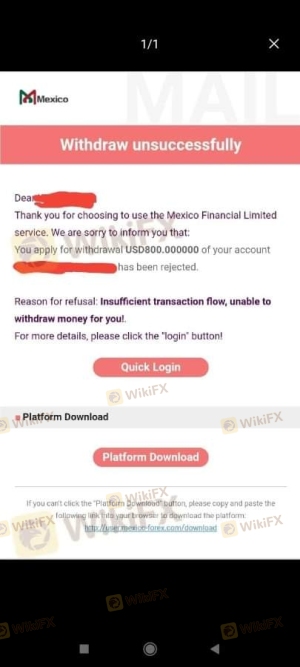

User feedback is a valuable resource for assessing a broker's reliability. Reviews of Face Capital reveal a pattern of negative experiences, with many traders reporting difficulties in withdrawing funds, lack of communication, and poor customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service | Medium | Poor |

| Transparency Concerns | High | Poor |

Common complaints include blocked withdrawals and lack of support when issues arise. These patterns suggest a troubling trend that could indicate that Face Capital is not a safe broker. Traders should be wary of platforms with a history of unresolved complaints, as this often reflects deeper operational issues.

Platform and Trade Execution

The trading platform offered by Face Capital is reportedly based on the popular MetaTrader 5, known for its robust features and user-friendly interface. However, the overall performance and reliability of the platform remain unclear. Users have expressed concerns regarding order execution quality, including instances of slippage and rejected orders, which can severely impact trading outcomes.

In addition, any signs of platform manipulation, such as sudden spikes in spreads or execution delays during volatile market conditions, could indicate unethical practices. Such issues further exacerbate the risks associated with trading on unregulated platforms like Face Capital.

Risk Assessment

When considering whether Face Capital is safe, it is important to evaluate the comprehensive risks involved in trading with this broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated broker with no oversight. |

| Financial Risk | High | High leverage and poor fund protection. |

| Operational Risk | High | Numerous complaints regarding withdrawals and service. |

Given the high-risk profile associated with Face Capital, potential traders should approach with extreme caution. It is advisable to seek alternative brokers with solid regulatory frameworks, transparent operations, and positive user feedback.

Conclusion and Recommendations

In conclusion, the evidence gathered regarding Face Capital strongly suggests that it may not be a safe broker for traders. The lack of regulation, poor client experiences, and high-risk trading conditions raise significant concerns about the legitimacy and operational integrity of this platform.

For traders seeking a reliable and secure trading environment, it is recommended to consider alternative brokers that are well-regulated and have positive reputations in the industry. Options include established firms that offer robust investor protection, transparent fee structures, and reliable customer service. Ultimately, the key to successful trading lies in choosing a trustworthy broker, and based on our findings, Face Capital does not meet these criteria.

Is Face Capital a scam, or is it legit?

The latest exposure and evaluation content of Face Capital brokers.

Face Capital Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Face Capital latest industry rating score is 1.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.