Is EMPIRE GOAL safe?

Business

License

Is Empire Goal A Scam?

Introduction

Empire Goal is an online forex broker that has garnered attention in the trading community for its aggressive marketing strategies and promises of high returns. As a relatively new player in the forex market, it claims to offer a range of trading options, including forex, cryptocurrencies, and indices. However, the rapid expansion of online trading platforms has also led to an increase in scams, making it essential for traders to carefully evaluate the legitimacy and safety of brokers like Empire Goal. This article aims to provide a comprehensive analysis of Empire Goal, focusing on its regulatory status, company background, trading conditions, client safety measures, customer experiences, and overall risk assessment. Our investigation is based on a thorough review of various online sources, including trader reviews, regulatory databases, and expert analyses.

Regulation and Legitimacy

The regulatory status of a forex broker is one of the most critical factors in determining its legitimacy. A broker that operates without oversight can pose significant risks to traders, including the potential loss of funds. Empire Goal is registered in the Marshall Islands, a location known for its lax regulatory environment. Unfortunately, this means that Empire Goal operates without any significant regulatory oversight, which raises alarms about its credibility.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | Marshall Islands | Unverified |

The absence of regulation is a major red flag. Licensed brokers are required to adhere to strict guidelines, including maintaining segregated accounts, ensuring client fund safety, and providing transparency in their operations. In contrast, Empire Goal's lack of oversight suggests that it does not follow these essential practices, leaving traders vulnerable. Additionally, there have been numerous complaints about the difficulty of withdrawing funds, which is often a hallmark of unregulated entities. This situation underscores the need for traders to approach Empire Goal with caution and to consider alternative, regulated options.

Company Background Investigation

Empire Goal is owned by Equal Target Ltd., which operates from the Trust Company Complex in Ajeltake Road, Majuro, Marshall Islands. The company's history is sparse, and there is little information available regarding its establishment or operational practices. This lack of transparency is concerning, especially for potential clients who seek to understand the broker's legitimacy.

The management team behind Empire Goal is largely unknown, with no publicly available information detailing their qualifications or previous experiences in the financial sector. This absence of information raises questions about the broker's ability to manage client funds responsibly and effectively. Furthermore, the use of stock photos and vague descriptions on the website only adds to the suspicion surrounding the authenticity of the broker's claims. Overall, the company's lack of transparency and information disclosure significantly diminishes its credibility in the eyes of potential investors.

Trading Conditions Analysis

When evaluating a forex broker, understanding its trading conditions is crucial. Empire Goal claims to offer competitive spreads, high leverage, and minimal fees. However, the reality may be different. The broker's fee structure appears to be opaque, with reports of hidden fees that can significantly impact traders' profitability.

| Fee Type | Empire Goal | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.1 pips | 1-2 pips |

| Commission Model | Variable | Fixed/Variable |

| Overnight Interest Range | Unspecified | Typically 0.5%-3% |

The spread of 0.1 pips for major currency pairs seems attractive at first glance, but traders should be wary of the underlying costs associated with trading. There are allegations of withdrawal fees that were not disclosed upfront, leading to frustration among users trying to access their funds. Such practices are often indicative of brokers that may not have the best interests of their clients at heart. Therefore, potential traders should carefully consider these factors before committing to Empire Goal.

Client Funds Safety

The safety of client funds is paramount in the forex trading industry. A broker must implement robust measures to protect client deposits and maintain financial integrity. Unfortunately, Empire Goal does not provide adequate information regarding its fund security protocols. The lack of segregated accounts and investor protection mechanisms raises significant concerns about the safety of clients' money.

Traders should be particularly cautious, as unregulated brokers like Empire Goal often do not have the safeguards in place to protect client funds in the event of insolvency or operational issues. Reports of clients being denied withdrawals further indicate that funds may not be secure with this broker. It is imperative for traders to prioritize safety and consider regulated alternatives that offer better protection for their investments.

Customer Experience and Complaints

Customer feedback is an essential aspect of evaluating the reliability of a broker. Empire Goal has received a mix of reviews, with many users expressing dissatisfaction with their experiences. Common complaints include difficulties with fund withdrawals, unresponsive customer service, and aggressive sales tactics.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service | Medium | Slow |

| Misleading Information | High | Unresponsive |

One notable case involved a trader who attempted to withdraw their funds after a series of profitable trades, only to face prolonged delays and lack of communication from the broker. This scenario is not isolated, as multiple users have reported similar issues. Such complaints highlight the potential risks associated with trading through Empire Goal and suggest a pattern of behavior that traders should be wary of.

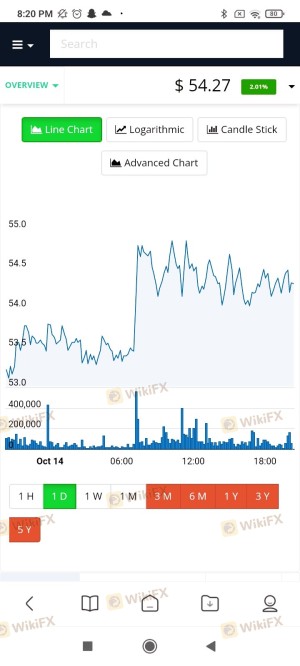

Platform and Execution

The trading platform provided by Empire Goal is web-based and lacks some of the advanced features found in industry-standard platforms like MetaTrader 4 or 5. Users have reported experiencing issues with platform stability and order execution, which can significantly impact trading performance. Instances of slippage and order rejections have also been noted, raising concerns about the broker's ability to provide a fair trading environment.

Traders should be cautious of platforms that exhibit signs of manipulation or poor execution quality. A reliable trading platform is essential for ensuring that trades are executed efficiently and at the desired prices. Therefore, potential clients should thoroughly evaluate the platform's performance and consider whether it meets their trading needs.

Risk Assessment

Engaging with Empire Goal presents several risks that traders must consider before proceeding. The lack of regulation, combined with the numerous complaints about fund withdrawals and customer service, creates an environment of uncertainty.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No oversight or protection for clients. |

| Financial Risk | High | Potential loss of funds due to hidden fees and withdrawal issues. |

| Operational Risk | Medium | Platform stability and execution quality concerns. |

To mitigate these risks, traders should conduct thorough due diligence and consider trading with regulated brokers that offer better security and transparency. Additionally, it is advisable to start with a demo account or invest only small amounts until confidence in the broker is established.

Conclusion and Recommendations

In conclusion, the evidence suggests that Empire Goal exhibits several characteristics typical of unregulated and potentially fraudulent brokers. The lack of oversight, numerous complaints regarding fund withdrawals, and questionable trading conditions raise significant concerns about the broker's legitimacy.

For traders seeking a safe and reliable trading experience, it is advisable to avoid Empire Goal and consider regulated alternatives that provide greater security and transparency. Brokers regulated by reputable authorities offer better protection for client funds, ensuring a more secure trading environment. Ultimately, traders should prioritize safety and conduct thorough research before engaging with any forex broker, especially those with red flags like Empire Goal.

Is EMPIRE GOAL a scam, or is it legit?

The latest exposure and evaluation content of EMPIRE GOAL brokers.

EMPIRE GOAL Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

EMPIRE GOAL latest industry rating score is 1.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.