Is Digital Crypto Investment safe?

Business

License

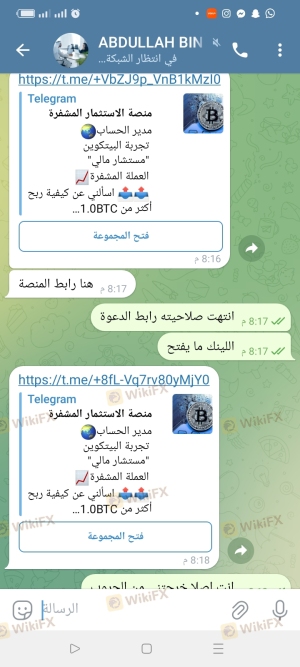

Is Digital Crypto Investment A Scam?

Introduction

Digital Crypto Investment is a relatively new player in the forex market, positioning itself as a platform that offers trading opportunities in cryptocurrencies and other digital assets. As the popularity of cryptocurrency trading continues to rise, it is crucial for traders to exercise caution and perform due diligence when evaluating forex brokers. The potential for scams and fraudulent activities in this space is significant, making it essential for traders to discern trustworthy platforms from those that may not have their best interests at heart. This article aims to provide a comprehensive analysis of Digital Crypto Investment, focusing on its regulatory status, company background, trading conditions, client fund safety, customer experience, and overall risk assessment. Our investigation will draw from various reputable sources, including regulatory databases, user reviews, and expert analyses, to ensure a well-rounded evaluation of whether Digital Crypto Investment is safe or a potential scam.

Regulatory and Legitimacy

The regulatory landscape for forex brokers is a critical factor in determining their legitimacy. Brokers that operate without proper regulation can pose significant risks to traders, as they may not adhere to stringent financial standards or practices. Digital Crypto Investment's regulatory status is under scrutiny, as it lacks oversight from recognized financial authorities.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Not Applicable | N/A | N/A | Not Verified |

The absence of regulation from top-tier authorities such as the SEC (Securities and Exchange Commission) in the United States, FCA (Financial Conduct Authority) in the United Kingdom, or ASIC (Australian Securities and Investments Commission) raises red flags about the safety of trading with Digital Crypto Investment. These regulators enforce strict compliance standards and provide investor protection mechanisms. Without such oversight, traders may find it challenging to seek recourse in the event of disputes or losses. Moreover, the lack of a verified regulatory status indicates that Digital Crypto Investment may not prioritize transparency and accountability, further contributing to concerns about whether Digital Crypto Investment is safe.

Company Background Investigation

Understanding the background of Digital Crypto Investment is essential to assess its credibility. The company claims to offer a user-friendly trading platform for cryptocurrencies, but details about its history, ownership structure, and management team are sparse. A transparent company typically provides information about its founders, operational history, and strategic objectives, which fosters trust among potential clients.

However, Digital Crypto Investment appears to lack this transparency, making it difficult for traders to gauge the experience and reliability of its management team. The absence of a clear operational history raises questions about the company's stability and commitment to ethical trading practices. Furthermore, without public information on the ownership structure, it is challenging to ascertain whether the company has any affiliations with reputable financial institutions or experienced professionals in the field. This lack of transparency is concerning and suggests that traders should approach Digital Crypto Investment with caution, as it may not have the necessary safeguards in place to ensure a safe trading environment.

Trading Conditions Analysis

When evaluating a forex broker, the trading conditions they offer, including fees and spreads, play a significant role in the overall trading experience. Digital Crypto Investment advertises competitive trading conditions, but a closer examination reveals potential issues that may not be immediately apparent.

| Fee Type | Digital Crypto Investment | Industry Average |

|---|---|---|

| Major Currency Pair Spread | TBD | TBD |

| Commission Model | TBD | TBD |

| Overnight Interest Range | TBD | TBD |

The lack of specific information regarding spreads and commissions suggests that traders may encounter hidden fees or unfavorable trading conditions. Such practices are often indicative of brokers that prioritize profit over client satisfaction. Moreover, if the trading costs are higher than average, it could significantly affect a trader's profitability. It is essential for traders to fully understand the fee structure before committing to a broker, as unexpected costs can lead to frustration and losses.

Client Fund Safety

Client fund safety is paramount when considering a forex broker. Digital Crypto Investment's policies regarding fund security, including measures for fund segregation and investor protection, are crucial indicators of its reliability. A reputable broker typically implements strict measures to ensure that client funds are held securely and are separate from the company's operational funds.

However, Digital Crypto Investment has not provided sufficient information about its fund safety protocols. The absence of details on fund segregation, negative balance protection, and investor compensation schemes raises concerns about the security of client assets. Furthermore, any historical issues related to fund safety or disputes with clients can significantly impact a broker's reputation. The lack of transparency in this area suggests that traders should be wary of entrusting their funds to Digital Crypto Investment, as the risks associated with potential fund mismanagement or loss are heightened without proper safeguards in place.

Customer Experience and Complaints

Customer feedback is a valuable resource for evaluating a broker's reliability and service quality. Digital Crypto Investment's reputation among users is mixed, with various reviews highlighting both positive and negative experiences. Common complaints include issues with withdrawal processes, lack of responsive customer support, and unclear fee structures.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Lack of Customer Support | Medium | Average |

| Unclear Fee Structures | High | Poor |

The severity of these complaints indicates significant areas of concern for potential clients. A broker's ability to address customer issues promptly and effectively is critical for building trust and maintaining a positive reputation. Unfortunately, Digital Crypto Investment's response to complaints has been reported as inadequate, suggesting a lack of commitment to customer satisfaction. Furthermore, the presence of recurring complaints about withdrawal delays and unclear fees raises questions about the overall reliability of the platform.

Platform and Trade Execution

The performance of the trading platform is another essential factor in assessing a broker's credibility. Digital Crypto Investment's platform is designed to facilitate cryptocurrency trading, but its reliability, stability, and user experience have been questioned by users. Reports of execution delays, slippage, and order rejections have surfaced, indicating potential issues with trade execution quality.

A reliable trading platform should provide smooth and efficient order execution, with minimal slippage and no instances of rejected orders. However, if traders frequently experience execution problems, it can lead to missed opportunities and losses. Moreover, any signs of platform manipulation or unfair practices can severely undermine a broker's reputation and raise concerns about its legitimacy.

Risk Assessment

Engaging with any forex broker carries inherent risks, and Digital Crypto Investment is no exception. The lack of regulatory oversight, transparency issues, and customer complaints contribute to a heightened risk profile for this broker.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No top-tier regulation, increasing potential for fraud. |

| Operational Risk | Medium | Lack of transparency and unclear fee structures. |

| Customer Service Risk | High | Frequent complaints about support and withdrawal issues. |

To mitigate these risks, traders should consider using regulated brokers with established reputations and transparent practices. Conducting thorough research and reading user reviews can also help in making informed decisions.

Conclusion and Recommendations

In conclusion, the evidence suggests that Digital Crypto Investment may not be a safe choice for traders. The absence of regulatory oversight, lack of transparency, and mixed customer feedback raise significant concerns about the platform's legitimacy. While some traders may be drawn to the potential opportunities offered by Digital Crypto Investment, the risks associated with trading on an unregulated platform cannot be overlooked.

For traders seeking a reliable and secure trading experience, it is advisable to consider alternatives that are regulated by reputable authorities and have a proven track record of customer satisfaction. Brokers such as Coinbase, Binance, or Interactive Brokers provide safer trading environments with robust regulatory frameworks, transparent fee structures, and responsive customer support. Ultimately, traders should prioritize their safety and due diligence before committing to any trading platform, especially one with questionable credibility like Digital Crypto Investment.

Is Digital Crypto Investment a scam, or is it legit?

The latest exposure and evaluation content of Digital Crypto Investment brokers.

Digital Crypto Investment Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Digital Crypto Investment latest industry rating score is 1.45, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.45 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.