Is Carrod Securities safe?

Business

License

Is Carrod Securities Safe or a Scam?

Introduction

Carrod Securities positions itself as an independent broker in the forex market, catering to traders interested in foreign exchange, contracts for differences, and spread betting. However, the need for traders to exercise caution when evaluating forex brokers cannot be overstated. The forex market is rife with unregulated entities that can potentially jeopardize traders' investments. Given the complexities and risks associated with trading, it is essential to conduct thorough due diligence before committing funds to any broker.

This article aims to provide a comprehensive analysis of Carrod Securities, focusing on its regulatory status, company background, trading conditions, customer experience, and overall risk assessment. The evaluation will be based on various data sources, including reviews from financial watchdogs, user testimonials, and regulatory databases, ensuring an objective and balanced perspective.

Regulation and Legitimacy

The regulatory environment plays a crucial role in determining the legitimacy and safety of a forex broker. Carrod Securities claims to be registered in the United Kingdom and mentions a license from the National Futures Association (NFA) in the United States. However, this license is listed as unauthorized, raising significant concerns about the broker's regulatory compliance.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| National Futures Association (NFA) | 0541770 | United States | Unauthorized |

The absence of valid regulatory oversight is a major red flag for potential investors. Legitimate brokers are typically registered with recognized financial authorities, which enforce stringent guidelines to protect traders. The lack of regulatory compliance not only exposes traders to potential fraud but also means that their funds may not be protected by any legal recourse. Consequently, it is crucial for traders to ask the question: Is Carrod Securities safe? The evidence suggests that it is not, given its unregulated status.

Company Background Investigation

Carrod Securities was incorporated on March 22, 2021, in the UK, with its registered office located in London. The company is classified under financial intermediation activities, but there is limited information regarding its operational history or ownership structure. The company has been described as dormant, which raises further questions about its legitimacy and operational capacity.

The management team behind Carrod Securities lacks transparency, as there is little publicly available information regarding their professional backgrounds or industry experience. This opacity is concerning, as reputable brokers typically provide details about their leadership to instill confidence in their clients. The lack of transparency and information disclosure further complicates the question of Is Carrod Securities safe? The absence of a clear operational history or leadership profile makes it difficult for potential clients to assess the broker's reliability.

Trading Conditions Analysis

When evaluating a forex broker, understanding the trading conditions is essential. Carrod Securities offers a single account type with a minimum deposit requirement of $1,000, which is considerably higher than the industry average. This high entry barrier may deter many potential traders, particularly beginners.

The overall fee structure remains ambiguous, with limited information available regarding spreads, commissions, and overnight interest rates. This lack of clarity raises concerns about potential hidden fees that could affect trading profitability.

| Fee Type | Carrod Securities | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | Not Specified | 1.0 - 1.5 pips |

| Commission Structure | Not Specified | Varies by broker |

| Overnight Interest Range | Not Specified | Varies by broker |

Given the unclear fee structure and high minimum deposit, traders should approach Carrod Securities with caution. The absence of transparent trading conditions further contributes to the skepticism surrounding the question, Is Carrod Securities safe?

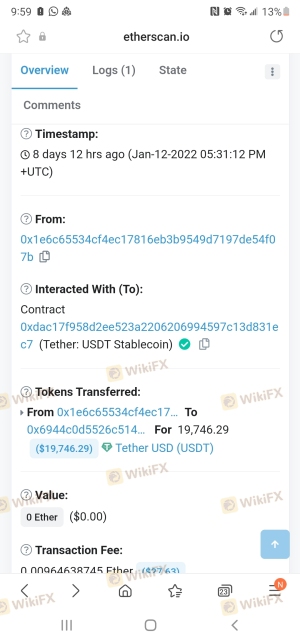

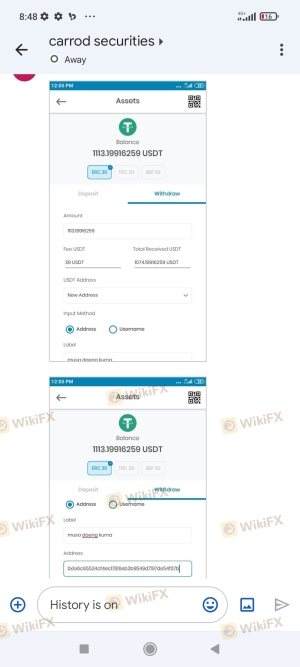

Customer Funds Security

The safety of customer funds is paramount when evaluating a forex broker. Carrod Securities claims to implement measures for segregating client funds, which is a standard practice among reputable brokers. However, the lack of regulatory oversight raises concerns about the effectiveness of these measures.

Without proper regulation, there are no guarantees that client funds are adequately protected or that the broker will adhere to best practices in fund management. Additionally, there have been reports of withdrawal issues from users, further complicating the assessment of fund safety. Historical controversies or disputes regarding fund security can significantly impact a broker's reputation and trustworthiness.

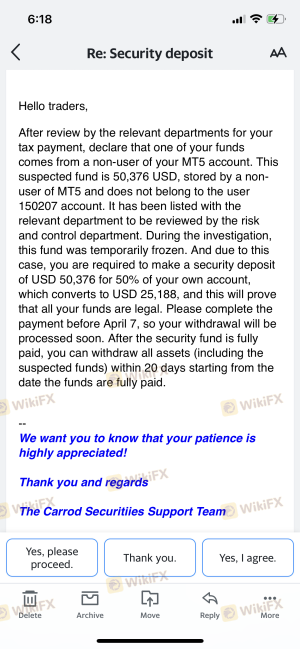

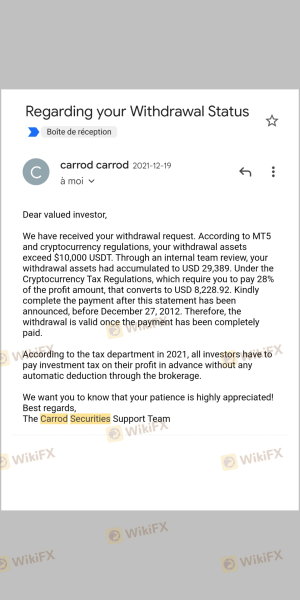

Customer Experience and Complaints

Customer feedback is a valuable indicator of a broker's reliability and service quality. Reviews of Carrod Securities reveal a pattern of complaints, particularly concerning withdrawal difficulties and lack of responsive customer service. Many users have reported being unable to access their funds or facing delays in processing withdrawal requests.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Poor |

Typical case studies illustrate how clients have been unable to withdraw their funds, often citing requests for additional payments or taxes before processing withdrawals. Such practices are alarming and suggest potential fraudulent behavior. This situation leads to the pressing question: Is Carrod Securities safe? The evidence suggests otherwise, as the company appears to struggle with addressing customer concerns effectively.

Platform and Execution

The trading platform offered by Carrod Securities is reportedly MetaTrader 5, a popular choice among traders. However, user experiences regarding platform stability and execution quality have been mixed. Reports of slippage and order rejections have raised concerns about the broker's execution practices.

Traders have also noted instances of platform manipulation, which is a serious issue that can undermine the integrity of trading. A reliable trading platform should provide a seamless experience, but the issues reported by users cast doubt on the question of Is Carrod Securities safe?

Risk Assessment

Using Carrod Securities presents several risks that traders should be aware of. The lack of regulation, unclear trading conditions, and poor customer feedback contribute to a high-risk profile.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated broker |

| Financial Risk | High | High minimum deposit and withdrawal issues |

| Operational Risk | Medium | Reports of platform instability |

To mitigate risks, traders should consider diversifying their investments and exploring alternative brokers with robust regulatory frameworks and positive customer feedback.

Conclusion and Recommendations

In conclusion, the evidence presented raises significant concerns about the legitimacy and safety of Carrod Securities. The absence of proper regulation, coupled with a lack of transparency and numerous customer complaints, suggests that traders should approach this broker with extreme caution. The question Is Carrod Securities safe? can be answered in the negative, as the broker exhibits several red flags that warrant serious consideration.

For traders seeking a reliable and trustworthy trading environment, it is advisable to explore alternative brokers that are well-regulated and have established positive reputations in the industry. Some recommended alternatives include brokers like OANDA, IG, and Forex.com, which provide greater transparency, regulatory oversight, and customer support.

Is Carrod Securities a scam, or is it legit?

The latest exposure and evaluation content of Carrod Securities brokers.

Carrod Securities Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Carrod Securities latest industry rating score is 1.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.