Carrod Securities 2025 Review: Everything You Need to Know

Executive Summary

Carrod Securities is an unreliable broker with serious regulatory concerns. Multiple industry sources show that this carrod securities review reveals the company operates without proper authorization despite claims of regulatory compliance. The broker says it offers forex and CFD trading services with a management team of experienced industry professionals. However, the lack of clear regulatory status and absence of real user feedback creates major red flags for potential clients.

The broker targets traders who want diverse trading products. But the regulatory uncertainty and trust issues make it wrong for most retail investors. WikiBit and other industry watchdogs have flagged Carrod Securities as a potentially fraudulent operation, with some sources marking its operating status as "SCAM." The company claims registration in the UK and states it is regulated by the US National Futures Association. But checking these claims proves very difficult.

With a user rating of zero across available platforms and no real positive feedback, this broker presents serious risks that outweigh any potential benefits for traders.

Important Notice

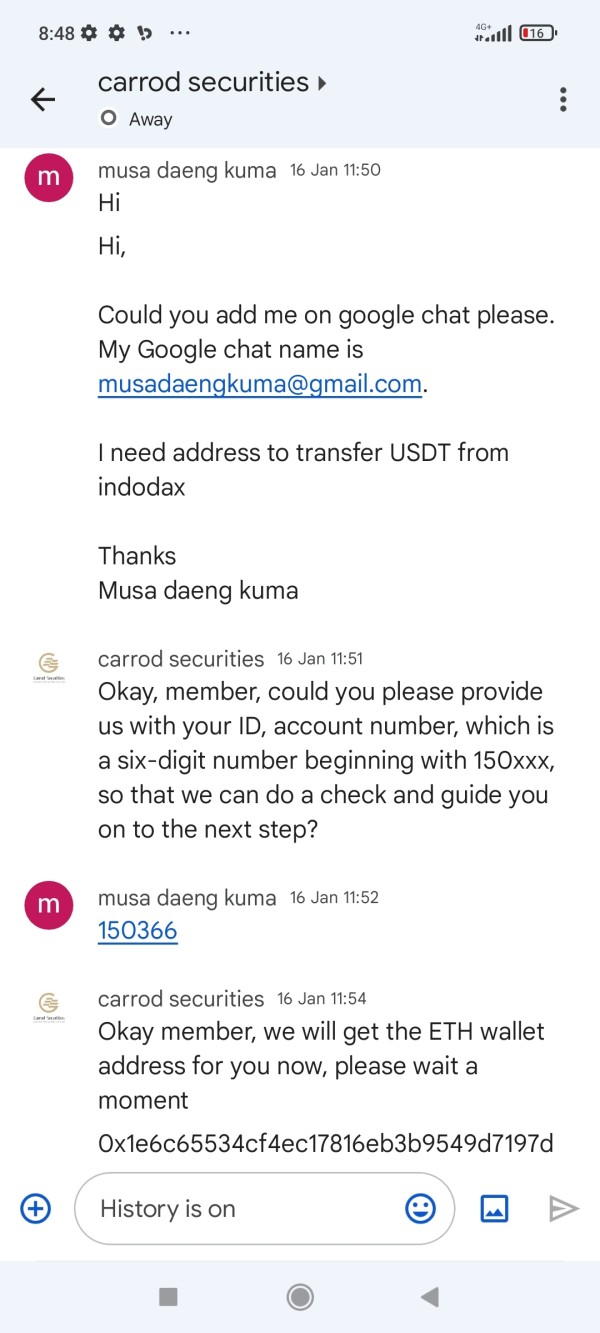

This evaluation notes potential differences between regional entities as Carrod Securities claims registration in the UK while stating regulation under the US National Futures Association. However, checking these regulatory claims has proven unsuccessful, with industry sources showing unauthorized status. Our assessment method relies on publicly available information from industry databases, regulatory websites, and user feedback platforms.

Due to the limited transparency provided by Carrod Securities regarding its operations, legal documentation, and regulatory status, some information may be incomplete or unavailable. Traders should use extreme caution and conduct independent verification before considering any engagement with this broker.

Rating Framework

Broker Overview

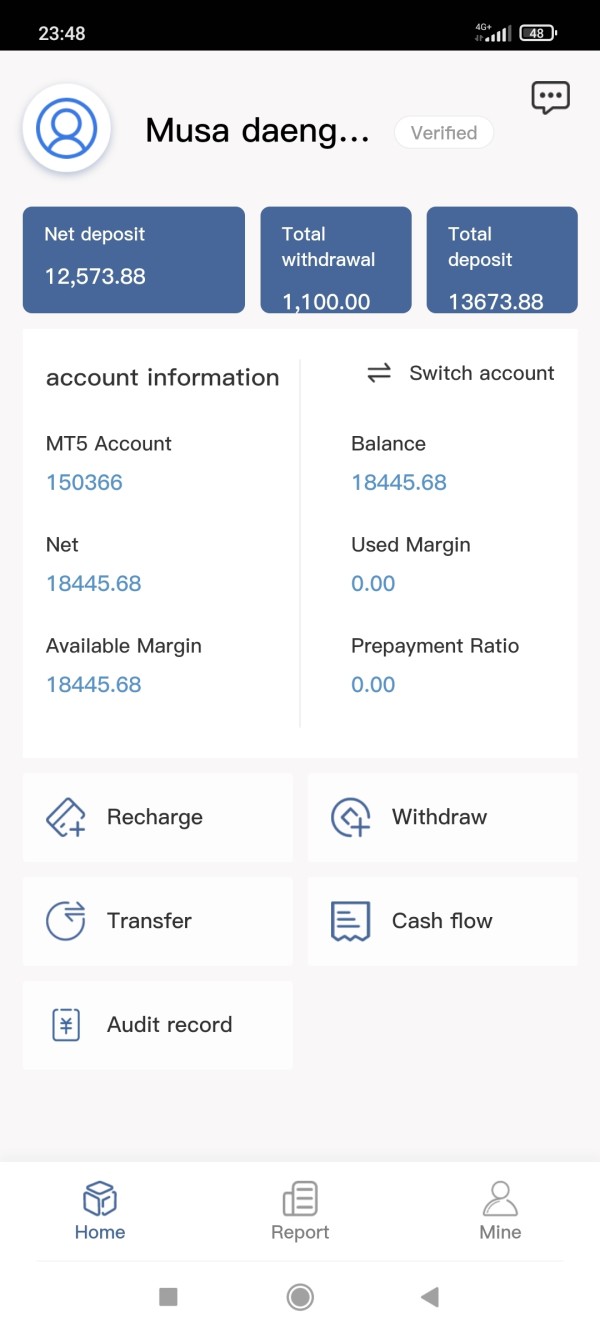

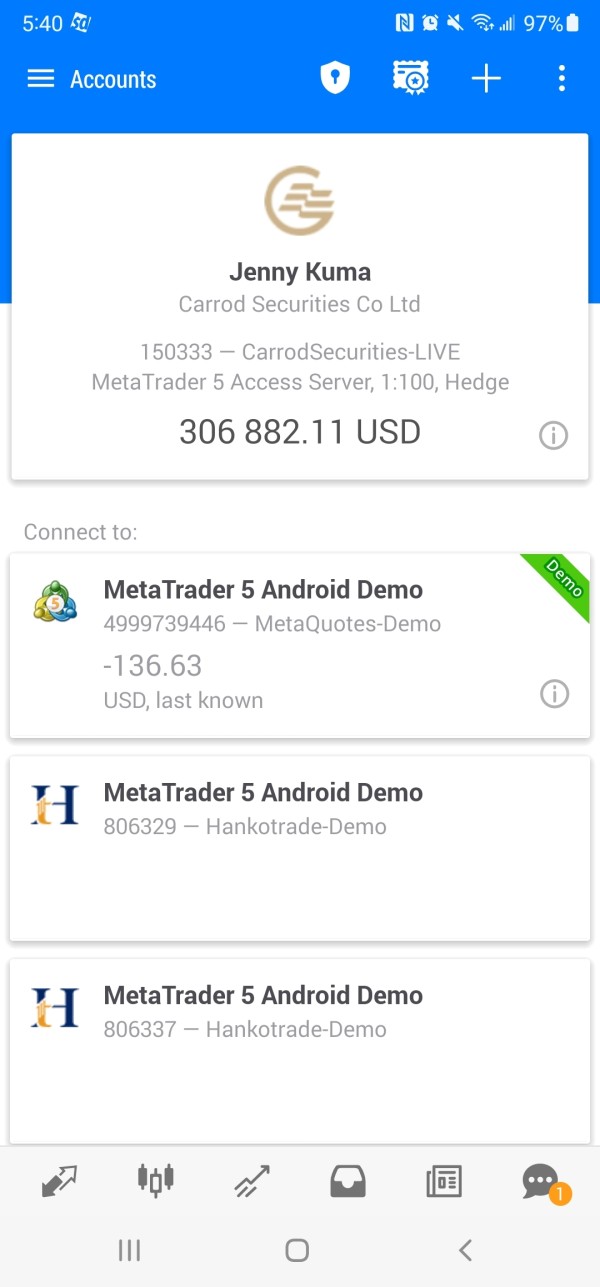

Carrod Securities presents itself as a rapidly developing international online forex dealer. The company says its management team consists of experienced industry experts. According to available information, the company aims to provide complete trading services in the foreign exchange market and related financial instruments.

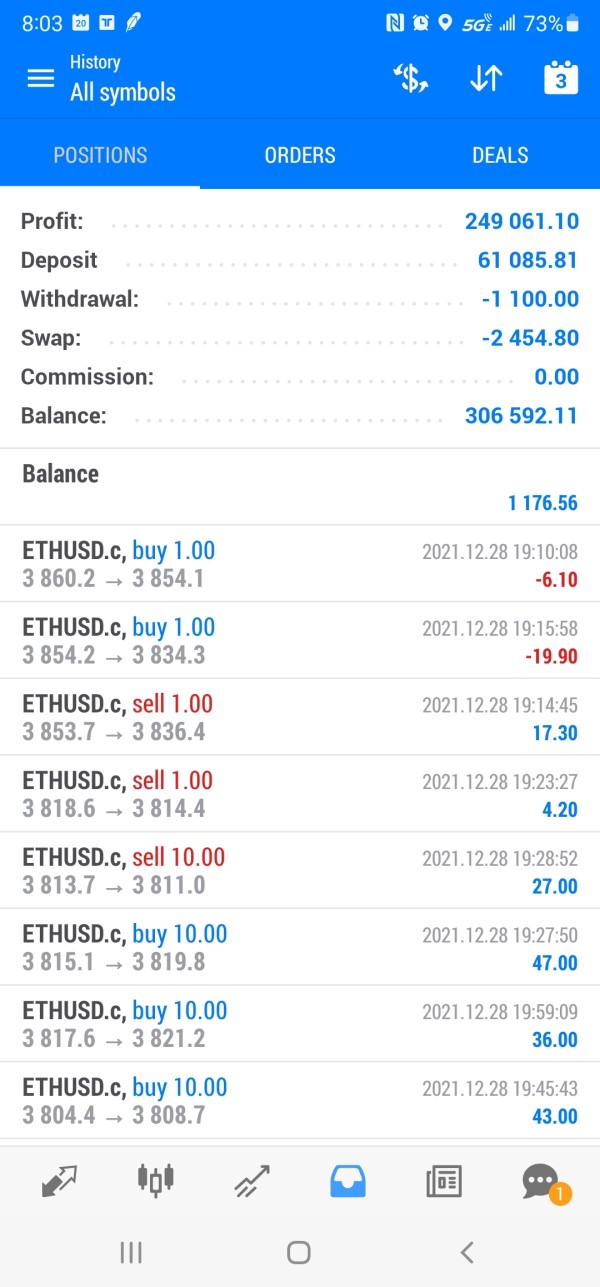

However, the lack of checkable establishment date and detailed company background raises immediate concerns about the broker's legitimacy and operational history. The broker claims to offer forex trading, contracts for difference, and other derivative products to retail and institutional clients. Despite these claims, specific details about their business model, operational procedures, and service delivery methods remain largely hidden.

The absence of clear information about company structure, ownership, and operational framework significantly impacts the ability to assess the broker's credibility and reliability. According to industry sources, Carrod Securities allegedly operates under UK registration while claiming regulatory oversight from the US National Futures Association. However, verification attempts have consistently failed to confirm these regulatory relationships.

This carrod securities review emphasizes that the regulatory status remains highly questionable, with multiple industry watchdogs flagging the broker as potentially fraudulent. The lack of accessible legal documentation, terms of service, and privacy policies further adds to concerns about the broker's operational legitimacy.

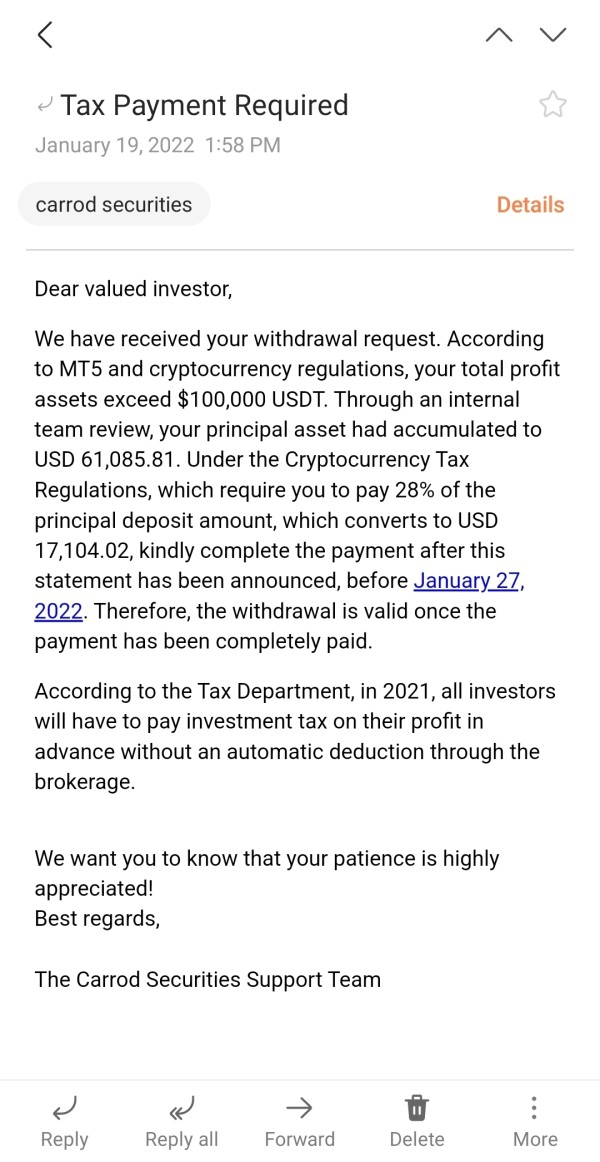

Regulatory Jurisdiction: Carrod Securities claims registration in the United Kingdom and states regulation under the US National Futures Association. However, industry verification shows unauthorized status with no confirmed regulatory approval from either jurisdiction.

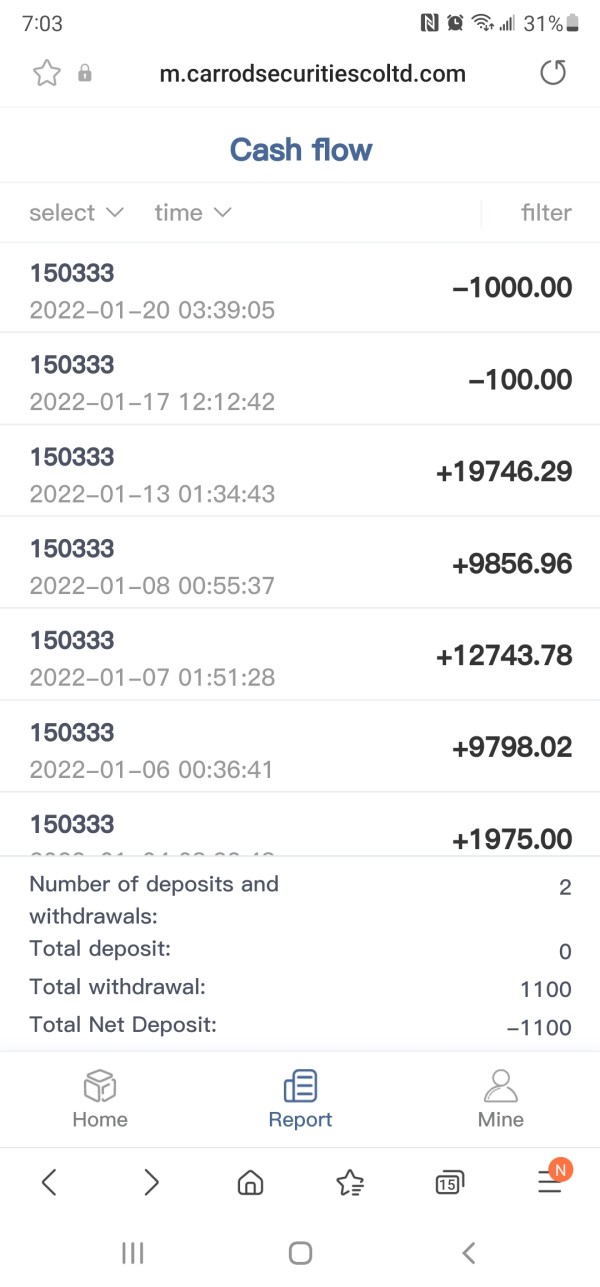

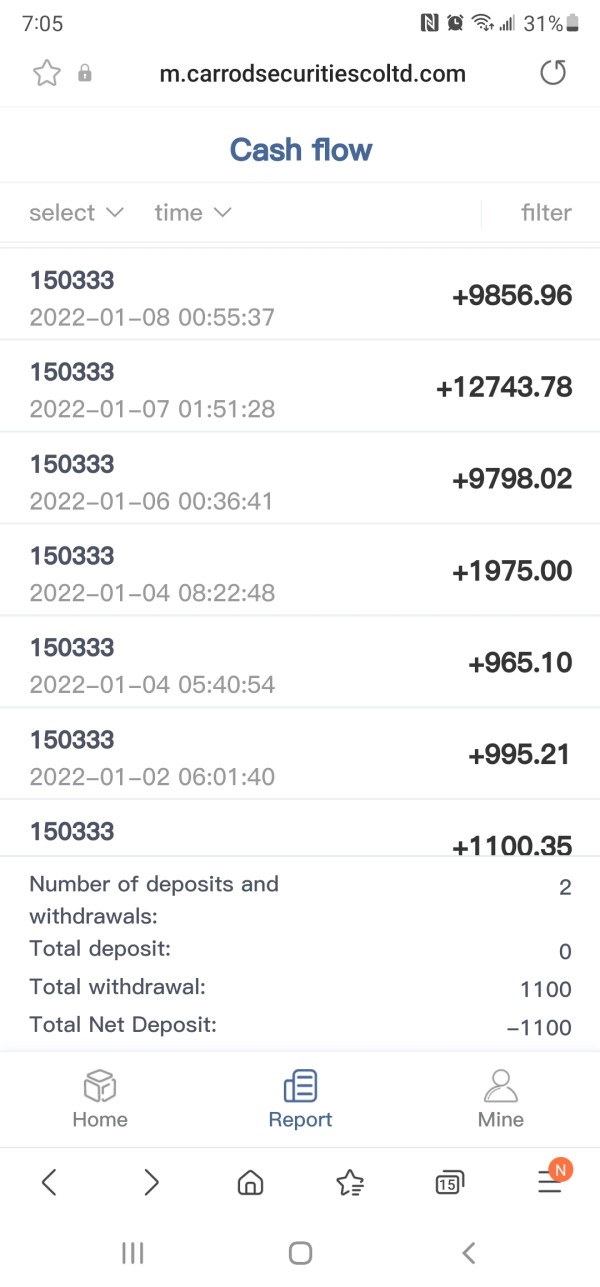

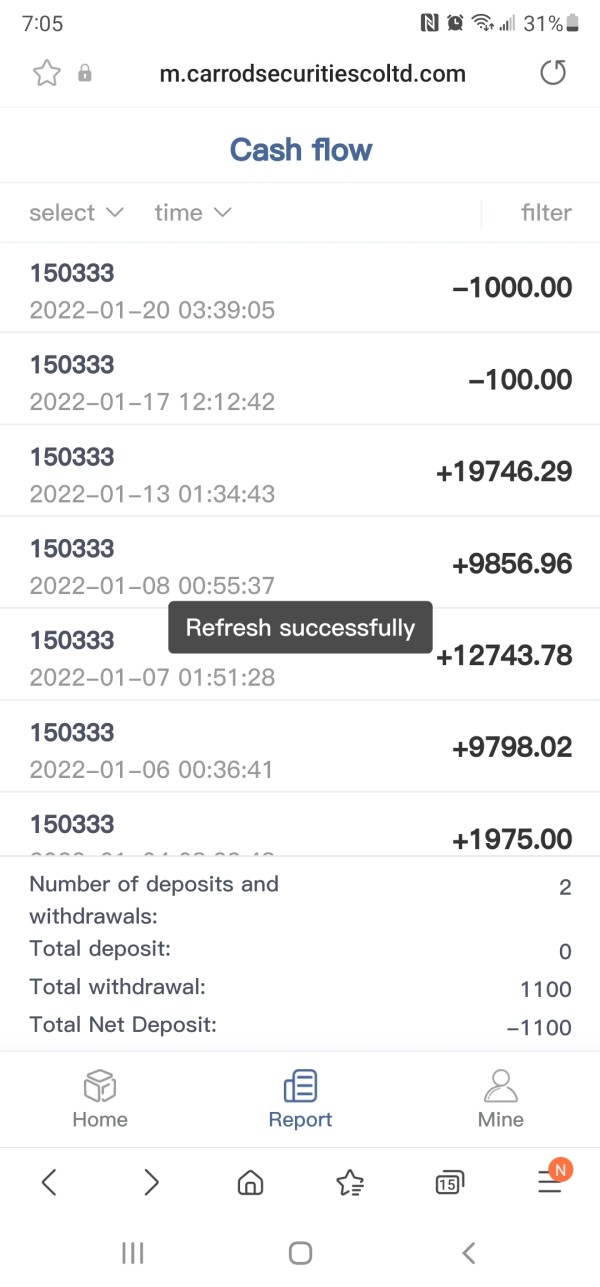

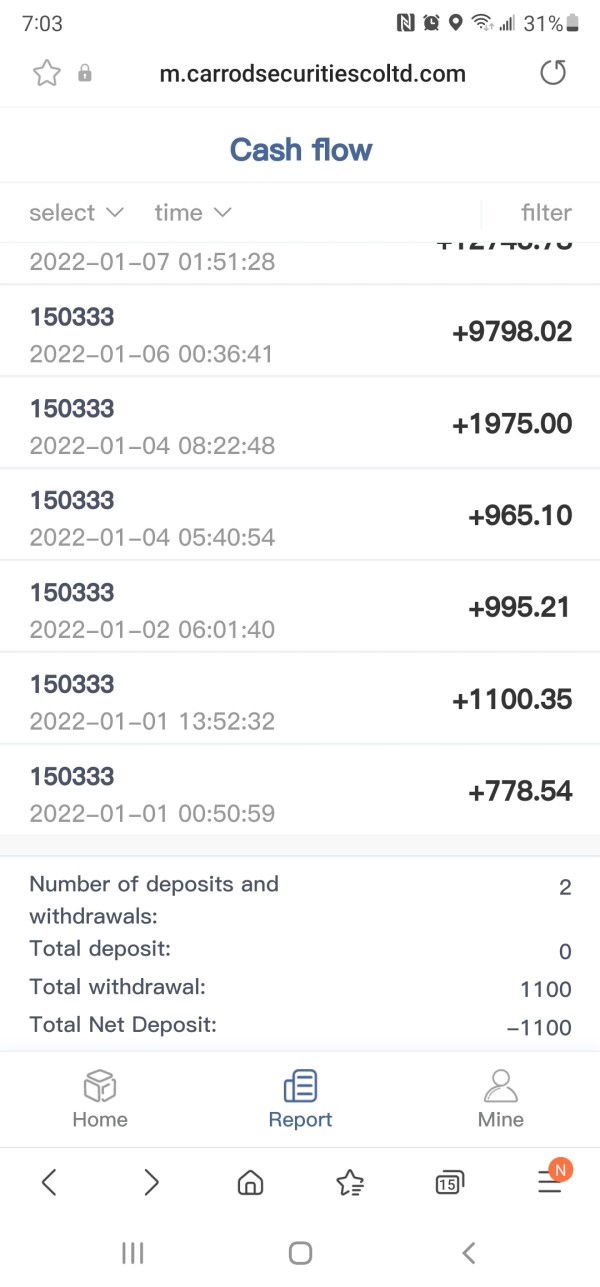

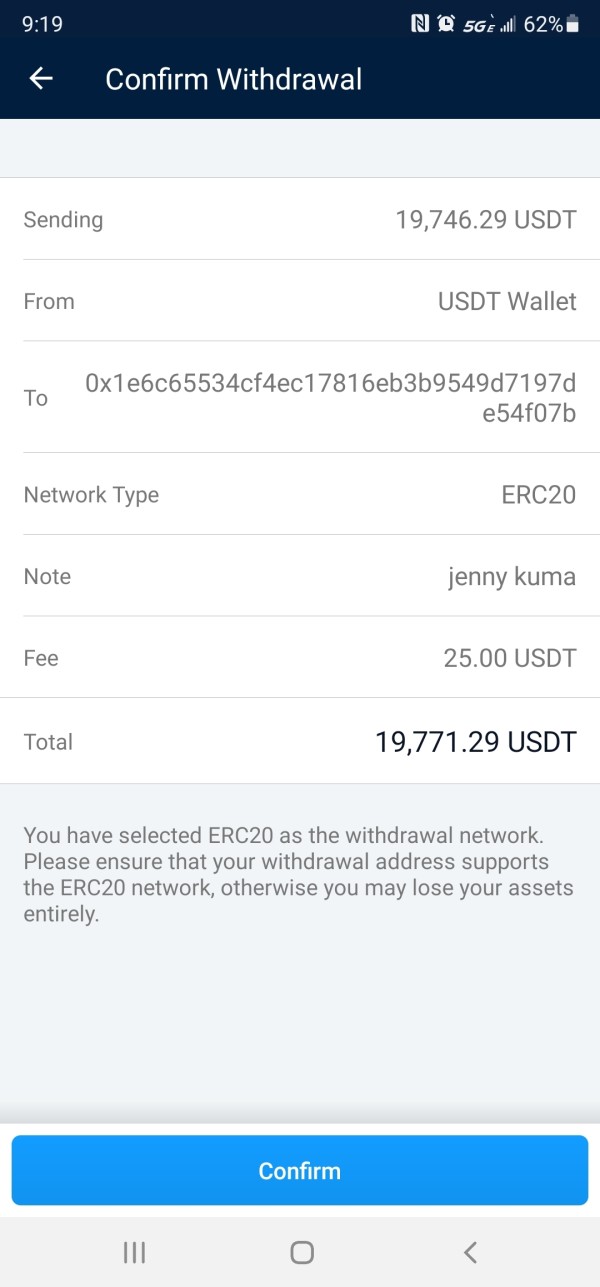

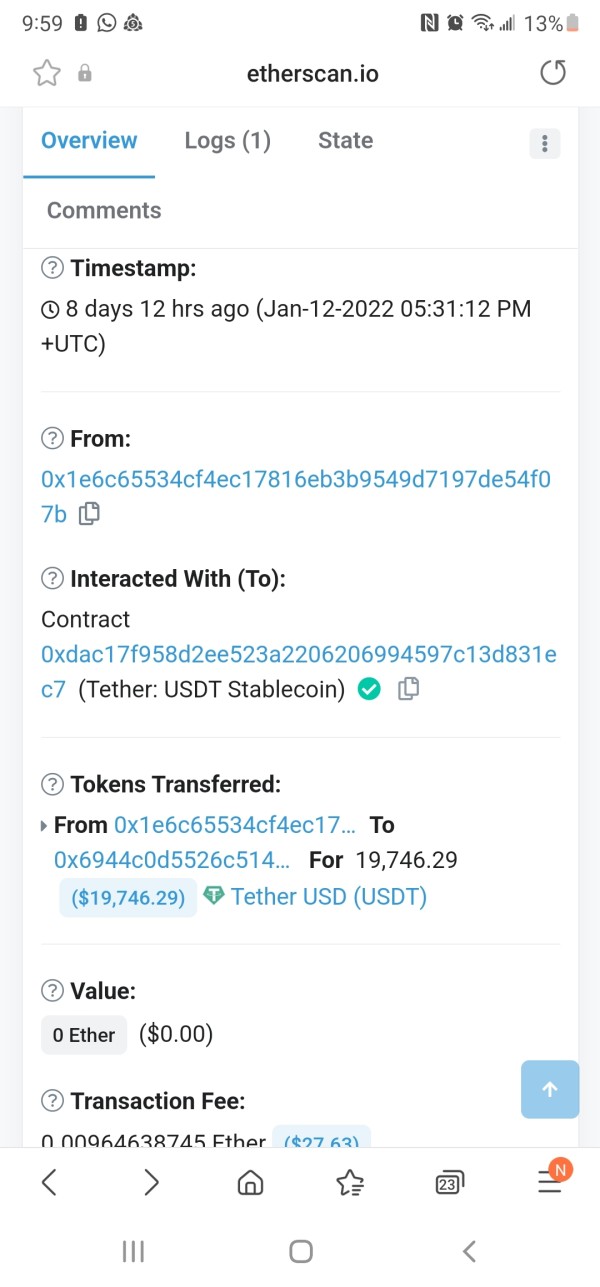

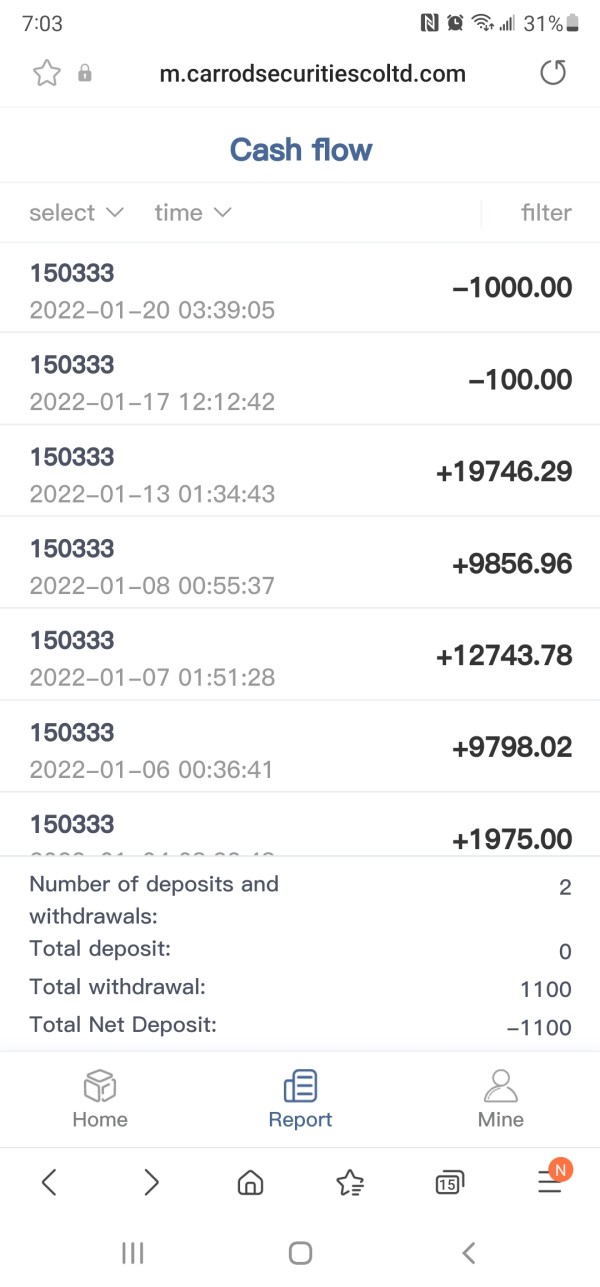

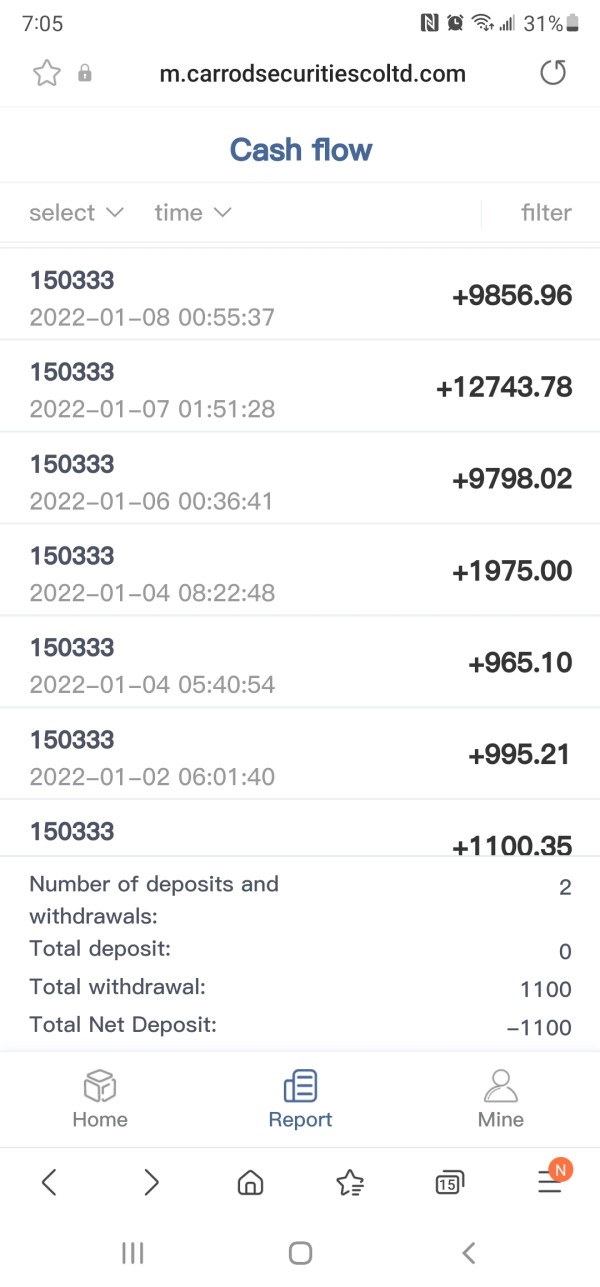

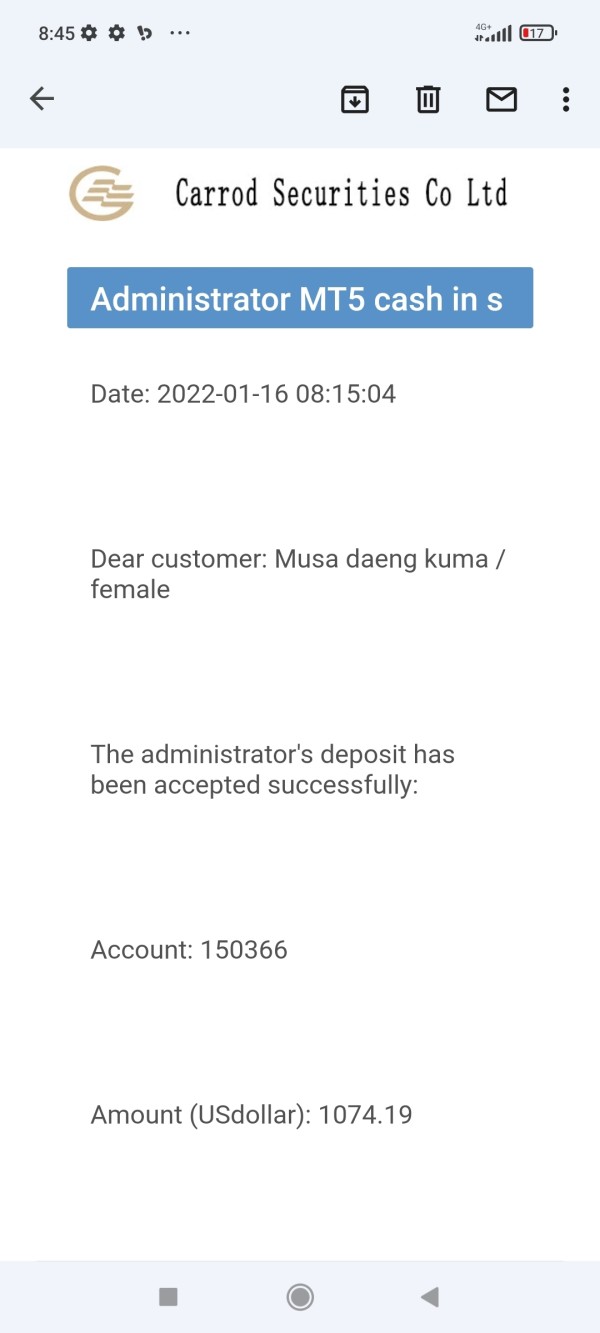

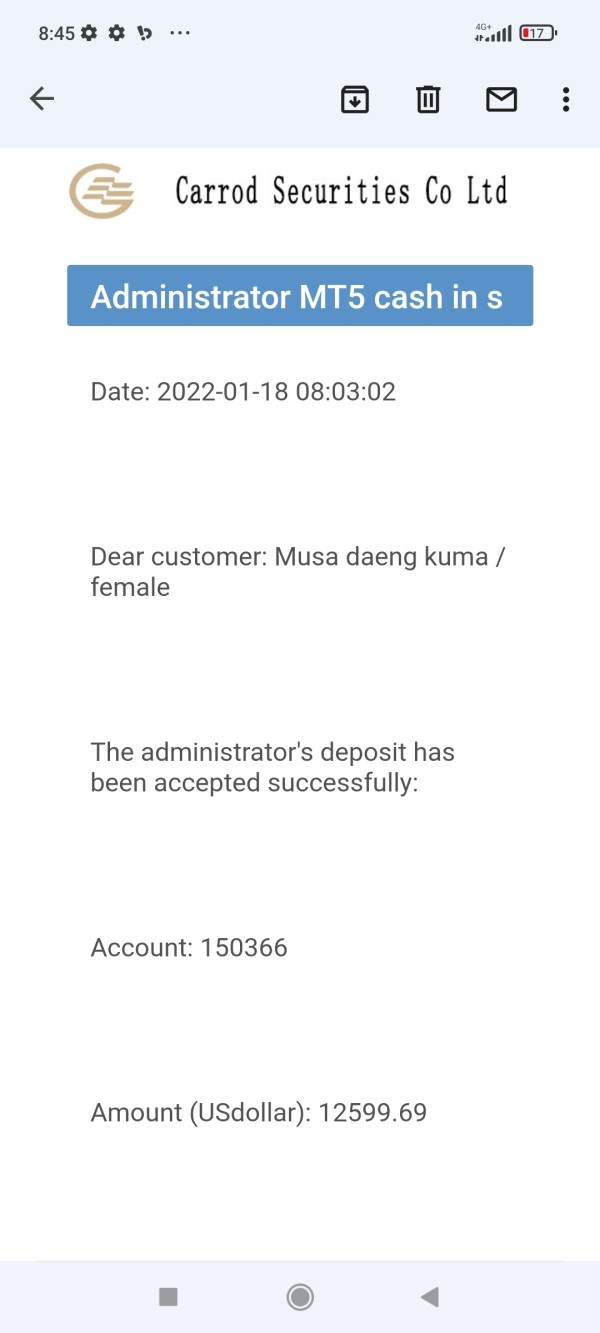

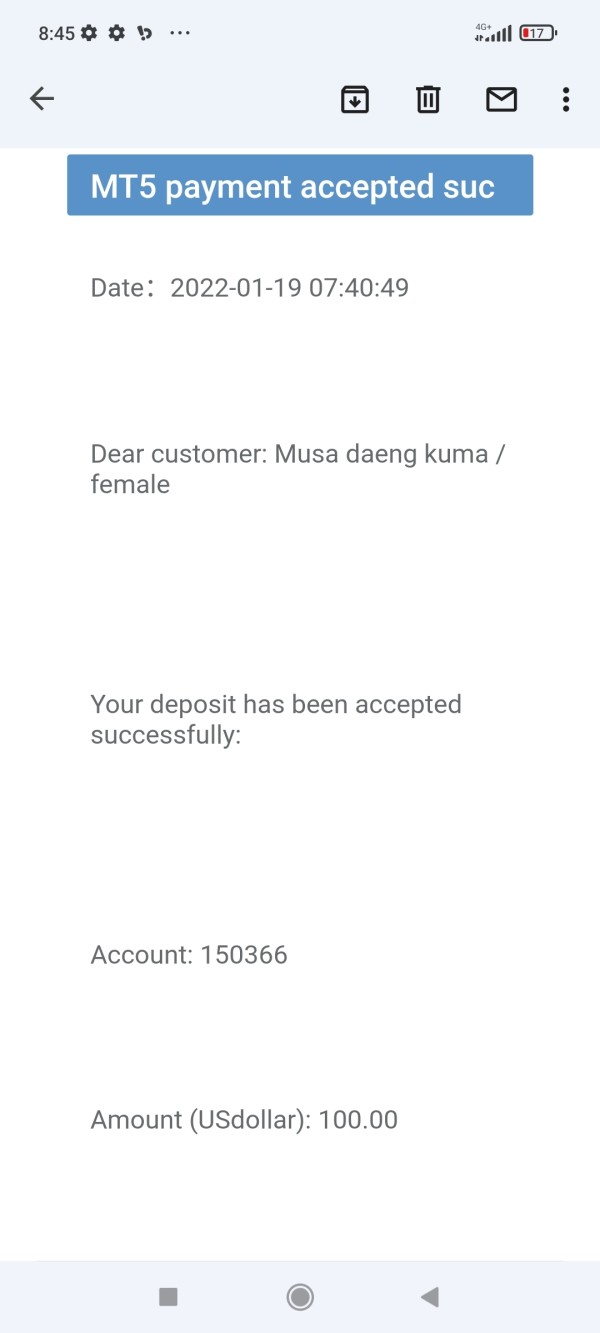

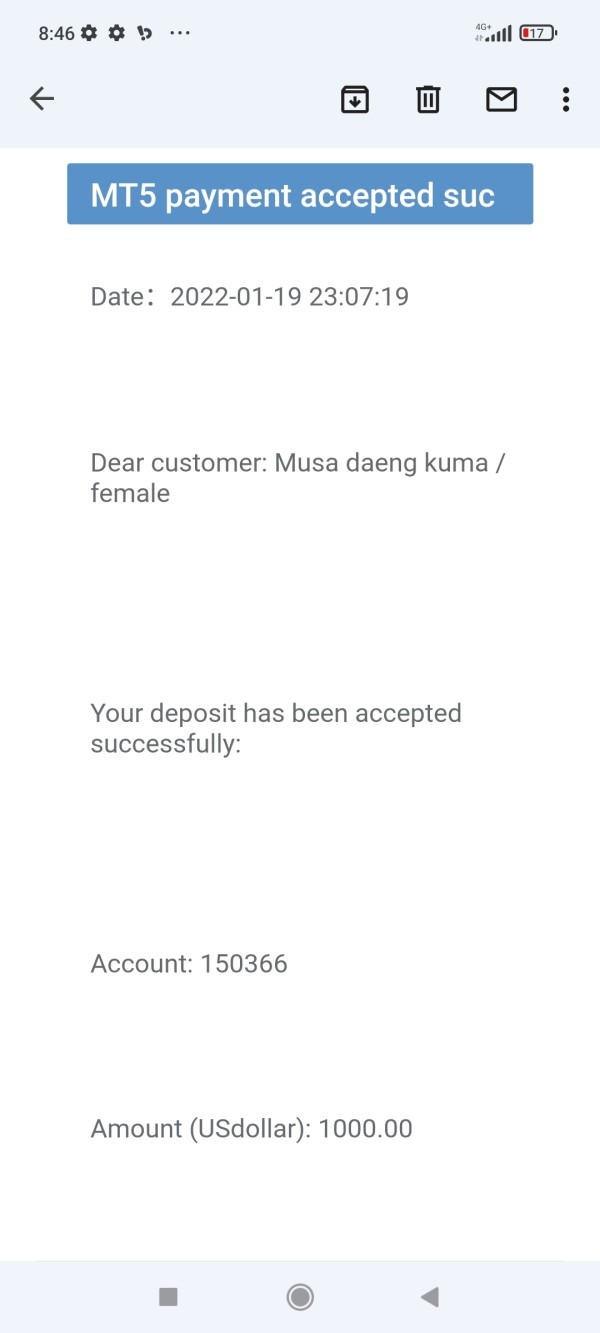

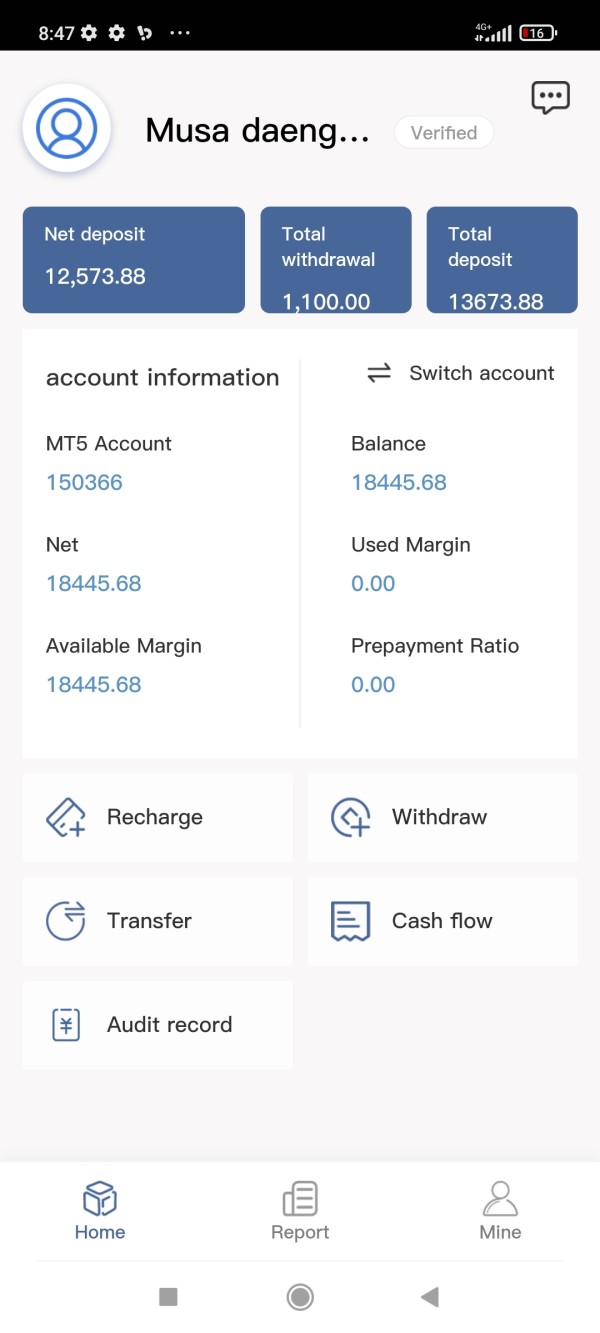

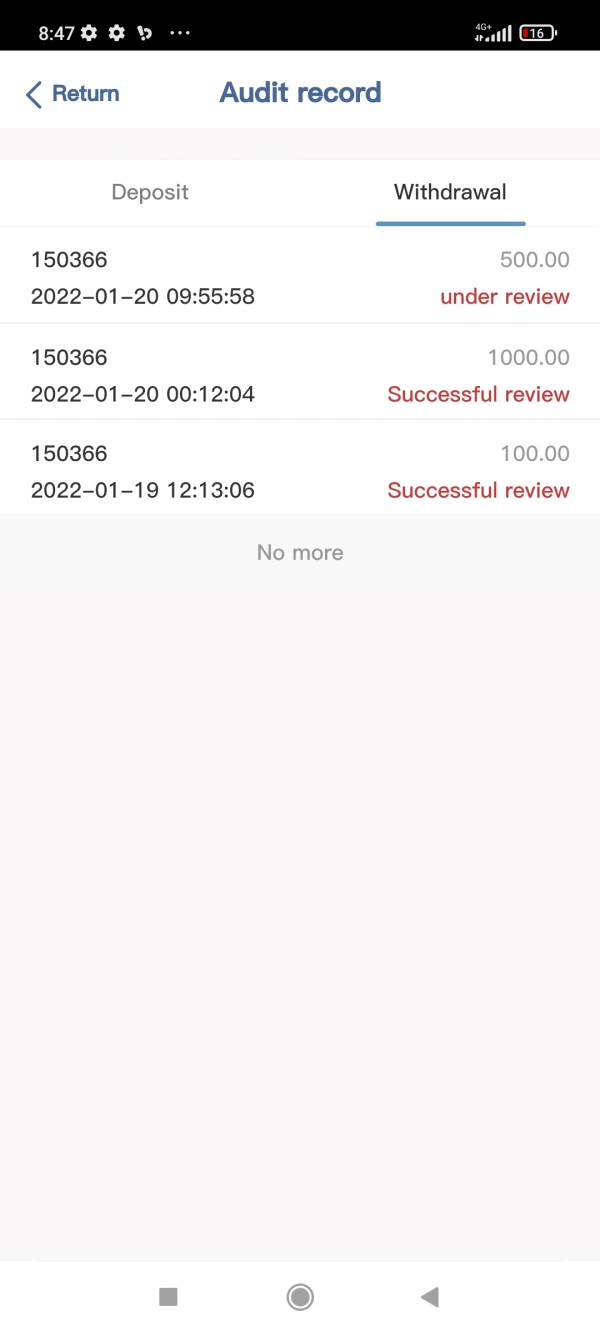

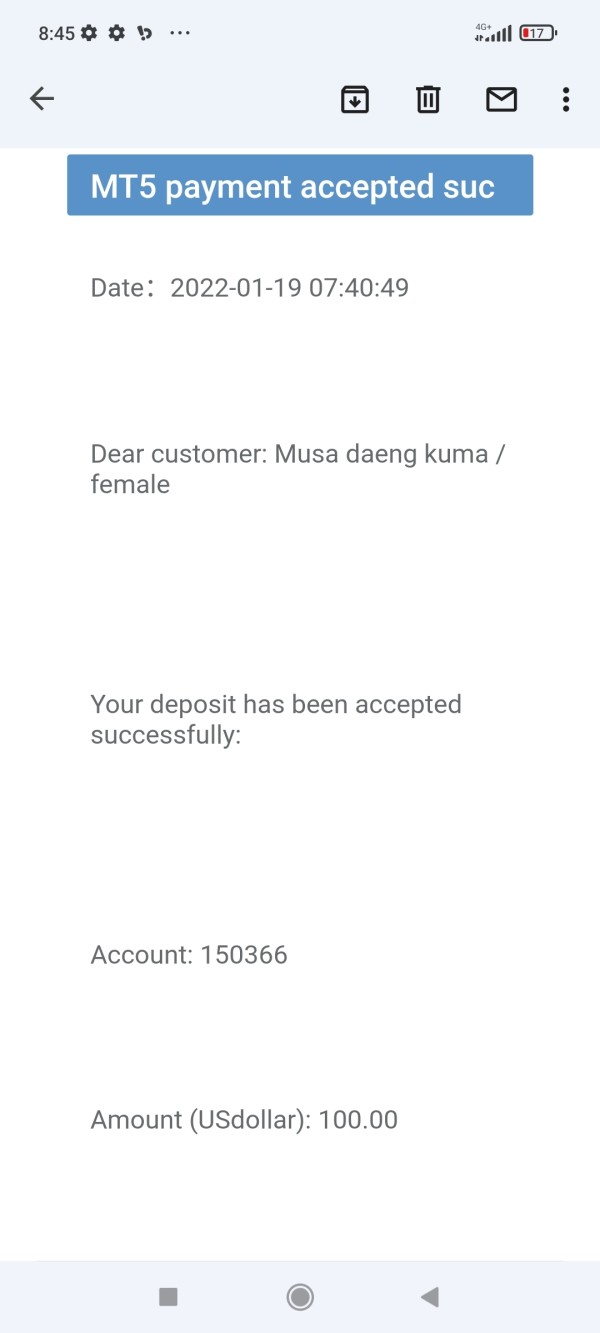

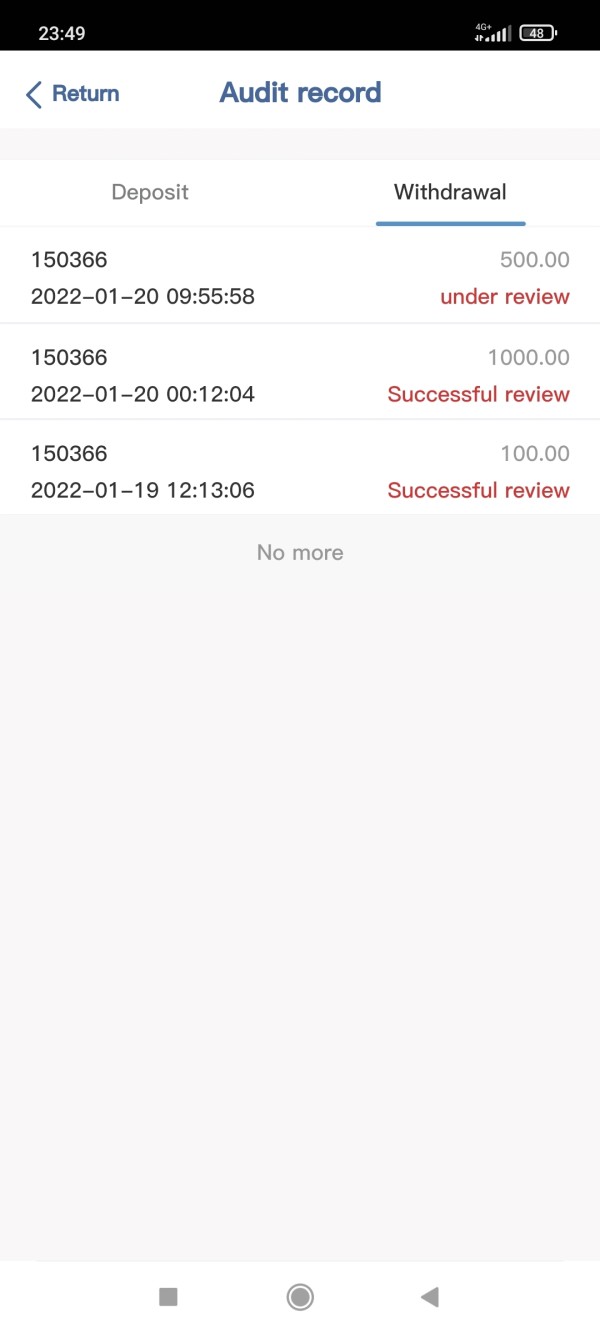

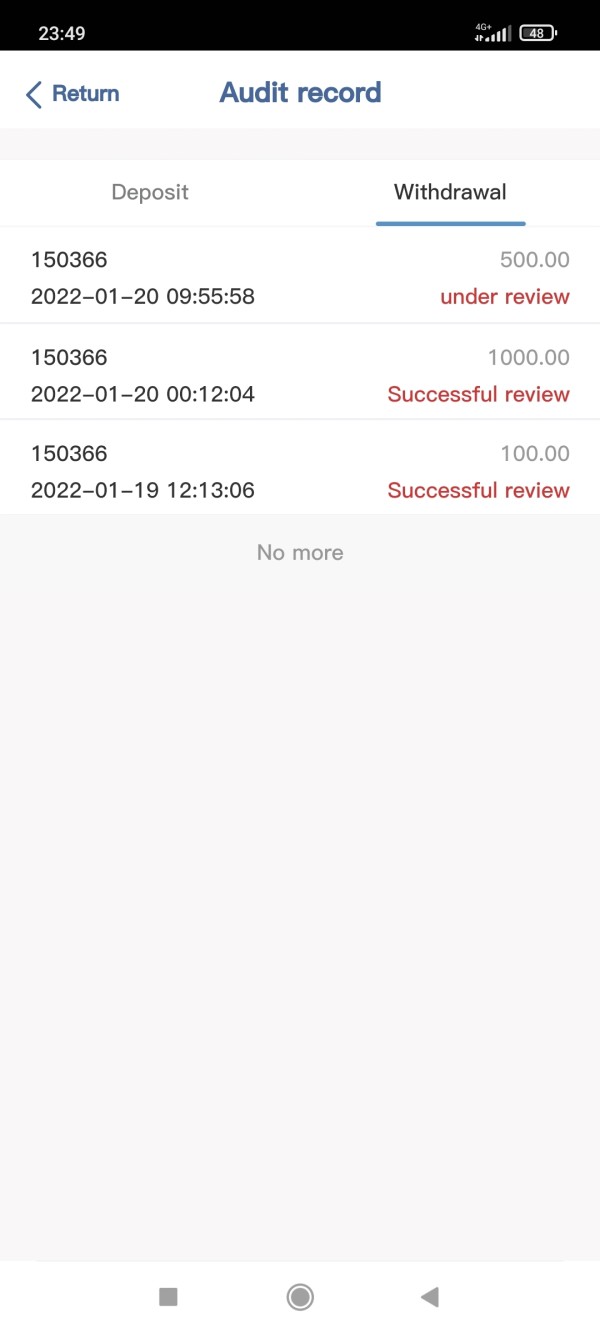

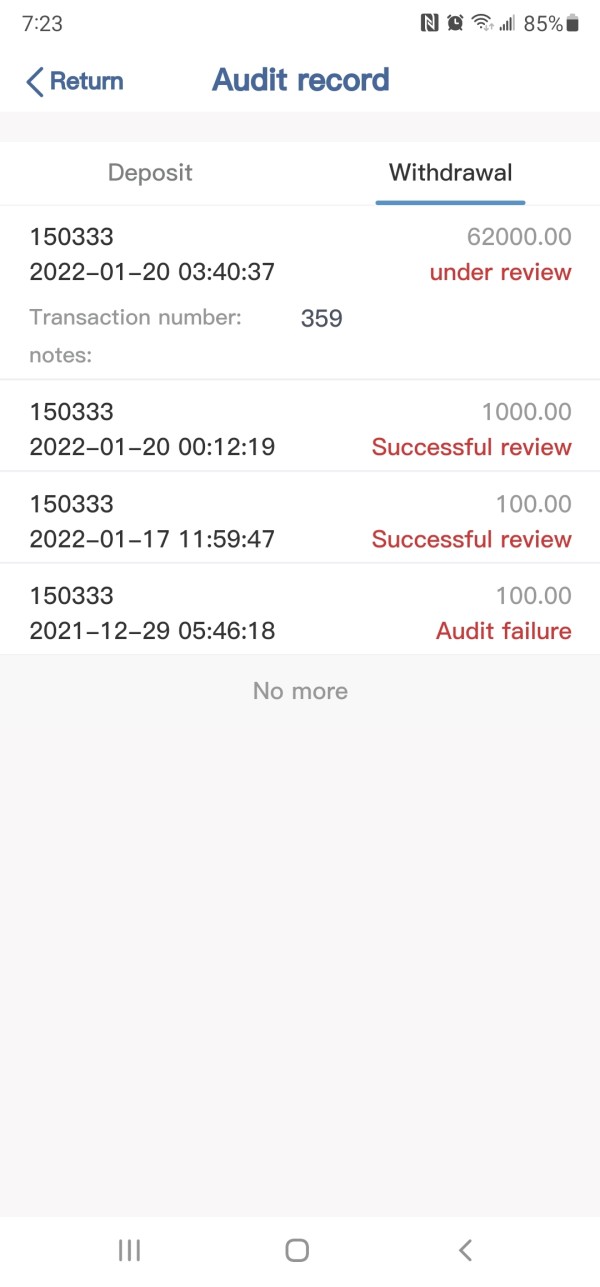

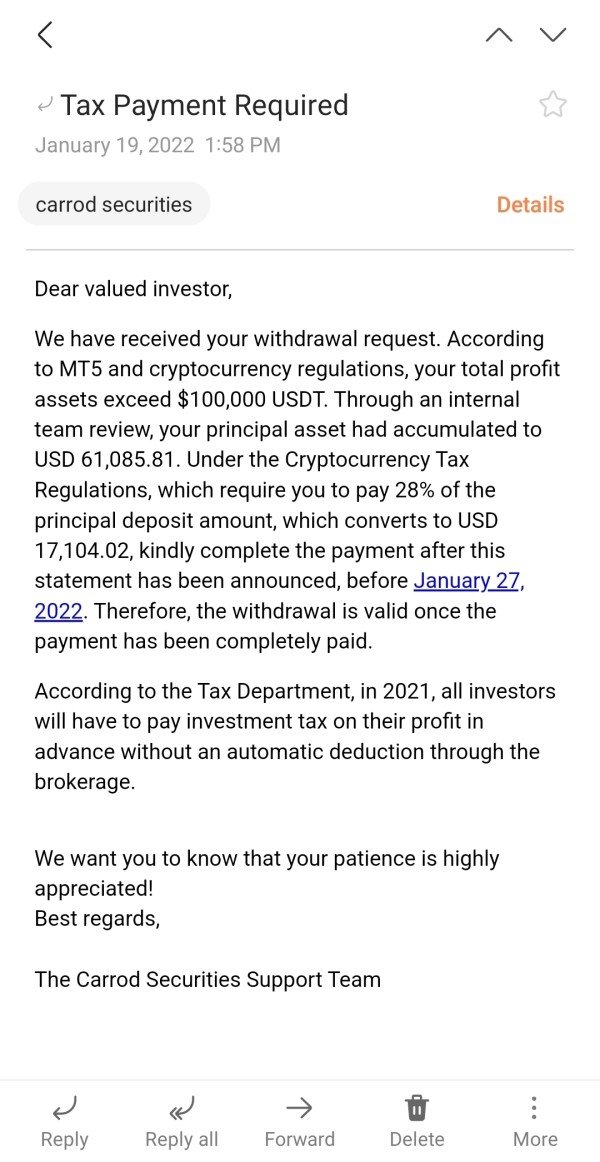

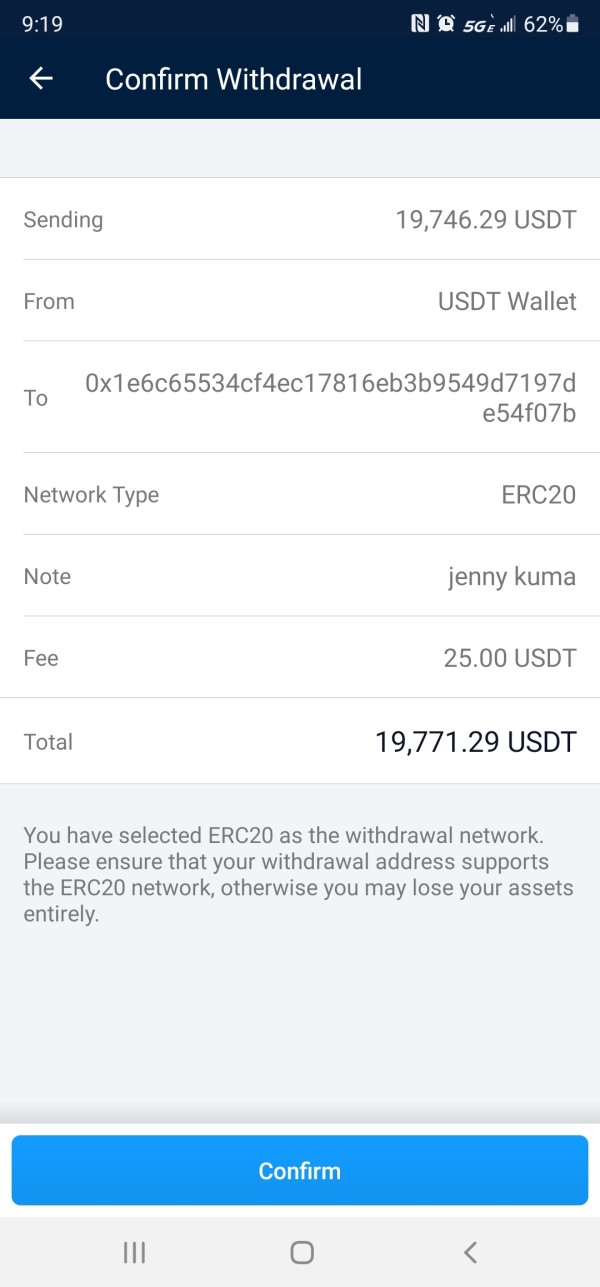

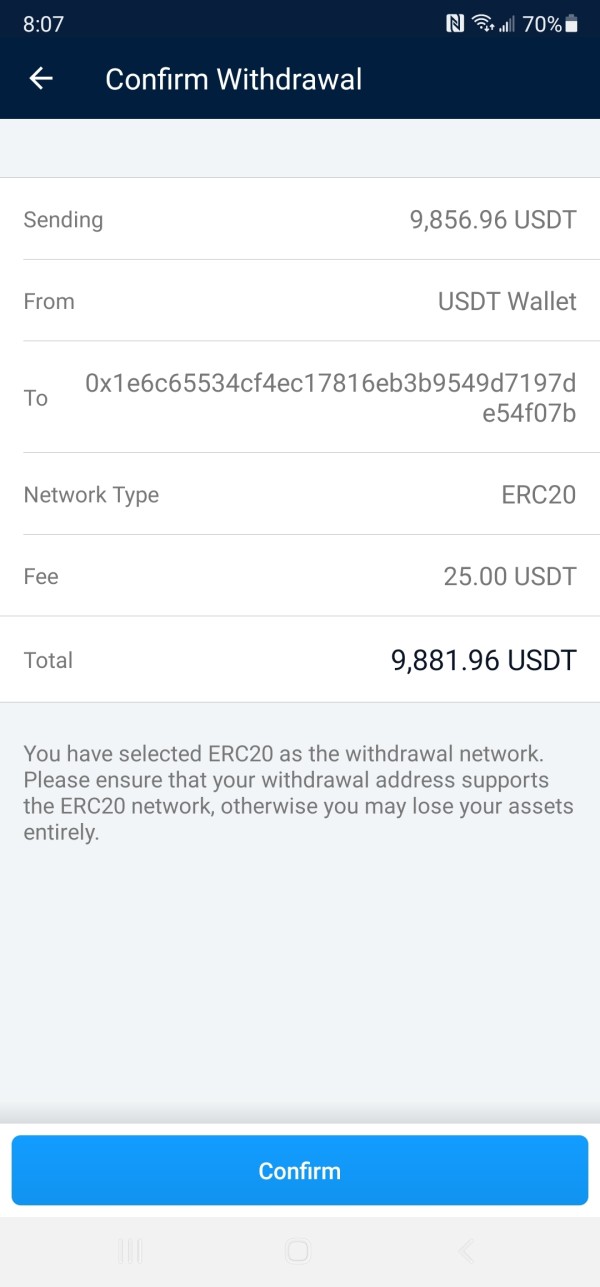

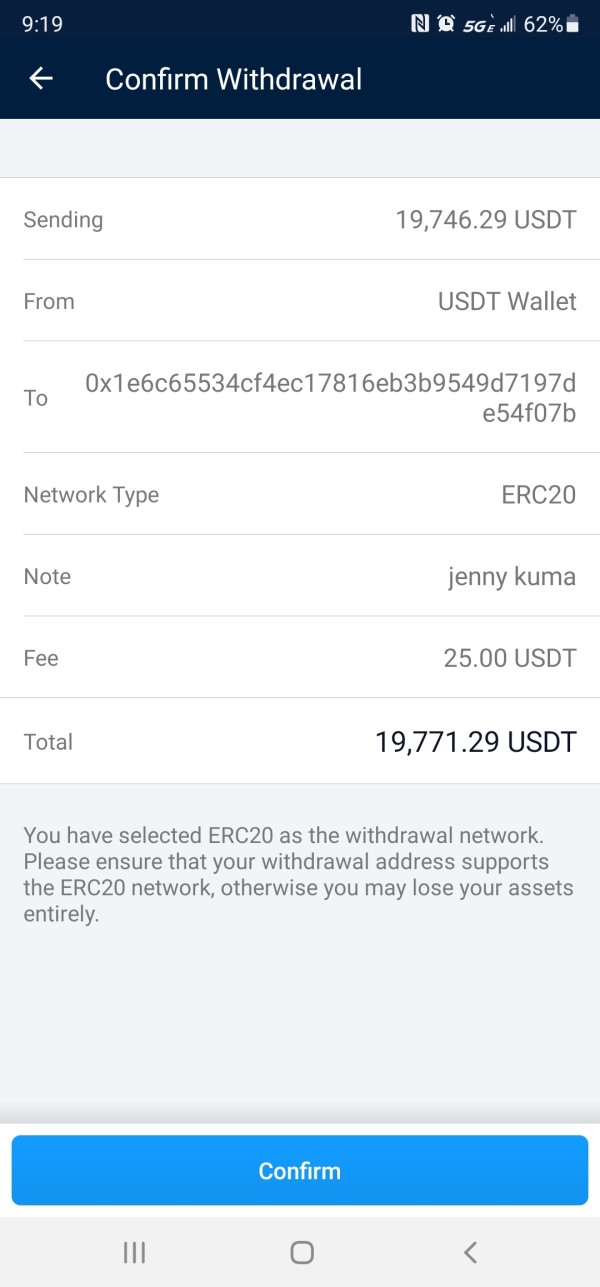

Deposit and Withdrawal Methods: Specific information regarding available payment methods, processing times, and associated fees is not detailed in available documentation. This creates uncertainty about fund management procedures.

Minimum Deposit Requirements: The broker has not disclosed minimum deposit amounts or account funding requirements in accessible materials. This makes it impossible to assess entry barriers for potential clients.

Bonus and Promotional Offers: No information regarding welcome bonuses, promotional campaigns, or incentive programs is available in current documentation or company communications.

Tradeable Assets: The broker claims to offer forex pairs and contracts for difference. Though specific instrument lists, market coverage, and product specifications remain undisclosed in available materials.

Cost Structure: Detailed information about spreads, commissions, overnight fees, and other trading costs is notably absent from available sources. This prevents accurate cost assessment for potential clients.

Leverage Ratios: Specific leverage offerings and margin requirements have not been disclosed in accessible documentation. This creates uncertainty about trading conditions and risk parameters.

Platform Options: The trading platform technology, software providers, and available interfaces are not specified in current materials. This limits assessment of technological capabilities and user experience.

Geographic Restrictions: Service availability by region and any jurisdictional limitations are not clearly outlined in available documentation from the broker.

Customer Support Languages: Specific language support options and communication capabilities are not detailed in accessible materials. Though this carrod securities review notes the absence of clear customer service information.

Account Conditions Analysis

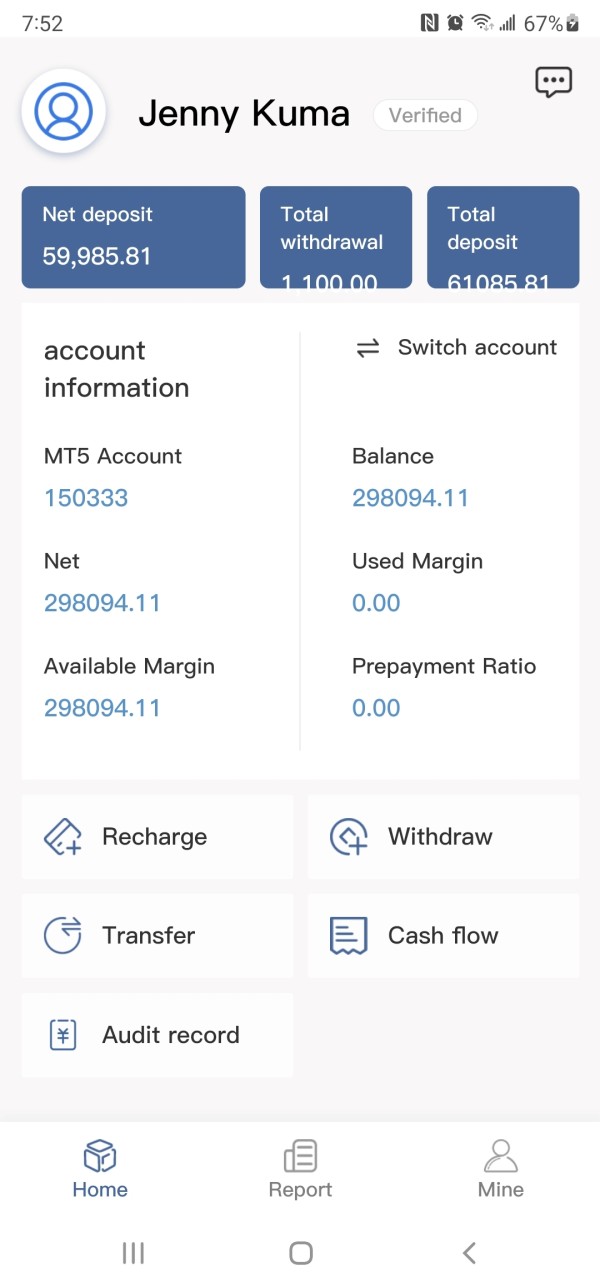

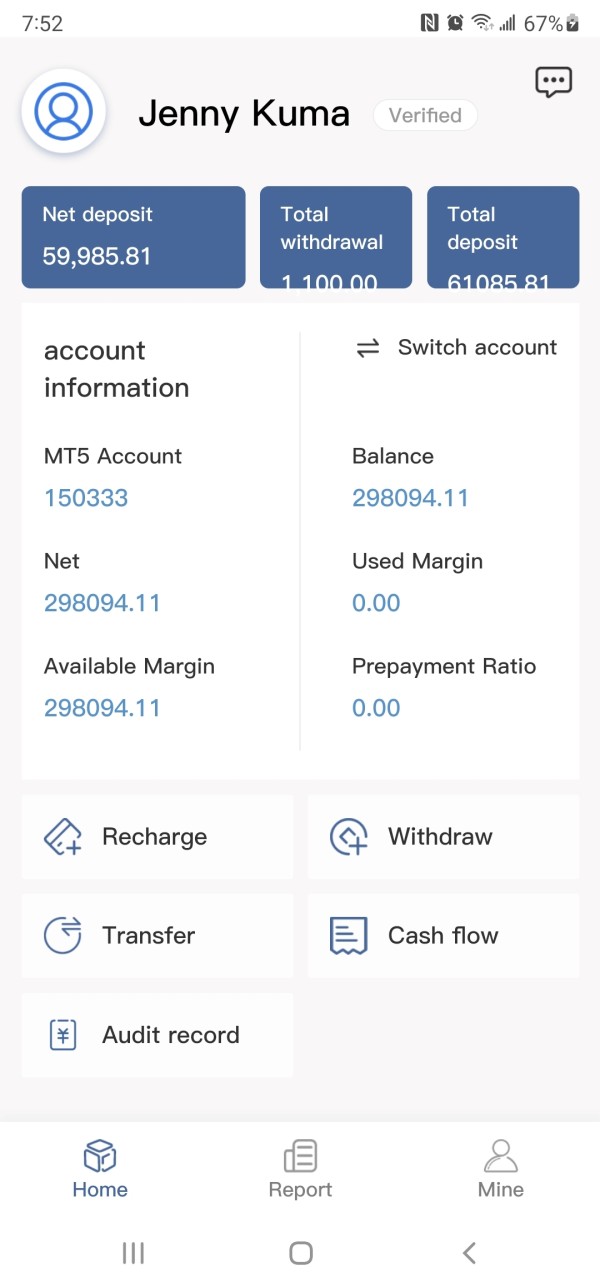

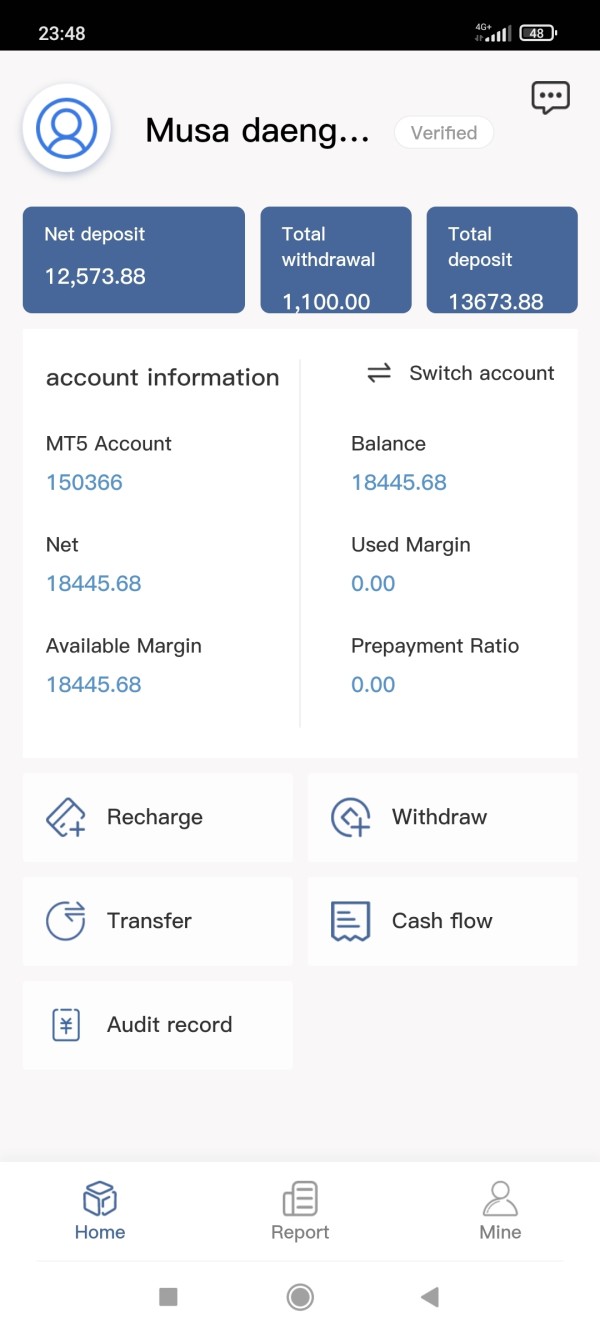

The account conditions offered by Carrod Securities remain largely hidden due to insufficient disclosure of essential details. Available sources do not provide information about different account types, tier structures, or varying service levels that might be available to different client categories. This lack of transparency makes it impossible to assess whether the broker offers standard retail accounts, professional accounts, or institutional services with distinct features and requirements.

Minimum deposit requirements represent another significant information gap. The broker has not disclosed specific funding thresholds for account activation. Industry standards typically range from $100 to $500 for retail accounts, but without confirmed information from Carrod Securities, potential clients cannot plan their initial investment or compare requirements with established brokers.

The absence of clear deposit information also raises questions about the broker's operational procedures and client onboarding processes. The account opening process and required documentation remain unspecified in available materials. Standard industry practices include identity verification, address confirmation, and financial suitability assessments, but Carrod Securities has not outlined their specific requirements or procedures.

Additionally, special account features such as Islamic accounts for Sharia-compliant trading, demo accounts for practice, or managed account options are not mentioned in accessible documentation. User feedback regarding account conditions is virtually non-existent, with a zero rating across available platforms providing no insight into client satisfaction with account setup, maintenance, or service delivery. This carrod securities review emphasizes that the lack of verified user experiences makes it impossible to assess real-world account performance or client satisfaction levels.

The absence of comparative information with other brokers further limits the ability to evaluate the competitiveness of account offerings.

The trading tools and resources provided by Carrod Securities remain largely undefined in available documentation. This creates significant uncertainty about the technological infrastructure and analytical support available to clients. Standard industry offerings typically include charting software, technical indicators, economic calendars, and market analysis tools, but specific details about Carrod Securities' technological capabilities are not disclosed in accessible materials.

Research and analysis resources represent another area of concern. The broker has not outlined market commentary, expert analysis, or educational content availability. Professional brokers typically provide daily market updates, technical analysis reports, and fundamental research to support client decision-making.

The absence of information about research capabilities suggests either limited analytical support or inadequate disclosure of available services. Educational resources and training materials are not mentioned in available documentation, despite their importance for trader development and regulatory compliance in many jurisdictions. Industry standards include webinars, tutorials, trading guides, and risk management education.

The lack of educational content information may indicate insufficient support for novice traders or regulatory compliance deficiencies. Automated trading support, including Expert Advisors, algorithmic trading capabilities, and API access, remains unspecified in current materials. These features are increasingly important for serious traders and institutional clients, but Carrod Securities has not disclosed their technological capabilities in these areas.

User feedback regarding tools and resources is unavailable due to the zero rating across platforms, preventing assessment of real-world tool performance and user satisfaction with available resources.

Customer Service and Support Analysis

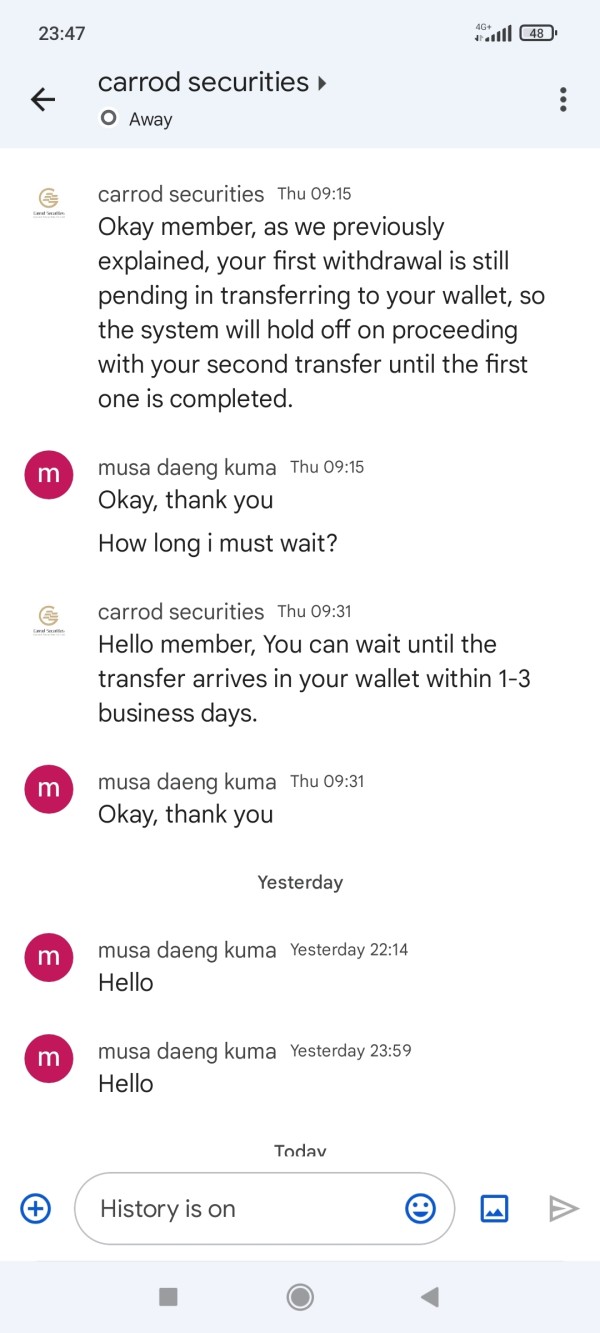

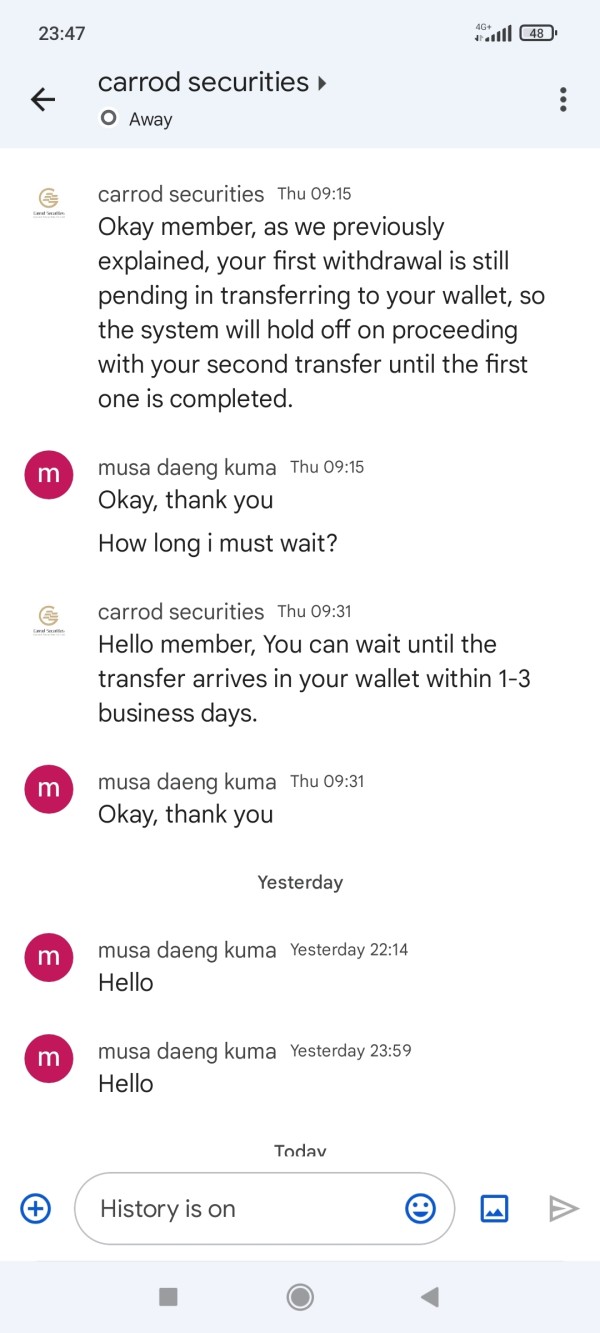

Customer service and support capabilities at Carrod Securities present significant concerns due to the complete absence of detailed information about support channels, availability, and service quality. Industry standards typically include multiple contact methods such as phone support, email assistance, live chat functionality, and comprehensive FAQ sections. However, Carrod Securities has not disclosed specific support channels or contact information in accessible documentation.

Response times and service quality metrics are entirely unavailable. This makes it impossible to assess the broker's commitment to client support and problem resolution. Professional brokers typically provide response time guarantees, escalation procedures, and service level agreements to ensure client satisfaction.

The absence of such information raises questions about the broker's operational capabilities and client service priorities. Multilingual support capabilities remain unspecified, despite their importance for international clients and regulatory compliance in various jurisdictions. Many brokers provide support in multiple languages to serve diverse client bases effectively.

The lack of language support information may indicate limited international capabilities or inadequate service infrastructure for global operations. Customer service hours and availability are not outlined in available materials, creating uncertainty about when clients can access support services. Professional brokers typically provide extended hours or 24/7 support to accommodate global trading schedules and time zone differences.

The zero user rating across available platforms provides no insight into actual service experiences, problem resolution effectiveness, or overall client satisfaction with support services. This complete absence of user feedback represents a significant red flag for potential clients seeking reliable customer support.

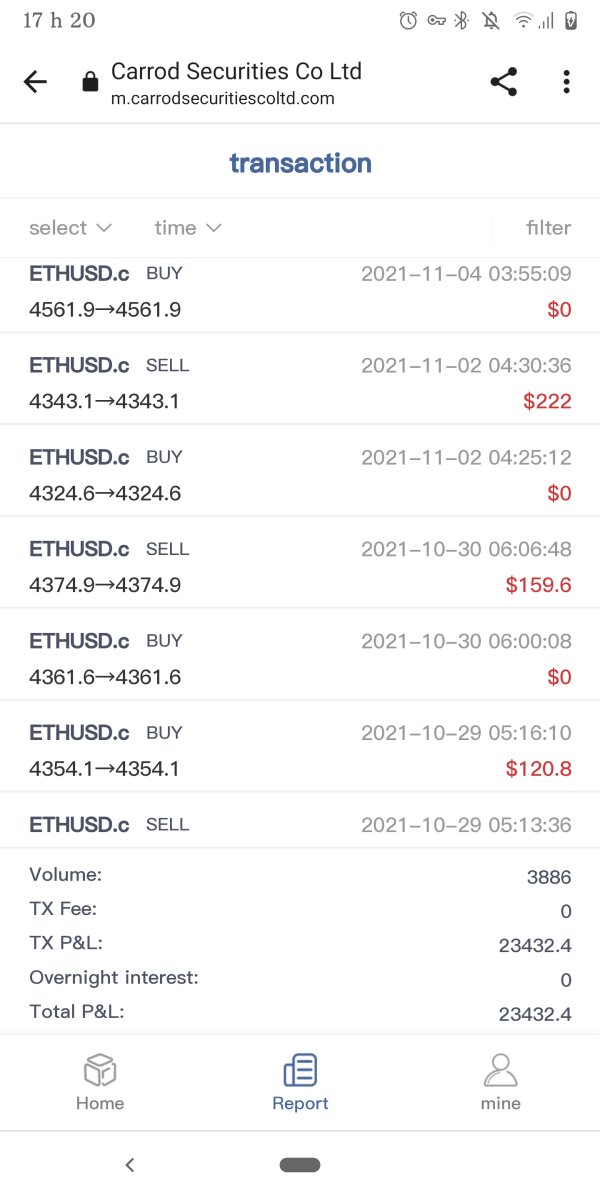

Trading Experience Analysis

The trading experience offered by Carrod Securities cannot be adequately assessed due to insufficient information about platform stability, execution quality, and overall trading environment. Professional brokers typically provide detailed specifications about order execution speeds, platform uptime statistics, and server reliability metrics. However, Carrod Securities has not disclosed any technical performance data or platform reliability information in accessible documentation.

Order execution quality and slippage characteristics remain entirely unspecified. This makes it impossible to evaluate the broker's ability to fill orders at requested prices during various market conditions. Industry standards include disclosure of execution statistics, average slippage rates, and order fill ratios to demonstrate execution quality.

The absence of such information prevents assessment of trading condition competitiveness and execution reliability. Platform functionality and user interface quality cannot be evaluated due to lack of specific information about trading software, charting capabilities, and order management features. Modern trading platforms typically offer advanced charting tools, multiple order types, risk management features, and customizable interfaces.

Without detailed platform information, potential clients cannot assess whether the trading environment meets their technical requirements and preferences. Mobile trading capabilities and cross-device synchronization are not addressed in available materials, despite their increasing importance for active traders. Contemporary brokers typically provide native mobile applications with full trading functionality and seamless integration with desktop platforms.

The zero user rating provides no insight into actual trading experiences, platform performance, or user satisfaction with trading conditions. This carrod securities review emphasizes that the lack of verified user feedback makes it impossible to assess real-world trading experience quality.

Trust and Reliability Analysis

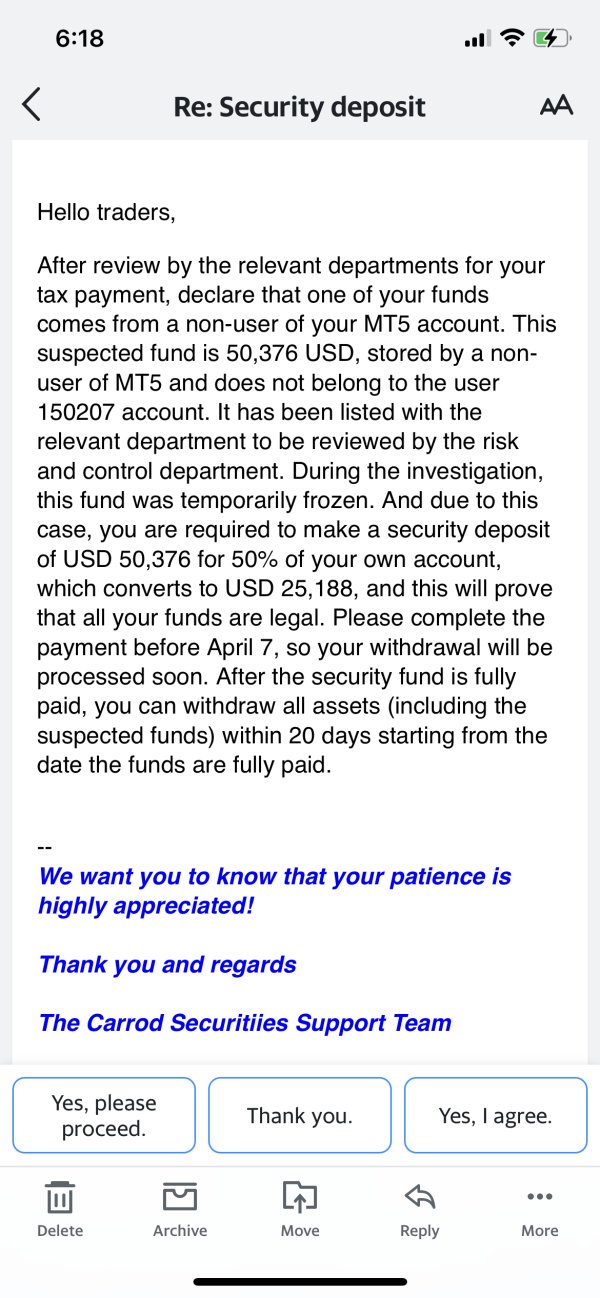

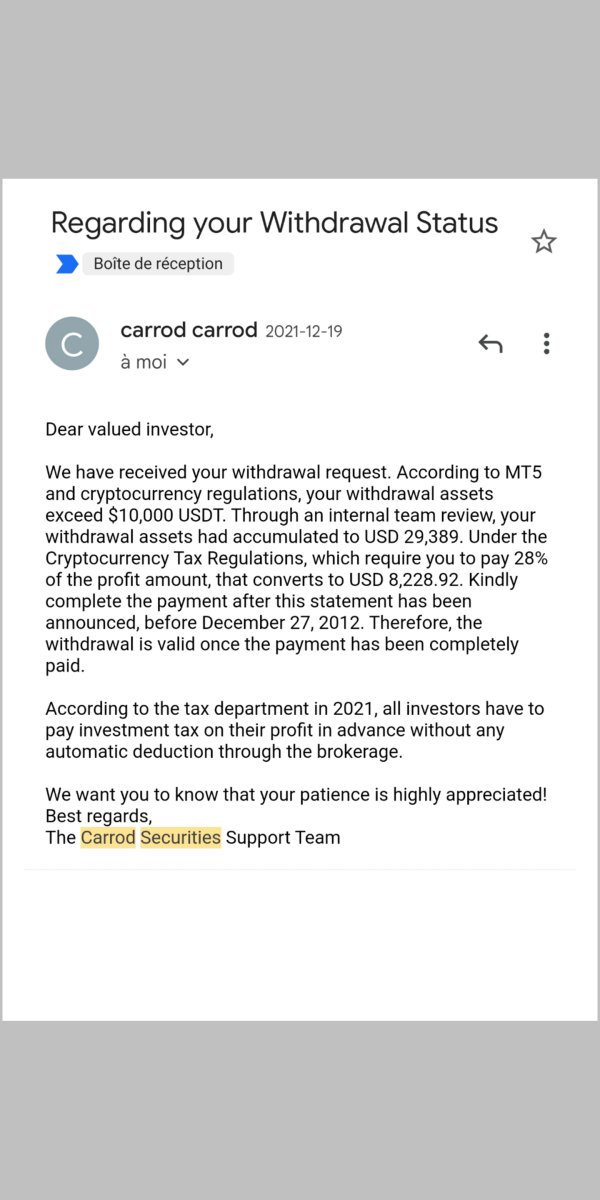

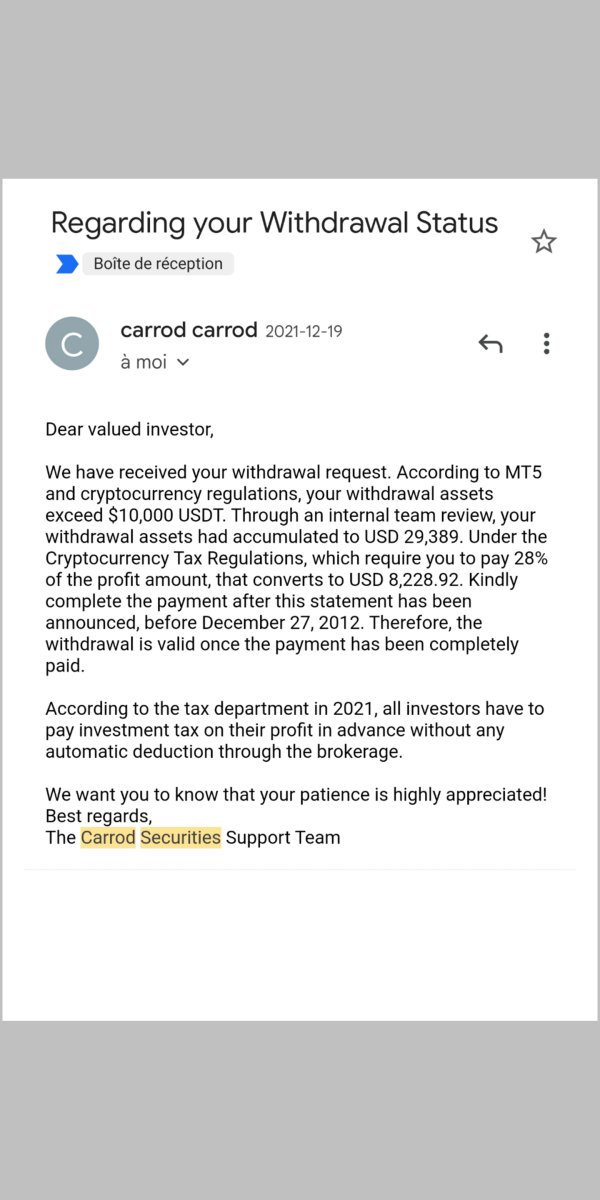

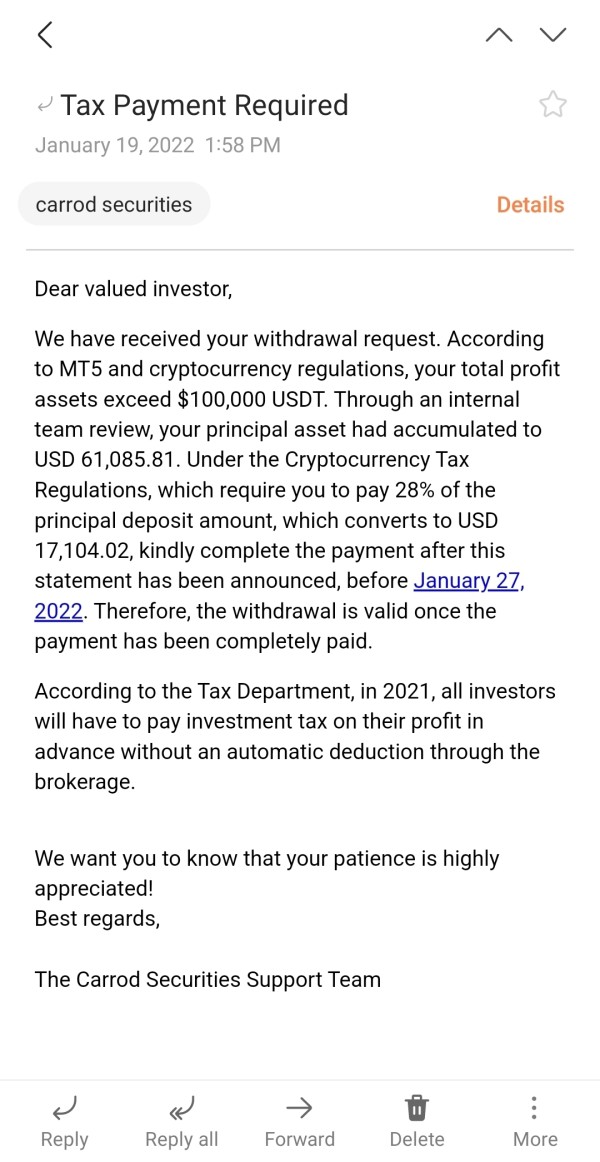

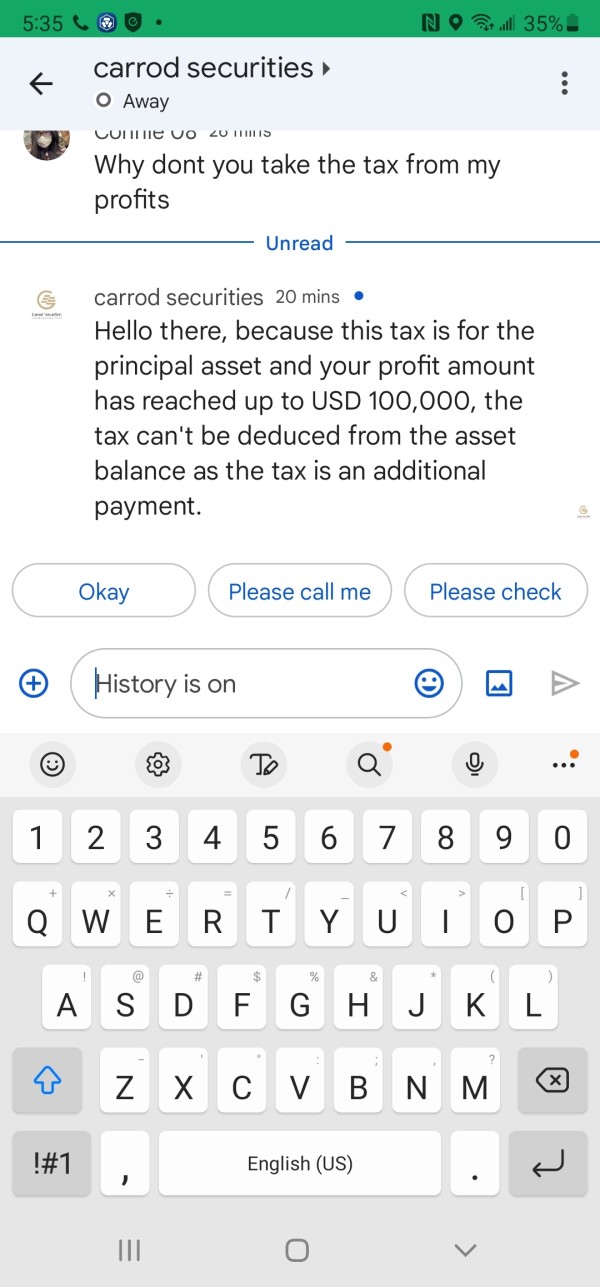

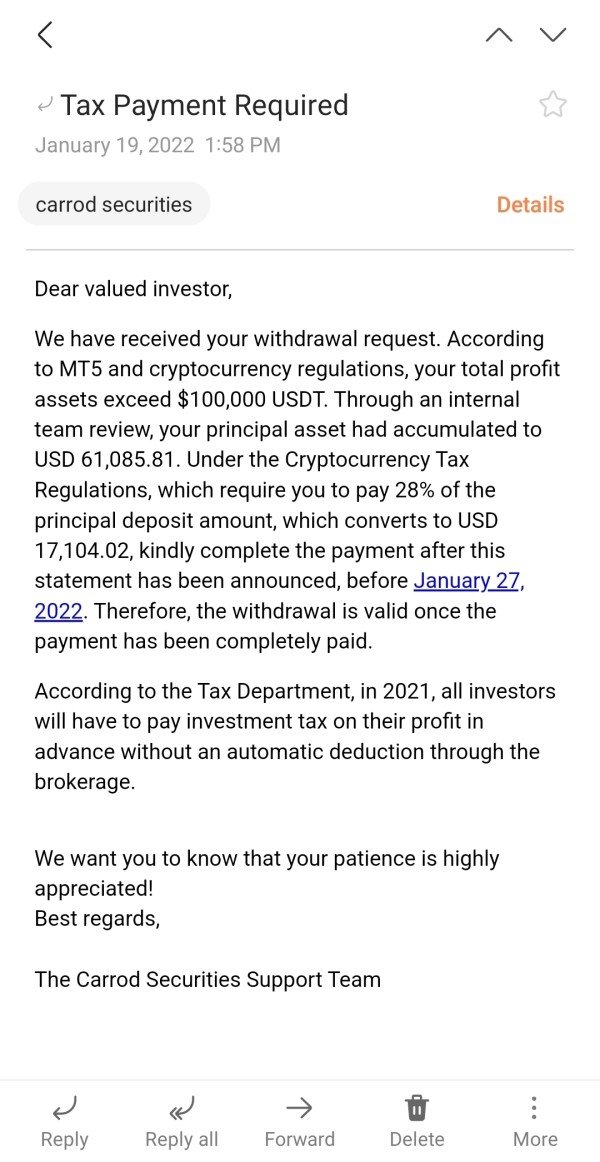

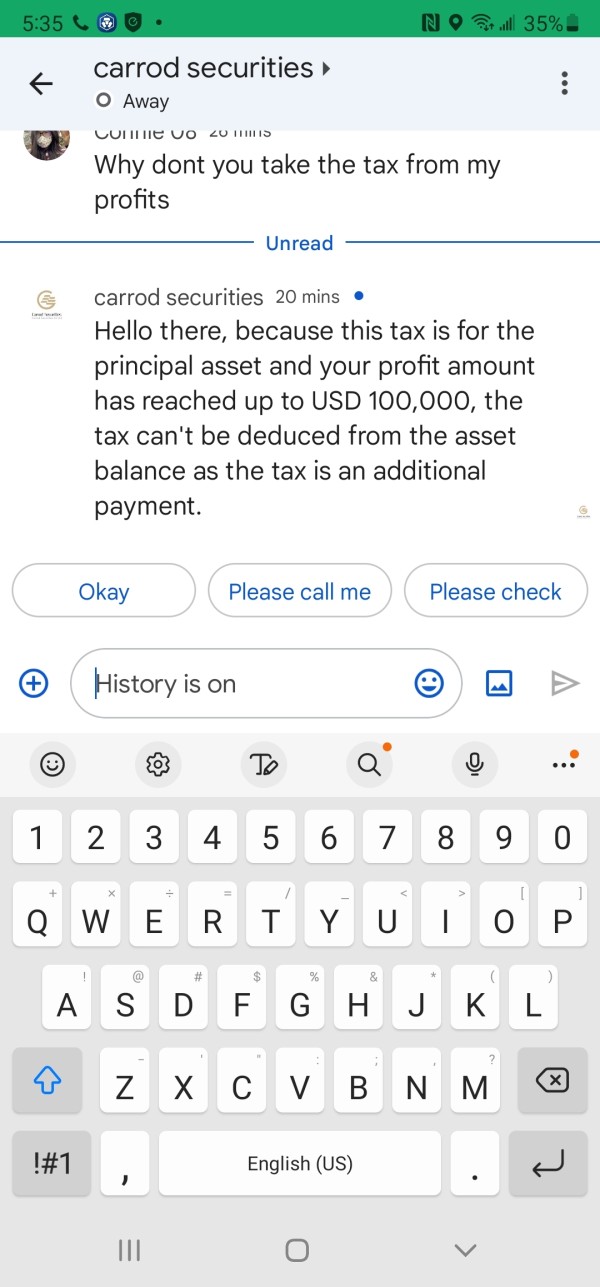

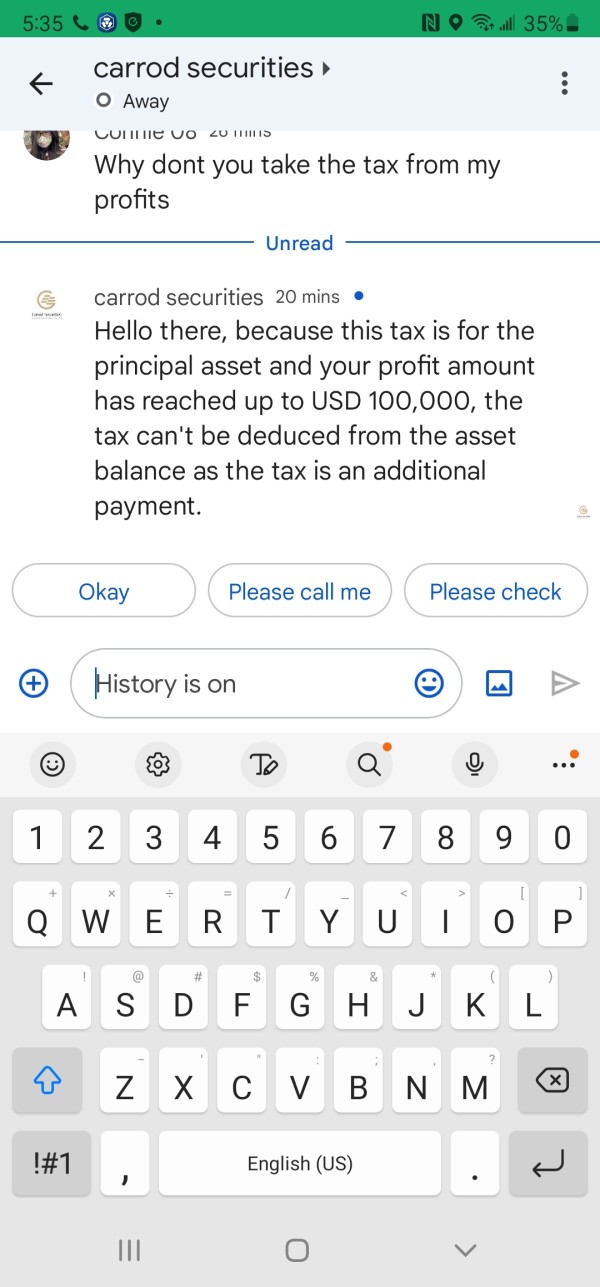

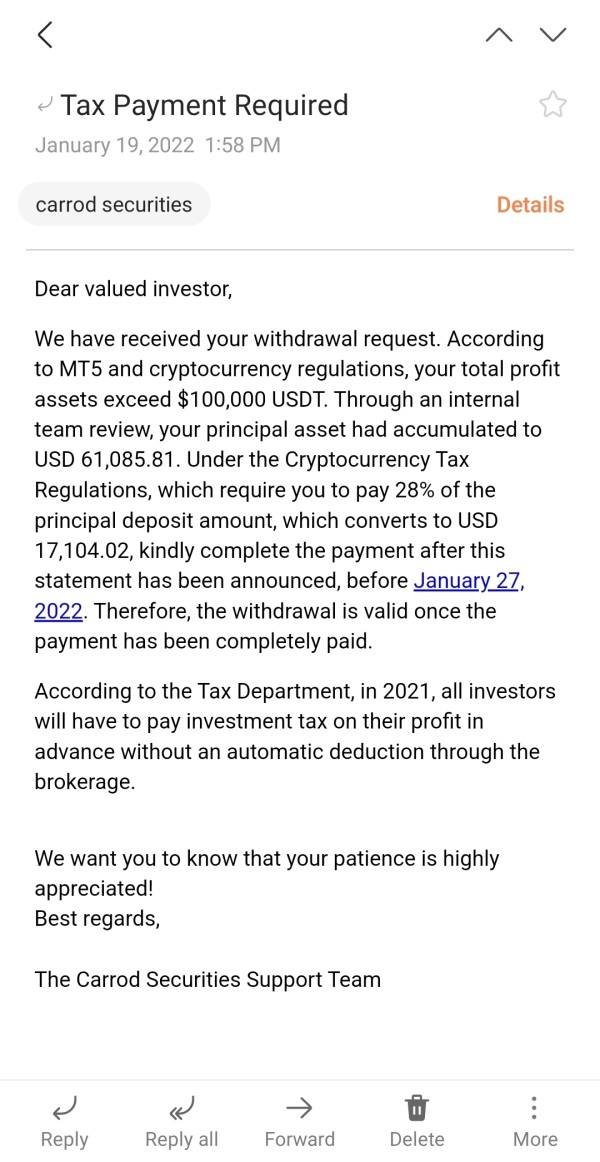

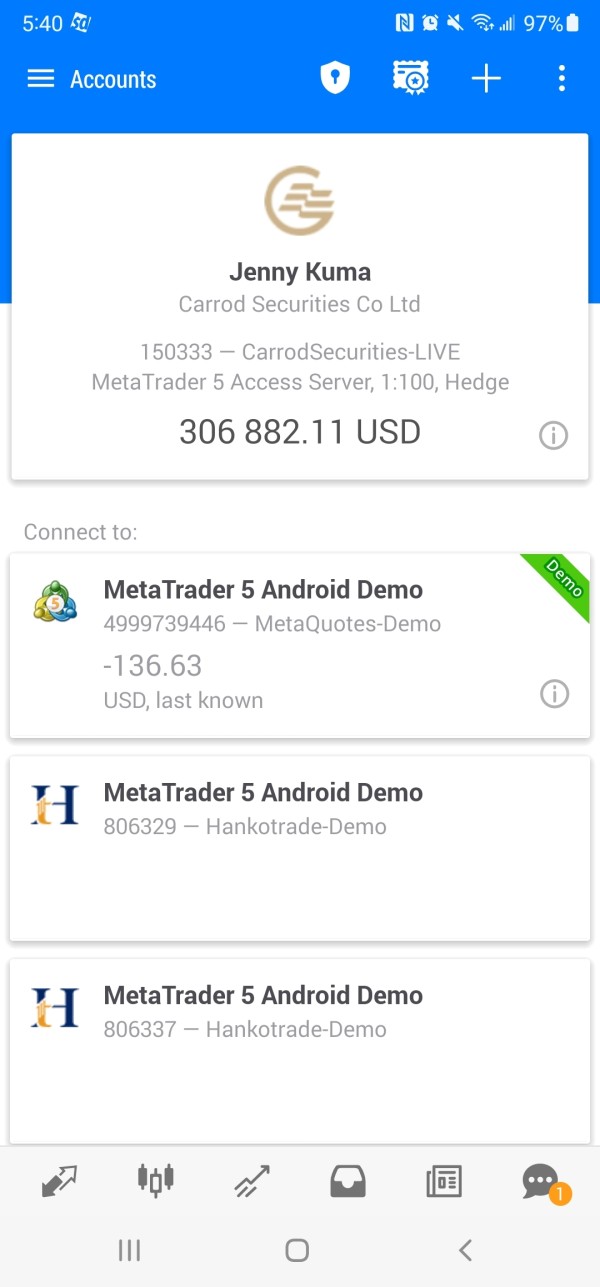

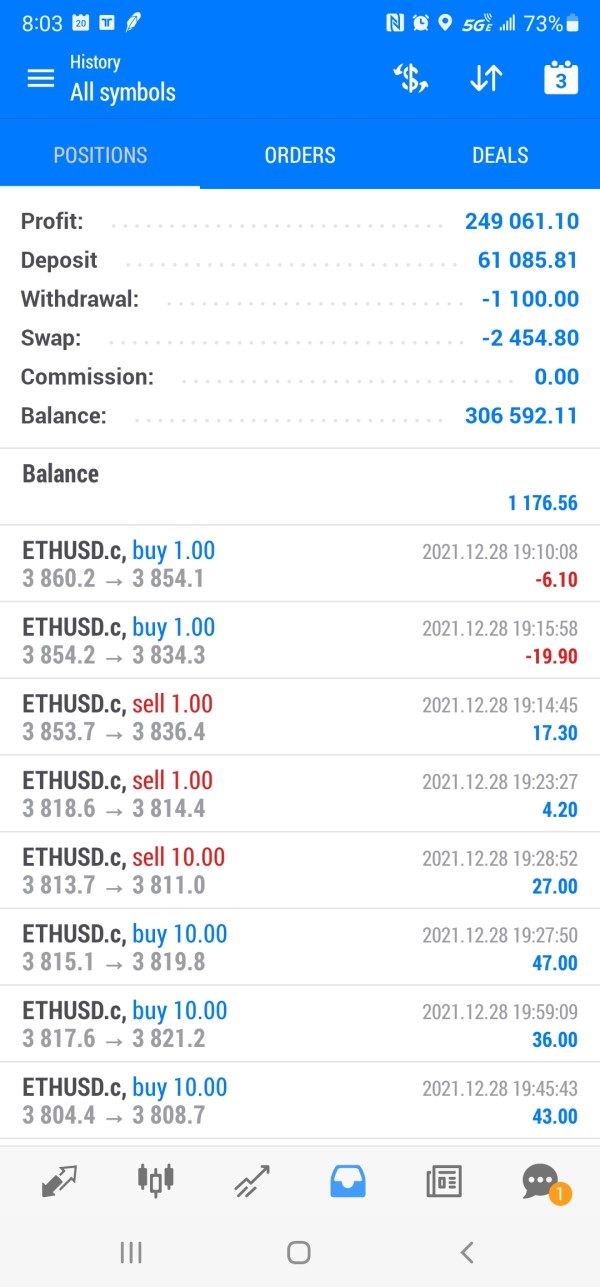

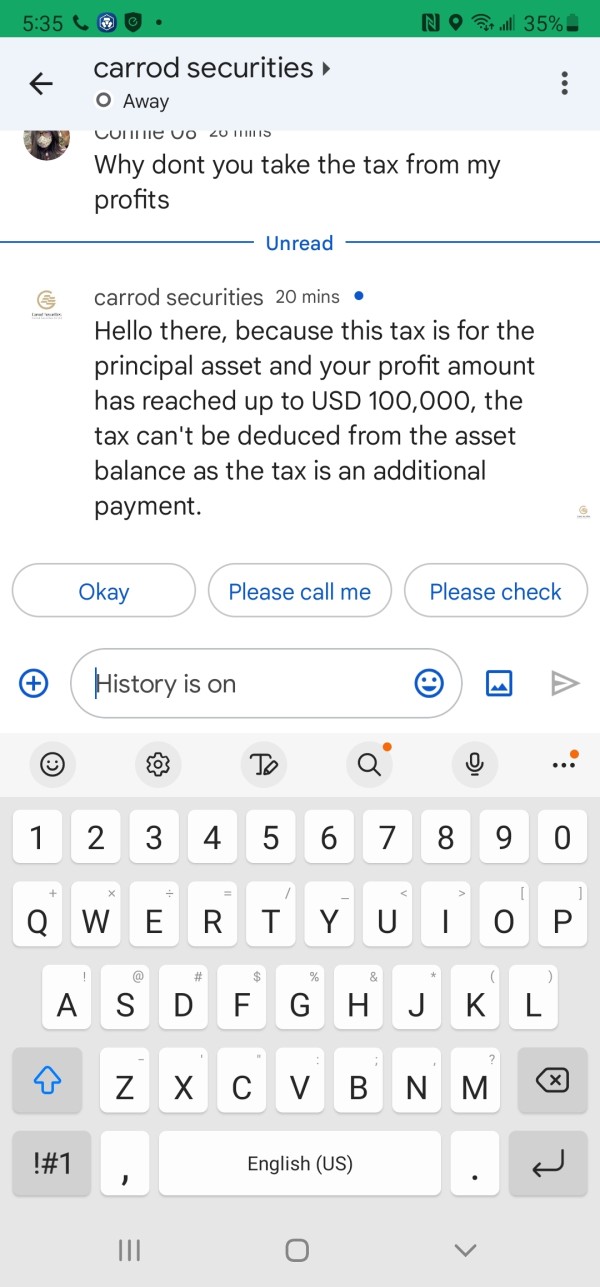

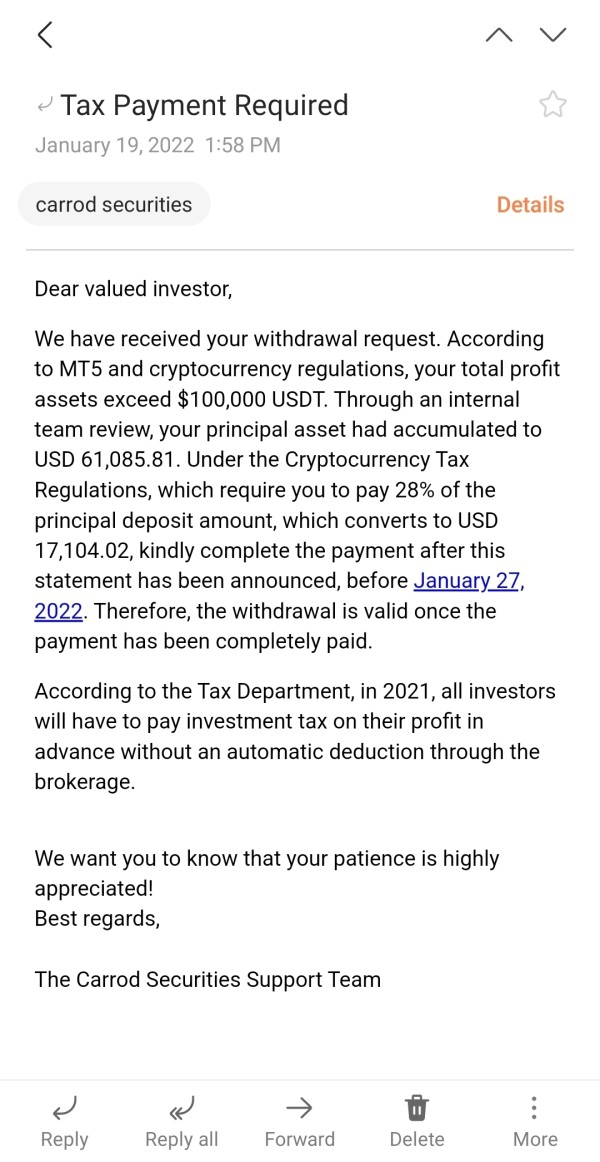

Trust and reliability concerns represent the most significant issues with Carrod Securities. Multiple industry sources have flagged the broker as unreliable or potentially fraudulent. The regulatory status remains highly questionable, with claims of NFA regulation proving unverifiable and no confirmed authorization from stated jurisdictions.

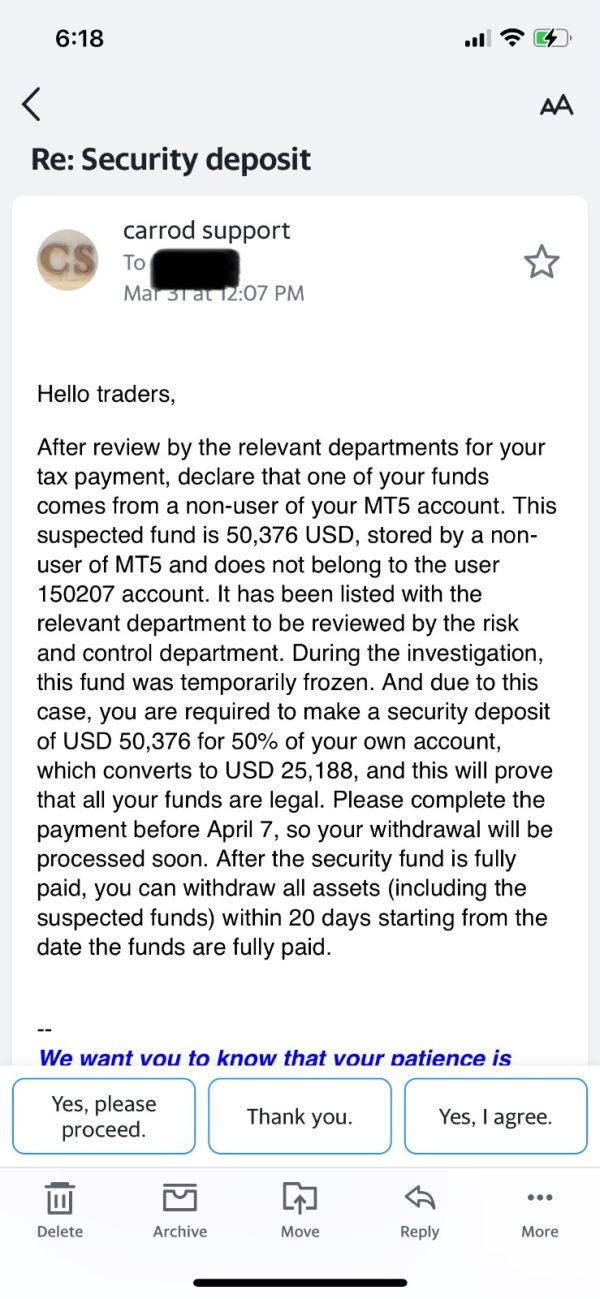

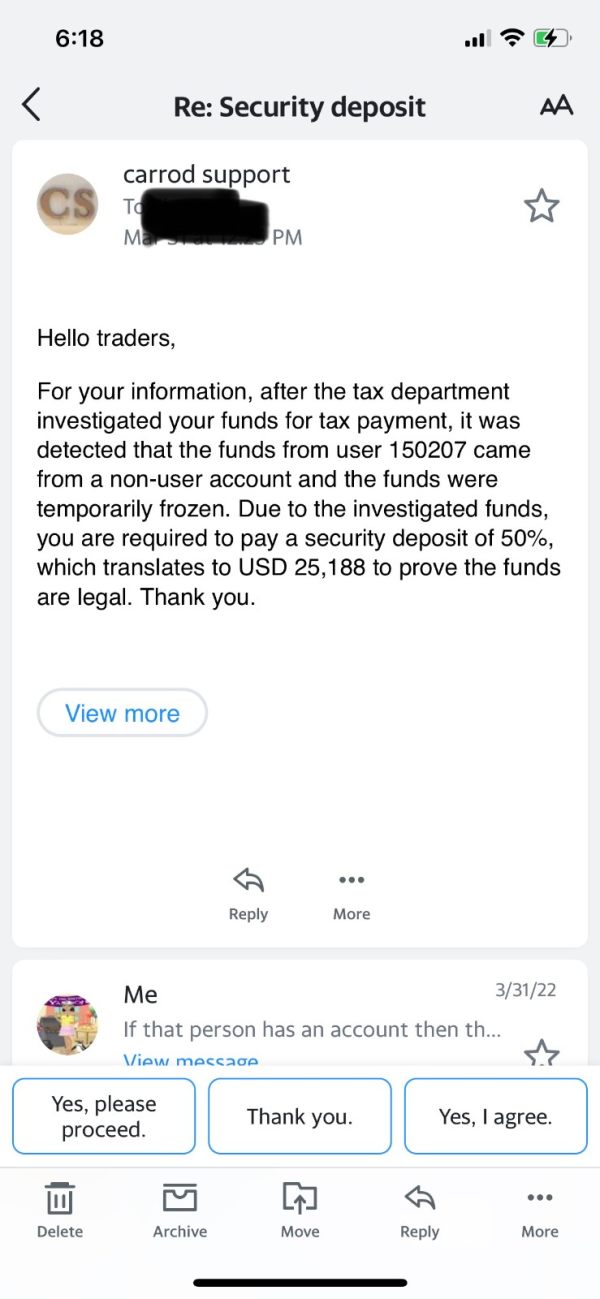

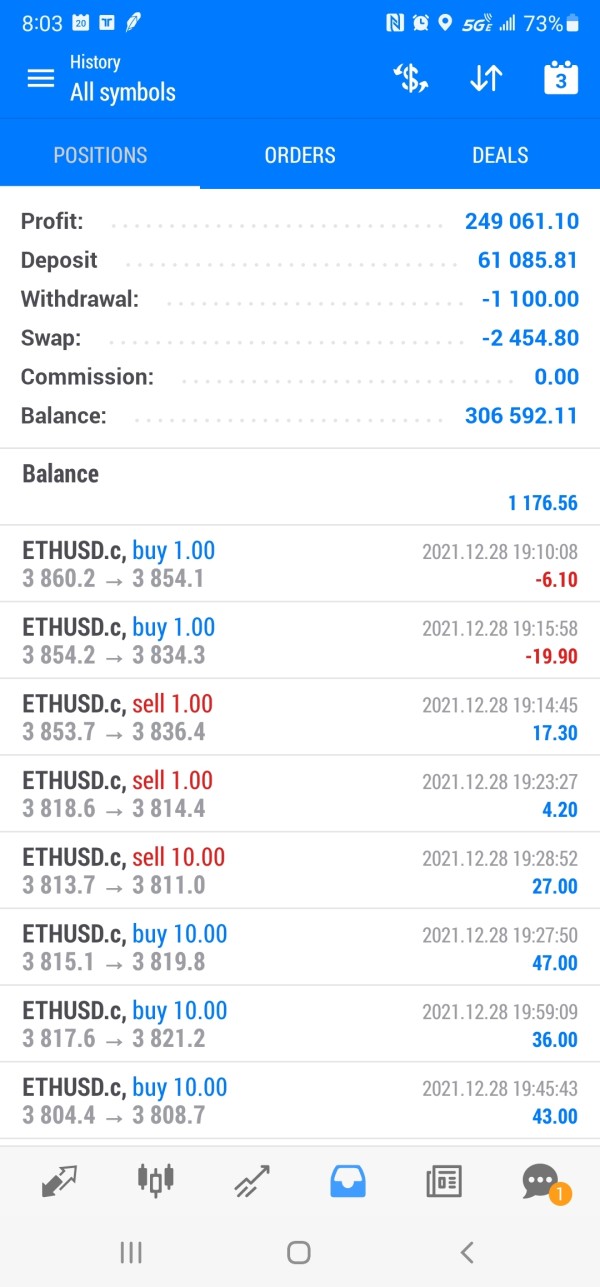

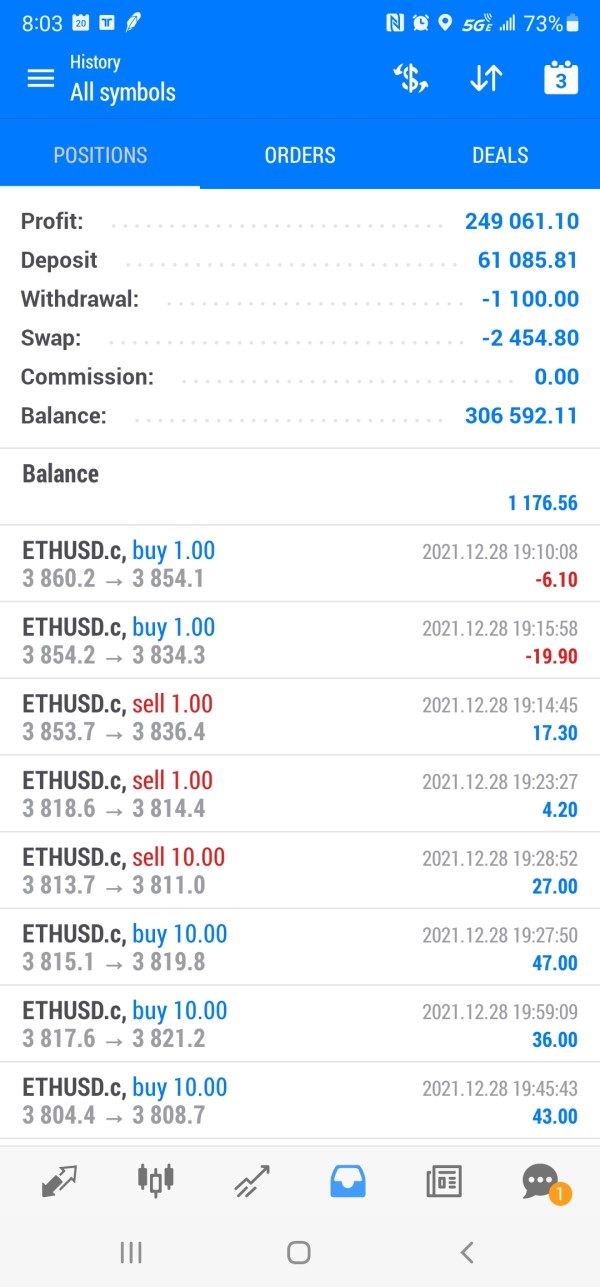

Industry watchdogs including WikiBit have marked the broker's operating status as "SCAM," indicating serious credibility concerns. Fund safety measures and client protection protocols are not disclosed in available documentation, creating uncertainty about segregation of client funds, insurance coverage, and regulatory protections. Professional brokers typically maintain segregated client accounts, provide deposit insurance, and operate under strict regulatory oversight to ensure fund security.

The absence of such information, combined with questionable regulatory status, raises serious concerns about fund safety. Company transparency issues are evident through the lack of accessible legal documentation, terms and conditions, privacy policies, and risk disclosures. Legitimate brokers typically provide comprehensive legal documentation to ensure regulatory compliance and client protection.

The absence of such materials suggests either operational deficiencies or deliberate lack of transparency to avoid regulatory scrutiny. Industry reputation assessment reveals consistently negative indicators, with no positive reviews or endorsements from reputable industry sources. The broker's presentation of offers that appear "too good to be true" while failing to provide verification of company address, regulatory status, or legal documentation follows patterns typical of fraudulent operations.

Third-party evaluations consistently raise red flags about the broker's legitimacy and operational integrity.

User Experience Analysis

User experience assessment for Carrod Securities proves challenging due to the complete absence of verified user feedback and the zero rating across available review platforms. This lack of user input represents a significant red flag, as legitimate brokers typically accumulate substantial user reviews and ratings over time through normal business operations. The absence of any positive user experiences or testimonials suggests either very limited actual operations or systematic issues with service delivery.

Interface design and usability cannot be evaluated due to insufficient information about platform accessibility, navigation structure, and user interface quality. Modern brokers typically invest significantly in user experience design to ensure intuitive navigation, efficient workflow, and accessible functionality across different user skill levels. Without detailed platform information or user feedback, assessment of interface quality remains impossible.

Registration and verification processes are not outlined in available documentation. This prevents evaluation of account opening efficiency and user-friendliness. Industry standards include streamlined KYC procedures, clear documentation requirements, and reasonable processing times.

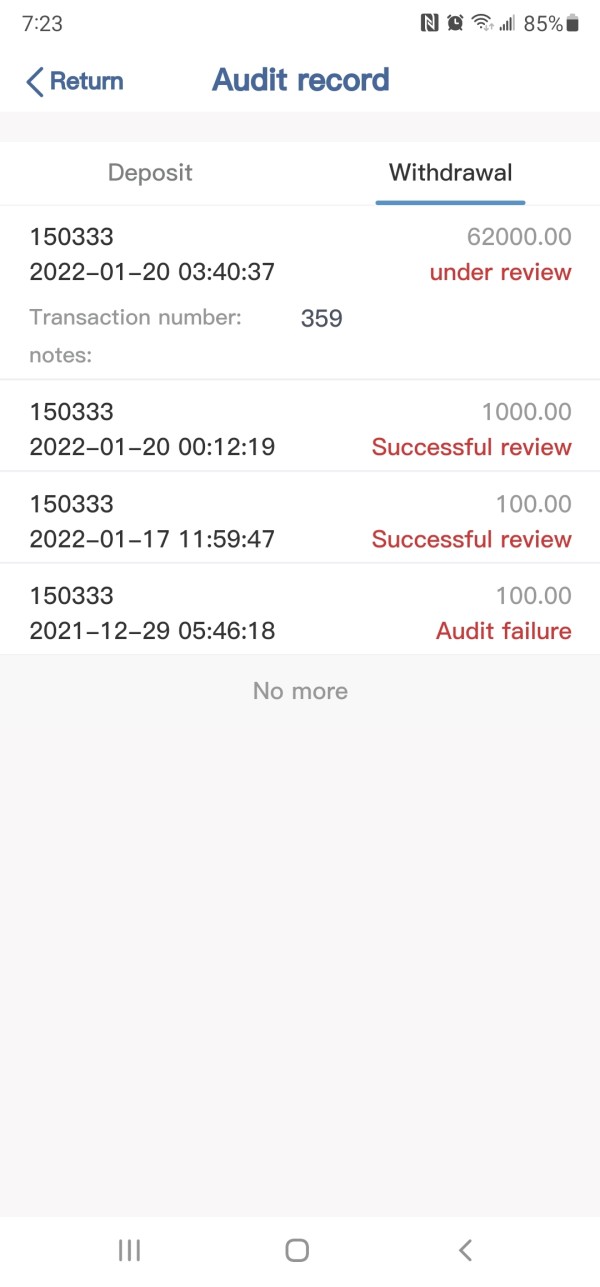

The absence of process information may indicate either inadequate operational procedures or deliberate lack of transparency about client onboarding requirements. Fund operation experiences, including deposit and withdrawal processes, cannot be assessed due to lack of user feedback and operational details. Professional brokers typically provide clear information about payment processing times, available methods, and associated fees.

The zero user rating provides no insight into actual fund operation experiences, processing efficiency, or client satisfaction with financial transactions. This complete absence of user feedback across all operational areas represents a critical concern for potential clients considering this broker.

Conclusion

This comprehensive carrod securities review reveals substantial concerns that make the broker unsuitable for most traders. The regulatory status remains highly questionable despite claims of UK registration and NFA oversight, with industry sources marking the broker as unreliable or potentially fraudulent. The complete absence of user feedback, combined with zero ratings across review platforms, suggests either very limited legitimate operations or systematic service issues.

The broker may theoretically appeal to traders seeking diversified product offerings, given claims of forex and CFD availability. However, the lack of transparency regarding trading conditions, costs, and operational procedures makes it impossible to assess actual service quality or competitiveness. The experienced management team claims provide little reassurance given the absence of verifiable company information and regulatory authorization.

The primary advantages appear limited to product diversity claims and management experience assertions. While significant disadvantages include unverified regulatory status, absent user feedback, lack of operational transparency, and industry warnings about reliability. The risk-to-benefit ratio strongly favors avoiding this broker in favor of established, properly regulated alternatives with proven track records and positive user experiences.