Is BSLFX safe?

Business

License

Is BSLFX Safe or Scam?

Introduction

BSLFX is a forex broker that has emerged in the competitive landscape of online trading, particularly targeting Chinese-speaking traders. Established in New Zealand in 2017, BSLFX positions itself as a platform for retail traders seeking to engage in foreign exchange markets. However, the rise of online trading has also seen a corresponding increase in fraudulent activities, making it crucial for traders to thoroughly evaluate the legitimacy of any broker before committing their funds. In this article, we will investigate whether BSLFX is a safe trading option or a potential scam. Our assessment is based on a comprehensive analysis of regulatory compliance, company background, trading conditions, customer feedback, and overall risk factors associated with using this broker.

Regulation and Legitimacy

The regulatory status of a forex broker is one of the most critical factors in determining its safety and reliability. BSLFX claims to be registered with the Financial Service Providers Register (FSPR) in New Zealand. However, there are concerns regarding the legitimacy of this registration, as the broker has been flagged as a suspicious clone by multiple sources. Below is a summary of the regulatory information for BSLFX:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Financial Service Providers Register (FSPR) | 29141 | New Zealand | Suspicious Clone |

The importance of regulatory oversight cannot be overstated. A broker operating under a reputable regulatory body is typically subject to strict compliance measures, ensuring transparency and protection for traders. In BSLFX's case, the low score of 1.53 on WikiFX indicates significant concerns about its regulatory compliance and trustworthiness. The broker's lack of a solid regulatory framework raises red flags, suggesting that traders should exercise caution when considering this platform.

Company Background Investigation

BSLFX, officially known as BSL Finance Limited, has been operational since 2017, but its history is not without controversy. The ownership structure and management team details remain opaque, leading to questions about the broker's transparency. A thorough investigation into the company's background reveals that it lacks a well-established reputation in the industry. The absence of comprehensive information regarding its management team further compounds concerns about its credibility.

The company's operational history is short, and while it claims to offer a robust trading environment, the lack of verifiable success stories or client testimonials raises doubts about its reliability. Transparency in operations is vital for building trust with clients, and BSLFX appears to fall short in this regard, which could be indicative of deeper issues within the organization.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions they offer is essential. BSLFX provides access to various currency pairs through the MetaTrader 4 platform, a widely recognized trading software. However, the overall cost structure and fee policies warrant closer examination.

| Fee Type | BSLFX | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | 2.0 pips | 1.0 - 1.5 pips |

| Commission Model | None | Varies (Typically low) |

| Overnight Interest Range | High | Moderate |

BSLFX's spreads are notably higher than the industry average, which may significantly impact traders' profitability. Additionally, the lack of a clear commission structure raises concerns about hidden fees that could be levied on traders. It is essential for potential clients to understand the complete fee landscape to avoid unexpected costs that could erode their trading capital.

Customer Funds Security

The safety of customer funds is paramount when considering whether BSLFX is safe. The broker claims to implement several security measures, but details on fund segregation and investor protection are lacking.

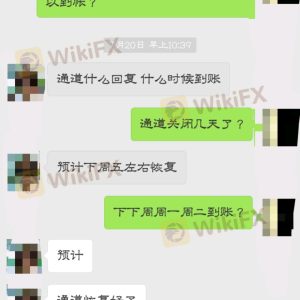

Investor protection mechanisms are vital for safeguarding traders' capital, especially in cases where a broker faces financial difficulties. The absence of information regarding negative balance protection further indicates potential risks for clients. Historical complaints related to withdrawal issues have also been reported, suggesting that BSLFX may not have a robust framework in place to ensure the safety and accessibility of client funds.

Customer Experience and Complaints

Customer feedback is a crucial component of assessing a broker's reliability. BSLFX has garnered mixed reviews, with numerous complaints surfacing regarding withdrawal difficulties and unresponsive customer service.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Communication | Medium | Poor |

| Misleading Information | High | Poor |

One notable case involved a trader who reported being unable to withdraw funds after multiple attempts, raising concerns about the broker's operational integrity. Such patterns of complaints could signify systemic issues within BSLFX, making it a risky choice for traders seeking a dependable platform.

Platform and Trade Execution

The trading platform provided by BSLFX is MetaTrader 4, known for its reliability and user-friendly interface. However, the execution quality and overall user experience must be scrutinized. Traders have reported instances of slippage and order rejections, which can hinder trading performance and lead to significant financial losses.

The potential for platform manipulation is another concern. While the MetaTrader platform is generally stable, any signs of irregularities should be carefully analyzed to ensure that traders are not being unfairly disadvantaged.

Risk Assessment

Engaging with BSLFX carries several risks that potential traders should be aware of.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Lack of proper regulation raises concerns. |

| Financial Risk | High | High spreads and withdrawal issues could lead to losses. |

| Operational Risk | Medium | Poor customer service and transparency issues. |

To mitigate these risks, traders should approach BSLFX with caution. It is advisable to start with a minimal investment and thoroughly test the platform's functionality and response to withdrawal requests before committing larger sums.

Conclusion and Recommendations

In conclusion, the evidence suggests that BSLFX presents several red flags that could indicate it is not a safe trading option. The combination of questionable regulatory status, high trading costs, and numerous customer complaints raises significant concerns about the broker's legitimacy.

For traders seeking a reliable forex broker, it is recommended to consider alternatives that are well-regulated and have a proven track record of positive customer experiences. Brokers with oversight from reputable regulatory bodies such as the FCA or ASIC are generally safer choices.

In summary, is BSLFX safe? The analysis indicates that potential traders should approach this broker with caution, as the risks associated with using BSLFX could outweigh any potential benefits.

Is BSLFX a scam, or is it legit?

The latest exposure and evaluation content of BSLFX brokers.

BSLFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

BSLFX latest industry rating score is 1.60, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.60 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.