Is Bohua technology safe?

Business

License

Is Bohua Technology A Scam?

Introduction

Bohua Technology is a forex broker that has gained attention in the trading community for its offerings in the foreign exchange market. As an unregulated entity, it positions itself as a platform for traders seeking access to various financial instruments, including currency pairs, precious metals, and commodities. However, the lack of regulatory oversight raises significant concerns about the safety and legitimacy of trading with this broker. This article aims to provide a thorough analysis of Bohua Technology, examining its regulatory status, company background, trading conditions, client safety measures, customer experiences, platform performance, and associated risks. By doing so, we seek to answer the pressing question: Is Bohua Technology safe or a scam?

Regulation and Legitimacy

The regulatory status of a forex broker is paramount in determining its legitimacy and safety for traders. Bohua Technology operates without any recognized regulatory framework, which is a significant red flag for potential clients. Unregulated brokers can expose traders to higher risks, including fraudulent activities and the potential loss of funds. The following table summarizes the core regulatory information for Bohua Technology:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

The absence of regulation means that Bohua Technology does not adhere to any formal oversight, which typically ensures that brokers follow ethical practices and maintain a level of transparency. Moreover, there have been reports of suspicious regulatory claims, with some alleging that the licenses presented by the broker are fake or clones. This lack of oversight can lead to non-compliance with trading standards, ultimately compromising the security of traders' investments.

Company Background Investigation

Bohua Technology has a relatively short history, having been established in recent years. Information regarding its ownership structure and management team is scarce, contributing to the overall opacity surrounding the broker. The company claims to be registered in the United Kingdom, but there are doubts about the validity of this claim, as it appears to lack proper registration documentation. The management teams credentials and professional backgrounds are not publicly disclosed, raising further concerns about the broker's transparency and reliability.

In terms of information disclosure, Bohua Technology does not provide sufficient details about its operations, making it difficult for potential clients to assess its credibility. A broker that lacks transparency in its corporate structure and management can be a cause for concern, as it may indicate a higher likelihood of unethical practices. Therefore, potential investors should exercise caution when considering Bohua Technology for their trading activities.

Trading Conditions Analysis

When evaluating a broker, it is essential to understand the trading conditions it offers, including costs and fees associated with trading. Bohua Technology claims to provide competitive trading conditions, but the lack of clarity regarding its fee structure raises questions. The following table compares Bohua Technology's core trading costs with industry averages:

| Cost Type | Bohua Technology | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Vague (claims low) | Varies (1-2 pips) |

| Commission Model | Not disclosed | Varies (0-10 USD) |

| Overnight Interest Range | Not specified | Varies (0.5-2%) |

While the broker advertises low spreads, it fails to provide specific details, which can lead to confusion for traders. Additionally, the absence of a clear commission structure is concerning, as traders may encounter unexpected costs. Such opacity in fee structures can be indicative of potential issues, leading to further skepticism about the broker's integrity.

Client Funds Safety

The safety of client funds is a critical aspect of any forex broker's operations. Bohua Technology does not provide clear information about its measures for protecting client funds. There is no indication of segregated accounts or investor protection policies, which are standard practices among regulated brokers. The lack of these safety measures significantly increases the risk for traders, as they may not have recourse in the event of financial disputes or broker insolvency.

Historically, unregulated brokers have faced allegations of mismanagement and misuse of client funds, leading to significant financial losses for traders. Without a robust framework to ensure the safety of investments, clients of Bohua Technology may find themselves vulnerable to such risks. Therefore, potential traders should consider the implications of trading with an unregulated broker like Bohua Technology.

Customer Experience and Complaints

Customer feedback is invaluable in assessing the reliability of a broker. Reports from users of Bohua Technology highlight several recurring issues, particularly concerning withdrawal difficulties. The following table summarizes the main complaint types associated with Bohua Technology:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Transparency | Medium | Inconsistent |

| Customer Service Delays | High | Slow |

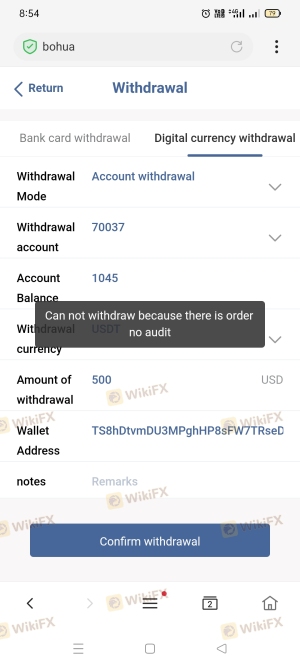

Many users report being unable to withdraw their funds, with some claiming that the broker provides vague explanations or excuses for the delays. This pattern of complaints raises concerns about the broker's operational integrity and responsiveness to client needs. For instance, one trader reported that their withdrawal request was pending for several weeks, ultimately leading to frustration and distrust in the platform. Such experiences should prompt potential clients to carefully consider the risks before engaging with Bohua Technology.

Platform and Execution

The trading platform offered by a broker plays a crucial role in the overall trading experience. Bohua Technology utilizes the MetaTrader 4 (MT4) platform, which is well-regarded for its user-friendly interface and extensive features. However, concerns have been raised regarding the platform's performance, particularly in terms of order execution quality and potential slippage. Traders have reported instances of delayed order execution and high slippage during volatile market conditions, which can significantly impact trading outcomes.

Moreover, there are allegations of platform manipulation, where traders suspect that the broker may engage in practices that disadvantage clients. Such practices could include artificially widening spreads or executing trades at unfavorable prices. These concerns further exacerbate the skepticism surrounding Bohua Technology, leading to questions about the broker's commitment to fair trading practices.

Risk Assessment

Trading with an unregulated broker like Bohua Technology carries inherent risks. The following risk assessment summarizes the key risks associated with using this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Lack of oversight increases potential for fraud. |

| Financial Risk | High | No protection for client funds. |

| Operational Risk | Medium | Complaints about withdrawal issues and customer service. |

| Market Risk | High | High leverage and volatile markets can lead to significant losses. |

To mitigate these risks, potential traders should conduct thorough research and consider alternative brokers with established regulatory frameworks. Engaging with well-regulated entities can provide a safer trading environment, reducing the likelihood of encountering issues related to fund security and operational integrity.

Conclusion and Recommendations

In conclusion, the evidence gathered raises significant concerns about the safety and legitimacy of Bohua Technology. The lack of regulation, coupled with numerous customer complaints regarding withdrawal issues and operational transparency, suggests that traders should approach this broker with caution. Is Bohua Technology safe? The overwhelming indicators point to a higher likelihood of risks associated with trading on this platform.

For traders considering their options, it is advisable to explore alternative brokers that are well-regulated and have a proven track record of client satisfaction. Brokers such as [Broker A] and [Broker B] offer secure trading environments, robust customer support, and transparent fee structures, making them more reliable choices for forex traders. Ultimately, prioritizing safety and regulatory compliance is essential for protecting investments in the volatile world of forex trading.

Is Bohua technology a scam, or is it legit?

The latest exposure and evaluation content of Bohua technology brokers.

Bohua technology Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Bohua technology latest industry rating score is 1.46, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.46 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.