Is ASIA PACIFIC safe?

Business

License

Is Asia Pacific Safe or a Scam?

Introduction

Asia Pacific is a forex brokerage that has garnered attention in the financial trading community. With the rise of online trading, the need for traders to thoroughly evaluate the credibility of brokers has never been more crucial. This is particularly true for Asia Pacific, which claims to offer a range of trading services in the forex market. However, with numerous reports of unregulated practices and negative user experiences, potential investors must exercise caution. In this article, we will investigate whether Asia Pacific is a safe trading option or if it poses risks to traders. Our analysis is based on a comprehensive review of regulatory status, company background, trading conditions, customer experiences, and overall risk assessment.

Regulation and Legitimacy

The regulatory framework surrounding a brokerage is fundamental to its legitimacy. Regulatory bodies enforce strict guidelines to protect investors and ensure fair trading practices. Unfortunately, Asia Pacific has come under scrutiny for its lack of regulation. It is essential to understand the implications of this absence.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The absence of regulation from recognized authorities indicates a significant risk for traders. Regulatory bodies such as the Financial Conduct Authority (FCA) in the UK or the Australian Securities and Investments Commission (ASIC) impose stringent requirements on brokers, including capital adequacy, operational transparency, and investor protection measures. Since Asia Pacific is not regulated by any tier-1, tier-2, or tier-3 jurisdictions, it raises red flags regarding its operational legitimacy. The lack of oversight means that traders have no recourse if issues arise, such as withdrawal problems or disputes over trades.

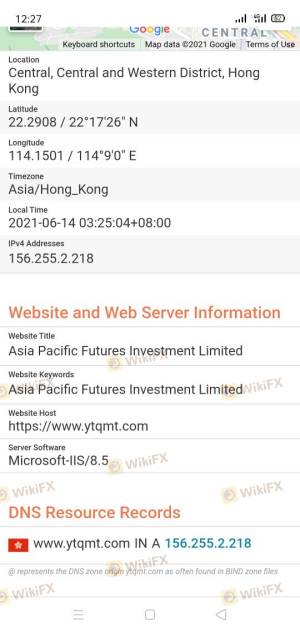

Company Background Investigation

Asia Pacific's history and ownership structure are pivotal in assessing its credibility. The company claims to operate from Canada, but many reports suggest that its actual operational transparency is severely lacking. The ownership details are often obscured, with little information available about the individuals behind the brokerage. This lack of transparency can be a significant concern for potential investors.

The management team's background is also crucial. A knowledgeable and experienced management team can often indicate a broker's reliability. However, Asia Pacific has not provided sufficient information regarding its management, leaving potential clients in the dark about who is overseeing their investments. Furthermore, the companys website has been reported as unavailable, which adds to the uncertainty surrounding its operations.

In summary, the lack of clear information about Asia Pacific's history, ownership, and management raises concerns about its trustworthiness. Without transparency, it is challenging for traders to feel confident in their decision to invest.

Trading Conditions Analysis

When considering whether Asia Pacific is safe, examining its trading conditions is vital. A broker's fee structure can significantly impact a trader's profitability. Asia Pacific claims to offer competitive trading conditions, but the lack of transparency raises questions about any hidden fees or unfavorable terms.

| Fee Type | Asia Pacific | Industry Average |

|---|---|---|

| Spread on Major Pairs | N/A | 1.0 - 2.0 pips |

| Commission Structure | N/A | Varies widely |

| Overnight Interest Range | N/A | 0.5% - 2.0% |

The absence of specific information regarding spreads, commissions, and overnight interest rates is concerning. Traders typically expect to find clear details on these costs, as they directly affect trading profitability. The lack of transparency may indicate potential hidden fees that could arise during trading, which can lead to unexpected losses.

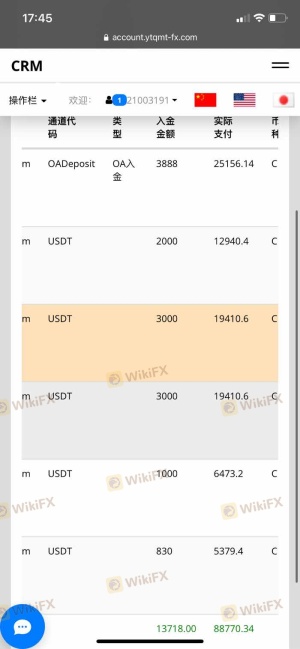

Additionally, reports of withdrawal issues and complaints about the overall trading experience further emphasize the need for caution. If traders encounter hidden fees or unexpected costs, it can quickly erode their capital, making it essential to fully understand the cost structure before engaging with Asia Pacific.

Client Fund Security

The safety of client funds is paramount when assessing a brokerage's reliability. Brokers are expected to implement robust security measures to protect their clients' investments. Unfortunately, Asia Pacific has not demonstrated a commitment to ensuring client fund safety.

Investors should inquire about fund segregation, investor protection mechanisms, and negative balance protection policies. Segregation of client funds ensures that traders' money is kept separate from the broker's operating funds, reducing the risk of loss in the event of insolvency. Additionally, investor protection mechanisms, such as compensation schemes, provide an added layer of security for traders. However, Asia Pacific has not provided sufficient information regarding these critical safety measures.

Furthermore, there have been historical reports of fund security issues, leading to significant concerns about the safety of deposits with this broker. Without clear policies in place to protect client funds, traders are exposed to unnecessary risks.

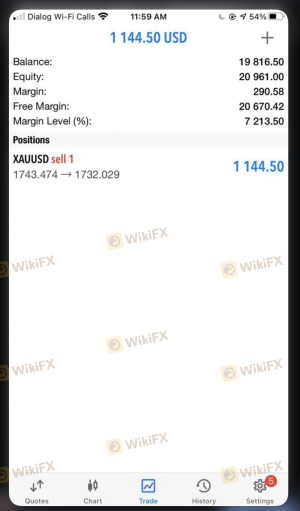

Customer Experience and Complaints

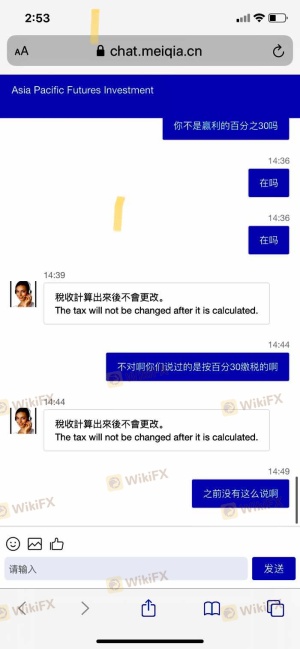

Evaluating customer experiences is crucial in determining whether Asia Pacific is safe. Numerous reviews indicate a pattern of negative experiences among users. Common complaints include withdrawal issues, poor customer service, and a lack of responsiveness to trader concerns.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service | Medium | Poor |

| Platform Stability | High | Poor |

The high severity of withdrawal issues is particularly alarming. Traders have reported significant delays in accessing their funds, which can be detrimental to their trading activities. Additionally, the company's poor response to customer inquiries exacerbates the situation, leaving traders feeling unsupported and frustrated.

One typical case involved a trader who attempted to withdraw their funds after several months of trading. Despite multiple requests, the withdrawal was delayed indefinitely with little explanation from the company. This lack of accountability raises concerns about the overall trustworthiness of Asia Pacific.

Platform and Trade Execution

The performance and reliability of the trading platform are critical factors in a trader's experience. Asia Pacific claims to offer a robust trading platform, but user feedback suggests otherwise. Reports of platform instability, execution delays, and high slippage have emerged, leading to dissatisfaction among traders.

Traders expect a seamless trading experience, including quick execution of orders and minimal slippage. However, if a broker's platform is prone to outages or delays, it can lead to missed trading opportunities and financial losses. Additionally, any signs of potential platform manipulation should raise red flags for traders.

Risk Assessment

In evaluating whether Asia Pacific is safe, it is essential to consider the overall risk associated with trading with this broker. The absence of regulation, combined with customer complaints and operational transparency issues, indicates a high-risk environment for traders.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No valid regulation |

| Financial Security | High | Poor fund protection |

| Customer Service | Medium | Frequent complaints |

Given the high-risk levels associated with regulatory and financial security, potential traders should approach Asia Pacific with extreme caution. It is advisable to consider alternative brokers that offer better regulatory oversight and customer protection.

Conclusion and Recommendations

In conclusion, the investigation into Asia Pacific raises significant concerns regarding its safety and reliability as a forex broker. The lack of regulation, poor customer experiences, and operational transparency suggest that traders should be wary of engaging with this broker.

For those considering trading, it is crucial to prioritize safety by choosing brokers with robust regulatory frameworks and positive user feedback. Alternatives such as IC Markets, Roboforex, and eToro offer better regulatory oversight and customer protection. Ultimately, while the allure of forex trading can be enticing, ensuring a safe trading environment is paramount for long-term success.

In light of the findings, it is clear that Asia Pacific is not a safe option for traders.

Is ASIA PACIFIC a scam, or is it legit?

The latest exposure and evaluation content of ASIA PACIFIC brokers.

ASIA PACIFIC Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ASIA PACIFIC latest industry rating score is 1.51, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.51 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.