Asia Pacific 2025 Review: Everything You Need to Know

Summary

This asia pacific review gives you a complete look at the Asia Pacific region's forex and CFD brokerage world for 2025. Market data shows the Asia Pacific region stays a major center for online trading. Many brokers have built strong operations to help local traders succeed. The region has different rules in each country, and more people want to trade, making it important for both old and new brokerage companies.

Industry reports show 11 major online brokers work well for trading in the Asia Pacific region right now. This means traders have many choices and different services to pick from. The region focuses on forex and CFD trading just like the rest of the world, but each country has its own rules and market conditions that can be very different. This review helps traders understand what they can expect from Asia Pacific brokerage services. Keep in mind that each broker might work differently than what we describe here for the whole region.

Important Notice

This asia pacific review uses market information and industry reports that anyone can find. Traders need to know the Asia Pacific region has many countries with their own rules, market conditions, and laws that can change your trading experience a lot. Each place in the region might protect investors differently, require different licenses, and have different rules for forex and CFD brokers.

We based this review on information that everyone can see, so it might not cover all current trading conditions, fees, or service quality that you might experience. You should do your own research and check all trading conditions directly with your chosen broker before you spend any money.

Scoring Framework

Broker Overview

The Asia Pacific region has become a major place for forex and CFD trading services. Industry research shows many brokers work in this diverse marketplace. Market research tells us the region has various online brokers that have built lots of experience for Asia Pacific market conditions and what traders want. This regional focus shows how important Asian financial markets have become and how retail trading demand has grown across countries like Australia, Japan, Singapore, Hong Kong, and other major financial centers.

The competitive market in the Asia Pacific region shows the sector has grown up. Brokers change their services to meet local rules while keeping international trading standards. Having multiple established operators means the market is healthy where traders can access different service types and trading conditions. But each broker works differently, and the rules are very different between places, creating a complex environment that needs careful checking by potential traders who want reliable brokerage services.

Regulatory Environment: The Asia Pacific region has multiple regulatory areas, each with different licensing needs and oversight standards. Available source materials don't give complete regulatory details for individual brokers in this region, so traders need to check regulatory status on their own.

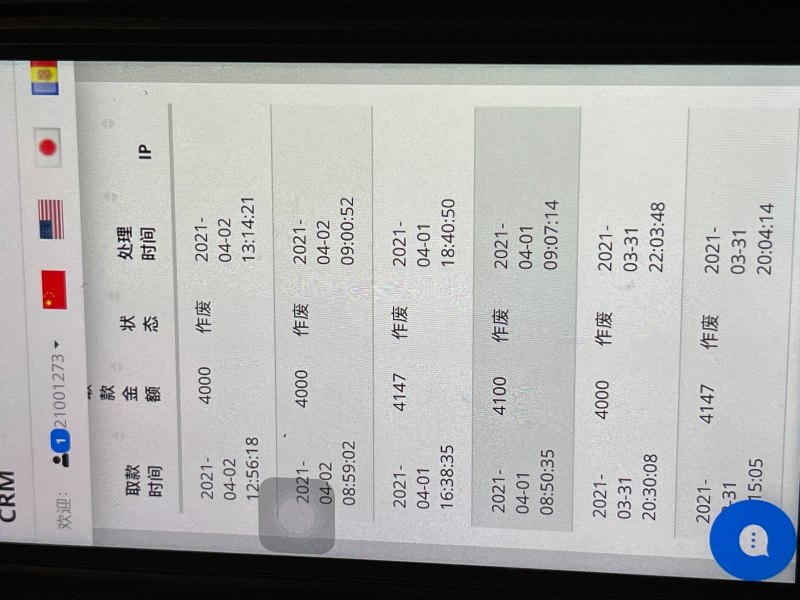

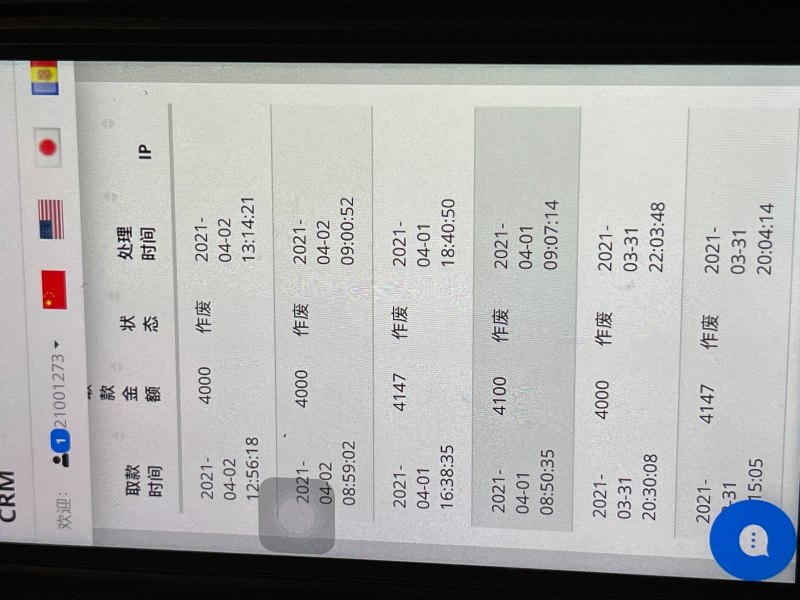

Deposit and Withdrawal Methods: Available information doesn't specify what payment methods Asia Pacific brokers typically offer. Regional preferences may include local banking systems and digital payment solutions commonly used across Asian markets.

Minimum Deposit Requirements: Source materials don't detail specific minimum deposit amounts. These typically change based on account types and regulatory requirements in different areas.

Promotional Offers: Details about bonus structures and promotional campaigns offered by Asia Pacific brokers aren't included in the available information. These often change a lot between operators and regulatory environments.

Tradeable Assets: Forex and CFD trading are identified as primary offerings in the region, but specific asset ranges including currency pairs, indices, commodities, and other instruments aren't detailed in the source materials.

Cost Structure: Complete information about spreads, commissions, and other trading costs isn't provided in available sources. These factors typically change based on account types and market conditions.

Leverage Ratios: Specific leverage offerings aren't detailed. These are generally subject to local regulatory limits that differ across Asia Pacific areas.

Platform Options: Trading platform specifications and technology offerings aren't covered in the available source materials.

Regional Restrictions: Specific country limitations aren't detailed in available information.

Customer Support Languages: Language support details aren't specified in source materials.

This asia pacific review shows traders need to do thorough research when selecting brokers in this diverse regional market.

Detailed Scoring Analysis

Account Conditions Analysis

Account conditions offered by brokers in the Asia Pacific region need careful checking because of the diverse regulatory landscape and different market practices across jurisdictions. Specific details about account types, minimum deposit requirements, and opening procedures aren't completely covered in available source materials, but the regional market typically offers multiple account levels to fit different trader profiles and investment amounts. The Asia Pacific regulatory environment is complex, so account conditions can change a lot between countries, with some places requiring stricter capital requirements or better verification procedures.

Traders should expect differences in documentation requirements, funding options, and account features depending on where they live and the broker's licensing area. Without specific information about Islamic accounts, professional trading accounts, or other specialized offerings, potential clients need to check these details directly with individual brokers. The account opening process in the Asia Pacific region may also involve additional compliance checks because of different anti-money laundering requirements across countries.

This asia pacific review shows that account conditions are a critical factor in broker selection, especially given the regulatory diversity across the region.

Trading tools and educational resources provided by Asia Pacific brokers are essential parts of the overall service offering. Specific details about these capabilities aren't detailed in available source materials. The regional market's sophistication suggests that competitive brokers typically provide complete analytical tools, market research, and educational content to support trader development and decision-making.

Regional brokers often adapt their research and analysis resources to focus on Asia Pacific market sessions, local economic events, and currency pairs that are particularly relevant to the regional trading community. However, without specific information about charting packages, technical indicators, economic calendars, or automated trading support, traders must check these offerings individually. Educational resources in the Asia Pacific region may include multilingual content to serve the diverse trader base, though the quality and completeness of these materials can change a lot between operators.

The availability of webinars, tutorials, market analysis, and trading guides represents important differences in a competitive market. The absence of detailed information about research quality, tool sophistication, and educational program effectiveness in available sources shows the importance of hands-on evaluation during the broker selection process.

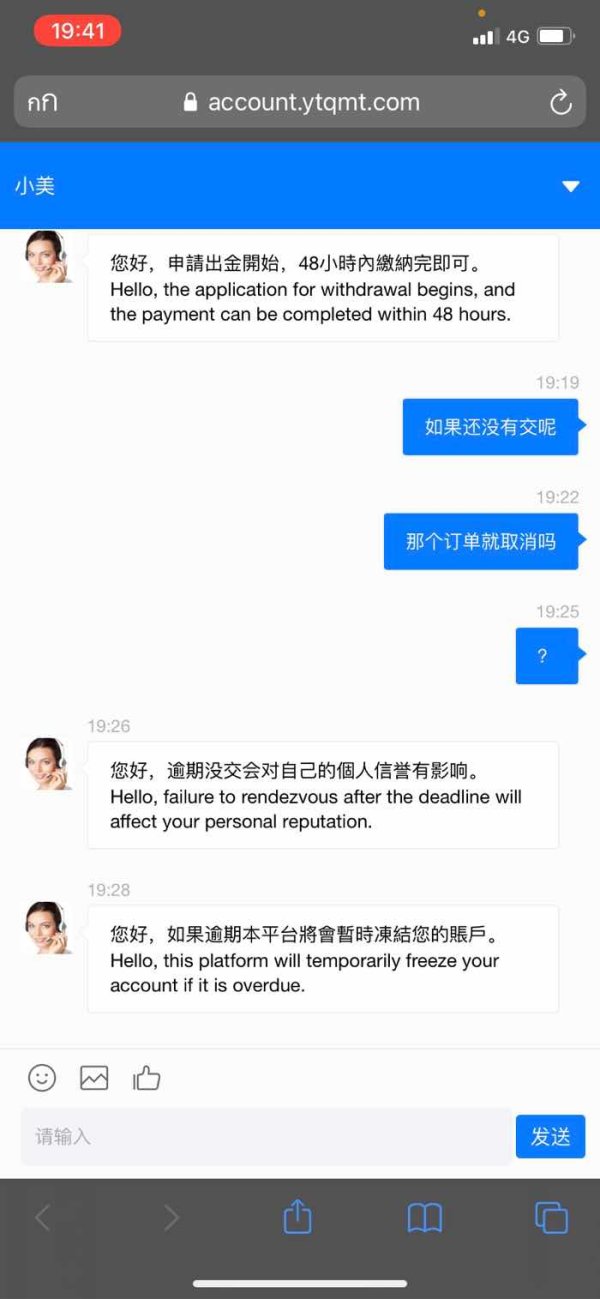

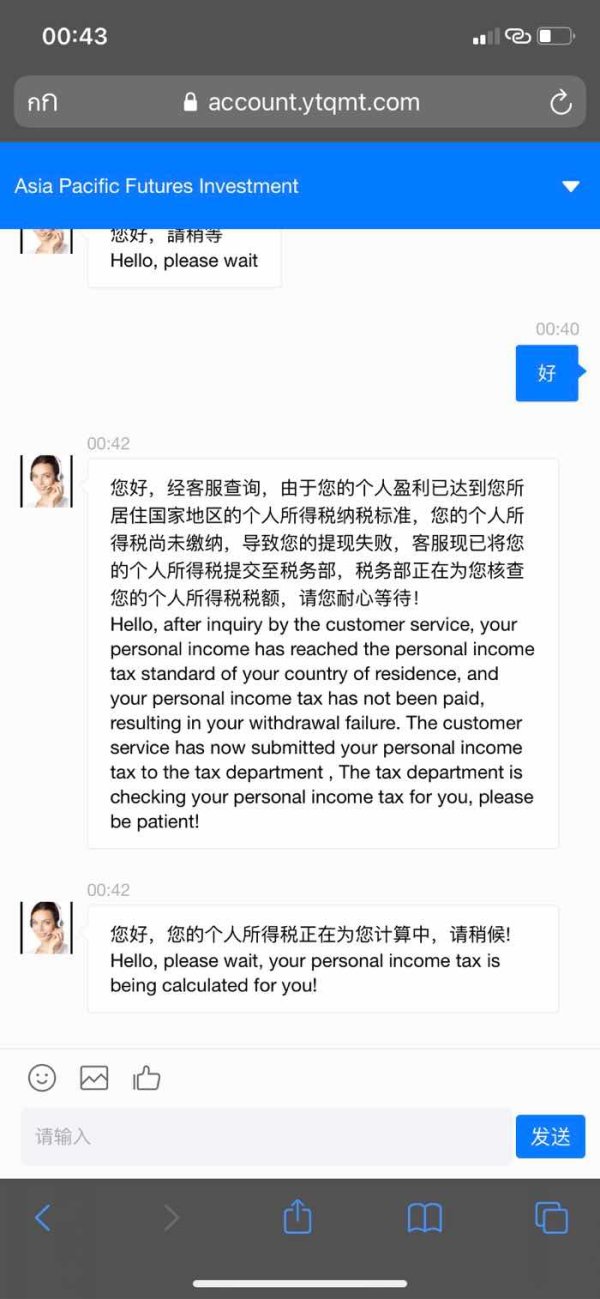

Customer Service and Support Analysis

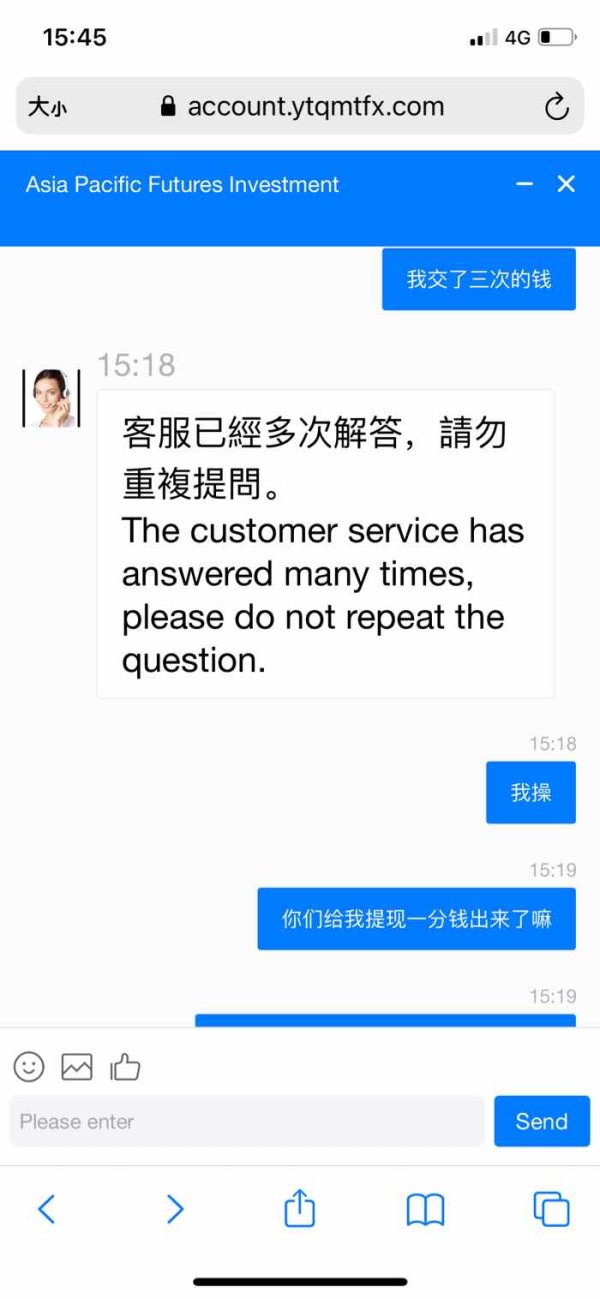

Customer service quality represents a crucial factor for traders in the Asia Pacific region, where diverse time zones, languages, and cultural expectations create unique support challenges. Specific information about service channels, response times, and support quality isn't provided in available source materials, but the regional market's characteristics suggest that effective brokers must offer complete multilingual support and extended operating hours. The Asia Pacific region's geographic spread means that quality brokers typically provide 24/5 or 24/7 support to help traders across different time zones from Sydney to Tokyo to Singapore.

However, without specific data about response times, resolution rates, or customer satisfaction metrics, traders must assess service quality through direct interaction and trial periods. Language support becomes particularly important in this diverse region, where traders may need help in English, Japanese, Chinese, Korean, or other local languages. The quality of multilingual support can change a lot between brokers, affecting the overall trading experience for non-English speaking clients.

Problem resolution capabilities and escalation procedures are essential service components that need evaluation, though specific case studies or performance metrics aren't available in the current source materials.

Trading Experience Analysis

The trading experience offered by Asia Pacific brokers includes platform stability, execution quality, and overall technological infrastructure. Specific performance metrics aren't detailed in available source materials. The region's diverse market conditions and regulatory requirements create unique challenges for brokers seeking to deliver consistent trading experiences across multiple areas.

Platform reliability becomes particularly important during Asia Pacific trading sessions, when major economic releases and market volatility can create demanding technical requirements. However, without specific data about server locations, execution speeds, or uptime statistics, traders must check platform performance through demo accounts and careful testing. Order execution quality represents a critical component of the trading experience, particularly for active traders who need fast, accurate fills during volatile market conditions.

The absence of specific information about execution statistics, slippage rates, or requote frequency in available sources means that traders need to assess these factors through practical experience. Mobile trading capabilities are increasingly important for the tech-savvy Asia Pacific trading community, though specific details about app functionality, features, and performance aren't covered in current source materials. This asia pacific review shows the importance of complete platform testing before committing to a broker.

Trust and Reliability Analysis

Trust and reliability represent fundamental considerations for traders checking Asia Pacific brokers, particularly given the different regulatory standards and oversight mechanisms across jurisdictions in the region. Specific regulatory details, licensing information, and compliance records aren't completely covered in available source materials, but the regional market's maturity suggests established operators maintain appropriate regulatory standing. The diversity of regulatory environments across the Asia Pacific region means that brokers may hold licenses from different authorities, each with distinct capital requirements, operational standards, and client protection measures.

Without specific information about regulatory compliance, capital adequacy, or segregation of client funds, traders must independently verify these crucial safety factors. Company transparency and corporate governance standards can change a lot across the region, with some areas maintaining higher disclosure requirements than others. The absence of specific information about company ownership, financial reporting, or regulatory compliance history in available sources shows the importance of independent research.

Industry reputation and track record represent important trust indicators, though specific information about regulatory actions, client disputes, or industry recognition isn't detailed in current source materials. This shows the need for thorough research when checking broker reliability.

User Experience Analysis

The overall user experience provided by Asia Pacific brokers includes interface design, operational efficiency, and customer satisfaction. Specific metrics and user feedback aren't detailed in available source materials. The region's diverse trader base and different technological preferences create unique challenges for brokers seeking to deliver satisfactory user experiences across different markets and demographics.

Registration and account verification processes in the Asia Pacific region may involve additional complexity because of different compliance requirements and documentation standards across jurisdictions. Without specific information about onboarding efficiency, verification timeframes, or user satisfaction with these processes, traders must check these factors through direct experience. Funding and withdrawal experiences represent critical components of overall user satisfaction, particularly given the diverse banking systems and payment preferences across Asia Pacific markets.

The efficiency of deposit processing, withdrawal timeframes, and payment method availability can significantly impact user experience, though specific performance data isn't available in current source materials. Interface design and platform usability considerations become particularly important for the diverse Asia Pacific user base, where different technological familiarity and preferences require adaptive design approaches. The absence of specific user feedback or satisfaction surveys in available sources shows the importance of hands-on evaluation during broker selection.

Conclusion

This asia pacific review reveals a complex and diverse regional market where traders have access to multiple brokerage options, though specific service details need individual verification. The presence of 11 identified brokers appropriate for Asia Pacific trading suggests a competitive environment that may benefit traders through varied service offerings and competitive conditions.

The regional focus on forex and CFD trading matches global market trends, making the Asia Pacific region suitable for traders interested in these instruments. However, the significant regulatory and operational differences across areas mean that trader experiences may change a lot depending on their location and chosen broker. Given the limited specific information available about individual broker services, fees, and performance metrics, prospective traders should conduct thorough independent research and use demo accounts to check potential brokers before making final selections in this diverse regional marketplace.