Is AMA FOREX safe?

Business

License

Is AMA Forex A Scam?

Introduction

AMA Forex, operating under the domain amaffx.com, positions itself as an online broker in the foreign exchange (forex) market, offering a range of trading instruments including forex pairs, cryptocurrencies, and CFDs. As with any online trading platform, it is crucial for traders to exercise caution and conduct thorough due diligence before committing their funds. The forex market, while lucrative, is also rife with potential scams and unregulated brokers that can lead to significant financial losses. In this article, we will systematically evaluate the safety and reliability of AMA Forex by examining its regulatory status, company background, trading conditions, customer experiences, and overall risk profile.

Regulation and Legitimacy

A broker's regulatory status is a fundamental aspect of its legitimacy. Regulation ensures that brokers adhere to strict standards, offering a layer of protection to traders. AMA Forex claims to be regulated by the MSB in Canada; however, this assertion lacks verification and appears to be misleading. The absence of credible regulatory oversight raises serious concerns about the safety of funds deposited with this broker.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The lack of regulation is a significant red flag. Regulated brokers are required to follow stringent guidelines, including maintaining segregated accounts for clients' funds and providing transparent reporting. In contrast, AMA Forex operates without any credible oversight, which places traders at a high risk of fraud and mismanagement. Historical compliance records indicate that unregulated brokers often engage in dubious practices, making it essential for traders to avoid such platforms.

Company Background Investigation

AMA Forex is purportedly owned by AMA FX Market Global Group Ltd. However, there is limited information available regarding the company's history, ownership structure, or operational transparency. The company claims to be based in the United Kingdom, but this assertion is unsupported by verifiable data, leading to suspicions about its legitimacy.

The management team's background is another critical factor in assessing the broker's reliability. A well-qualified team with a strong track record in financial services typically indicates a more trustworthy operation. Unfortunately, information on the management team at AMA Forex is scarce, further contributing to the uncertainty surrounding this broker.

Transparency is key in the financial services industry, and the apparent lack of information regarding AMA Forex's operations and management raises concerns. Traders should be wary of platforms that do not disclose sufficient information about their operations and leadership.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is vital for any trader. AMA Forex presents itself as a low-cost trading option, but the specifics of its fee structure are not clearly outlined on its website. This lack of transparency can lead to unexpected costs that may not be immediately apparent to traders.

| Fee Type | AMA Forex | Industry Average |

|---|---|---|

| Spread on Major Pairs | N/A | 1.0 - 2.0 pips |

| Commission Structure | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The absence of clear information regarding spreads, commissions, and overnight fees is concerning. Traders often rely on these details to calculate their potential costs and profitability. The lack of transparency may indicate that AMA Forex employs hidden fees or unfavorable trading conditions, which can significantly impact a trader's overall experience.

Customer Funds Safety

The safety of customer funds is paramount when choosing a forex broker. AMA Forex's website does not provide adequate information regarding its security measures, such as the segregation of client funds or investor protection policies.

Segregated accounts are essential as they ensure that clients' funds are kept separate from the broker's operational funds, thereby protecting them in the event of the broker's insolvency. Furthermore, the absence of negative balance protection mechanisms poses a risk, as traders could find themselves owing money beyond their initial investment.

Historical issues related to fund security and withdrawal problems are common among unregulated brokers. Given that AMA Forex lacks regulatory oversight, traders should be particularly cautious regarding the safety of their funds and the potential for withdrawal difficulties.

Customer Experience and Complaints

Customer feedback is a crucial component in evaluating a broker's reliability. Reviews and testimonials from current and former users of AMA Forex reveal a pattern of dissatisfaction, with many users reporting issues related to withdrawals and customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Support | Medium | Poor |

| Misleading Information | High | Poor |

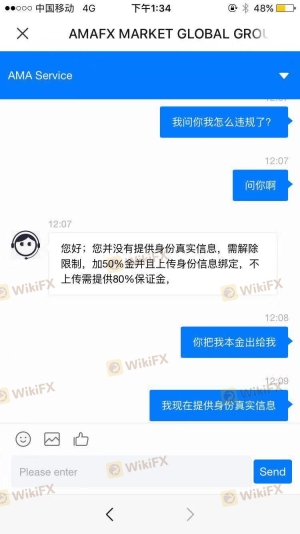

Common complaints include difficulty in withdrawing funds, unresponsive customer service, and allegations of misleading information about trading conditions. These issues are particularly alarming and suggest that traders may encounter significant obstacles when attempting to access their funds.

One notable case involved a trader who reported being unable to withdraw their funds despite multiple requests, leading to frustration and financial loss. Such experiences highlight the risks associated with trading with an unregulated broker like AMA Forex.

Platform and Trade Execution

The performance of a trading platform is critical for a successful trading experience. AMA Forex utilizes the popular MetaTrader 4 (MT4) platform, which is known for its user-friendly interface and robust features. However, the overall execution quality, including slippage and order rejection rates, is less clear.

Traders have reported mixed experiences regarding order execution, with some citing instances of slippage and delayed order fills. These issues can significantly affect trading outcomes, particularly in volatile market conditions. Furthermore, any signs of platform manipulation should be taken seriously, as they could indicate unethical practices by the broker.

Risk Assessment

Using AMA Forex presents several inherent risks that traders should consider. The lack of regulation, insufficient transparency, and negative feedback from users all contribute to a heightened risk profile.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No credible oversight |

| Fund Safety Risk | High | Lack of protection measures |

| Withdrawal Risk | High | Reports of withdrawal issues |

To mitigate these risks, traders should exercise extreme caution when considering AMA Forex as a trading option. It is advisable to seek alternatives that offer robust regulatory frameworks and positive user experiences.

Conclusion and Recommendations

In conclusion, the evidence gathered suggests that AMA Forex operates in a manner that raises significant concerns regarding its safety and reliability. The lack of regulation, poor customer feedback, and transparency issues indicate that traders should approach this broker with caution.

It is crucial for traders to prioritize their financial safety and consider reputable alternatives that are well-regulated and have positive user reviews. Brokers such as those regulated by the FCA or ASIC provide a more secure trading environment and are recommended for traders seeking a trustworthy platform.

Ultimately, the question “Is AMA Forex safe?” leans toward a negative response, and potential users are advised to explore safer trading options to protect their investments.

Is AMA FOREX a scam, or is it legit?

The latest exposure and evaluation content of AMA FOREX brokers.

AMA FOREX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

AMA FOREX latest industry rating score is 1.51, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.51 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.