Is alpha2trade safe?

Business

License

Is Alpha2trade A Scam?

Introduction

Alpha2trade positions itself as a promising player in the forex market, offering a range of trading options across various financial instruments. However, the landscape of online trading is fraught with risks, and traders must exercise caution when evaluating brokers. The importance of thorough due diligence cannot be overstated, as the potential for scams and unethical practices is ever-present in the industry. This article aims to provide an objective analysis of Alpha2trade's legitimacy by examining its regulatory status, company background, trading conditions, customer fund safety, client experiences, platform performance, and associated risks.

Regulation and Legitimacy

A broker's regulatory status is a cornerstone of its legitimacy. Alpha2trade claims to operate as a forex broker, yet it lacks proper regulation from any recognized financial authority. This absence of oversight raises significant red flags for potential investors. Below is a summary of the core regulatory information concerning Alpha2trade:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

The lack of regulation means that there are no legal protections in place for clients, making it easy for the broker to engage in potentially fraudulent activities without fear of repercussions. Reputable brokers are typically overseen by top-tier regulatory bodies, such as the Financial Conduct Authority (FCA) in the UK or the Australian Securities and Investments Commission (ASIC). Alpha2trade's absence from such lists indicates a significant risk for traders, as they may not have recourse if issues arise.

Company Background Investigation

Alpha2trade's company history and ownership structure provide further insight into its reliability. Unfortunately, information regarding the company's origins and management team is limited and often vague. The lack of transparency regarding its corporate structure raises concerns about accountability and trustworthiness. Without clear information on who runs the company and their professional backgrounds, potential investors are left in the dark.

Typically, reputable brokers provide detailed information about their management teams, including their qualifications and industry experience. This is not the case with Alpha2trade, which contributes to the perception of it being an untrustworthy entity. The overall opacity of the company, coupled with its lack of regulatory oversight, suggests that traders should exercise extreme caution when considering this broker.

Trading Conditions Analysis

When evaluating whether Alpha2trade is safe, it's essential to analyze its trading conditions. The broker offers various account types, but the overall fee structure and trading costs warrant scrutiny. Below is a comparison of Alpha2trade's trading costs against industry averages:

| Fee Type | Alpha2trade | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1.0 - 2.0 pips |

| Commission Model | N/A | $5 - $10 per lot |

| Overnight Interest Range | N/A | Varies |

The absence of specific figures for spreads and commissions is concerning. A lack of transparency in these areas may indicate that traders could face hidden fees or unfavorable trading conditions. Additionally, brokers that do not clearly outline their fee structures often have a history of exploiting clients through unexpected charges. This lack of clarity further contributes to the argument that Alpha2trade may not be a safe trading option.

Client Fund Safety

The safety of client funds is paramount when considering a broker. Alpha2trade's policies regarding fund safety are notably lacking. There is no evidence of segregated accounts or investor protection measures typically offered by regulated brokers. Segregated accounts ensure that client funds are kept separate from the broker's operational funds, providing a layer of security in the event of financial difficulties.

Moreover, Alpha2trade does not provide negative balance protection, meaning traders could potentially lose more than their initial deposits. This is a critical risk factor, particularly in the volatile forex market. Historical reports of fund safety issues or disputes involving Alpha2trade further emphasize the need for caution when dealing with this broker.

Client Experience and Complaints

Client feedback is a vital component in assessing whether Alpha2trade is safe. Numerous reports indicate a pattern of complaints regarding withdrawal issues, unresponsive customer service, and aggressive sales tactics. Below is a summary of the main complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

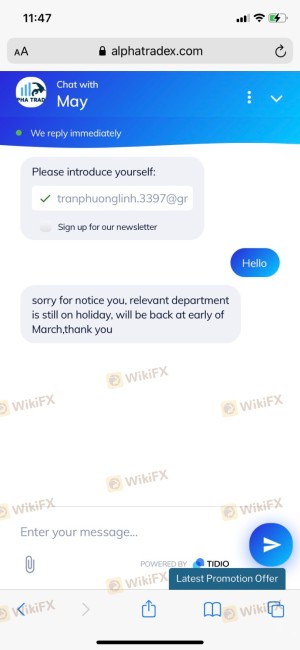

| Unresponsive Support | Medium | Poor |

| Misleading Promotions | High | Inconsistent |

These complaints paint a troubling picture of Alpha2trade's client relations. A lack of responsiveness and failure to address significant issues such as withdrawal delays suggest that the broker may not prioritize customer satisfaction or ethical business practices. For instance, several users have reported being unable to withdraw their funds, with some claiming that their requests were met with excuses or delays. Such experiences raise legitimate concerns about the broker's reliability and trustworthiness.

Platform and Trade Execution

An evaluation of Alpha2trade's trading platform is essential in determining its overall quality. Users have reported mixed experiences regarding platform performance, stability, and execution quality. Issues such as slippage and order rejections have been highlighted, which can significantly impact trading outcomes.

The absence of clear information about the platform's features and capabilities raises further concerns. A reputable broker typically offers a robust trading platform with transparent execution policies. Without this assurance, potential traders may find themselves at a disadvantage, especially in fast-moving markets.

Risk Assessment

Using Alpha2trade poses several risks that should not be overlooked. The following risk scorecard summarizes the key risk areas associated with this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight or protections |

| Financial Risk | High | Potential for loss exceeding initial deposits |

| Operational Risk | Medium | Platform stability and execution concerns |

| Customer Service Risk | High | Poor handling of complaints and withdrawals |

To mitigate these risks, traders should consider using regulated brokers that offer transparent fee structures, robust customer support, and strong fund protection measures. It is advisable to conduct thorough research and seek alternatives that prioritize client safety and satisfaction.

Conclusion and Recommendations

In conclusion, the evidence collected strongly suggests that Alpha2trade may not be a safe option for traders. The lack of regulation, transparency issues, and numerous customer complaints raise significant concerns about its legitimacy. Potential investors should approach this broker with extreme caution, if at all.

For traders seeking reliable alternatives, it is recommended to consider brokers that are regulated by top-tier authorities, such as the FCA or ASIC. These brokers typically offer better protections for client funds, transparent trading conditions, and responsive customer service. By prioritizing safety and due diligence, traders can better navigate the complexities of the forex market and avoid potential scams.

In summary, is Alpha2trade safe? The overwhelming evidence points to a high level of risk, making it advisable for traders to seek more reputable options.

Is alpha2trade a scam, or is it legit?

The latest exposure and evaluation content of alpha2trade brokers.

alpha2trade Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

alpha2trade latest industry rating score is 1.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.