Is Affluent Trade safe?

Business

License

Is Affluent Trade Safe or a Scam?

Introduction

Affluent Trade is an online trading platform that positions itself within the forex market, claiming to offer various trading instruments, including forex, stocks, and cryptocurrencies. As the online trading landscape continues to expand, traders must exercise caution and thoroughly evaluate the legitimacy of brokers before committing their funds. The rise of unregulated and potentially fraudulent platforms has made it imperative for traders to seek reliable information. This article investigates the trustworthiness of Affluent Trade by examining its regulatory status, company background, trading conditions, customer feedback, and overall risk assessment. The findings are based on a comprehensive analysis of various online reviews, regulatory databases, and user experiences.

Regulation and Legitimacy

Understanding the regulatory framework surrounding a trading platform is crucial for ensuring the safety of your funds. Affluent Trade claims to operate from the UK; however, it lacks any regulatory oversight from recognized authorities, which raises significant red flags. Below is a summary of the regulatory status of Affluent Trade:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unregulated |

The absence of a regulatory license means that Affluent Trade is not subject to the stringent regulations imposed by financial authorities such as the Financial Conduct Authority (FCA) in the UK. Regulated brokers are required to adhere to strict operational guidelines, including maintaining segregated accounts for client funds, ensuring transparency in fees, and providing negative balance protection. The lack of such oversight with Affluent Trade indicates that traders may not have legal recourse in case of disputes or financial losses, making it a high-risk option for investors.

Company Background Investigation

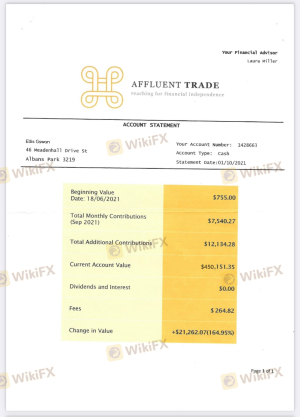

Affluent Trade's history and ownership structure remain obscured, further fueling concerns about its legitimacy. The company purportedly started its operations in 2021, but there is little information available regarding its founders or management team. A transparent company typically provides information about its leadership and operational history, which is vital for building trust with clients.

With no identifiable management team or clear ownership structure, potential investors are left in the dark regarding who is managing their funds. This lack of transparency is a significant red flag, as it suggests that the company may not be accountable for its actions. The absence of a physical address or contact information for company representatives further complicates the situation, as it makes it difficult for clients to seek assistance or lodge complaints.

Trading Conditions Analysis

Affluent Trade presents a variety of trading conditions that may seem attractive at first glance, but a closer examination reveals potential issues. The platform claims to offer competitive spreads and leverage options, but the absence of clarity regarding fees can lead to unexpected costs for traders.

| Fee Type | Affluent Trade | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | Variable | 1.0 - 2.0 pips |

| Commission Structure | N/A | $0 - $10 per trade |

| Overnight Interest Range | N/A | 0.5% - 1.5% |

While the platform advertises low initial deposits and high leverage (up to 1:400), such conditions can also lead to significant risks, especially for inexperienced traders. Additionally, multiple user reviews have highlighted concerns about hidden fees and aggressive sales tactics employed by account managers to encourage further investments. These practices not only compromise the integrity of the trading environment but also raise questions about the broker's overall reliability.

Customer Funds Safety

Ensuring the safety of client funds is a fundamental aspect of any reputable trading platform. Unfortunately, Affluent Trade does not provide adequate information regarding its security measures. The absence of segregated accounts and investor protection mechanisms means that client funds could be at risk in the event of the company's insolvency.

Historically, unregulated brokers have often faced issues related to fund mismanagement, leading to significant losses for their clients. Without a regulatory body overseeing its operations, Affluent Trade may have the freedom to operate without the accountability that regulated brokers must adhere to. This lack of oversight raises serious concerns about the safety of client funds and the potential for fraudulent activity.

Customer Experience and Complaints

Customer feedback is a critical component in assessing the reliability of any trading platform. Reviews of Affluent Trade reveal a mixed bag of experiences, with many users reporting issues related to fund withdrawals and customer service responsiveness.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Account Management Tactics | Medium | Poor |

| Customer Support Response | High | Poor |

Common complaints include difficulties in withdrawing funds, with numerous users claiming that their accounts were frozen or that they were pressured to invest more money before being allowed to access their funds. These patterns of behavior are characteristic of potential scam operations, where brokers use manipulative tactics to retain client funds.

Two typical case studies illustrate these issues: one user reported being unable to withdraw their initial deposit after several months of trading, while another experienced aggressive calls from account managers urging them to make additional investments. The negative experiences shared by users highlight the need for caution when considering Affluent Trade as a trading option.

Platform and Execution

The quality of a trading platform significantly impacts the overall trading experience. Affluent Trade offers a proprietary trading platform, but user reviews indicate concerns about its stability and execution efficiency. Traders have reported instances of slippage and rejected orders, which can severely affect trading outcomes, particularly in volatile market conditions.

Moreover, the lack of transparency regarding the platform's features and functionalities raises questions about its reliability. Users expect a seamless trading experience with real-time data and efficient order execution, but the reported issues suggest that Affluent Trade may not meet these expectations.

Risk Assessment

Using Affluent Trade presents a range of risks that potential investors must consider. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated status poses significant risks to client funds. |

| Financial Risk | High | Lack of transparency in fees and withdrawal practices can lead to financial losses. |

| Operational Risk | Medium | Reports of platform instability and execution issues can affect trading outcomes. |

To mitigate these risks, traders are advised to conduct thorough research before engaging with any broker, particularly those lacking regulatory oversight. Seeking out regulated alternatives can provide a safer trading environment and greater peace of mind.

Conclusion and Recommendations

In conclusion, the evidence suggests that Affluent Trade is not a safe trading platform. The unregulated status, combined with a lack of transparency regarding company operations and a history of customer complaints, raises significant concerns about the legitimacy of this broker. Potential traders should exercise extreme caution and consider alternative options that offer regulatory protection and a proven track record of reliable service.

For traders seeking safer alternatives, consider platforms that are regulated by reputable authorities such as the FCA or ASIC, which provide greater security for client funds and a more transparent trading experience. Always prioritize due diligence to protect your investments in the dynamic world of online trading.

Is Affluent Trade a scam, or is it legit?

The latest exposure and evaluation content of Affluent Trade brokers.

Affluent Trade Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Affluent Trade latest industry rating score is 1.49, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.49 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.