TAG 2025 Review: Everything You Need to Know

Executive Summary

This TAG review presents a complete analysis of The Awareness Group's broker program. The program operates under a commission-sharing business model designed for freight brokerage agents. Based on available public information, TAG offers a 70/30 commission split structure with weekly payment schedules. This positions itself as an opportunity for individuals seeking remote work arrangements in the transportation and logistics sector.

The program provides access to marketing materials, training resources, and support tools. However, specific details about regulatory oversight and user feedback remain limited in publicly available sources. TAG's business model centers on enabling agents to work from home while earning competitive commissions on successful deals. This makes it particularly suitable for those interested in freight brokerage without traditional office constraints.

Our neutral assessment reflects the limited availability of comprehensive user reviews and regulatory information. These are crucial factors in evaluating any broker program. The 70/30 commission structure and remote work flexibility represent the program's primary value propositions for potential agents.

Important Notice

This evaluation is based on publicly available information and industry-standard assessment criteria. Readers should note that specific regulatory details and comprehensive user feedback were not extensively available in public sources at the time of this review. We recommend conducting independent due diligence and contacting TAG directly for detailed program terms and conditions.

Cross-regional entity differences could not be thoroughly assessed due to limited information about international operations or varying regulatory frameworks across different jurisdictions.

Rating Framework

Broker Overview

The Awareness Group operates a broker program that allows agents to work remotely in the freight brokerage industry. The company positions itself as a service organization that provides opportunities for individuals to earn commissions through successful transportation deals. The business model emphasizes flexibility and remote work capabilities. This appeals to those seeking non-traditional employment arrangements in the logistics sector.

The program's commission-sharing structure offers a 70/30 split in favor of the agent, with payments processed weekly. This arrangement suggests a focus on providing competitive compensation while maintaining operational sustainability. The company provides various support materials and training resources to help agents succeed in their roles. However, specific details about the comprehensiveness of these resources remain limited in public documentation.

TAG's approach to freight brokerage appears to emphasize technology integration and modern business practices. The program targets individuals interested in the transportation industry who prefer remote work arrangements over traditional office-based positions. This TAG review finds that the company's business model aligns with contemporary trends toward flexible work arrangements. However, comprehensive assessment requires additional information about operational details and user experiences.

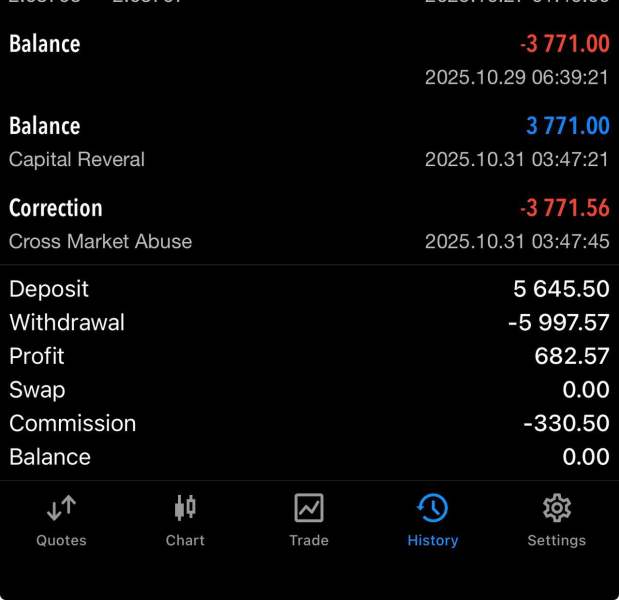

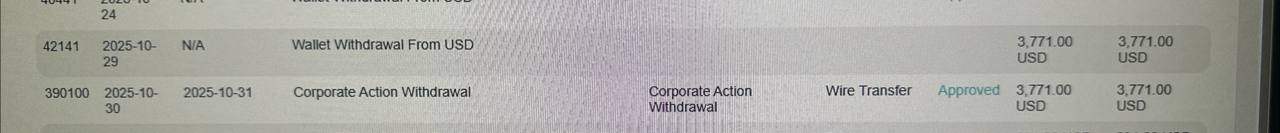

Regulatory Status: Specific regulatory information was not detailed in available public sources. This makes it difficult to assess compliance frameworks and oversight mechanisms.

Payment Methods: Weekly commission payments are mentioned, but detailed information about payment processing methods and withdrawal options was not specified in available materials.

Minimum Investment: Specific minimum investment or startup cost requirements were not detailed in publicly available program information.

Promotional Offers: Current promotional offers or incentive structures beyond the standard commission split were not mentioned in available sources.

Service Offerings: The program focuses on freight brokerage services. However, the specific range of transportation services and market segments was not comprehensively detailed.

Cost Structure: The primary cost structure involves a 70/30 commission split, with agents retaining 70% of successful deal commissions while 30% goes to TAG for support services and infrastructure.

Operational Framework: Specific operational requirements, performance metrics, and success benchmarks were not detailed in available public information.

Geographic Coverage: Information about geographic service areas and regional restrictions was not specified in available program materials.

Support Languages: Customer service language options and communication channels were not detailed in publicly available sources.

This TAG review notes that many operational details would require direct communication with the company for comprehensive understanding.

Account Conditions Analysis

The account conditions for TAG's broker program center around the commission-sharing arrangement. However, comprehensive details about account setup requirements remain limited in public sources. The 70/30 commission split represents the primary financial structure, with agents receiving the majority share of successful deal revenues. This arrangement suggests a competitive approach to agent compensation within the freight brokerage industry.

Weekly payment schedules indicate a commitment to regular cash flow for participating agents. This can be advantageous for those relying on consistent income streams. However, specific details about minimum performance requirements, account maintenance fees, or qualification criteria were not extensively detailed in available public information.

The program appears designed for individuals seeking flexible work arrangements. However, specific onboarding processes and account activation requirements would need clarification through direct contact with TAG. Without detailed user feedback, it's challenging to assess the practical experience of account setup and management.

This TAG review finds that while the basic commission structure is clear, comprehensive account condition details require additional research and direct inquiry with the company for potential participants to make fully informed decisions.

TAG provides access to marketing materials, training resources, and support tools as part of its broker program. These resources appear designed to help agents succeed in freight brokerage activities. However, specific details about the comprehensiveness and quality of these materials remain limited in public sources.

The availability of marketing materials suggests recognition of the importance of business development support for remote agents. Training resources indicate an investment in agent education and skill development, which is crucial for success in the transportation and logistics industry. Support tools likely encompass various operational aids, though their specific nature and effectiveness require further investigation.

The combination of these resources suggests a structured approach to agent support. However, without detailed user feedback or comprehensive descriptions, it's difficult to assess their practical value and effectiveness. The quality and relevance of training materials, in particular, would be crucial factors for agent success but are not thoroughly documented in available public information.

Industry standards for broker support typically include ongoing education, market updates, and operational guidance. While TAG mentions providing these elements, comprehensive evaluation would require direct experience or detailed user testimonials that were not extensively available during this review period.

Customer Service and Support Analysis

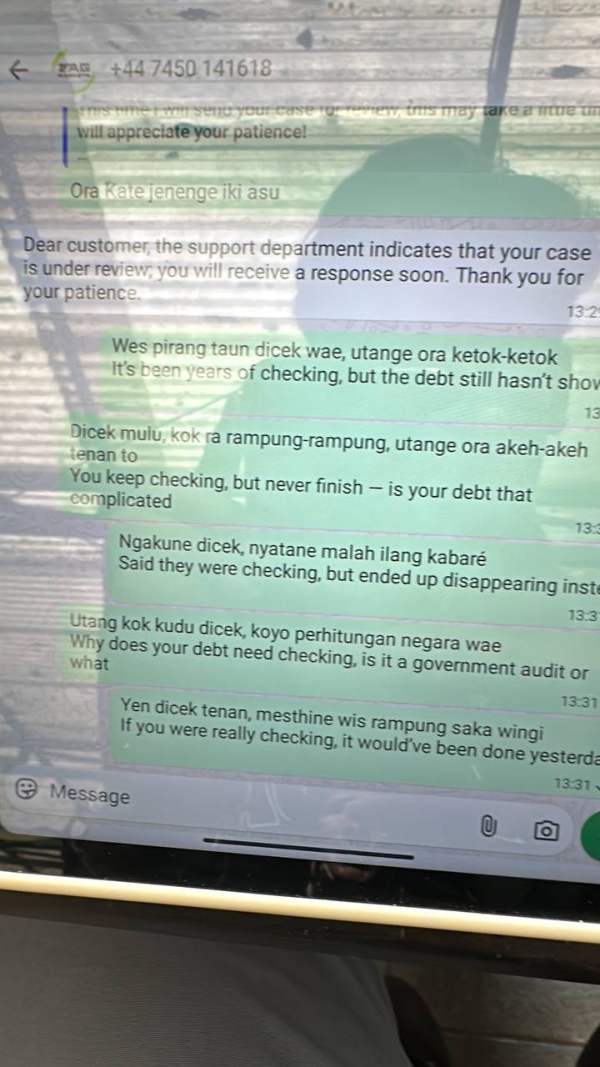

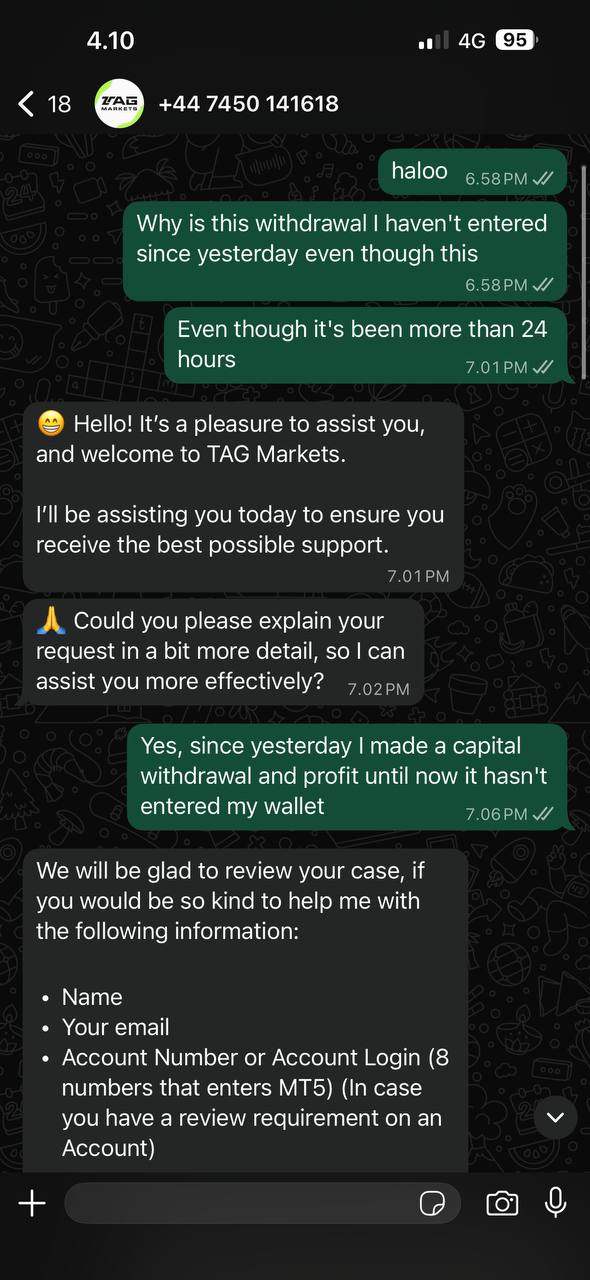

Customer service and support information for TAG's broker program was not extensively detailed in available public sources. This makes comprehensive assessment challenging. The mention of support tools suggests some level of agent assistance, but specific service channels, response times, and support quality metrics were not documented in publicly available materials.

Effective customer support is crucial for remote agents who may need technical assistance, operational guidance, or problem resolution without traditional office support structures. The absence of detailed support information in public sources represents a significant gap in available assessment data.

Industry best practices for broker programs typically include multiple communication channels, reasonable response times, and knowledgeable support staff. Without specific information about TAG's support infrastructure, potential agents would need to inquire directly about service availability and quality expectations.

The success of remote broker arrangements often depends heavily on reliable support systems. This makes this information gap particularly relevant for potential program participants. Comprehensive support evaluation would require direct experience or detailed user feedback that was not extensively available in public sources during this review period.

Trading Experience Analysis

The trading experience for TAG's broker program relates to freight brokerage operations rather than traditional financial trading. The program's focus on remote work arrangements and commission-based compensation suggests an emphasis on flexibility and performance-based outcomes. However, specific details about operational processes, technology platforms, and user experience were not comprehensively documented in available public sources.

The 70/30 commission structure and weekly payment schedule indicate a business model designed to provide competitive compensation and regular cash flow. These factors contribute positively to the overall experience for successful agents. However, actual user experiences and satisfaction levels were not extensively documented in available materials.

Remote work capabilities represent a significant advantage for many potential agents. This offers flexibility that traditional office-based positions may not provide. However, the effectiveness of remote operations depends heavily on technology infrastructure and support systems, details of which were not thoroughly available in public documentation.

This TAG review notes that comprehensive trading experience assessment would require detailed user feedback and operational information that was not extensively available in public sources. Potential participants would benefit from direct communication with current or former agents to better understand practical experience factors.

Trust and Reliability Analysis

Trust and reliability assessment for TAG's broker program faces significant limitations due to the absence of detailed regulatory information and comprehensive user feedback in publicly available sources. The lack of specific regulatory oversight details makes it challenging to assess compliance frameworks and consumer protection measures.

Company transparency appears limited based on available public information. Many operational details and performance metrics are not readily accessible. This information gap makes it difficult for potential agents to conduct thorough due diligence before program participation.

The freight brokerage industry typically operates under various regulatory frameworks. However, specific compliance information for TAG was not detailed in available sources. Industry reputation and track record information were similarly limited, making comprehensive trust assessment challenging.

Without extensive user testimonials or third-party evaluations, potential participants must rely primarily on direct communication with the company for trust and reliability assessment. This situation emphasizes the importance of thorough independent research and direct inquiry before making participation decisions.

User Experience Analysis

User experience analysis for TAG's broker program is significantly limited by the absence of comprehensive user feedback and testimonials in publicly available sources. The remote work model and commission-based structure suggest potential advantages for certain user types. However, actual user satisfaction and experience quality remain undocumented in available materials.

The program's emphasis on flexibility and remote operations may appeal to individuals seeking non-traditional work arrangements. However, the practical experience of program participation requires further investigation. Interface design, operational ease, and overall user satisfaction metrics were not available in public sources.

Registration and onboarding processes were not detailed in available information. This makes it difficult to assess the user experience from initial contact through active participation. Similarly, ongoing operational experience and common user challenges were not documented in publicly accessible materials.

The absence of user reviews and feedback represents a significant limitation in comprehensive experience assessment. Potential participants would benefit from direct contact with current or former agents to understand practical experience factors and satisfaction levels before making participation decisions.

Conclusion

This TAG review reveals a broker program that offers commission-sharing opportunities in the freight brokerage industry. The program features a 70/30 split favoring agents and weekly payment schedules. The program's emphasis on remote work flexibility may appeal to individuals seeking alternative employment arrangements in the transportation and logistics sector.

However, significant information gaps regarding regulatory oversight, comprehensive user feedback, and detailed operational procedures limit the ability to provide a complete assessment. The program appears most suitable for individuals interested in freight brokerage who prefer remote work arrangements and performance-based compensation.

The main advantages include competitive commission structure and work flexibility. Primary concerns center on limited transparency and the absence of extensive user testimonials. Potential participants should conduct thorough independent research and direct communication with TAG before making participation decisions.