Qtrade 2025 Review: Everything You Need to Know

Executive Summary

Qtrade is a top low-fee Canadian brokerage. It mainly serves experienced investors who want cost-effective trading solutions that don't break the bank. This qtrade review shows a platform that offers competitive pricing and diverse investment tools, but it has big problems with customer service delivery that can't be ignored. The brokerage works under CIRO regulation. This provides essential oversight for Canadian investors, but the company struggles with user satisfaction scores that show broader service quality concerns.

Recent evaluations show that Qtrade positions itself as an affordable alternative in the Canadian brokerage landscape. It offers access to stocks, mutual funds, and various investment vehicles that meet most investor needs. However, user feedback shows significant room for improvement. This is particularly true in support services where Trustpilot ratings show a concerning score of 40 that should worry potential customers. The platform's target demographic consists mainly of self-directed, experienced investors who prioritize low fees over comprehensive hand-holding services that beginners might need. While Qtrade excels in cost efficiency and regulatory compliance, potential users should carefully consider the trade-offs between savings and service quality when evaluating this brokerage option.

Important Notice

This evaluation focuses specifically on Qtrade as a Canadian brokerage operating under CIRO regulation. Regional differences in brokerage services, regulatory frameworks, and available features may vary significantly across different jurisdictions that investors should understand. Investors should verify that Qtrade's services are available in their region. They should also understand local regulatory protections before proceeding with any investment decisions.

Our assessment methodology incorporates user feedback from multiple review platforms, regulatory filings, and publicly available information about Qtrade's services. Given the dynamic nature of the brokerage industry, fees, features, and policies may change without notice to existing or potential customers. Prospective clients should verify current offerings directly with Qtrade before making investment decisions.

Rating Framework

Broker Overview

Qtrade operates as a Canadian online brokerage platform designed to serve experienced investors. These investors prioritize cost efficiency over extensive support services that traditional brokerages might offer. The company has established itself within the competitive Canadian discount brokerage market by focusing on low-fee structures that appeal to self-directed traders and long-term investors who know what they want. According to available information, Qtrade's business model centers on providing essential trading services while maintaining competitive pricing. This pricing strategy undercuts many traditional full-service brokerages that charge higher fees for additional services.

The platform's approach targets investors who possess sufficient market knowledge to navigate trading decisions independently. This makes it less suitable for beginners requiring extensive educational resources or guidance from customer service representatives. Qtrade's positioning reflects a clear strategic choice to compete primarily on cost rather than comprehensive service offerings. This explains both its appeal to cost-conscious investors and the challenges reflected in customer satisfaction metrics that show room for improvement.

Operating under CIRO regulation, Qtrade maintains the regulatory compliance standards required for Canadian brokerages. This ensures basic investor protections and operational oversight that Canadian investors expect from legitimate brokerages. The brokerage supports multiple asset classes including stocks and mutual funds. This provides sufficient diversity for most retail investment strategies that individual investors typically pursue. However, this qtrade review indicates that while the platform delivers on its core promise of low-cost trading, users should prepare for potentially limited support when issues arise.

Regulatory Framework: Qtrade operates under CIRO oversight. This ensures compliance with Canadian securities regulations and provides standard investor protections available to Canadian brokerage clients.

Deposit and Withdrawal Methods: Specific information regarding deposit and withdrawal options was not detailed in available materials. Canadian brokerages typically support bank transfers and electronic fund transfers that most investors find convenient.

Minimum Deposit Requirements: Current minimum deposit requirements were not specified in the reviewed materials. These should be verified directly with Qtrade before opening an account.

Promotional Offers: Details regarding current bonus promotions or special offers were not available in the source materials. This qtrade review recommends checking directly with Qtrade for current promotional opportunities.

Tradeable Assets: Qtrade provides access to stocks and mutual funds. This offers sufficient asset diversity for most retail investment strategies, though the complete range of available instruments requires direct verification with the brokerage.

Cost Structure: Positioned as a low-fee brokerage, Qtrade emphasizes competitive pricing that appeals to cost-conscious investors. Specific spread and commission details were not provided in available materials, but the low-cost positioning suggests favorable fee structures compared to full-service alternatives.

Leverage Options: Information regarding available leverage ratios was not specified in the reviewed materials. Investors interested in leveraged trading should contact Qtrade directly for current offerings.

Platform Selection: Details about specific trading platforms offered by Qtrade were not comprehensively covered in available sources. This represents an area where potential clients should request additional information directly from the brokerage.

Geographic Restrictions: Specific geographic limitations were not detailed in the materials reviewed for this qtrade review. Investors should verify availability in their region before proceeding.

Customer Service Languages: Available customer service language options were not specified in the source materials. This information should be confirmed with Qtrade for investors who require support in specific languages.

Detailed Rating Analysis

Account Conditions Analysis

Account condition evaluation faces limitations due to insufficient specific information in available materials. This includes details about Qtrade's account types, minimum requirements, and special features that might appeal to different investor segments. Canadian brokerages typically offer standard individual and registered accounts like RRSP and TFSA. However, Qtrade's specific account structure, opening procedures, and unique features require direct verification with the brokerage to understand what options are actually available.

The absence of detailed account condition information in publicly available materials suggests either limited marketing of account features or a focus on simplicity over complex account structures. Experienced investors, who comprise Qtrade's target demographic, may appreciate straightforward account options without extensive complexity that can confuse decision-making. However, this cannot be confirmed without more comprehensive data about actual account offerings and their specific terms.

Account opening processes, verification requirements, and special account features such as joint accounts or corporate trading accounts remain unspecified in current materials. Potential clients should directly contact Qtrade to understand available account types. They should also learn about associated requirements and any restrictions that may apply to their specific investment needs and goals.

The lack of publicly available account condition details may reflect Qtrade's focus on cost efficiency over marketing comprehensive account features. This qtrade review recommends direct consultation with Qtrade representatives to understand current account offerings. This will help determine suitability for individual investment strategies and long-term financial goals.

Qtrade demonstrates strength in providing diverse investment tools, particularly in stocks and mutual funds. This covers the core needs of most retail investors who want access to traditional investment vehicles. The platform's tool selection appears designed for self-directed investors who require access to essential investment vehicles. These investors don't necessarily need advanced analytical tools or extensive research resources that some premium platforms provide.

The availability of mutual funds alongside individual stocks provides investors with options for both active trading and passive investment strategies. This combination serves the needs of experienced investors who may wish to blend individual stock selection with diversified fund investments for a balanced portfolio approach. However, specific fund selection criteria and availability require direct verification with Qtrade to understand the actual scope of investment options.

Research and educational resources were not detailed in available materials. This suggests either limited offerings in this area or insufficient public information about available tools that could help investors make informed decisions. Given Qtrade's positioning as a low-cost provider targeting experienced investors, extensive research tools may not be a priority feature. However, this could limit appeal for investors seeking comprehensive analytical support for their trading decisions.

Automated trading capabilities, advanced charting tools, and third-party research integration remain unspecified in current materials. The tools and resources evaluation reflects Qtrade's apparent focus on providing essential investment access rather than comprehensive trading infrastructure. This aligns with its cost-conscious positioning but may limit appeal for more sophisticated trading strategies that require advanced platform features.

Customer Service and Support Analysis

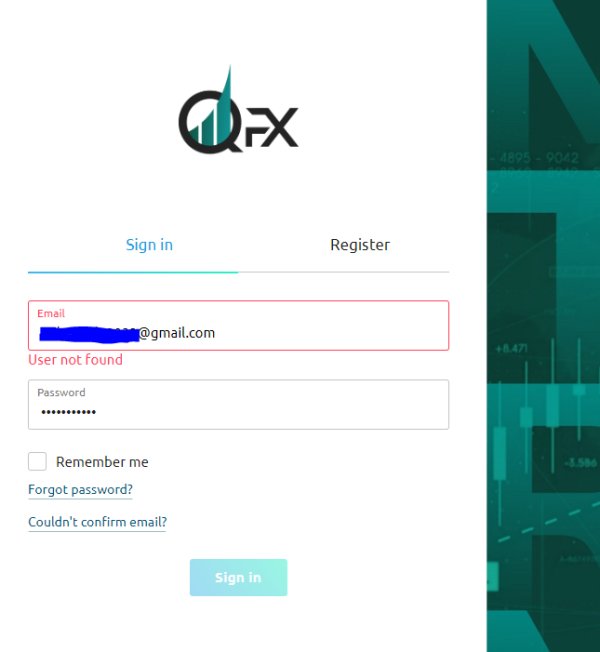

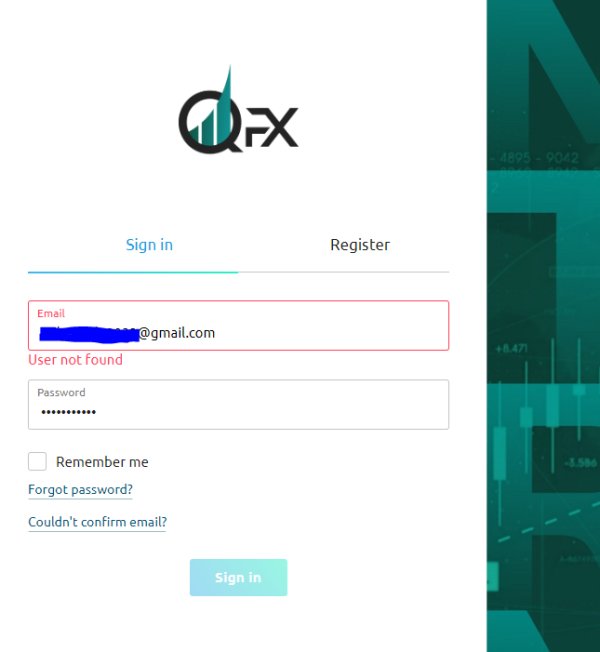

Customer service represents Qtrade's most significant challenge. This is evidenced by the troubling Trustpilot rating of 40, which indicates widespread user dissatisfaction with support quality across multiple service areas. User feedback specifically mentions negative experiences with Qtrade support. This suggests systemic issues in service delivery that potential clients should carefully consider before choosing this brokerage.

The low customer satisfaction scores reflect broader concerns about response times, problem resolution effectiveness, and overall service quality. For a brokerage targeting experienced investors, poor customer service can be particularly problematic when technical issues or account problems arise. Even experienced users require reliable support for platform-related concerns that they cannot resolve independently.

Available customer service channels, response time commitments, and service hour availability were not detailed in reviewed materials. However, the negative user feedback suggests deficiencies across multiple service dimensions that impact the overall customer experience. The disconnect between Qtrade's low-cost positioning and service quality expectations may contribute to user dissatisfaction. Clients may expect reasonable service standards regardless of fee structures that brokerages charge.

Support quality issues can significantly impact the overall trading experience, particularly during market volatility when timely assistance becomes crucial. The poor Trustpilot ratings suggest that Qtrade's cost savings may come at the expense of service reliability. This requires potential clients to weigh fee advantages against potential support limitations when platform issues arise that need professional assistance.

Trading Experience Analysis

Trading experience evaluation faces limitations due to insufficient specific information about platform stability, execution quality, and overall trading environment. The absence of detailed trading performance metrics, platform uptime statistics, or execution speed data makes comprehensive assessment challenging for this qtrade review.

Platform functionality, order execution capabilities, and trading interface design were not comprehensively covered in reviewed sources. These factors critically impact daily trading activities that investors rely on for successful portfolio management. Experienced investors, who comprise Qtrade's target market, typically require reliable platform performance and efficient order processing. This makes these unspecified areas important for potential clients to investigate before committing to the platform.

Mobile trading capabilities, platform customization options, and advanced order types remain undetailed in current materials. The lack of specific trading experience information may reflect either limited platform features or insufficient public documentation of trading capabilities. Both scenarios could impact investor decision-making when choosing between different brokerage options.

Given Qtrade's positioning as a low-cost provider, trading platform sophistication may be limited compared to premium brokerages. However, this qtrade review cannot provide definitive conclusions without more comprehensive platform information about actual capabilities and limitations. Potential clients should request platform demonstrations or trial access to evaluate trading experience suitability for their specific needs.

Trust and Reliability Analysis

Qtrade's regulatory status under CIRO provides essential foundation for trust and reliability. This ensures compliance with Canadian securities regulations and access to standard investor protection mechanisms that Canadian investors expect from legitimate brokerages. CIRO oversight includes requirements for segregated client funds, regulatory reporting, and adherence to industry standards that protect Canadian investors from fraud and mismanagement.

The regulatory framework provides confidence in basic operational integrity and financial oversight. However, specific details about Qtrade's financial strength, insurance coverage, and additional security measures were not detailed in available materials that could provide additional assurance. CIRO regulation ensures minimum standards but does not guarantee service quality or operational excellence beyond regulatory requirements that all compliant brokerages must meet.

Company transparency regarding ownership, financial performance, and business operations was not comprehensively covered in reviewed sources. While regulatory compliance provides basic assurance, additional transparency in corporate governance and financial stability would strengthen overall trust assessment. This information helps investors understand the long-term viability and stability of their chosen brokerage partner.

The combination of regulatory oversight and concerning customer service ratings creates a mixed trust profile. Regulatory compliance provides basic security while service quality issues may impact operational reliability that affects day-to-day user experience. Potential clients benefit from regulatory protections but should consider service reliability concerns when evaluating overall platform trustworthiness.

User Experience Analysis

User experience assessment reveals significant challenges, primarily reflected in the low Trustpilot rating of 40. This indicates widespread user dissatisfaction across multiple experience dimensions that extend beyond isolated incidents to systemic problems. The poor ratings suggest issues that impact the overall user journey from account opening through ongoing platform use.

User feedback specifically highlighting negative support experiences suggests that customer interaction points represent major pain areas. These problems occur throughout the overall user journey and can significantly impact satisfaction levels. For experienced investors who may require occasional assistance despite their knowledge level, poor support experiences can significantly impact overall platform satisfaction and willingness to recommend the service to others.

The target demographic of experienced investors may have higher tolerance for limited hand-holding. However, they still expect functional reliability and responsive support when needed for technical or account-related issues. The disconnect between user expectations and delivered experience, as reflected in review scores, suggests fundamental gaps in service delivery. These gaps impact overall user satisfaction and represent areas where Qtrade needs significant improvement.

Interface design, registration processes, and fund management experiences were not specifically detailed in available materials. However, the poor overall ratings suggest deficiencies across multiple user touchpoints that create frustration for customers. Potential improvements in communication, response times, and problem resolution could significantly enhance user experience. Current feedback indicates substantial work needed in these areas to meet basic customer expectations.

Conclusion

Qtrade presents a mixed proposition for Canadian investors. It delivers on its core promise of low-cost trading while struggling significantly with customer service quality that impacts overall user satisfaction. This qtrade review reveals a brokerage that successfully serves cost-conscious, experienced investors who prioritize fee savings over comprehensive support. However, it may disappoint users who expect reliable customer service when issues arise that require professional assistance.

The platform's strengths lie in its competitive fee structure, regulatory compliance under CIRO, and access to essential investment tools including stocks and mutual funds. However, the concerning Trustpilot rating of 40 and specific user complaints about support quality represent serious limitations. Potential clients must carefully consider these drawbacks when evaluating whether Qtrade meets their investment needs and service expectations.

Qtrade appears most suitable for highly experienced, self-directed investors who rarely require customer support and prioritize cost savings above service quality. Investors who value responsive customer service, comprehensive platform features, or extensive support resources may find better alternatives despite potentially higher costs. The decision ultimately depends on individual priorities and tolerance for service limitations in exchange for fee savings.