Qointech 2025 Review: Everything You Need to Know

Executive Summary

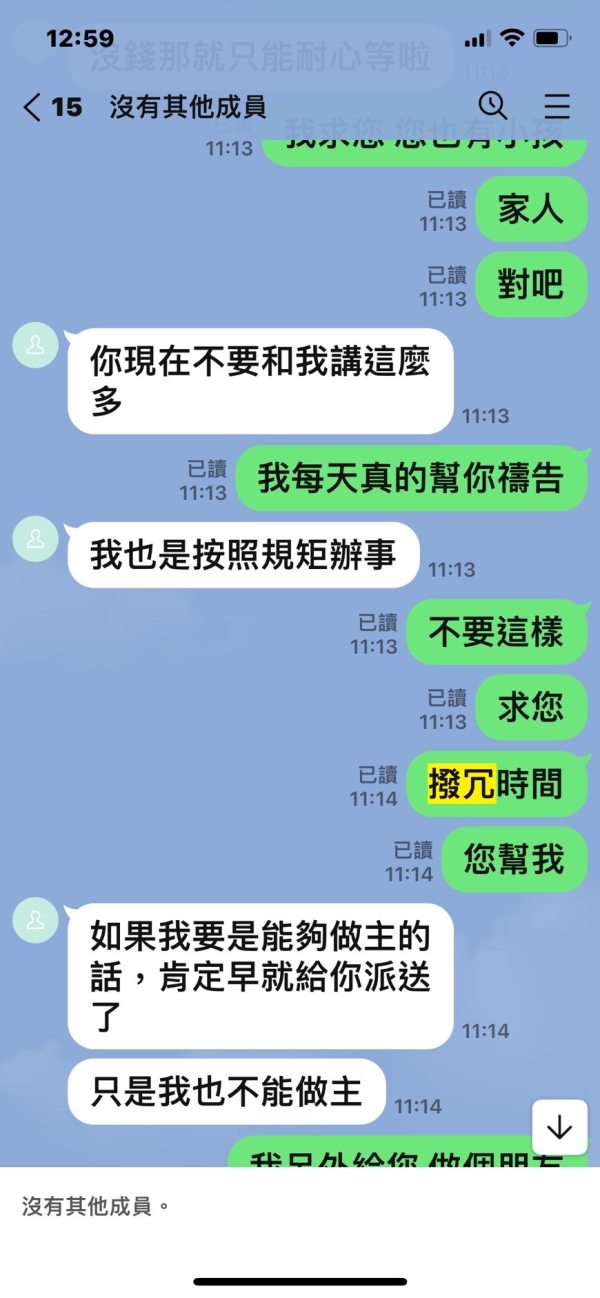

This qointech review shows major concerns about this forex broker's legitimacy and trustworthiness. Qointech operates as an unregulated forex and commodities broker, which raises immediate red flags for potential traders. According to multiple industry sources, the company maintains a concerning trust score of approximately 25%, with numerous negative reviews and scam warnings circulating within the trading community.

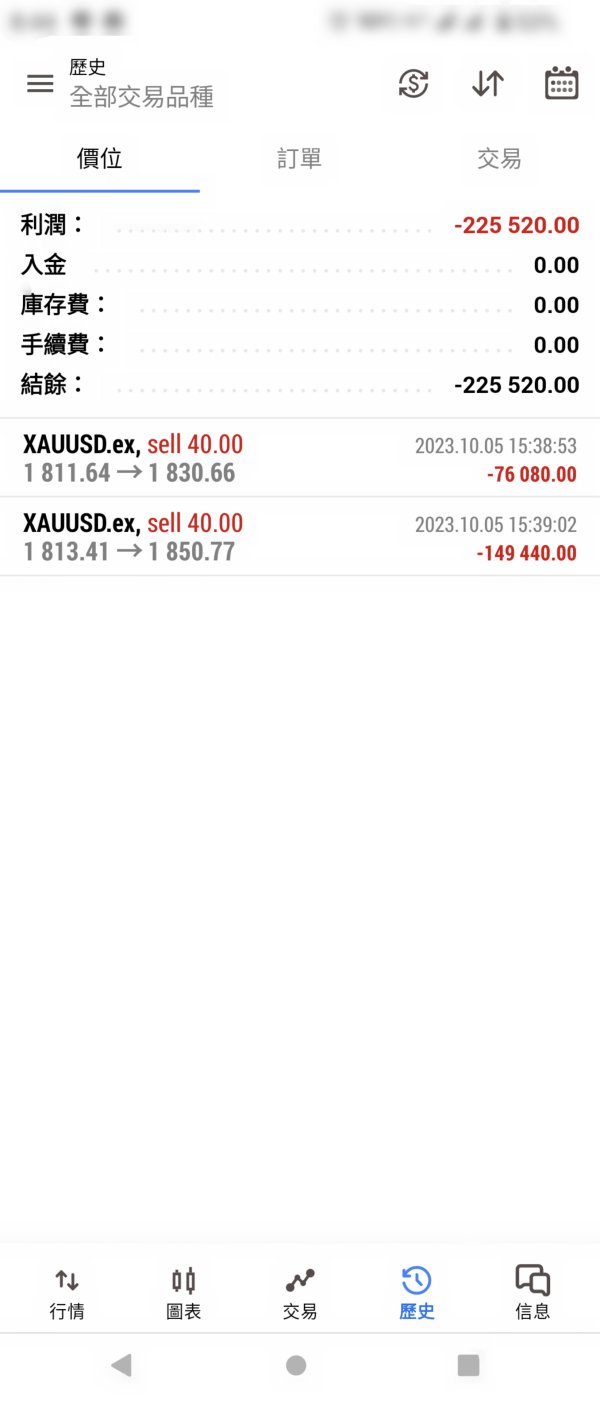

Qointech claims to provide forex and commodities trading services to both retail and institutional clients. The lack of specific information regarding fees, spreads, trading platforms, and regulatory compliance creates substantial uncertainty. The absence of clear regulatory oversight from major financial authorities significantly undermines the broker's credibility. Industry watchdogs have issued warnings about potential fraudulent activities associated with unregulated brokers like Qointech.

The broker's website lacks transparency in crucial areas including commission structures, minimum deposit requirements, and detailed platform specifications. This qointech review emphasizes the importance of exercising extreme caution when considering this broker, as the combination of regulatory absence and negative user feedback suggests substantial risks for potential investors.

Important Notice

This qointech review is based on publicly available information and user feedback collected from various industry sources. Qointech operates without regulatory supervision from recognized financial authorities, which may expose users to significant legal and financial risks across different jurisdictions. The regulatory landscape varies significantly between regions, and the absence of proper licensing creates potential complications for traders seeking recourse in case of disputes.

Our evaluation methodology relies on verified industry reports, user testimonials, and regulatory database searches. Given the unregulated status of Qointech, potential users should conduct thorough due diligence and consider the substantial risks associated with unregulated forex brokers before making any financial commitments.

Rating Framework

Broker Overview

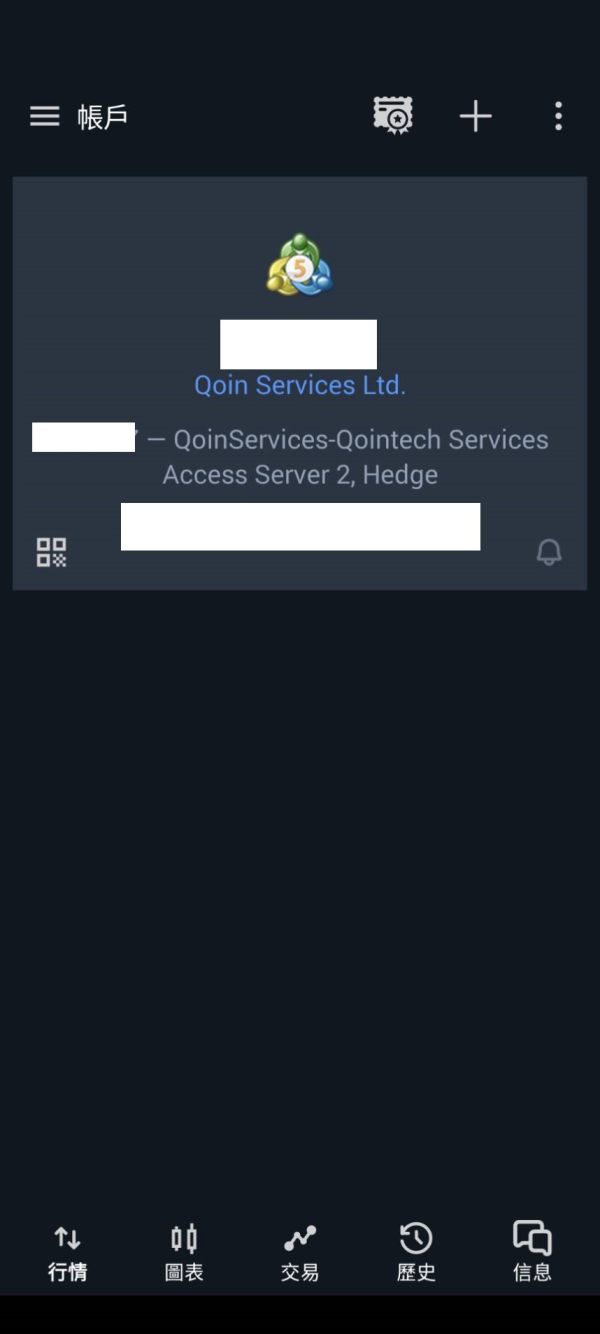

Qointech presents itself as a forex and commodities broker serving both retail and institutional clients. Specific details about the company's founding date and corporate headquarters remain unclear in available documentation. The broker claims to facilitate trading in foreign exchange markets and commodity instruments, positioning itself within the competitive online trading landscape. However, the lack of transparent corporate information raises immediate concerns about the company's legitimacy and operational history.

The business model appears to focus primarily on forex and commodities trading services. Specific details about execution methods, liquidity providers, and operational infrastructure remain undisclosed. According to industry sources, Qointech operates without proper regulatory authorization from major financial supervisory bodies, which significantly impacts its credibility within the professional trading community.

This qointech review highlights the concerning absence of regulatory compliance. The broker lacks authorization from recognized authorities such as the FCA, ASIC, CySEC, or other major regulatory bodies. The unregulated status creates substantial risks for traders, as there are no investor protection schemes or regulatory oversight to ensure fair trading practices and fund security.

Regulatory Status: Qointech operates without regulatory authorization from major financial authorities. This creates significant compliance and security concerns for potential users.

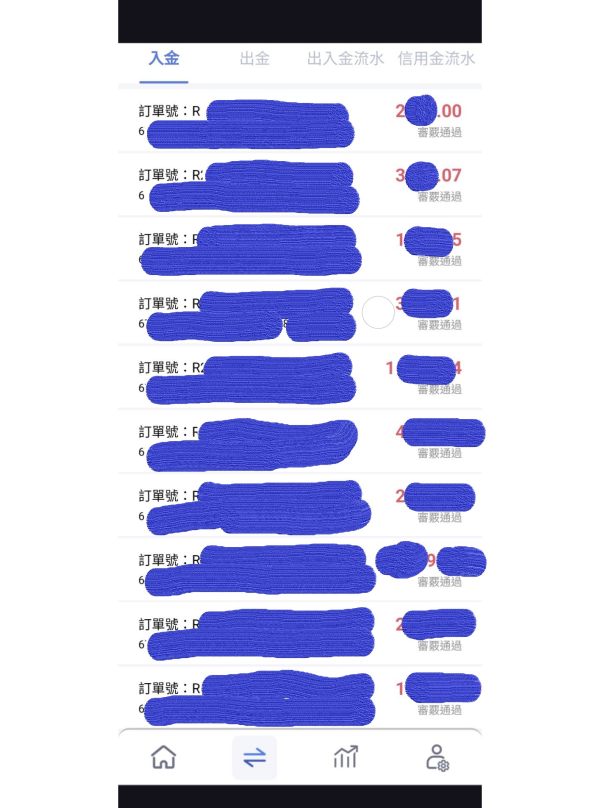

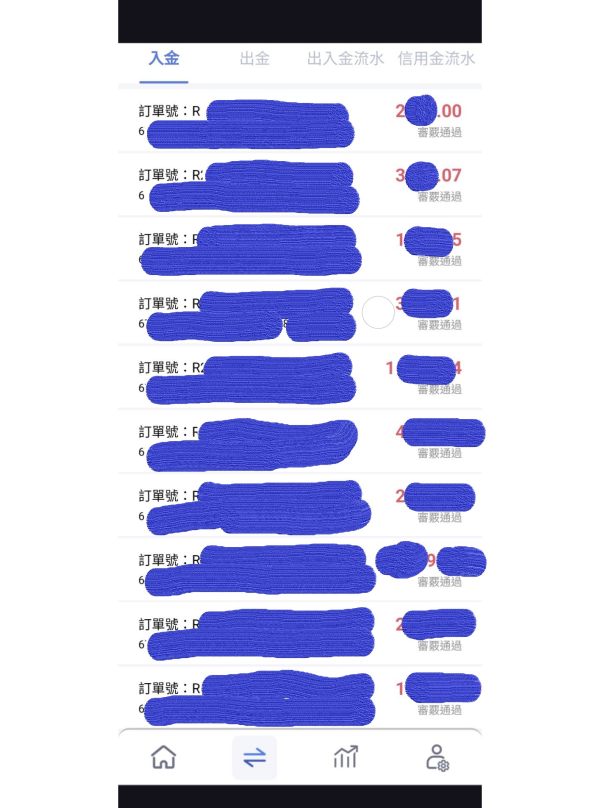

Deposit and Withdrawal Methods: Specific information about available payment methods and processing procedures is not detailed in available resources.

Minimum Deposit Requirements: The broker has not disclosed specific minimum deposit amounts in publicly available documentation.

Promotional Offers: Details regarding bonus structures, promotional campaigns, or incentive programs are not specified in current information sources.

Tradeable Assets: The broker focuses on forex and commodities trading services. Specific instrument lists and market coverage details remain undisclosed.

Cost Structure: Critical information about spreads, commissions, overnight fees, and other trading costs is not transparently provided. This makes cost comparison difficult.

Leverage Options: Specific leverage ratios and margin requirements are not detailed in available broker information.

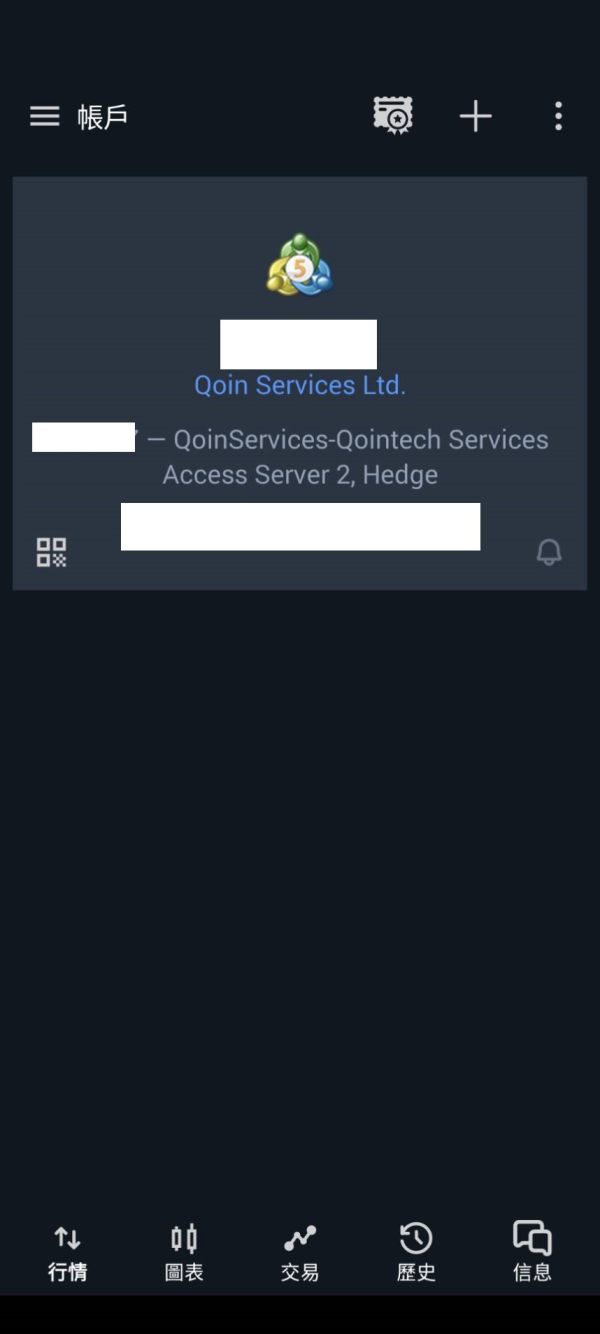

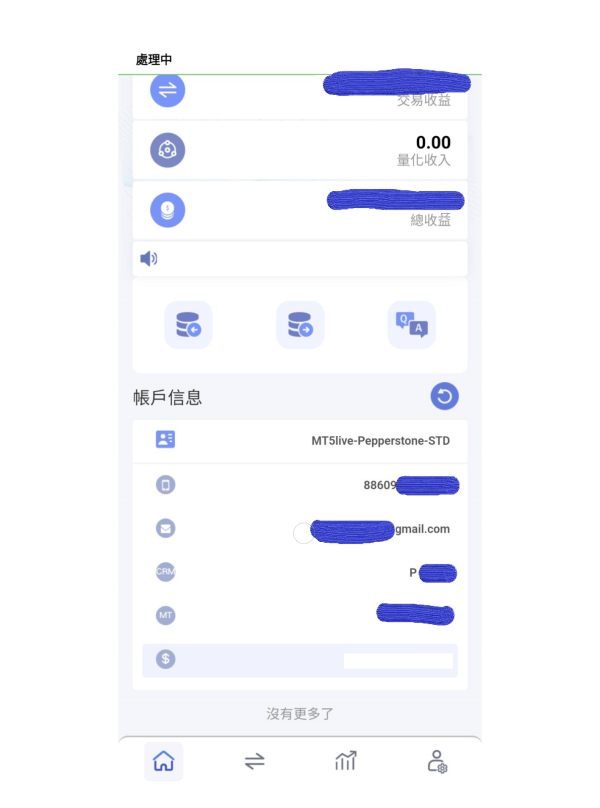

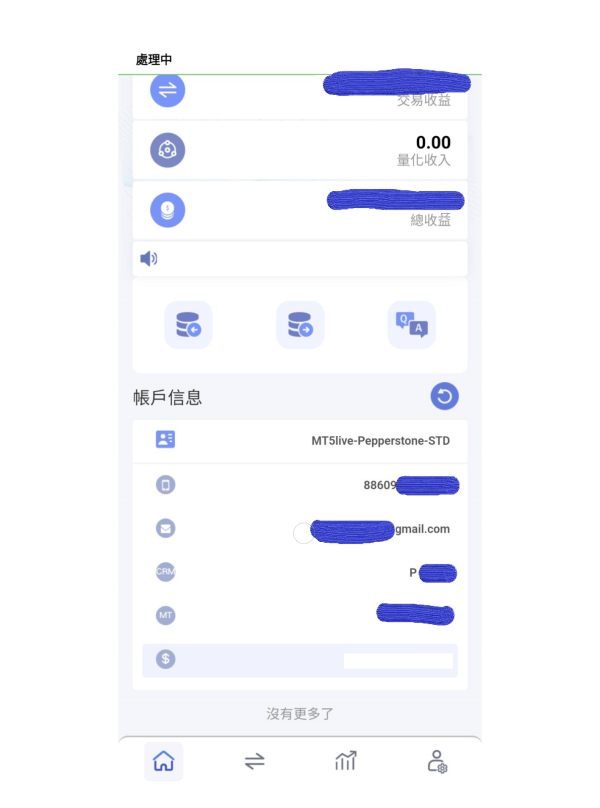

Platform Selection: The trading platforms supported by Qointech are not specifically mentioned in current documentation.

Geographic Restrictions: Information about regional limitations or restricted territories is not provided in available sources.

Customer Support Languages: The range of supported languages for customer service is not specified in current materials.

This qointech review emphasizes the concerning lack of transparency in essential operational details. This is characteristic of potentially problematic brokers.

Account Conditions Analysis

The account conditions offered by Qointech present significant concerns due to the lack of detailed information and transparency. Available sources do not specify the types of accounts available, their respective features, or the requirements for account opening. This absence of clear account structure information makes it impossible for potential traders to make informed decisions about their trading setup.

The minimum deposit requirements remain undisclosed. This is unusual for legitimate brokers who typically provide clear pricing structures. The lack of transparency, combined with the low user trust scores reported across multiple review platforms, suggests that account conditions may not be competitive or clearly defined. The absence of specific information about account tiers, benefits, or special features raises questions about the broker's operational legitimacy.

Account opening procedures and verification requirements are not detailed in available documentation. This creates uncertainty about onboarding processes. Legitimate brokers typically provide comprehensive information about KYC procedures, documentation requirements, and account activation timelines. The lack of such information in this qointech review reflects poorly on the broker's transparency standards.

Special account features such as Islamic accounts, professional trader accounts, or institutional services are not mentioned in available sources. This suggests either limited service offerings or poor communication of available services to potential clients.

The trading tools and resources provided by Qointech appear limited based on available information. The broker claims to offer forex and commodities trading services, but specific details about analytical tools, charting packages, or trading software are not clearly documented. This lack of detailed tool specifications makes it difficult to assess the broker's technological capabilities or competitive positioning.

Research and analysis resources are not mentioned in available documentation. Professional brokers typically provide market analysis, economic calendars, news feeds, and research reports to support their clients' trading activities. The absence of such information suggests either limited research capabilities or poor marketing communication.

Educational resources are not specified in current broker information. Educational support is particularly important for retail traders, and its absence may indicate limited commitment to client development and success. Automated trading support is not detailed in available sources. This limitation could significantly impact traders who rely on automated strategies or systematic trading approaches.

Customer Service and Support Analysis

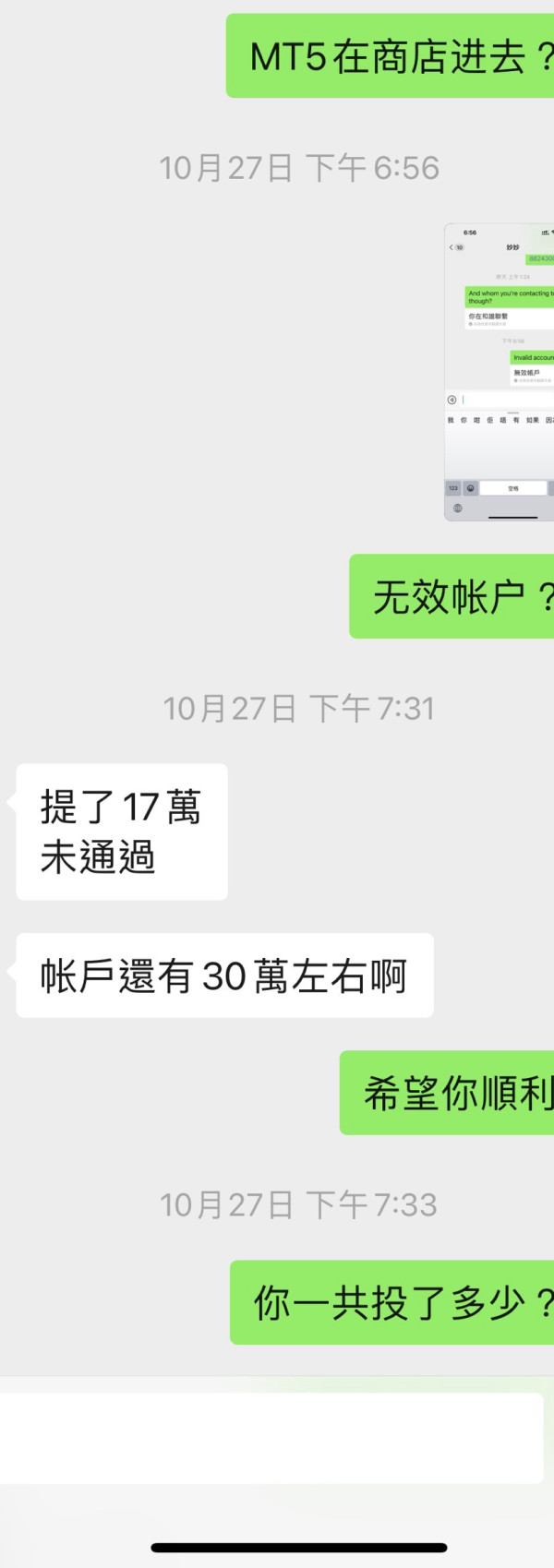

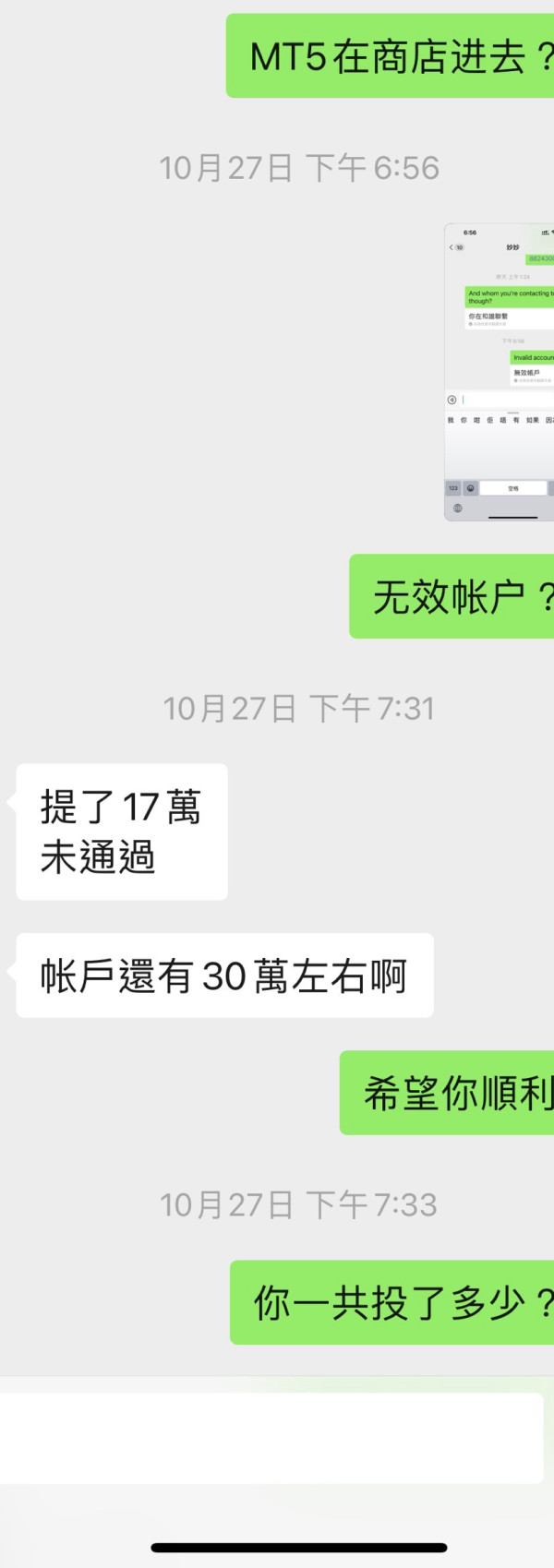

Customer service quality represents a critical concern for Qointech based on available user feedback and trust scores. The low trust rating of approximately 25% suggests significant issues with customer satisfaction and service delivery. Industry sources indicate negative user experiences, though specific details about service quality metrics are not comprehensively documented.

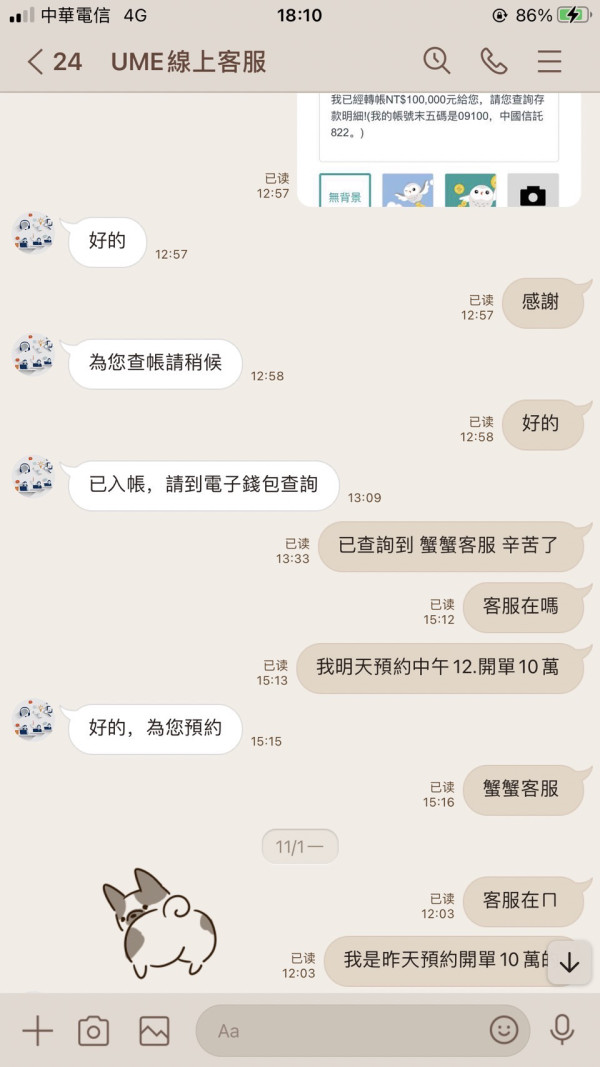

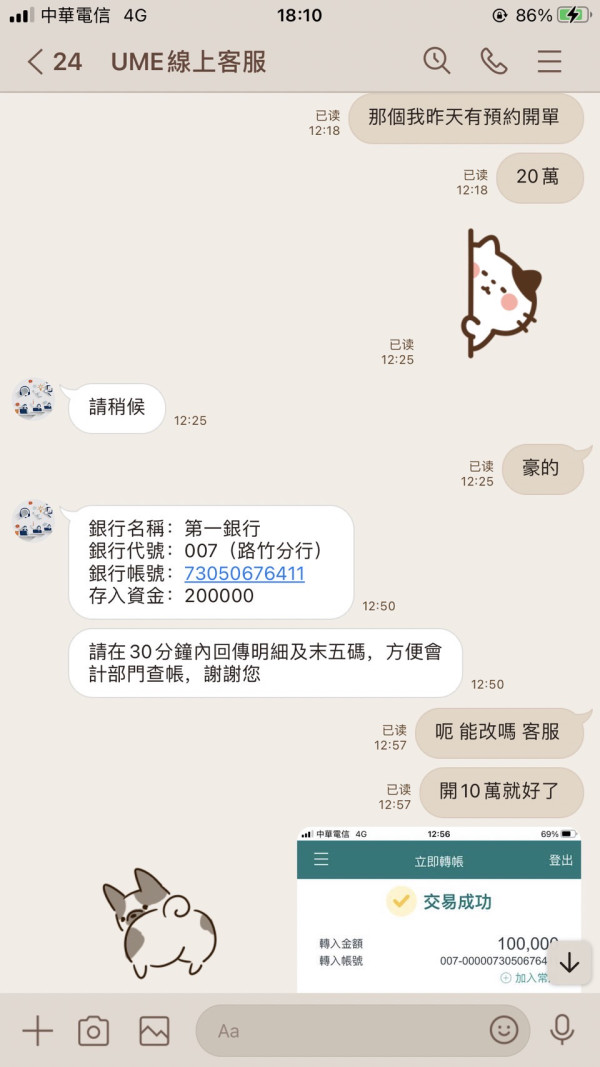

Available customer service channels, response times, and support availability hours are not specified in current broker documentation. Professional brokers typically provide multiple contact methods including phone, email, live chat, and sometimes social media support. The lack of clear customer service information raises concerns about accessibility and responsiveness.

Service quality indicators suggest substandard customer support experiences based on user trust scores and negative feedback patterns. The low trust ratings reported across multiple platforms indicate potential issues with problem resolution, communication effectiveness, and overall client satisfaction.

Multilingual support capabilities are not detailed in available information. This could limit accessibility for international clients. Professional brokers typically provide support in multiple languages to serve diverse client bases effectively.

Trading Experience Analysis

The trading experience offered by Qointech raises significant concerns based on available information and user feedback. Platform stability and execution speed details are not provided in current documentation, making it impossible to assess the technical quality of the trading environment. Reliable trade execution is fundamental to successful forex trading, and the lack of performance data is concerning.

Order execution quality is not documented in available sources. Professional brokers typically provide transparency about execution statistics and performance metrics to build client confidence. The absence of such information in this qointech review suggests potential execution quality issues.

Platform functionality and feature completeness cannot be adequately assessed due to limited technical specifications in available documentation. Modern traders expect comprehensive charting tools, technical indicators, risk management features, and mobile accessibility. The lack of detailed platform information raises questions about technological capabilities.

Mobile trading experience details are not provided. This is particularly concerning given the importance of mobile access in contemporary trading. Professional brokers typically offer dedicated mobile applications or responsive web platforms optimized for mobile devices.

The overall trading environment cannot be properly evaluated due to insufficient cost and execution information. This qointech review highlights these transparency gaps as significant concerns for potential users.

Trust and Security Analysis

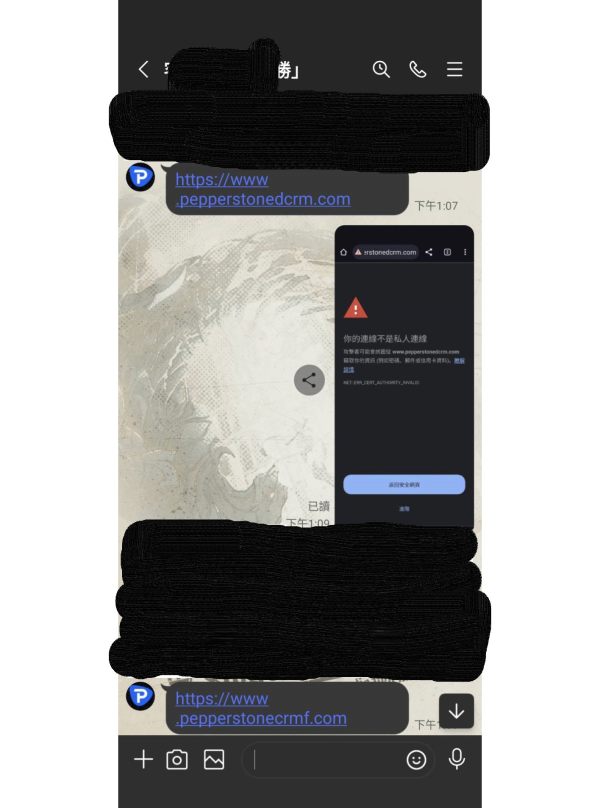

Trust and security represent the most critical concerns in this qointech review. The broker's unregulated status creates fundamental security risks, as there is no regulatory oversight to ensure proper business practices or fund protection. Major regulatory bodies such as the FCA, ASIC, CySEC, and others provide essential investor protections that are absent with unregulated brokers.

Fund security measures are not guaranteed without proper regulatory supervision. Legitimate brokers typically maintain client funds in segregated accounts with tier-one banks and provide detailed information about fund protection measures.

Corporate transparency is severely lacking, with limited information about company ownership, financial statements, or operational history. Professional brokers typically provide comprehensive corporate information, regulatory filings, and transparency about their business operations and financial stability.

Industry reputation analysis reveals concerning patterns. The approximately 25% trust score and negative user feedback indicate significant credibility issues. Multiple industry sources have raised warnings about the risks associated with unregulated brokers like Qointech.

The absence of regulatory oversight means there are no established procedures for dispute resolution, compensation claims, or regulatory intervention in case of operational issues. This creates substantial risks for traders who may have limited recourse in case of problems.

User Experience Analysis

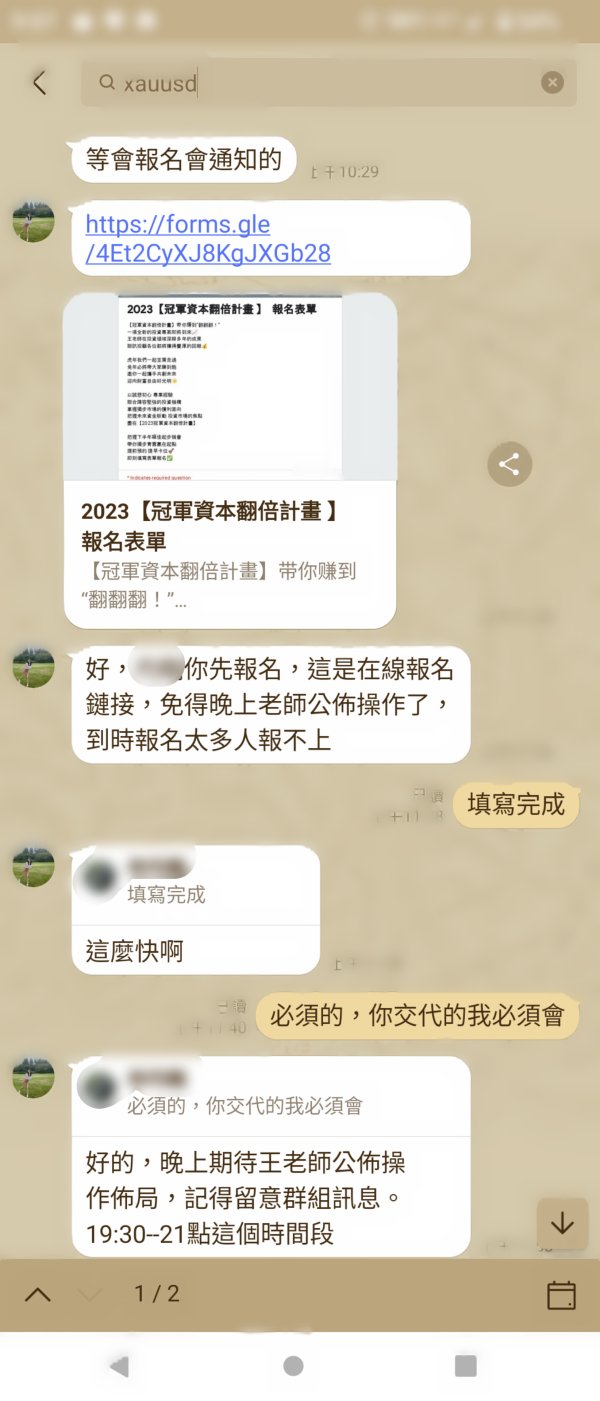

User experience analysis reveals significant concerns about overall satisfaction with Qointech's services. Available feedback indicates predominantly negative user experiences, with low trust scores and warning flags from industry watchdogs. The 25% trust rating suggests that the majority of users who have interacted with the broker have experienced unsatisfactory outcomes.

Interface design and usability cannot be properly assessed due to limited technical information about the trading platforms and user interfaces. Modern traders expect intuitive, responsive, and feature-rich trading environments that support efficient decision-making and trade execution.

Registration and verification processes are not detailed in available documentation. This creates uncertainty about onboarding experiences. Legitimate brokers typically provide clear information about account opening procedures, verification requirements, and activation timelines.

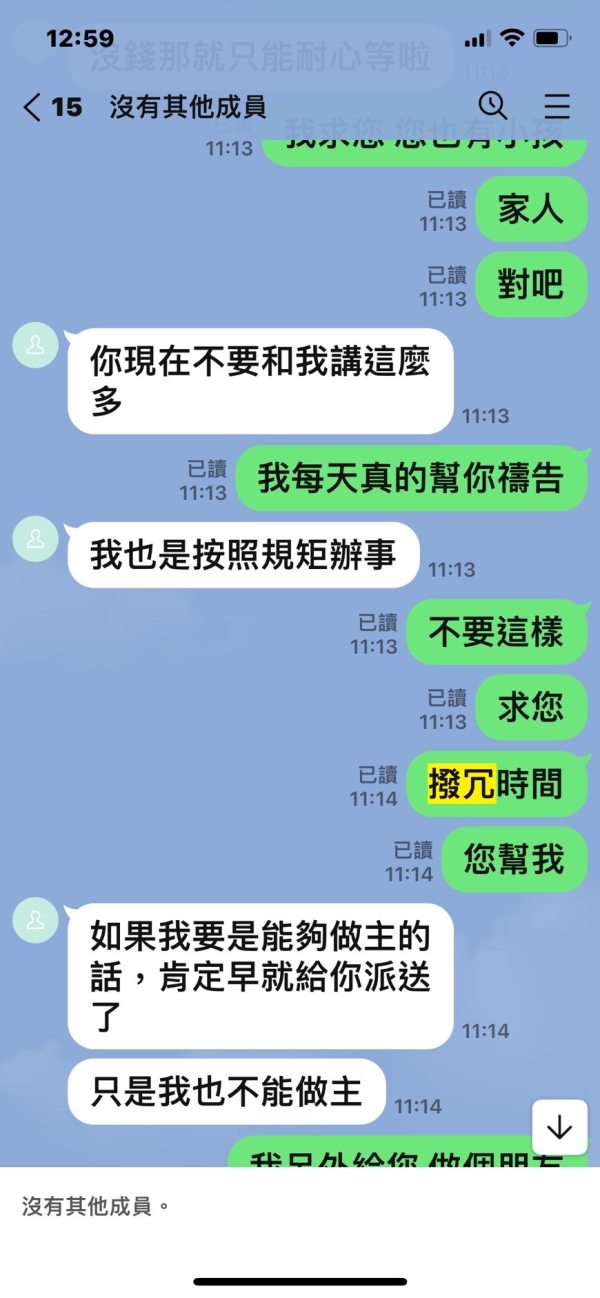

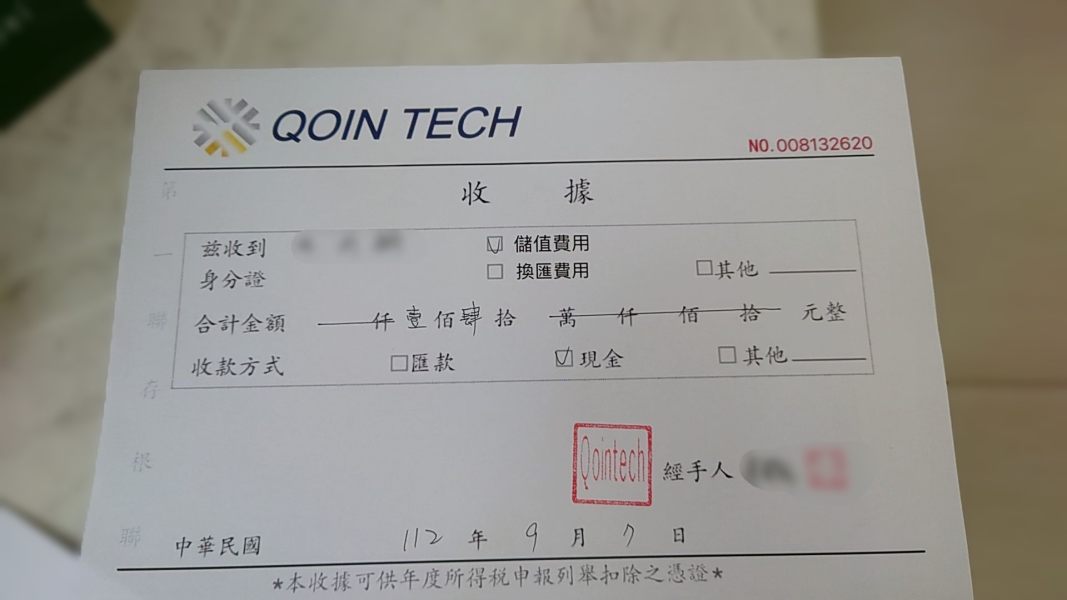

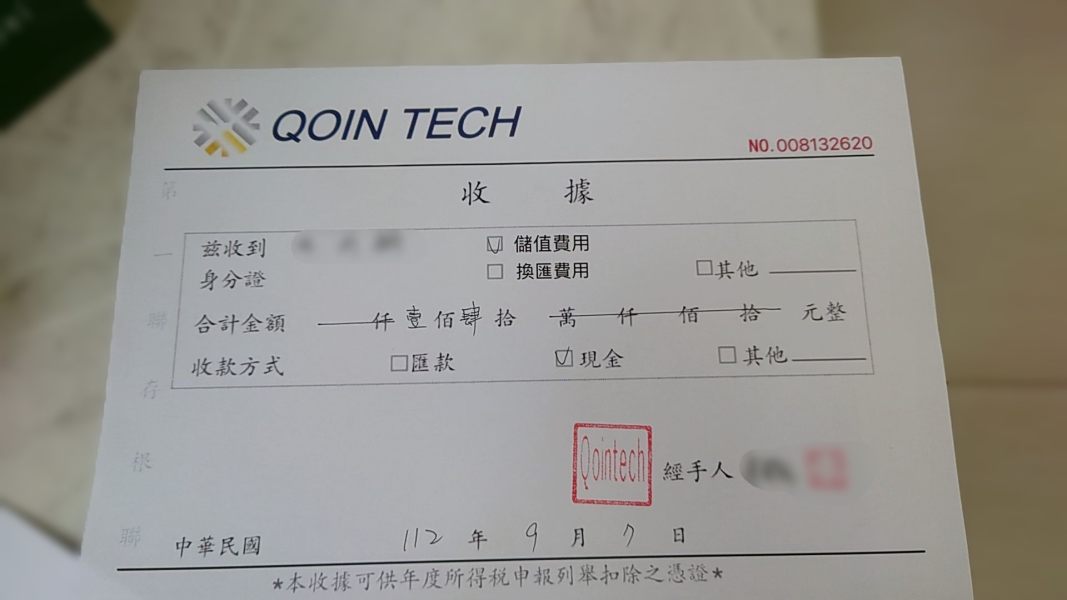

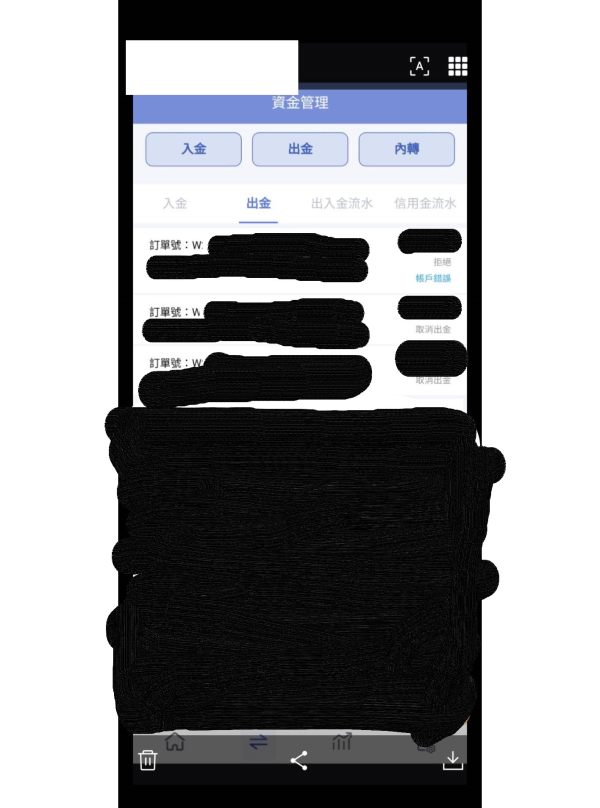

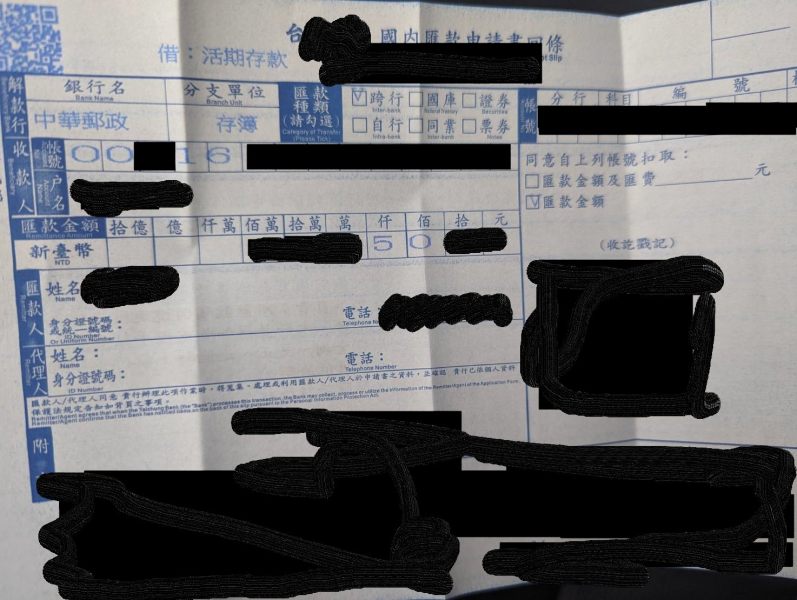

Fund operation experiences are not specifically documented, though the negative user feedback suggests potential issues with financial transactions and fund accessibility. Common user complaints appear to center around trust and security concerns, though specific complaint categories are not detailed in available sources. The pattern of negative feedback and low trust scores suggests systemic issues with service delivery and client satisfaction.

Conclusion

This comprehensive qointech review reveals significant concerns about the broker's legitimacy, regulatory compliance, and overall trustworthiness. Operating without proper regulatory authorization creates substantial risks for potential traders, as there are no investor protections or oversight mechanisms to ensure fair practices and fund security.

The broker may only be suitable for traders with extremely high risk tolerance who fully understand the implications of trading with unregulated entities. However, given the numerous red flags including low trust scores, negative user feedback, and lack of transparency, most traders would be better served by choosing regulated alternatives with proper oversight and investor protections.

The primary disadvantages significantly outweigh any potential benefits. Major concerns include regulatory absence, limited transparency, poor user trust scores, and insufficient operational details. Potential users should exercise extreme caution and thoroughly consider the substantial risks before engaging with this broker.