Morpher 2025 Review: Everything You Need to Know

Summary

Morpher stands out as an impressive decentralized trading platform. It eliminates traditional intermediaries through innovative blockchain technology that revolutionizes how investors access financial markets. This morpher review reveals a platform built on Ethereum. The platform offers zero commission trading across multiple asset classes, making it particularly attractive for modern investors seeking cost-effective trading solutions.

The platform's key highlights include zero trading fees, support for fractional trading, and access to diverse asset categories. These categories range from traditional stocks and forex to cryptocurrencies, NFTs, and luxury goods. According to Cryptowisser reports, Morpher provides unlimited liquidity through its unique protocol design. This allows users to trade with leverage up to 10x without the typical constraints of traditional brokerages.

Morpher primarily targets innovative investors who want to explore new trading paradigms. This includes forex traders seeking lower costs, cryptocurrency enthusiasts looking for diverse asset exposure, and stock traders interested in fractional ownership opportunities. The platform's decentralized nature appeals to users who prefer greater control over their trading activities. They benefit from reduced fees and enhanced accessibility.

Important Notice

Regional Entity Differences: Morpher operates as a decentralized platform. It does not mention traditional regulatory oversight in available documentation. Users should independently verify the legal compliance requirements in their respective jurisdictions before engaging with the platform. Regulatory frameworks for decentralized trading platforms vary significantly across different regions.

Review Methodology: This evaluation is based on available platform documentation and user feedback from various review platforms. It also includes technical analysis of the platform's features as reported by cryptocurrency exchange review sites including Cryptowisser and other industry sources.

Rating Framework

Broker Overview

Morpher represents a new generation of decentralized trading platforms. It fundamentally reimagines how financial markets operate through innovative blockchain technology and synthetic asset creation. The platform eliminates traditional intermediaries by leveraging Ethereum blockchain technology to create synthetic assets that mirror real-world market movements. This innovative approach allows Morpher to offer zero commission trading while providing access to an unprecedented range of asset classes. These would typically require multiple different brokerages or investment platforms.

The company's business model centers on creating a truly decentralized trading environment. Users maintain greater control over their investments while benefiting from reduced costs and enhanced accessibility. Unlike traditional brokers that rely on order books and market makers, Morpher uses smart contracts to generate infinite liquidity. This ensures that users can always execute trades regardless of market conditions or trading volumes.

Morpher's platform supports an extensive range of tradeable assets. These include traditional stocks, cryptocurrencies, forex pairs, commodities, and unique offerings like NFTs and luxury goods. This comprehensive morpher review indicates that the platform caters to diverse trading preferences while maintaining a unified, streamlined trading experience across all asset categories. The experience is delivered through its Ethereum-based infrastructure.

Regulatory Jurisdiction: Available documentation does not specify traditional regulatory oversight. Morpher operates as a decentralized platform, so users should verify local compliance requirements independently.

Deposit and Withdrawal Methods: Specific deposit and withdrawal mechanisms are not detailed in current available documentation. The platform's Ethereum-based nature suggests cryptocurrency-focused funding methods.

Minimum Deposit Requirements: Exact minimum deposit amounts are not specified in available platform documentation.

Bonus and Promotions: No specific promotional offers or bonus programs are mentioned in current available information.

Tradeable Assets: The platform supports stocks, cryptocurrencies, forex, commodities, NFTs, luxury goods, and other synthetic assets. This provides one of the most diverse asset selections available on any single platform.

Cost Structure: Zero commission trading with no traditional trading fees. This allows users to benefit from full market exposure without typical brokerage costs eating into profits.

Leverage Options: Maximum leverage of 10x is available across supported asset categories. This provides enhanced trading opportunities while maintaining risk management protocols.

Platform Options: Ethereum-based trading platform providing unlimited liquidity through smart contract technology. This ensures consistent trade execution regardless of market conditions.

Geographic Restrictions: Specific regional limitations are not detailed in available documentation.

Customer Service Languages: Supported languages for customer service are not specified in current available information.

This morpher review highlights the platform's focus on innovation and cost reduction. Some traditional broker features may require additional clarification directly from the platform.

Detailed Rating Analysis

Account Conditions Analysis (8/10)

Morpher's account structure represents a significant departure from traditional brokerage models. It offers compelling advantages for cost-conscious traders who want to minimize transaction expenses. The platform's zero commission structure eliminates one of the most significant barriers to frequent trading, making it particularly attractive for active traders and those implementing strategies that require multiple transactions. The fractional trading capability allows investors with smaller capital bases to access expensive assets. These would otherwise be prohibitive for many retail investors.

User feedback indicates strong satisfaction with the account accessibility and cost structure. Many highlight the platform's ability to democratize access to diverse asset classes. The absence of traditional account tiers or minimum balance requirements creates an egalitarian trading environment where all users receive the same benefits regardless of their investment size.

Compared to traditional brokers that typically charge commissions ranging from $5-$15 per trade, Morpher's zero-fee structure can result in substantial savings over time. This morpher review finds the account conditions particularly beneficial for investors who value cost efficiency and asset diversity over traditional broker services like research reports or dedicated account management.

However, the lack of detailed information about account opening procedures and verification requirements represents an area where potential users may need additional clarification. They should seek this information before committing to the platform.

The platform's Ethereum-based infrastructure provides a robust foundation for trading multiple asset categories through a single interface. Morpher's synthetic asset creation technology represents an innovative approach to market access, allowing users to gain exposure to assets that might be difficult or expensive to access through traditional channels. The unlimited liquidity feature ensures consistent trade execution. This addresses one of the common frustrations with smaller or newer trading platforms.

User feedback suggests satisfaction with the platform's functionality and innovative features. Specific details about advanced trading tools, charting capabilities, or analytical resources are not extensively documented in available sources. The platform's focus on decentralization and cost reduction may mean that some traditional broker tools are either unavailable or implemented differently than users might expect.

The multi-asset support spanning traditional securities, cryptocurrencies, and alternative investments like NFTs and luxury goods provides unique diversification opportunities. These are not typically available through conventional brokers. This breadth of options appeals to investors seeking exposure to emerging asset classes or those looking to consolidate their trading activities on a single platform.

Educational resources and research tools are not specifically detailed in current documentation. This may be a consideration for newer investors who rely heavily on broker-provided guidance and market analysis.

Customer Service and Support Analysis (6/10)

Available documentation does not provide comprehensive details about customer service channels, response times, or support quality metrics. This lack of transparency around customer support represents a potential concern for users who prioritize responsive customer service. It may also concern those who may need assistance with platform-specific features or technical issues.

The decentralized nature of the platform may result in a different support model compared to traditional brokers. It potentially relies more on community resources, documentation, or automated systems rather than traditional call centers or live chat support. This approach may appeal to tech-savvy users who prefer self-service options but could be challenging for those who value direct human support.

Without specific information about multilingual support, users in non-English speaking regions may face additional challenges when seeking assistance. The absence of documented service level agreements or response time commitments makes it difficult to assess whether the platform can provide adequate support for time-sensitive trading issues.

Users considering the platform should factor in the potential for limited traditional customer support. They should evaluate whether Morpher aligns with their service expectations and technical comfort level.

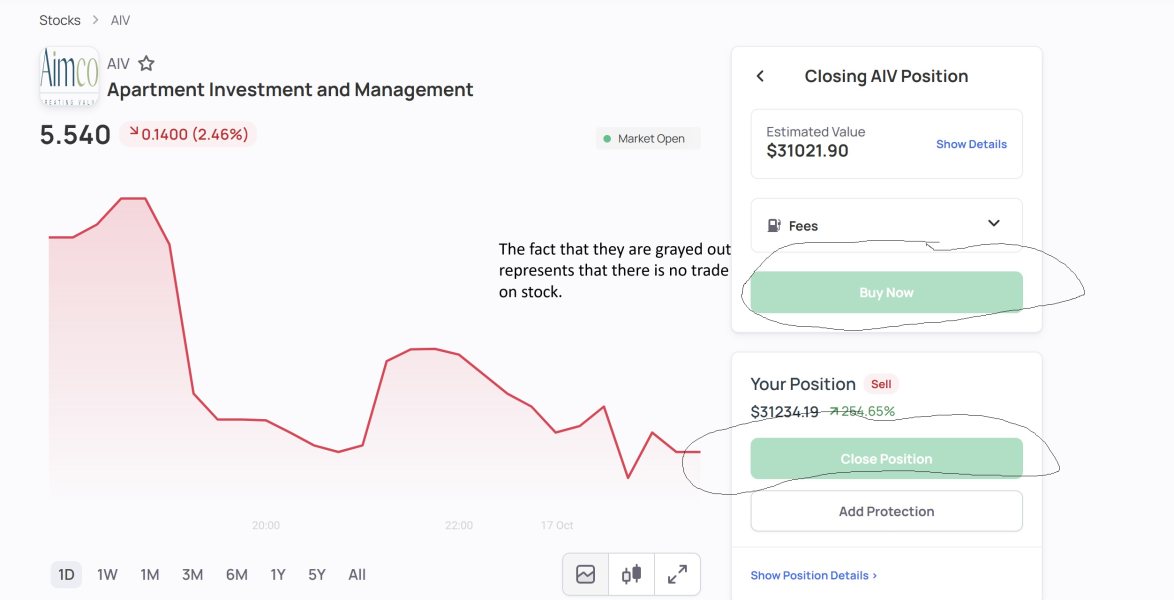

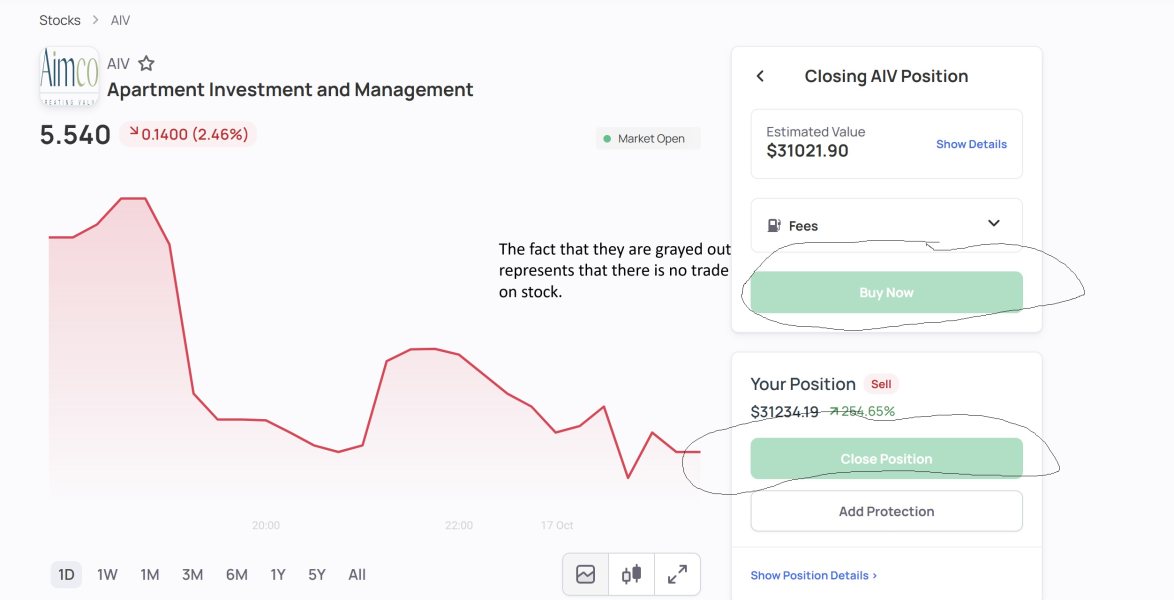

Trading Experience Analysis (8/10)

User reports suggest positive experiences with platform liquidity and stability. The unlimited liquidity feature is particularly well-received by traders who value consistent execution. The ability to trade diverse asset classes through a single platform streamlines the trading experience and reduces the complexity of managing multiple broker relationships. The zero-commission structure enhances the overall value proposition by allowing traders to focus on market movements rather than transaction costs.

The platform's Ethereum-based infrastructure provides transparency and security benefits that appeal to users familiar with blockchain technology. The synthetic asset model allows for creative trading strategies and access to markets that might otherwise be restricted or expensive to enter through traditional channels.

However, specific performance metrics such as execution speeds, slippage rates, or platform uptime statistics are not detailed in available documentation. The absence of information about mobile trading capabilities may be a consideration for users who prioritize on-the-go trading access.

This morpher review indicates that while the core trading experience appears solid based on user feedback, potential users should verify that the platform's unique approach aligns with their specific trading needs. They should also confirm technical requirements before committing significant capital.

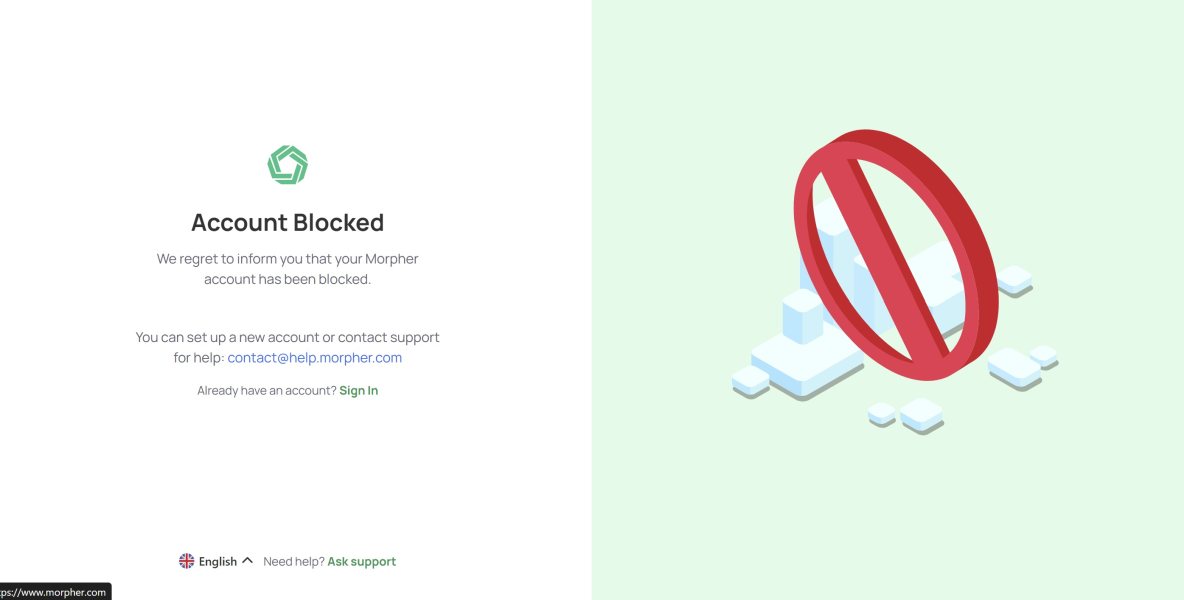

Trust Score Analysis (6/10)

The platform's trust evaluation is complicated by the lack of traditional regulatory oversight information in available documentation. While decentralized platforms offer certain advantages in terms of user control and transparency, the absence of conventional regulatory backing may concern users who prioritize traditional financial oversight and protection mechanisms.

The Ethereum-based infrastructure provides inherent transparency through blockchain technology. This allows users to verify transactions and platform operations independently. This technical transparency can be viewed as an alternative form of oversight for users comfortable with blockchain verification methods.

User trust feedback indicates a moderate confidence level of 67. This suggests that while users appreciate the platform's innovative features, some concerns exist regarding the overall risk profile. The lack of detailed information about security measures, fund protection protocols, or dispute resolution procedures contributes to uncertainty around the platform's risk management framework.

Potential users should carefully consider their comfort level with decentralized platforms and blockchain-based trading before committing funds. This is particularly important if they prioritize traditional regulatory protections and established dispute resolution mechanisms.

User Experience Analysis (7/10)

Overall user satisfaction appears positive. Users appreciate the platform's innovative features and cost structure. The ability to access diverse asset classes through a unified interface simplifies portfolio management and reduces the complexity associated with maintaining multiple trading accounts across different platforms.

The platform's focus on democratizing access to various asset classes resonates well with users seeking alternatives to traditional financial services. The zero-commission model and fractional trading capabilities particularly appeal to cost-conscious investors and those with smaller initial capital amounts.

However, the absence of detailed information about user interface design, registration processes, or fund management procedures makes it difficult to fully assess the platform's ease of use for newcomers. The innovative nature of the platform may require a learning curve for users accustomed to traditional broker interfaces and procedures.

User feedback suggests that while the platform offers compelling features, some aspects may benefit from additional clarity or documentation. This would help users fully understand and utilize the available capabilities. The platform appears best suited for users who value innovation and cost savings over traditional broker services and support structures.

Conclusion

Morpher emerges as an innovative decentralized trading platform that successfully addresses key pain points in traditional trading. It achieves this through zero-commission transactions and diverse asset access. The platform's Ethereum-based infrastructure and synthetic asset model create unique opportunities for cost-conscious investors seeking exposure to multiple asset classes through a single interface.

The platform is particularly well-suited for innovative investors comfortable with blockchain technology. It also appeals to active traders seeking to minimize transaction costs, and those interested in accessing alternative asset classes like NFTs and luxury goods alongside traditional securities and cryptocurrencies.

Key advantages include the elimination of trading commissions, unlimited liquidity provision, and unprecedented asset diversity. However, potential drawbacks involve limited traditional regulatory oversight information, unclear customer support structures, and the need for users to be comfortable with decentralized platform operations. Investors should carefully weigh these factors against their individual trading needs and risk tolerance when considering Morpher as their trading platform.