Maono Global Markets 2025 Review: Everything You Need to Know

Executive Summary

This maono global markets review gives you a complete look at the South Africa-based online trading platform that has caught attention in the forex community. Based on user feedback and market data we found, Maono Global Markets shows both good and bad points for traders who might want to use it. The broker offers competitive spreads starting from 1 pip and high leverage up to 1:500. This appeals to traders who want aggressive trading conditions. With a user rating of 4.5, the platform shows decent customer satisfaction levels.

But our review found big concerns about regulatory transparency. Specific licensing information stays unclear in the documents we could find. The platform serves mainly traders who want high leverage opportunities and competitive pricing structures. It operates through the MT5 trading platform across multiple asset classes including forex, indices, and stocks. Maono Global Markets does not provide services to US investors, which limits how many people can use it worldwide. This review aims to give balanced insights for traders thinking about this broker. We weigh both the attractive trading conditions and the regulatory uncertainties that may hurt investor confidence.

Important Disclaimers

Regional Entity Differences: Maono Global Markets operates with geographical restrictions and does not offer services to United States investors. Traders from different places may experience different service levels and regulatory protections depending on where they live.

Review Methodology: This evaluation uses publicly available user feedback, market information, and official broker communications. Due to limited regulatory transparency in available sources, some assessments rely on user experiences rather than verified regulatory documentation. Potential traders should do independent research and consider getting professional advice before making investment decisions with any broker.

Rating Framework

Broker Overview

Maono Global Markets operates as an online trading platform headquartered in South Africa. It positions itself in the competitive forex and CFD trading market. According to available information, the company focuses on giving traders access to global financial markets through modern trading technology and competitive pricing structures. The broker says it commits to helping both new and experienced traders achieve their financial goals through complete market access and professional support services.

The platform's business model centers on offering online trading services across multiple asset classes. It puts particular emphasis on forex trading. Maono Global Markets promotes itself as a trusted broker dedicated to providing unmatched market access, though specific establishment dates and detailed company history remain unclear in available documentation. The broker's team reportedly consists of experienced professionals committed to delivering best-in-class resources and support for informed trading decisions.

Regarding trading infrastructure, maono global markets review data shows the broker operates through the MetaTrader 5 (MT5) platform. This provides traders with access to advanced trading tools and analytical capabilities. The available asset portfolio includes foreign exchange pairs, stock indices, and individual equity instruments, offering diversification opportunities for different trading strategies. However, specific regulatory oversight information remains notably absent from readily available sources. This represents a significant consideration for potential clients evaluating the broker's credibility and operational transparency.

Regulatory Jurisdiction: Available documentation does not specify particular regulatory authorities overseeing Maono Global Markets operations. This represents a significant information gap for potential traders seeking regulatory assurance.

Deposit and Withdrawal Methods: Specific information regarding available funding options, processing times, and associated fees is not detailed in accessible sources.

Minimum Deposit Requirements: The minimum initial deposit amount required to open trading accounts remains unspecified in available materials.

Bonus and Promotional Offers: Current promotional campaigns, welcome bonuses, or ongoing incentive programs are not mentioned in accessible broker information.

Tradeable Assets: The platform provides access to foreign exchange currency pairs, stock market indices, and individual equity securities across multiple global markets.

Cost Structure: Spreads begin from 1 pip according to user feedback. Commission structures, overnight financing rates, and additional fees require clarification from the broker directly.

Leverage Ratios: Maximum leverage reaches 1:500, appealing to traders seeking higher position sizing relative to account capital.

Platform Options: MetaTrader 5 serves as the primary trading interface. It offers advanced charting, automated trading capabilities, and comprehensive market analysis tools.

Geographic Restrictions: United States residents cannot access Maono Global Markets services.

Customer Support Languages: Specific language support options are not detailed in available information sources.

This maono global markets review highlights the need for prospective traders to request detailed information directly from the broker regarding missing specifications.

Detailed Rating Analysis

Account Conditions Analysis (6/10)

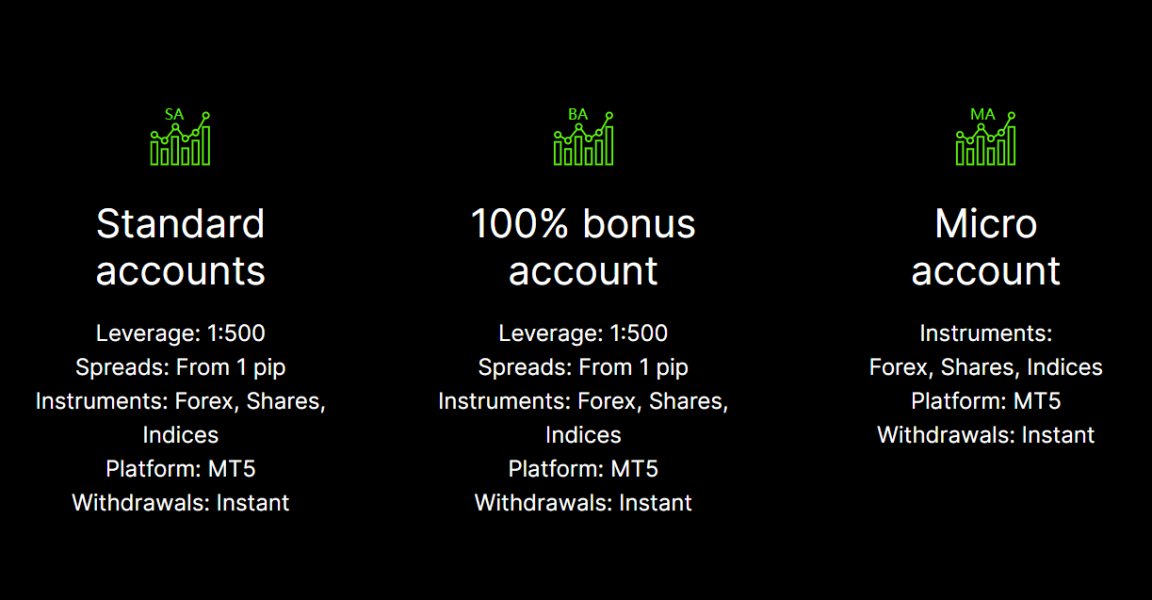

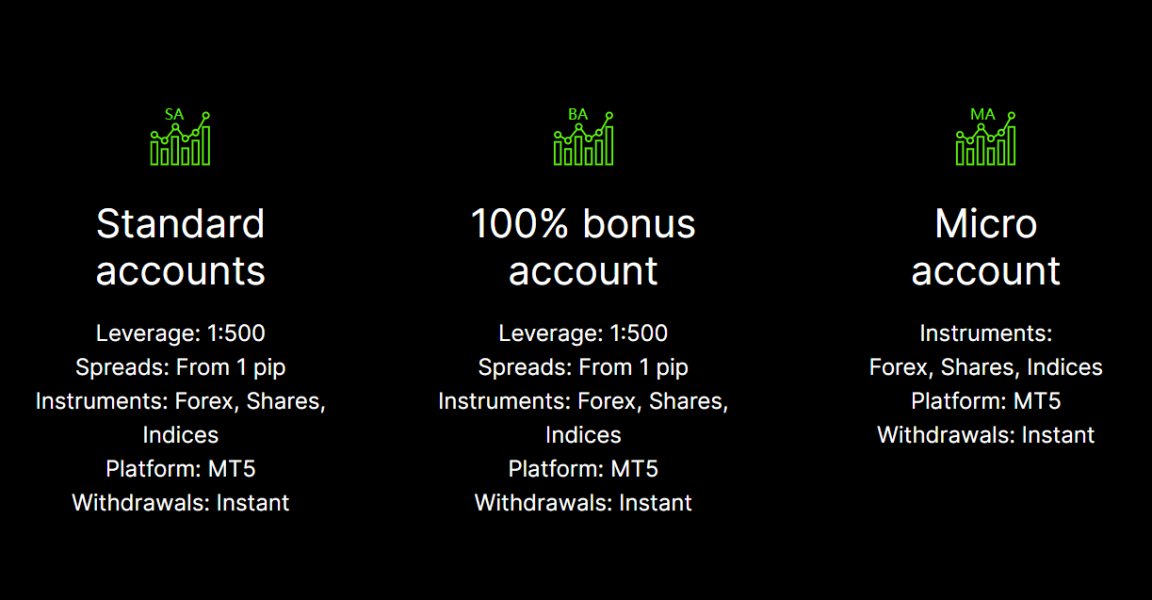

Account opening conditions at Maono Global Markets present a mixed evaluation scenario. The broker offers attractive leverage ratios reaching 1:500, which significantly exceeds standard retail forex broker offerings. This appeals to traders seeking maximum position sizing flexibility. Spread structures beginning from 1 pip demonstrate competitive pricing, particularly for major currency pairs, though specific account tier differences remain unclear in available documentation.

However, critical information gaps significantly impact the overall account conditions assessment. Minimum deposit requirements are not specified in accessible sources. This makes it difficult for potential traders to plan their initial investment. Account type variations, if any exist, lack detailed explanation regarding features, benefits, or eligibility criteria. Special account options such as Islamic swap-free accounts for religious compliance are not mentioned in available materials.

The absence of detailed account opening procedures, required documentation, and verification timelines further complicates the evaluation process. User feedback does not provide comprehensive insights into the practical experience of establishing trading accounts. This leaves prospective clients without clear expectations regarding onboarding processes.

Additionally, account maintenance fees, inactivity charges, or minimum trading volume requirements remain unspecified. These represent potential hidden costs that could affect long-term trading profitability. This maono global markets review emphasizes the importance of obtaining complete account terms and conditions directly from the broker before proceeding with registration.

Maono Global Markets provides trading infrastructure through the MetaTrader 5 platform. This represents a solid foundation for technical analysis and trade execution. MT5 offers advanced charting capabilities, multiple timeframe analysis, custom indicator support, and automated trading through Expert Advisors, meeting the technical requirements of both manual and algorithmic traders.

The asset selection encompasses forex currency pairs, stock indices, and individual equity securities. This provides reasonable diversification opportunities across different market sectors. This multi-asset approach allows traders to implement various strategies and hedge positions across correlated instruments, though specific instrument counts and market coverage details require clarification.

However, significant information gaps exist regarding additional trading resources that modern traders typically expect. Educational materials, market research reports, economic calendars, and trading webinars are not mentioned in available sources. The absence of proprietary analysis tools, trading signals, or market commentary represents a potential disadvantage compared to full-service brokers offering comprehensive research departments.

Furthermore, mobile trading capabilities, while likely available through standard MT5 mobile applications, lack specific mention regarding broker customization or additional mobile features. Social trading, copy trading, or portfolio management tools are not referenced in accessible documentation. This limits options for traders seeking automated or social trading experiences.

Customer Service and Support Analysis (8/10)

User feedback consistently highlights excellent customer service quality as a notable strength of Maono Global Markets. The 4.5 user rating partly reflects positive experiences with support team responsiveness and problem-solving capabilities. This suggests the broker prioritizes customer relationship management and issue resolution.

Available user testimonials indicate satisfaction with support team knowledge and willingness to assist with trading-related inquiries. This positive feedback suggests that when traders encounter technical difficulties, account questions, or general trading support needs, the customer service team demonstrates competency in addressing these concerns effectively.

However, specific operational details regarding customer support infrastructure remain unclear. Available contact methods, response time guarantees, support hours, and multilingual capabilities are not detailed in accessible sources. The absence of information regarding live chat availability, telephone support, email response times, or ticket system efficiency makes it difficult to set appropriate expectations for support experiences.

Additionally, escalation procedures for complex issues, dedicated account management for larger clients, or specialized technical support for platform difficulties are not mentioned in available documentation. While user feedback suggests positive experiences, the lack of transparent support policies and service level commitments represents an area requiring direct clarification from the broker.

Trading Experience Analysis (7/10)

The overall trading experience at Maono Global Markets receives generally positive user feedback, particularly regarding spread competitiveness and platform functionality. Traders report satisfaction with the 1 pip starting spreads, which contribute to cost-effective trading, especially for high-frequency strategies or scalping approaches that require tight bid-ask differentials.

MetaTrader 5 platform stability appears adequate based on available user experiences, though specific performance metrics regarding execution speeds, server uptime, or slippage statistics are not provided in accessible sources. The platform's comprehensive analytical tools and automated trading capabilities support various trading styles and experience levels.

However, concerning feedback exists regarding profit withdrawal experiences, with documented user complaints about profit removal incidents. These allegations represent serious concerns about broker integrity and client fund handling, though specific circumstances, resolution outcomes, or broker responses to these complaints remain unclear in available information.

Additional trading experience factors such as requote frequency, order execution quality during high volatility periods, or weekend gap handling lack detailed user feedback or broker transparency. The absence of trading condition guarantees, execution policy documentation, or performance statistics makes it difficult to assess the consistency and reliability of the trading environment.

This maono global markets review emphasizes the importance of understanding complete trading terms and conditions, particularly regarding profit withdrawal procedures and dispute resolution mechanisms, before committing significant capital to the platform.

Trust and Reliability Analysis (5/10)

Trust and reliability assessment for Maono Global Markets faces significant challenges due to limited regulatory transparency in available documentation. The absence of specific regulatory authority oversight, license numbers, or compliance certifications represents a major concern for traders prioritizing regulatory protection and fund security.

While the broker maintains a 4.5 user rating suggesting general satisfaction, this positive feedback must be balanced against the lack of regulatory accountability and oversight mechanisms. Established regulatory frameworks typically provide investor protection schemes, dispute resolution procedures, and operational standards that are not clearly evident in Maono Global Markets' available information.

User complaints regarding profit removal incidents further impact the reliability assessment, particularly when combined with unclear regulatory status. These allegations, regardless of their resolution, highlight potential risks associated with fund security and withdrawal procedures that regulated brokers typically address through mandatory client fund segregation and regulatory oversight.

Company transparency regarding ownership structure, financial statements, regulatory compliance status, or operational history remains limited in accessible sources. The absence of third-party audits, regulatory reporting, or independent verification of business practices creates uncertainty about the broker's operational integrity and long-term stability.

Additionally, the lack of clear dispute resolution mechanisms, regulatory complaint procedures, or independent arbitration options leaves traders with limited recourse in case of disagreements or service issues. This significantly impacts the overall trust and reliability evaluation.

User Experience Analysis (6/10)

User experience evaluation reveals a complex picture combining positive satisfaction indicators with concerning negative feedback incidents. The 4.5 user rating suggests that many traders find the platform satisfactory for their trading needs, particularly appreciating the competitive spreads and customer service quality that contribute to positive overall experiences.

The MetaTrader 5 interface provides familiar functionality for experienced traders while offering comprehensive tools for market analysis and trade management. Platform accessibility and standard MT5 features likely contribute to user satisfaction, though specific customization options or broker-enhanced features are not detailed in available sources.

However, documented complaints regarding profit removal significantly impact the user experience assessment, as these incidents create uncertainty about fund security and withdrawal reliability. Such concerns can overshadow positive platform features and customer service experiences, particularly for traders prioritizing capital safety and withdrawal guarantees.

Registration and account verification processes lack detailed user feedback, making it difficult to assess onboarding efficiency and user-friendliness. Similarly, funding and withdrawal experiences beyond the mentioned complaints require additional user testimonials for comprehensive evaluation.

The broker appears most suitable for traders seeking high leverage opportunities and competitive spreads while accepting higher risk tolerance regarding regulatory oversight. However, traders prioritizing regulatory protection, transparent fund handling, and comprehensive dispute resolution mechanisms may find the platform less suitable for their risk management requirements.

Conclusion

This maono global markets review concludes that the broker presents a mixed proposition for potential traders. While competitive spreads starting from 1 pip, high leverage up to 1:500, and generally positive customer service feedback create attractive trading conditions, significant concerns regarding regulatory transparency and documented user complaints about profit removal cannot be overlooked.

The platform appears most suitable for experienced traders with higher risk tolerance who prioritize aggressive trading conditions over regulatory assurance. However, traders seeking comprehensive regulatory protection, transparent fund handling procedures, and established dispute resolution mechanisms may find more suitable alternatives in the heavily regulated broker segment.

Key advantages include competitive pricing structures and responsive customer support, while primary disadvantages center on regulatory uncertainty and concerning withdrawal-related complaints that require careful consideration before account opening.