JRFX Review 2

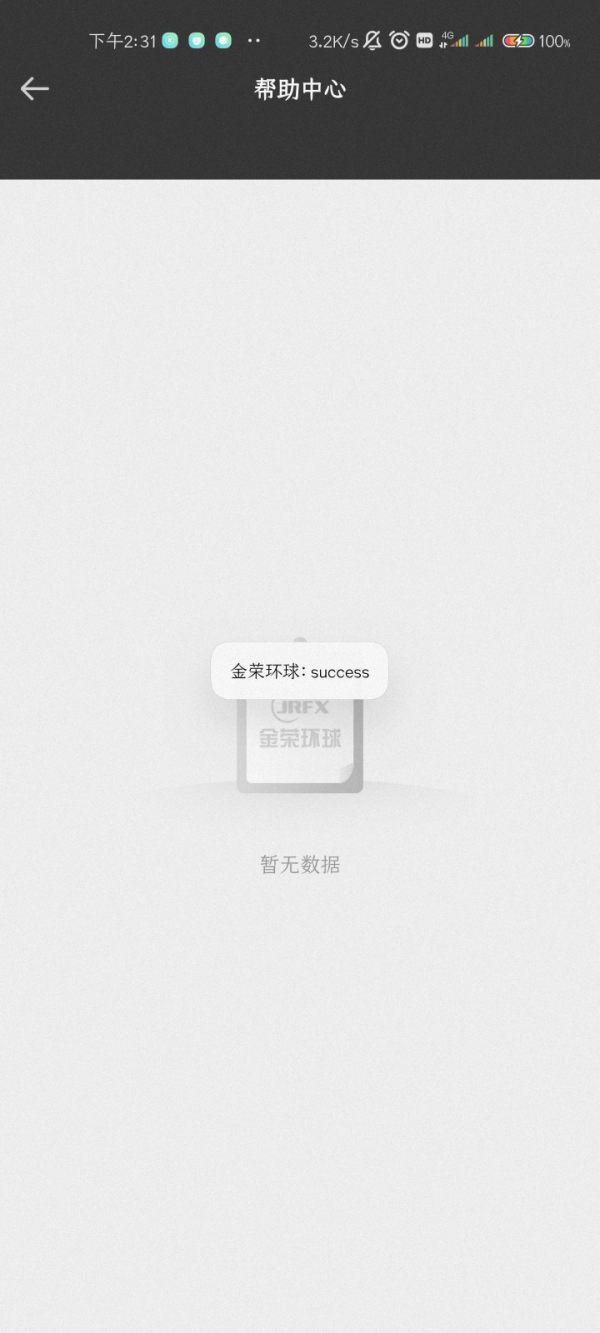

Can't log in, it shows network connection problem, stay away from scammers, don't be deceived

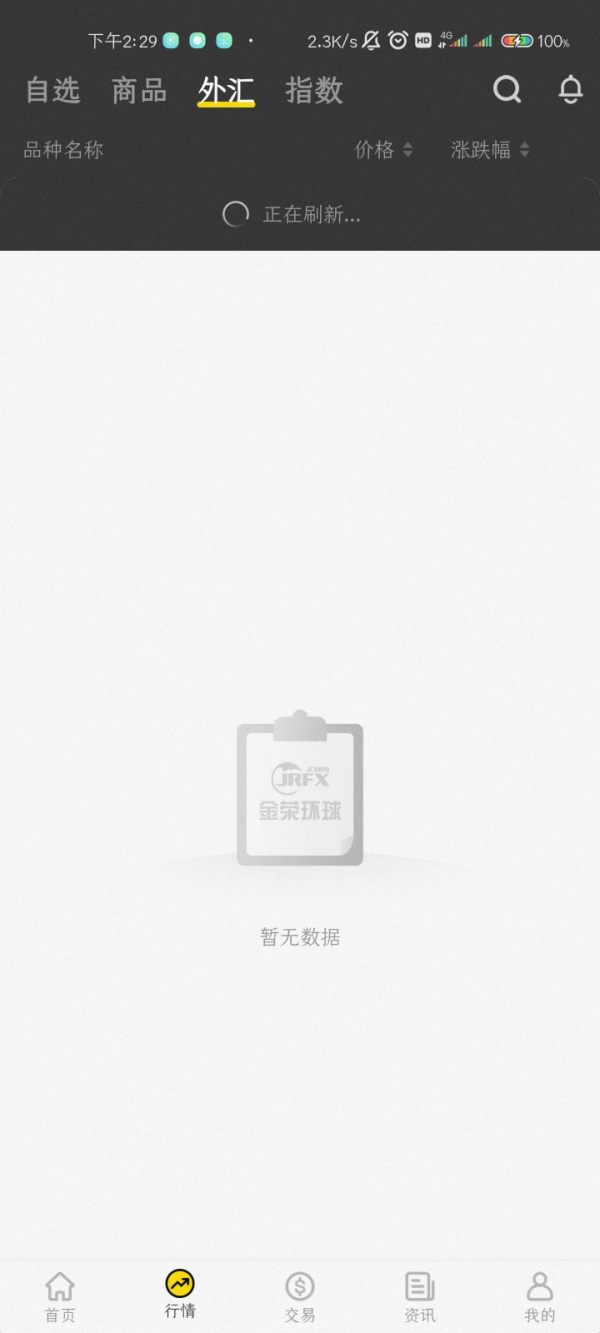

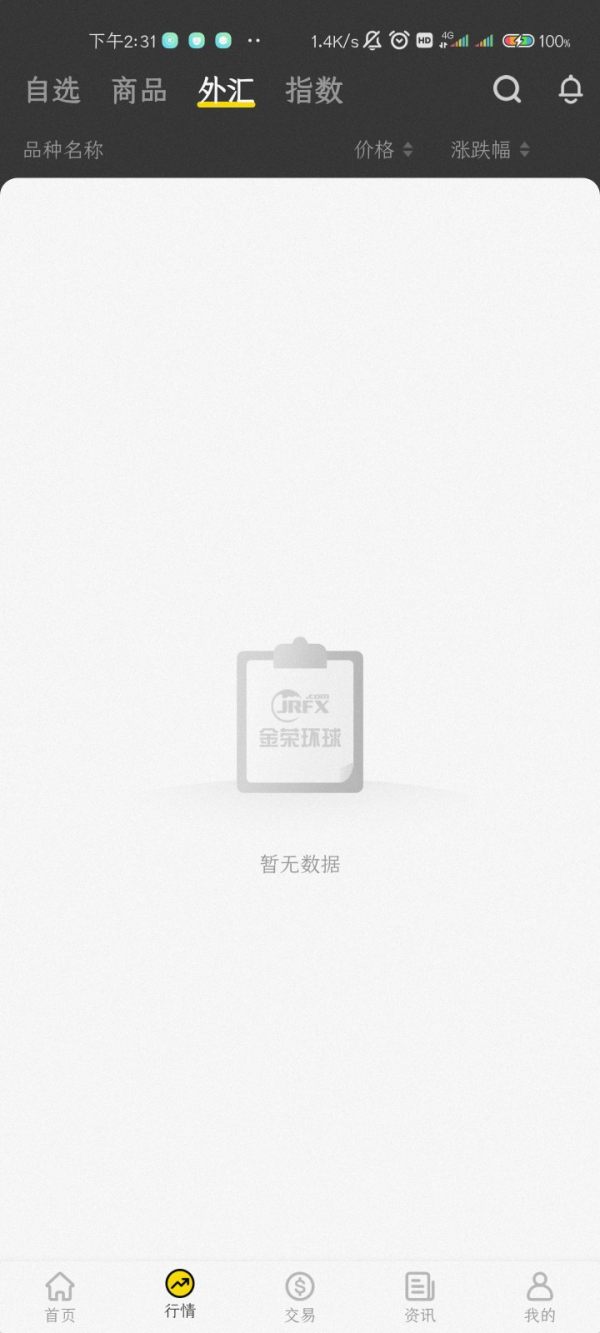

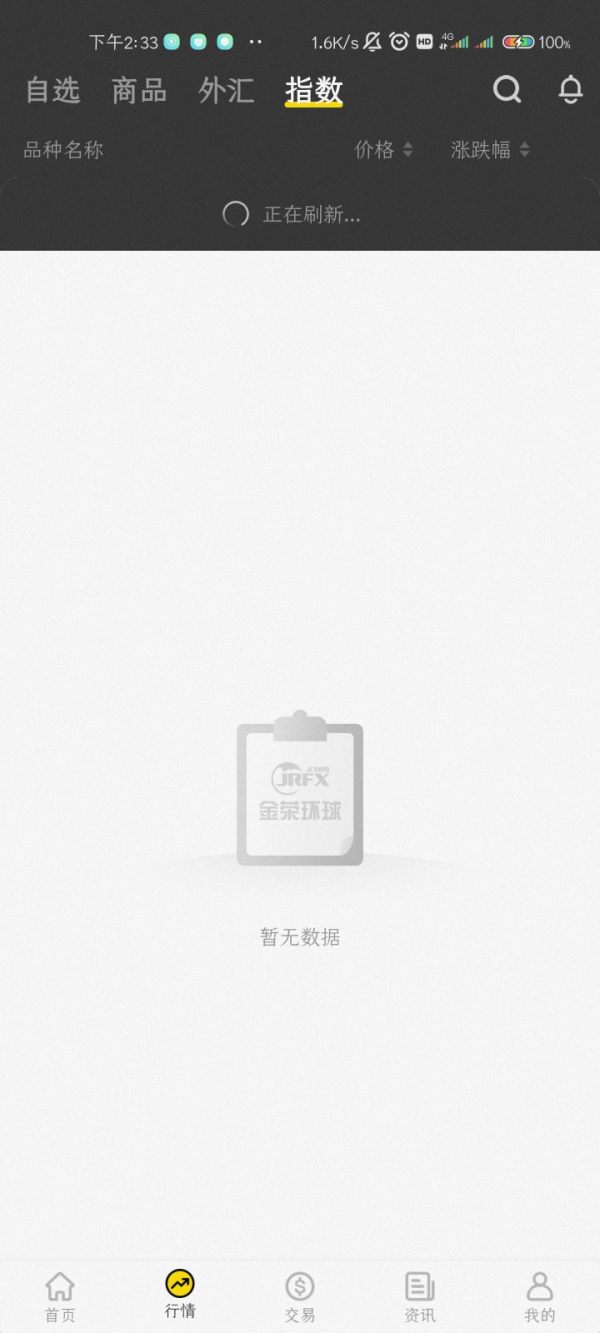

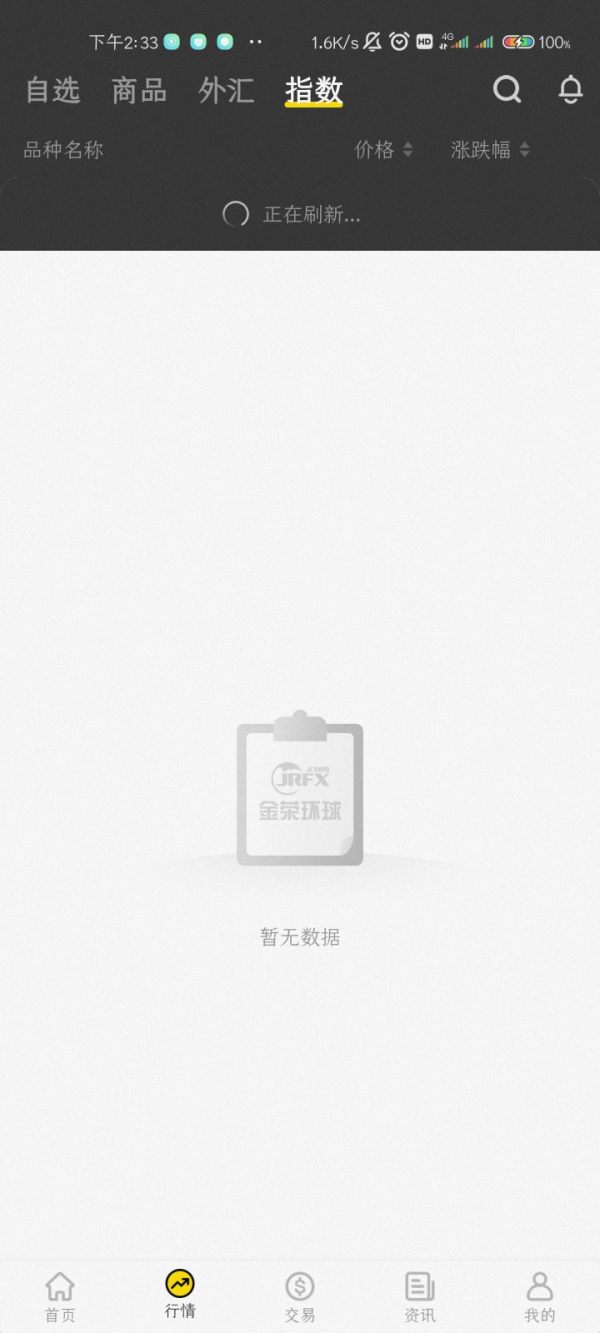

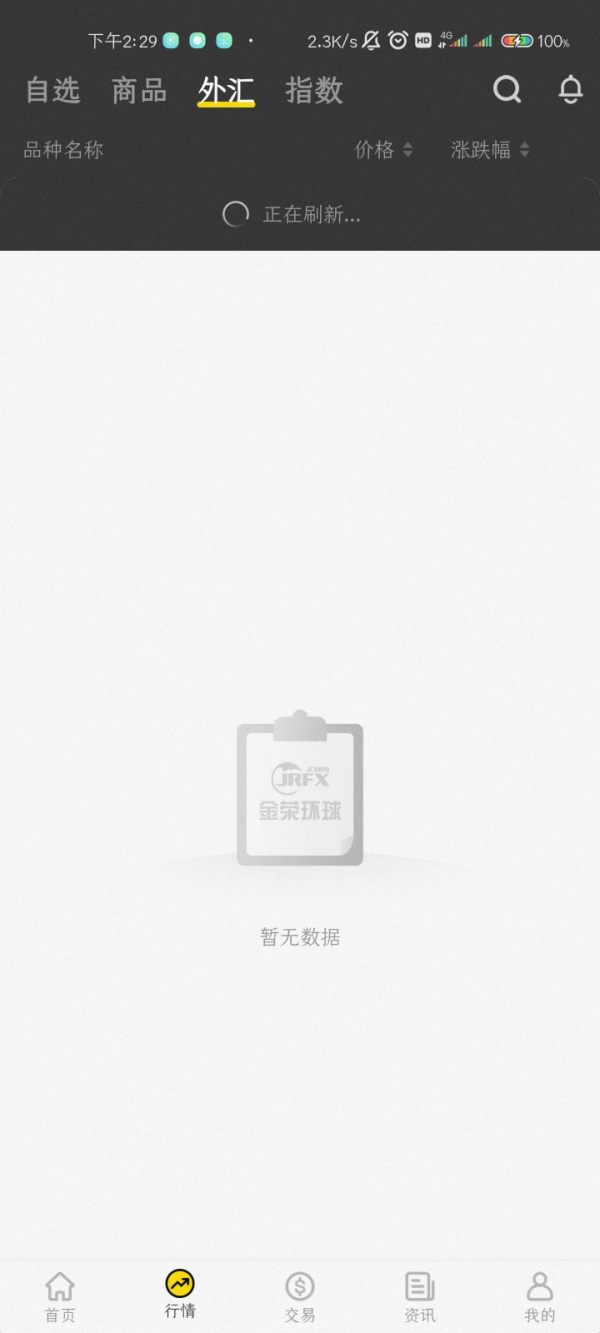

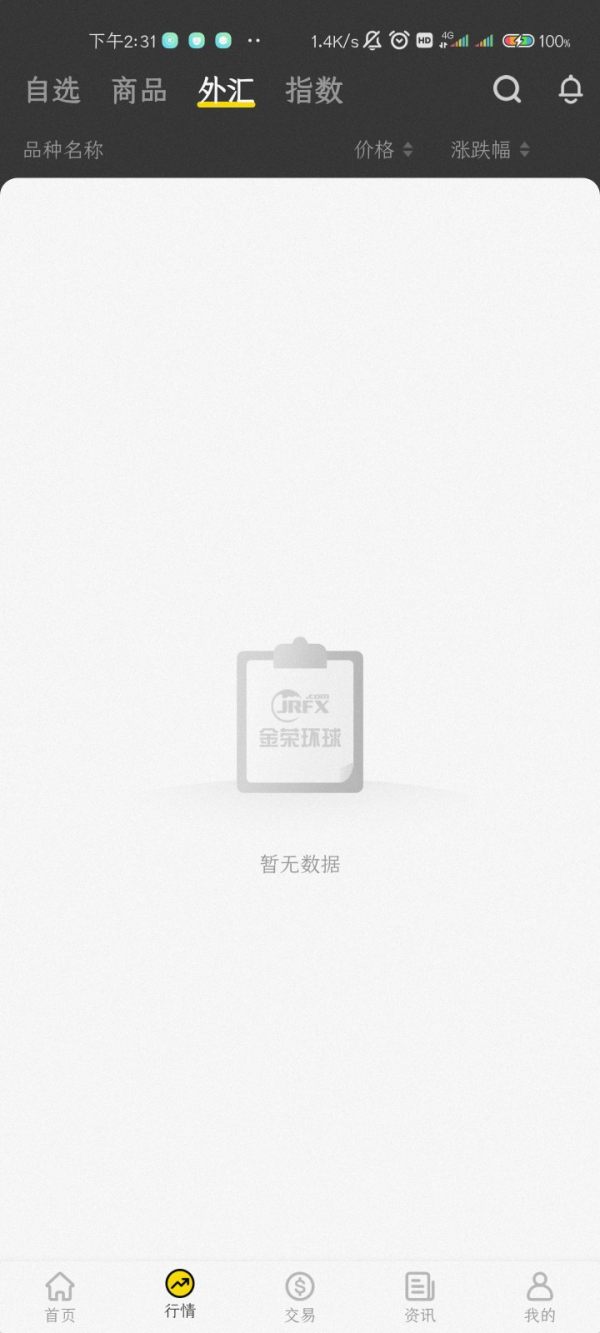

APP cannot be logged in normally and does not show the market information. Is the platform absconded with fund?

JRFX Forex Broker provides real users with * positive reviews, * neutral reviews and 2 exposure review!

Business

License

Can't log in, it shows network connection problem, stay away from scammers, don't be deceived

APP cannot be logged in normally and does not show the market information. Is the platform absconded with fund?

The jrfx review shows jrfx as a safe and reliable global CFD trading platform. The platform has gained recognition for its transparent and high-quality service provision, though there's room for improvement. With an overall user TrustScore of 2.9 based on 14 reviews, the platform's performance is neutral but shows promising features for traders.

Notably, jrfx requires a minimum deposit of only $1 USD. This makes it particularly attractive for beginners who want to start trading without a large investment. Additionally, the platform offers an impressive maximum leverage of 1:1000, which is ideal for traders looking to exploit high-leverage trading opportunities.

As a result, jrfx is positioned as an accessible entry point for novice investors. It also caters to those interested in aggressive trading strategies with its high leverage options. Owing to its regulation by multiple governing bodies including the FCA, FSP, BVIFSC, and DMCC, jrfx offers an added layer of security and credibility in the dynamic world of CFD trading.

It is important to note that jrfx is regulated by multiple agencies such as the FCA, FSP, BVIFSC, and DMCC. There may be variations in trading conditions and regulatory requirements across different regions. Hence, traders should be aware that the experience and specific regulations imposed might differ based on their geographic location.

This review has been carefully compiled based on a combination of user feedback, regulatory information, and market data analysis. While every effort has been made to ensure the accuracy of the information presented, potential clients should verify details with jrfx directly, as certain features may not be uniformly available worldwide.

| Dimension | Score | Rating Basis |

|---|---|---|

| Account Conditions | 8/10 | The platform's minimum deposit of $1 USD makes it accessible for beginners. |

| Tools and Resources | 6/10 | Provides a MetaTrader 4 platform with access to forex, commodities, indices, and cryptocurrencies, though detailed tools information is limited. |

| Customer Service & Support | 5/10 | Limited user feedback on customer support quality makes this area less transparent. |

| Trading Experience | 7/10 | The trading experience is average with neutral user feedback; further data on execution quality is needed. |

| Trust | 6/10 | While the broker is regulated by multiple authorities, the overall user rating and transparency issues lower the trust score. |

| User Experience | 6/10 | A TrustScore of 2.9 indicates that while functional, there is significant room for improvement. |

jrfx is a London-based online forex and cryptocurrency broker that offers global market access through its CFD trading services. Although the specific founding year is not disclosed in the available information, the company has established itself as a reliable intermediary for a diverse range of asset classes. The platform focuses on providing transparent and high-quality services with a strong commitment to offering low entry barriers for new traders.

With its competitive minimum deposit of just $1 USD and an ultra-high maximum leverage of 1:1000, jrfx aims to attract novice traders. These features appeal to those looking to dip their toes into CFD trading while also attracting experienced traders willing to take calculated risks. According to various reports and user analyses, jrfx has carved out a niche within the competitive environment of global financial trading.

In terms of technology and asset offering, jrfx relies on the widely-used MetaTrader 4 platform. This platform is recognized for its robust trading capabilities and user-friendly interface. The broker allows trading in multiple asset classes including forex, commodities, indices, and cryptocurrencies.

Regulation is a key highlight for jrfx, as it is under the oversight of prominent regulatory bodies such as the FCA, FSP, BVIFSC, and DMCC. This multi-regulatory framework bolsters the broker's credibility and provides customers with a measure of security in their trading activities. Overall, the jrfx review emphasizes that while the platform offers competitive entry-level benefits, there are areas that require further enhancement, particularly in the realm of user support and detailed trading resources.

Regulated Jurisdictions

jrfx is regulated by multiple authorities, including the FCA, FSP, BVIFSC, and DMCC. This multi-agency oversight helps ensure that the platform adheres to strict financial standards and risk management protocols, providing a secure trading environment for investors.

Deposit and Withdrawal Methods

Information on the specific deposit and withdrawal methods is not provided in the available summary. This absence of detail makes it difficult to fully assess the ease and efficiency of the funding process on the platform.

Minimum Deposit Requirement

The jrfx platform requires a minimum deposit of only $1 USD. This low barrier to entry is designed primarily to accommodate beginners who wish to engage in the forex and CFD trading markets without significant initial financial commitment.

Bonuses and Promotions

The information provided does not include any concrete details regarding bonus offers or promotional campaigns from jrfx. As such, potential users must note that bonus structures, if any, are not clearly communicated in the available data.

Tradable Assets

jrfx offers a range of tradable assets including forex pairs, commodities, indices, and cryptocurrencies. This diversified asset coverage allows traders to explore various markets, though detailed information on the breadth of offerings and associated trading conditions is currently limited.

Cost Structure

Key details regarding spreads and commissions are not explicitly disclosed in the provided summary. Without clear information on the cost structure, traders are advised to conduct further research or directly inquire with jrfx to understand potential trading costs and fee structures.

Leverage Ratio

One of the standout features of jrfx is its maximum leverage ratio, which can reach up to 1:1000. This high leverage option can be attractive for traders looking to maximize their exposure, but it also carries increased risk, emphasizing the need for cautious and informed trading strategies.

Platform Selection

The trading platform offered by jrfx is MetaTrader 4, a well-known and widely used software in the industry. This platform provides robust technical analysis tools and supports automated trading, although there is limited additional information on any proprietary enhancements or customizations.

Regional Restrictions

There is no detailed information provided on specific regional restrictions. Users should directly confirm with jrfx if their country of residence may affect account eligibility or trading conditions.

Customer Support Languages

The available summary does not detail the languages in which customer support is offered. Therefore, clarity regarding the multilingual support capabilities of jrfx remains absent, and further investigation is advised.

This detailed jrfx review provides an in-depth look at the platform's features. It also highlights several areas—especially regarding funding methods, promotions, cost structure, and customer support—that require additional clarity.

The jrfx review indicates that the account conditions provide a notable advantage for new traders. This is primarily due to the exceptionally low minimum deposit requirement of $1 USD. While the available details do not elaborate on the variety of account types or any specialized account features such as Islamic accounts, the low entry cost remains a key selling point.

The lack of detailed information on the account opening process and verification steps means that potential users must rely on basic details when considering jrfx for their trading journey. Compared to other brokers, the simplicity and affordability of account access with jrfx can be seen as a significant benefit. Nonetheless, the absence of comprehensive account type breakdowns or unique features leaves room for further improvement.

The regulatory framework under which jrfx operates also adds a layer of legitimacy. This bolsters its account conditions despite some ambiguity in the overall account structure.

In evaluating the tools and resources available through jrfx, the review notes that the broker uses the established MetaTrader 4 platform. This provides a reliable foundation for trading. However, beyond the standard technical analysis tools and charting functions inherent to MT4, there is limited information on additional research resources or educational materials offered by the broker.

The absence of detailed descriptions regarding market analysis tools, automated trading support, or proprietary indicators leaves many users wondering whether additional resources could enhance their trading experience. Furthermore, while the trading platform is robust, the jrfx review does not provide clarity on the availability of webinars, tutorials, or customer guides that are crucial for effective market analysis, particularly for novice traders. This gap suggests that while the technical infrastructure is in place, there is potential for improvement in the wider array of educational and research resources available.

Customer service is a critical pillar for any trading platform. Yet the jrfx review reflects limited available data on the quality and responsiveness of customer support. The provided information does not delve into the specific support channels, such as live chat, email, or telephone assistance, nor does it mention the operating hours or language options available to customers.

User feedback regarding customer service appears minimal. There are no detailed examples of support case resolutions or typical response times. The lack of explicit detail regarding multi-language support further complicates the overall picture of customer assistance at jrfx.

This analysis suggests that while regulatory oversight instills some level of confidence, the area of customer service requires transparency improvements. Prospective users may need to seek direct clarification from the broker regarding support capabilities before committing to an account.

When assessing the trading experience offered by jrfx, the review identifies several factors that contribute to an overall neutral performance. The use of the MetaTrader 4 platform implies a stable and well-recognized trading environment with comprehensive charting and analytical features. However, there is little detail on order execution quality, such as slippage or re-quotes, which are essential factors for many active traders.

Additionally, while the platform is recognized for its functionality, there is no specific information addressing the mobile trading experience or the availability of advanced trading tools. The jrfx review also highlights that user feedback on the trading experience is somewhat neutral, with many users not reporting significant issues but also not expressing strong satisfaction. As with many aspects of the platform, further detailed data on trading conditions would help potential users gauge whether the trading experience meets their high-performance requirements.

Trust is a cornerstone in evaluating any financial trading platform. The jrfx review places mixed emphasis on this aspect. On one hand, jrfx is duly regulated by several well-respected authorities, including the FCA, FSP, BVIFSC, and DMCC, which provides a notable measure of security and regulatory compliance.

However, the overall user TrustScore of 2.9 suggests notable reservations among clients. This potentially stems from opaque practices or insufficient transparency regarding funds' security measures and corporate governance. While regulatory oversight is a strong positive indicator, the lack of detailed information on robust fund safeguarding protocols, financial reporting transparency, and historical handling of negative events dampens overall trust levels.

Industry comparisons reveal that while regulatory compliance is essential, consistent customer satisfaction and transparent communication regarding risk management are equally important in fostering trader confidence.

The overall user experience at jrfx, as captured by a TrustScore of 2.9, indicates significant scope for improvement. Users may appreciate the low barrier to entry and the potential of high leverage; however, the platform appears to lack in areas that directly impact user satisfaction, such as an intuitive interface, seamless navigation, and streamlined registration processes. The jrfx review notes that details regarding the ease of fund management and the user interface's responsiveness are not provided in depth.

This absence of detailed user feedback makes it challenging to fully evaluate the registration, trading, and deposit/withdrawal processes. Feedback suggests that although the platform performs adequately on a technical level, improvements in site design, instructional support for new users, and clearer process guidelines would likely boost the overall user experience. Such enhancements are essential to align the platform's technological capabilities with the expectations of modern traders.

In conclusion, the jrfx review underlines that while jrfx offers attractive features such as an extremely low minimum deposit and a high maximum leverage of 1:1000, several aspects require further development. The broker is well-regulated by multiple authorities, which adds credibility; however, user feedback indicates that the overall user experience and customer service need significant improvement. jrfx is best suited for beginners and traders eager to utilize high leverage—provided they conduct their own due diligence regarding funds' security measures and cost structures.

Overall, jrfx presents a mixed bag of strengths and weaknesses that potential traders should carefully consider before engaging.

FX Broker Capital Trading Markets Review