itradefx 2025 Review: Everything You Need to Know

Summary

This comprehensive itradefx review reveals significant concerns about the broker's safety and legitimacy. Potential traders should carefully consider these issues before making any decisions. Based on available information from multiple sources including WikiBit, Forex-Ratings, and Gripeo, itradefx faces substantial credibility issues within the forex trading community.

User feedback consistently raises red flags about the broker's trustworthiness. Some traders explicitly label the platform as fraudulent. Despite the lack of detailed regulatory information and limited positive user testimonials, some retail investors continue to express interest in the broker's trading conditions.

However, the overwhelming evidence suggests that itradefx primarily attracts retail forex traders who may not be fully aware of the potential risks. According to Forex-Ratings.com, user comments include direct accusations that "itradefx are scammers." WikiBit and Gripeo have highlighted ongoing concerns about the broker's safety and legal status.

The absence of clear regulatory oversight and the prevalence of negative user experiences make this broker particularly concerning. Risk-averse investors seeking reliable trading partners should exercise extreme caution.

Important Notice

This review is based on publicly available information and user feedback collected from various third-party evaluation platforms. Traders should be aware that different regions may experience varying regulatory environments and trading conditions when dealing with itradefx.

The information presented reflects the current state of available data. Potential users should conduct their own due diligence before making any investment decisions. The evaluation methodology employed in this review relies primarily on user testimonials, third-party assessments, and publicly accessible information.

Comprehensive regulatory and operational details from the broker itself remain limited.

Rating Framework

Broker Overview

itradefx operates in the competitive forex brokerage space. Specific details about its establishment date, company background, and core business model remain unclear based on available public information. The broker appears to target retail forex traders, but the lack of transparent corporate information raises immediate concerns.

These concerns focus on its operational legitimacy and long-term viability in the market. The platform's business approach and corporate structure have not been clearly communicated through official channels. This makes it difficult for potential clients to assess the company's stability and commitment to regulatory compliance.

This opacity in fundamental business information contributes significantly to the trust issues highlighted by various review platforms. Regarding trading infrastructure, specific information about the platform types offered by itradefx, available asset classes, and regulatory oversight remains largely undisclosed in publicly available sources. The absence of clear regulatory authority supervision represents a critical gap.

Potential traders must consider this when evaluating this broker against industry standards. This itradefx review emphasizes the importance of regulatory clarity, which appears to be significantly lacking in this case.

Regulatory Regions: Available information does not specify the regulatory jurisdictions under which itradefx operates. This represents a significant transparency concern for potential clients.

Deposit and Withdrawal Methods: Specific payment methods and processing procedures have not been detailed in the available source materials.

Minimum Deposit Requirements: Exact minimum deposit amounts are not specified in the accessible information. This makes it difficult for traders to plan their initial investments.

Bonuses and Promotions: Current promotional offerings and bonus structures are not mentioned in the available documentation.

Tradeable Assets: The range of financial instruments available for trading through itradefx has not been clearly specified in public sources.

Cost Structure: Detailed information about spreads, commissions, and other trading costs remains undisclosed in the available materials. This makes cost comparison with other brokers challenging.

Leverage Ratios: Specific leverage offerings and their associated risk parameters are not detailed in accessible sources.

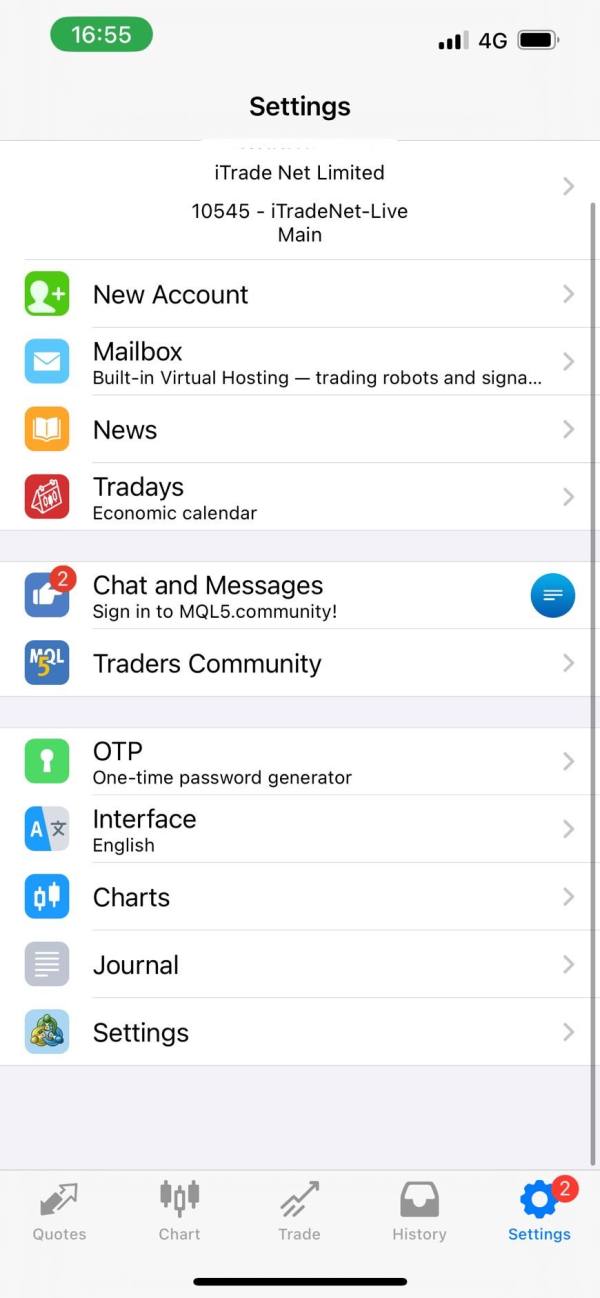

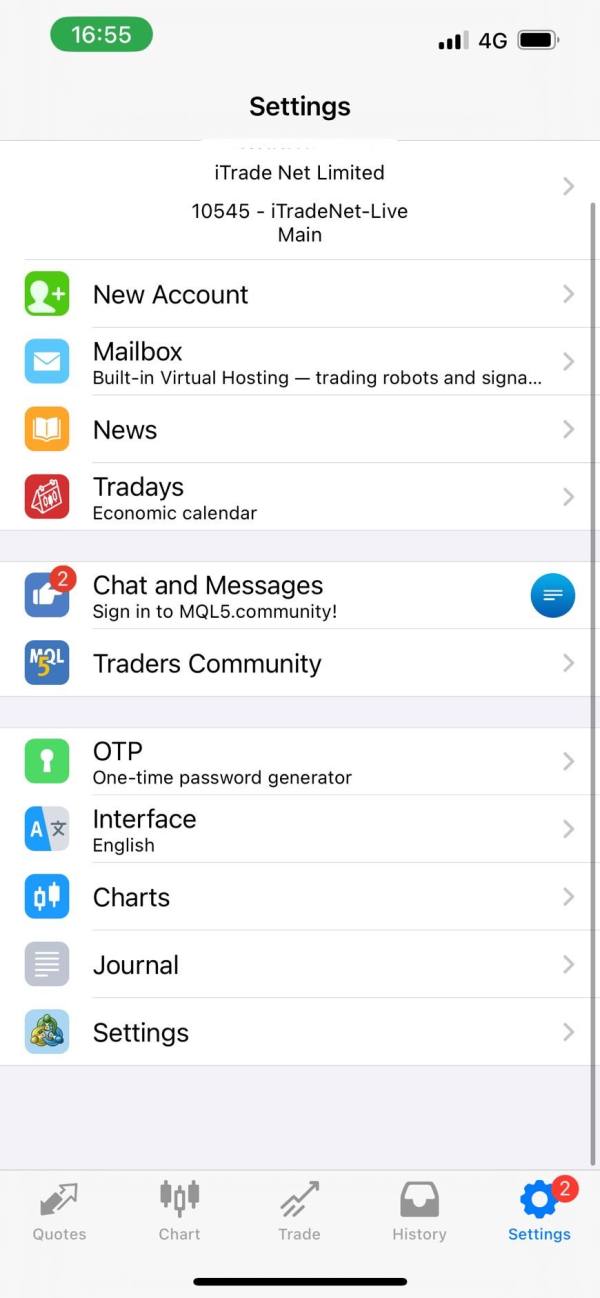

Platform Options: Information about trading platform availability, including MetaTrader support or proprietary platforms, is not specified.

Regional Restrictions: Geographic limitations on service availability are not clearly outlined.

Customer Service Languages: Multi-language support capabilities are not specified in available sources.

This itradefx review highlights the concerning lack of transparency in fundamental operational details. Professional traders typically require this information for informed decision-making.

Detailed Rating Analysis

Account Conditions Analysis (4/10)

The account conditions offered by itradefx remain largely undisclosed in publicly available information. This immediately raises concerns about transparency and professional standards. Without clear details about account types, their specific features, and associated benefits, potential traders cannot make informed comparisons with industry competitors.

They also cannot assess whether the offerings meet their trading requirements. The absence of specific minimum deposit information makes it impossible to evaluate the accessibility of the broker's services for different trader segments. Professional brokers typically provide clear tiered account structures with varying deposit requirements.

These structures accommodate different trading styles and capital levels. The lack of such clarity suggests either poor communication practices or potentially problematic operational structures. Account opening procedures and verification processes are not detailed in available sources.

This could indicate streamlined onboarding or, conversely, inadequate know-your-customer procedures. Additionally, no information is available regarding specialized account options such as Islamic accounts for Muslim traders. These are standard offerings among reputable international brokers.

User feedback from Forex-Ratings.com includes direct accusations that "itradefx are scammers." This significantly undermines confidence in the account conditions and overall service quality. This itradefx review emphasizes that the lack of transparent account information, combined with negative user experiences, creates substantial concerns about the broker's legitimacy and professional standards.

The trading tools and analytical resources provided by itradefx are not documented in available public sources. This represents a significant gap in the broker's transparency and professional presentation. Modern forex brokers typically offer comprehensive suites of trading tools, including technical indicators, charting packages, economic calendars, and market analysis resources.

These tools support trader decision-making processes. Research and analytical content, which serves as a cornerstone of professional brokerage services, appears to be either non-existent or not publicly promoted by itradefx. This absence of visible analytical support raises questions about the broker's commitment to trader education and market insight provision.

These are essential components of reputable brokerage services. Educational resources, including webinars, tutorials, and market guides, are not mentioned in available information. Professional brokers typically invest significantly in trader education as both a service differentiator and a means of promoting responsible trading practices.

The apparent lack of such resources suggests limited commitment to client development and success. Automated trading support, including expert advisor compatibility and algorithmic trading infrastructure, is not specified in accessible sources. This omission is particularly concerning given the growing importance of automated trading strategies in modern forex markets.

Professional brokers are expected to provide robust technological support for such approaches.

Customer Service and Support Analysis (4/10)

Customer service capabilities and support infrastructure details are notably absent from publicly available information about itradefx. This raises immediate concerns about the broker's commitment to client care and problem resolution. Professional forex brokers typically maintain multiple communication channels, including live chat, email, and telephone support.

They also provide clearly published availability hours and response time commitments. The lack of specified customer service channels, response time guarantees, and service quality metrics makes it impossible for potential clients to assess whether the broker can provide adequate support. This becomes particularly important during critical trading situations or account-related issues.

This transparency gap becomes particularly concerning when combined with negative user feedback documented on review platforms. Multi-language support capabilities are not detailed, which could indicate limited international service capacity or poor communication of available services. Global forex brokers typically provide support in multiple languages to serve their diverse client base effectively.

The absence of such information suggests either limited scope or inadequate service promotion. User feedback from various sources indicates negative experiences with the broker, though specific details about customer service interactions are limited. The combination of negative user sentiment and lack of transparent customer service information creates substantial concerns about the broker's ability to handle client needs professionally and efficiently.

Trading Experience Analysis (5/10)

Platform stability, execution speed, and overall trading infrastructure details are not specified in available sources. This makes it impossible to assess the technical quality of the trading experience offered by itradefx. Professional brokers typically provide detailed specifications about their trading infrastructure, including server locations, execution speeds, and uptime guarantees.

These specifications demonstrate their technical capabilities to potential clients. Order execution quality metrics, such as slippage rates, requote frequency, and fill ratios, are not documented in accessible information. These technical performance indicators are crucial for traders to evaluate whether a broker can provide reliable execution during various market conditions.

This becomes particularly important during high volatility periods when execution quality becomes critical. Platform functionality and feature completeness remain undisclosed, including whether the broker offers advanced order types, risk management tools, and professional trading features. Experienced traders typically require these features for their trading strategies.

The absence of such technical specifications makes it difficult for serious traders to assess platform suitability. Mobile trading capabilities and cross-platform synchronization features are not mentioned in available sources. This is concerning given the increasing importance of mobile trading in modern forex markets.

This itradefx review notes that the lack of comprehensive platform information, combined with limited user feedback on trading experience, creates uncertainty. The uncertainty concerns the broker's technical capabilities and execution reliability.

Trust and Reliability Analysis (2/10)

The trust and reliability assessment for itradefx reveals severe concerns that potential traders must carefully consider. Available information does not specify any regulatory licenses or oversight from recognized financial authorities. This represents a fundamental red flag in the forex brokerage industry where regulatory compliance is essential for client protection and operational legitimacy.

Fund safety measures, including segregated client accounts, deposit insurance, and third-party custodial arrangements, are not documented in accessible sources. Professional brokers typically highlight their client fund protection mechanisms as key differentiators and regulatory requirements. The absence of such information is particularly concerning for potential depositors.

Company transparency regarding ownership structure, management team, and corporate governance is notably lacking. Reputable brokers typically provide detailed information about their leadership, corporate history, and business operations. This information helps build trust with potential clients.

The opacity surrounding itradefx's corporate structure contributes significantly to trust concerns. Third-party evaluations from WikiBit and Gripeo have highlighted ongoing concerns about the broker's safety and legal status. User feedback includes direct accusations of fraudulent behavior.

The combination of regulatory uncertainty, negative user experiences, and third-party warnings creates a compelling case for extreme caution. Potential traders should exercise this caution when considering this broker for trading activities.

User Experience Analysis (3/10)

Overall user satisfaction metrics are not available from official sources. However, the limited feedback accessible through review platforms suggests significant dissatisfaction among users who have interacted with itradefx. The absence of positive testimonials or success stories raises concerns about the broker's ability to deliver satisfactory service experiences to its client base.

Interface design, platform usability, and navigation efficiency details are not documented in available sources. This makes it impossible to assess whether the broker provides intuitive and professional user interfaces that meet modern trading standards. Contemporary traders expect sophisticated yet user-friendly platforms that facilitate efficient trading operations.

Registration and account verification procedures are not detailed in accessible information. This could indicate either streamlined processes or potentially inadequate compliance procedures. Professional brokers typically balance efficient onboarding with thorough verification requirements.

They do this to meet regulatory standards while providing good user experiences. Common user complaints documented in review platforms include fundamental concerns about the broker's legitimacy and trustworthiness. Some users explicitly warn others about potential fraudulent activities.

The prevalence of such serious allegations, combined with the absence of positive user feedback, suggests systemic issues. These issues affect the overall user experience and service delivery.

Conclusion

This comprehensive itradefx review reveals significant concerns about the broker's safety, legitimacy, and overall trustworthiness. These concerns make it unsuitable for most traders, particularly those who prioritize security and regulatory compliance. The combination of limited transparency, absence of clear regulatory oversight, and negative user feedback creates a risk profile that exceeds acceptable levels for prudent investment decisions.

The broker is not recommended for risk-averse investors or traders who require reliable, professionally managed trading environments. The lack of fundamental information about operations, regulatory status, and service offerings, combined with explicit user warnings about potential fraudulent activities, makes itradefx a poor choice. Serious forex trading activities require better alternatives.

The primary disadvantages include questionable legitimacy, absence of regulatory clarity, negative user testimonials, and lack of transparency in fundamental operational aspects. No clear advantages have been identified through available sources that would offset these significant concerns.