IGOFX 2025 Review: Everything You Need to Know

Executive Summary

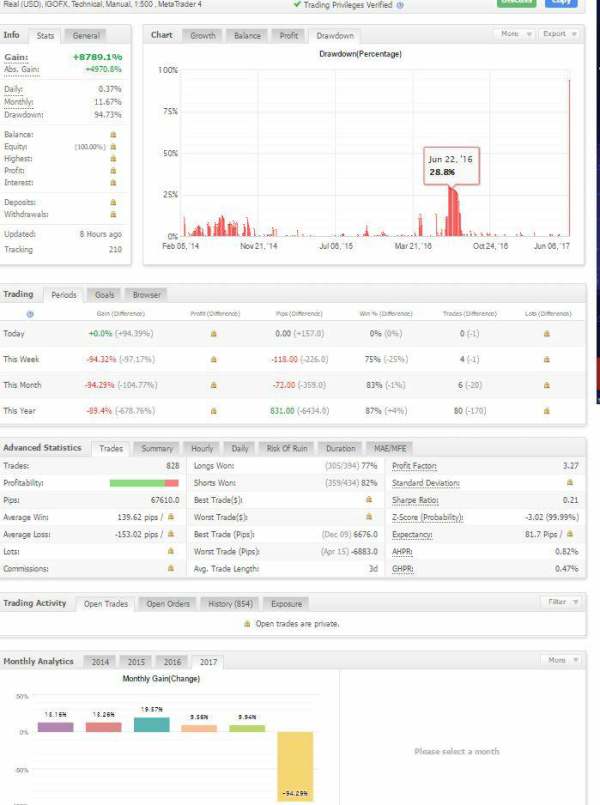

IGOFX is an online forex broker established in 2006 and headquartered in Vanuatu. The company operates under the regulation of the Vanuatu Financial Services Commission with license number 14626. This igofx review reveals that the broker offers multiple trading instruments through the industry-standard MetaTrader 4 platform, catering to both novice and experienced traders seeking diverse investment opportunities.

The broker provides commission-free trading across various asset classes including forex pairs, CFDs, commodities, and cryptocurrencies. With over 25 currency pairs available for trading, IGOFX positions itself as a comprehensive trading solution. However, traders should note that EUR/USD spreads are fixed at 3 pips. This is considerably higher than industry standards where most brokers offer spreads within the 1-pip range.

IGOFX's primary appeal lies in its zero-commission structure and multi-asset trading capabilities. This makes it particularly suitable for traders who prioritize cost-effective trading and portfolio diversification. The broker's use of the reliable MT4 platform ensures familiar trading environment for most forex traders. However, the absence of demo accounts may limit its appeal to beginners who prefer risk-free practice opportunities.

Important Notice

This review is based on publicly available information and user feedback regarding IGOFX's services. Traders should be aware that regulatory policies and trading conditions may vary across different jurisdictions. IGOFX operates under Vanuatu Financial Services Commission regulation. Investors must ensure compliance with their local legal requirements before engaging with the broker.

The information presented in this analysis reflects the broker's offerings as of the review date. Prospective clients should verify current terms and conditions directly with IGOFX before making investment decisions.

Rating Framework

Broker Overview

IGOFX was established in 2006 as an online trading platform based in Vanuatu. The company positions itself as a comprehensive financial services provider in the competitive forex market. Over its years of operation, IGOFX has developed a reputation for offering straightforward trading conditions with a focus on commission-free transactions.

The broker's business approach centers on providing multiple account options that scale with client deposit levels. This allows traders to access different features based on their investment capacity and trading requirements. The broker operates primarily through the MetaTrader 4 platform, offering access to over 25 currency pairs alongside CFDs, binary options, precious metals including gold and silver, and various other financial instruments.

IGOFX maintains its regulatory standing through the Vanuatu Financial Services Commission. This provides the legal framework for its operations while ensuring compliance with international trading standards. This igofx review indicates that the broker's platform supports multiple asset classes including forex, commodities, indices, and cryptocurrencies, making it a versatile choice for traders seeking portfolio diversification.

The company's commitment to commission-free trading across all account types represents a significant cost advantage. This is particularly beneficial for active traders who execute frequent transactions.

Regulatory Jurisdiction: IGOFX operates under the supervision of the Vanuatu Financial Services Commission with license number 14626. This provides regulatory oversight for the broker's operations and client fund protection measures.

Deposit and Withdrawal Methods: Specific information regarding deposit and withdrawal methods is not detailed in available materials. Traders require direct verification with the broker.

Minimum Deposit Requirements: The exact minimum deposit amounts for different account types are not specified in available documentation. These should be confirmed directly with IGOFX.

Bonus and Promotions: Current promotional offerings and bonus structures are not mentioned in available materials. These may require direct inquiry with the broker.

Tradeable Assets: IGOFX supports trading in forex pairs, CFDs, binary options, gold, silver, and other precious metals. This provides diverse investment opportunities across multiple asset classes.

Cost Structure: The broker offers commission-free trading across all account types with fixed spreads. EUR/USD spreads are set at 3 pips, which is notably higher than the industry standard of 1 pip offered by most competitors.

Leverage Ratios: Specific leverage information is not detailed in available materials. This requires confirmation with the broker directly.

Platform Options: IGOFX provides the MetaTrader 4 trading platform. This is widely recognized as an industry standard for forex trading.

Geographic Restrictions: Information regarding specific geographic restrictions is not mentioned in available documentation.

Customer Service Languages: Details about supported customer service languages are not specified in available materials.

This igofx review highlights that while the broker offers competitive commission-free trading, several important details require direct verification with the company. This ensures complete understanding of trading conditions.

Detailed Rating Analysis

Account Conditions Analysis (7/10)

IGOFX provides multiple account types structured around initial deposit amounts. This offers traders flexibility in choosing services that match their investment capacity. According to available information, the broker differentiates its account offerings based on the size of the initial deposit, though specific deposit thresholds for each account tier are not clearly detailed in public documentation.

The broker's account structure appears designed to accommodate traders with varying capital levels. This ranges from smaller retail investors to those with more substantial trading funds. However, unlike many industry competitors, IGOFX notably does not provide free demo accounts, which represents a significant limitation for new traders seeking to familiarize themselves with the platform before committing real capital.

All account types benefit from commission-free trading. This represents a considerable cost advantage for active traders. The fixed spread structure across all accounts provides predictable trading costs, though the 3-pip spread on EUR/USD is substantially higher than industry standards.

This igofx review notes that while the commission-free model is attractive, the wider spreads may offset some of the cost benefits. This is particularly true for high-frequency traders. The absence of detailed information regarding account opening procedures, verification requirements, and special account features such as Islamic accounts limits the comprehensiveness of this evaluation.

Prospective clients should directly contact IGOFX to clarify specific account terms and conditions.

IGOFX offers a comprehensive range of trading instruments that spans multiple asset classes. This provides traders with substantial diversification opportunities. The broker supports over 25 currency pairs, covering major, minor, and exotic forex pairs that cater to various trading strategies and market preferences.

Beyond traditional forex trading, IGOFX extends its offerings to include CFDs, commodities, and cryptocurrencies. This allows traders to build diversified portfolios within a single platform. The inclusion of precious metals such as gold and silver provides additional hedging opportunities during market volatility, while the cryptocurrency options enable participation in the growing digital asset market.

The MetaTrader 4 platform serves as the primary trading environment. It offers robust charting tools, technical indicators, and automated trading capabilities through Expert Advisors. MT4's proven reliability and extensive feature set provide traders with professional-grade tools for market analysis and trade execution.

However, this analysis notes that specific information regarding research and analysis resources, educational materials, and advanced trading tools is not detailed in available documentation. The absence of mentioned educational resources may limit the platform's appeal to novice traders seeking comprehensive learning materials to develop their trading skills.

Customer Service and Support Analysis (6/10)

Available information regarding IGOFX's customer service infrastructure is limited. This makes it challenging to provide a comprehensive assessment of support quality and availability. The lack of detailed information about customer service channels, response times, and service quality represents a transparency concern for prospective clients.

Industry-standard customer support typically includes multiple communication channels such as live chat, email, phone support, and comprehensive FAQ sections. However, specific details about IGOFX's customer service offerings, including available contact methods and operating hours, are not clearly documented in available materials.

The absence of user testimonials or feedback regarding customer service experiences limits the ability to assess actual service quality and problem resolution effectiveness. Professional forex brokers typically provide multilingual support to accommodate their international client base, but IGOFX's language support capabilities are not specified in available documentation.

Response time expectations, escalation procedures, and specialized support for different account types are important factors that require direct verification with the broker. This igofx review emphasizes the importance of clarifying customer service terms before opening an account, particularly for traders who may require immediate assistance during volatile market conditions.

Trading Experience Analysis (7/10)

IGOFX's trading experience centers around the MetaTrader 4 platform. This provides a familiar and reliable trading environment for most forex traders. MT4's robust architecture supports stable trade execution, comprehensive charting capabilities, and extensive customization options that enhance the overall trading experience.

The platform's technical analysis tools include multiple timeframes, various chart types, and a wide range of built-in technical indicators that support different trading strategies. The Expert Advisor functionality enables automated trading systems, appealing to traders who prefer algorithmic trading approaches or wish to implement systematic trading strategies.

However, the fixed spread structure with EUR/USD at 3 pips represents a significant cost consideration that may impact trading profitability. This is particularly true for scalping strategies or high-frequency trading approaches. While the commission-free model eliminates additional transaction costs, the wider spreads may result in higher overall trading expenses compared to brokers offering tighter spreads with small commissions.

Order execution quality, slippage rates, and requote frequency are critical factors that are not detailed in available documentation. The stability of the trading environment during high-volatility periods and major news events requires direct assessment through actual trading experience.

This igofx review notes that while the MT4 platform provides a solid foundation for trading activities, the lack of mobile trading experience details and advanced platform features may limit appeal for traders seeking cutting-edge trading technology.

Trust and Security Analysis (5/10)

IGOFX operates under the regulatory oversight of the Vanuatu Financial Services Commission with license number 14626. This provides a basic level of regulatory compliance and client protection. However, Vanuatu's regulatory framework is generally considered less stringent compared to major financial jurisdictions such as the UK's FCA, Cyprus' CySEC, or Australia's ASIC.

The single regulatory jurisdiction presents limitations in terms of investor protection measures and dispute resolution mechanisms compared to brokers holding multiple licenses from tier-one regulatory authorities. While VFSC regulation provides some oversight, it may not offer the same level of client fund protection and compensation schemes available under more established regulatory frameworks.

Available documentation does not provide detailed information about client fund segregation, insurance coverage, or other security measures that protect trader deposits. The absence of information regarding negative balance protection, which is standard among reputable brokers, raises additional considerations for risk management.

Company transparency regarding ownership structure, financial statements, and operational procedures is not clearly detailed in available materials. Professional brokers typically provide comprehensive disclosure about their corporate structure and financial standing to build client confidence.

The lack of information about third-party audits, security certifications, and industry awards limits the ability to assess the broker's overall reputation and standing within the forex industry.

User Experience Analysis (6/10)

The overall user experience assessment for IGOFX is constrained by limited available information regarding user satisfaction levels and feedback from active traders. The absence of demo accounts represents a significant limitation for new traders who typically prefer to test platform functionality and trading conditions before committing real capital.

The MetaTrader 4 platform provides a generally user-friendly interface that most forex traders find familiar and intuitive. The platform's standardized layout and functionality reduce the learning curve for traders transitioning from other brokers, while the extensive customization options allow experienced users to tailor the interface to their preferences.

Account registration and verification procedures are not detailed in available documentation. This makes it difficult to assess the efficiency and user-friendliness of the onboarding process. Streamlined account opening with clear verification requirements typically enhances the user experience and reduces barriers to entry.

The absence of detailed information regarding deposit and withdrawal procedures, processing times, and associated fees creates uncertainty about the overall convenience of fund management. Efficient and transparent money management processes are crucial components of positive user experience.

User interface design, platform navigation, and overall ease of use for different experience levels require direct assessment through platform interaction. The lack of comprehensive user testimonials and satisfaction ratings limits the ability to gauge real-world user experience across different trader types and trading styles.

Conclusion

This comprehensive igofx review reveals a broker that offers solid basic trading conditions with some notable limitations. IGOFX provides commission-free trading across multiple asset classes through the reliable MT4 platform, making it suitable for traders who prioritize cost-effective access to diverse markets including forex, commodities, and cryptocurrencies.

The broker's primary strengths include its zero-commission structure and broad asset coverage. This can benefit active traders seeking portfolio diversification. However, the 3-pip spread on EUR/USD significantly exceeds industry standards, potentially offsetting commission savings.

The absence of demo accounts and limited transparency regarding customer service capabilities present additional considerations for prospective clients. IGOFX appears most suitable for experienced traders who understand the platform's limitations and can effectively manage the higher spread costs. New traders may find better value with brokers offering demo accounts, tighter spreads, and more comprehensive educational resources, despite potentially higher commission charges.