FX-Farms 2025 Review: Everything You Need to Know

Executive Summary

FX-Farms presents itself as a forex trading platform. It has generated mixed responses from the trading community. According to Trustpilot reviews, some users consider FX-Farms "a very good company," particularly praising its accessibility for newcomers to forex trading. The platform offers a notably low minimum deposit requirement starting at just $25. This makes it attractive for beginners who want to enter the forex market without substantial initial capital.

However, this fx-farms review reveals significant concerns that potential traders should carefully consider. Multiple sources have raised fraud allegations against the platform. They question the legitimacy of its promised investment returns. The company operates through a model that involves recruiting individual investors with promises of returns and direct referral commissions. This has drawn scrutiny from industry observers.

The platform targets both beginners and experienced traders. It offers educational systems designed to help users develop their trading skills. Despite some positive user feedback, the lack of clear regulatory information and ongoing scam allegations create substantial uncertainty about the platform's credibility. This uncertainty also affects its long-term viability in the competitive forex market.

Important Notice

Regional Entity Differences: FX-Farms does not provide specific regulatory information in available materials. This may result in users from different regions facing varying legal risks and protections. The absence of clear regulatory oversight means that trader protections may differ significantly depending on your location. Some jurisdictions may not recognize any legal recourse for disputes.

Review Methodology: This evaluation is based on comprehensive analysis of user feedback, available market information, and public reports. Due to limited official documentation from FX-Farms, some information gaps exist. Readers should conduct additional due diligence before making any trading decisions.

Rating Framework

Broker Overview

FX-Farms operates in the forex trading space with a business model that emphasizes recruitment of individual investors. They make promises of advertised returns. While the company's establishment date is not clearly specified in available materials, the platform has developed a presence in online trading communities. This has generated both positive testimonials and serious concerns about its operational practices.

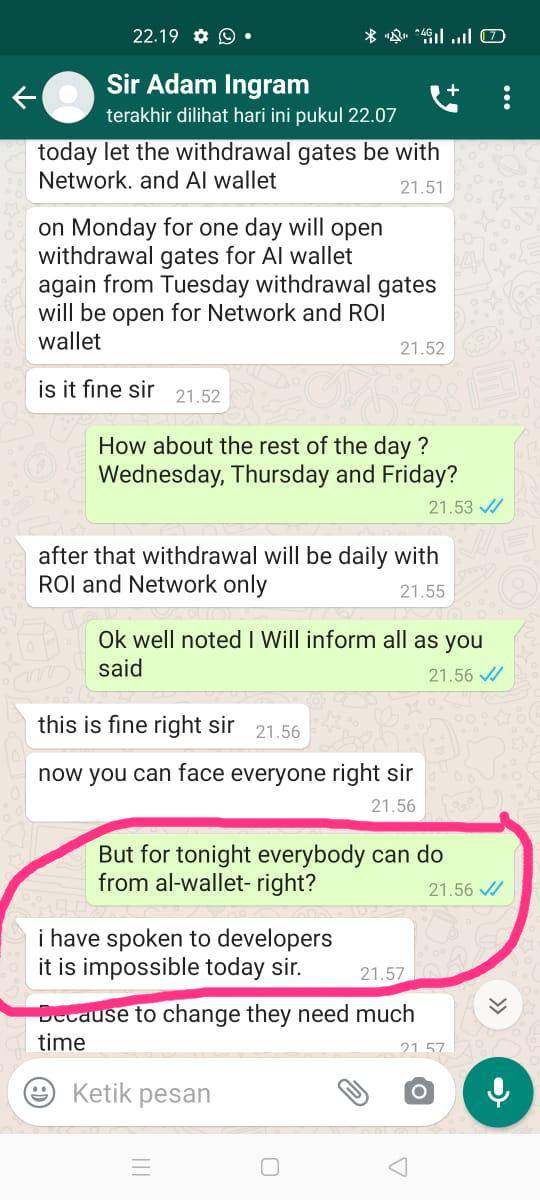

The company's approach centers on recruiting affiliates who invest funds based on promised returns. The platform offers direct referral commissions to users who successfully bring in new investors. This multi-level structure has raised questions among industry observers about whether the focus is genuinely on forex trading or primarily on recruitment and investment collection.

FX-Farms positions itself as serving both novice and experienced traders. Specific details about their trading platform technology and infrastructure remain limited in available documentation. The fx-farms review materials suggest that while some users report positive experiences, the overall picture remains clouded by transparency issues. Conflicting reports about the company's legitimacy and regulatory status also create confusion.

Regulatory Status: Available materials do not specify concrete regulatory oversight or licensing information for FX-Farms. This represents a significant concern for potential traders seeking regulated broker protection.

Deposit and Withdrawal Methods: Specific information about available deposit and withdrawal methods is not detailed in accessible materials. The platform does specify minimum deposit requirements for different account types.

Minimum Deposit Requirements: FX-Farms offers basic accounts with a minimum deposit of $25. Trading accounts require between $1,501 and $10,000, providing options across different capital levels.

Bonus and Promotions: Current promotional offerings and bonus structures are not specifically outlined in available materials.

Tradeable Assets: The platform primarily focuses on forex trading. The full range of available currency pairs and other instruments is not comprehensively detailed.

Cost Structure: Specific information regarding spreads, commissions, and other trading costs is not provided in accessible materials. This makes cost comparison difficult.

Leverage Options: Leverage ratios and margin requirements are not specified in available documentation.

Platform Selection: The specific trading platform or platforms offered by FX-Farms are not detailed in current materials.

Geographic Restrictions: Regional availability and restrictions are not clearly outlined.

Customer Support Languages: Available support languages are not specified in accessible materials.

This fx-farms review highlights the significant information gaps that potential traders should consider when evaluating the platform.

Detailed Rating Analysis

Account Conditions Analysis (7/10)

FX-Farms offers a tiered account structure that caters to different investment levels. This contributes to its relatively strong rating in this category. The platform provides basic accounts with a minimum deposit requirement of just $25, making it one of the more accessible options for traders with limited initial capital. This low barrier to entry is particularly attractive for beginners who want to explore forex trading without committing substantial funds upfront.

The trading account tier requires a significantly higher minimum deposit ranging from $1,501 to $10,000. This suggests that the platform attempts to serve both entry-level and more serious traders. However, the substantial jump between account tiers may create a gap for intermediate traders who have outgrown the basic account but aren't ready for the higher-tier requirements.

User feedback indicates that the minimum deposit requirements are generally viewed favorably. This is particularly true among newcomers to forex trading. When compared to industry standards, FX-Farms' entry-level requirements are competitive, though the lack of detailed information about account features and benefits at each tier limits the ability to fully evaluate the value proposition.

The fx-farms review materials suggest that while account accessibility is strong, the absence of detailed information about account-specific features, tools, and services prevents a higher rating in this category.

FX-Farms receives an average rating for tools and resources. This is primarily based on its educational system offerings. The platform emphasizes providing educational resources to help traders develop their skills, which represents a positive aspect for users seeking to improve their trading knowledge and capabilities.

However, the specific details about trading tools, analytical resources, and platform features remain largely unspecified in available materials. The lack of information about charting capabilities, technical analysis tools, market research resources, and automated trading support limits the ability to assess the platform's technical offerings comprehensively.

User feedback regarding the educational system is generally positive. Traders appreciate the learning opportunities provided. However, the absence of detailed information about research and analysis resources, real-time market data quality, and advanced trading tools suggests that the platform may not offer the comprehensive toolkit that experienced traders typically expect.

The platform's focus on education is commendable. Without clear information about the breadth and quality of analytical tools, trading indicators, and market research capabilities, FX-Farms falls into the average category for this dimension.

Customer Service and Support Analysis (5/10)

Customer service and support receive a below-average rating based on mixed user feedback and limited information about support infrastructure. Some users report satisfactory interactions with FX-Farms support. There are indications of complaints and inconsistent service quality that impact the overall rating.

The specific customer service channels, availability hours, and response time commitments are not clearly outlined in available materials. This makes it difficult for potential traders to understand what level of support they can expect. This lack of transparency about support infrastructure is particularly concerning for traders who may need assistance during critical trading situations.

User feedback suggests varying experiences with customer service quality. Some users express concerns about the professionalism and effectiveness of support interactions. The existence of complaints and disputes, combined with limited information about resolution processes, contributes to the below-average rating.

The absence of detailed information about multilingual support, dedicated account management, and escalation procedures further impacts the rating. For a trading platform where timely and effective support can be crucial for users' trading success, the uncertainty around customer service capabilities represents a significant concern.

Trading Experience Analysis (5/10)

The trading experience dimension receives a below-average rating due to limited available information about platform performance, execution quality, and trading environment characteristics. User feedback regarding specific trading experiences, platform stability, and execution speeds is notably sparse in available materials.

Without detailed information about order execution quality, slippage rates, requote frequency, or platform reliability, it's challenging to assess how well FX-Farms performs in delivering a smooth trading experience. The absence of technical performance data and user testimonials about platform functionality raises questions about the platform's trading infrastructure.

Mobile trading capabilities, platform features, and trading environment characteristics are not comprehensively detailed. This makes it difficult for potential users to understand what to expect from the actual trading experience. The lack of information about platform customization options, advanced order types, and trading tools impacts the overall assessment.

The limited feedback available suggests that users have varying experiences. Without substantial data about platform performance metrics, execution quality, and trading environment stability, FX-Farms cannot achieve a higher rating in this critical dimension.

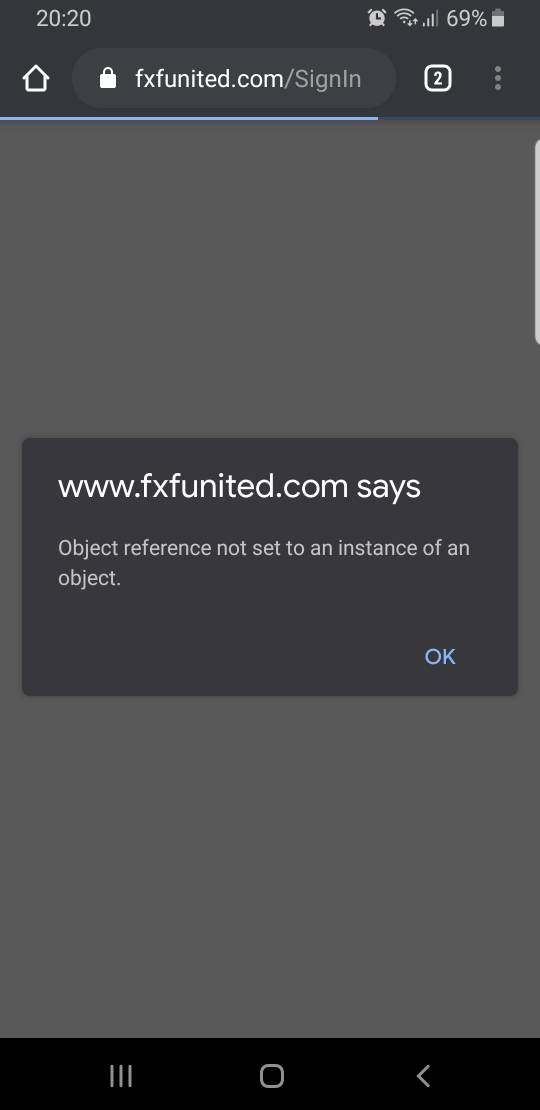

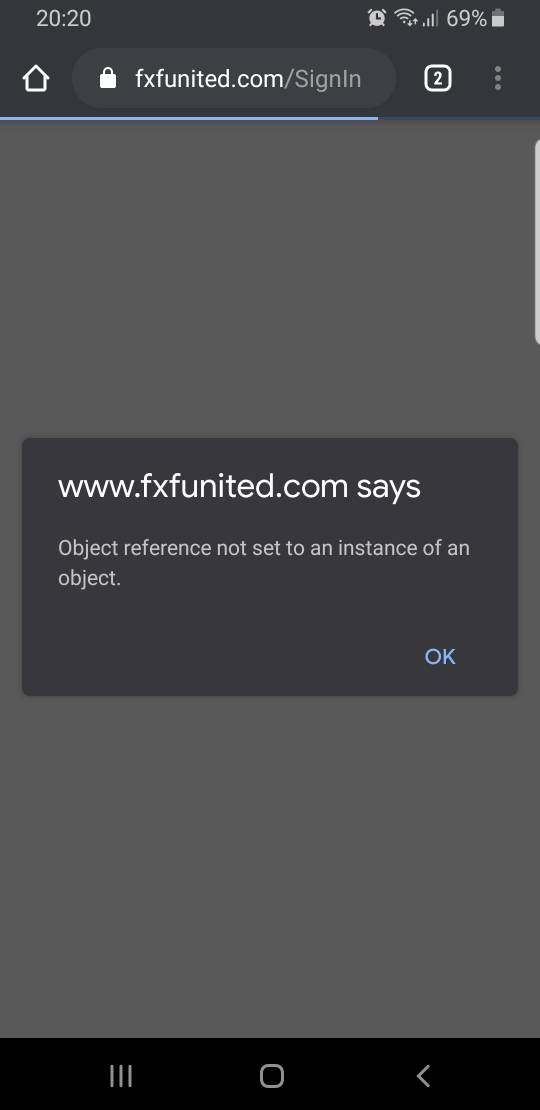

Trust and Safety Analysis (4/10)

Trust and safety represent the most concerning aspect of FX-Farms. They earn a poor rating due to multiple factors that raise serious questions about the platform's credibility. The absence of clear regulatory information is a significant red flag, as legitimate forex brokers typically provide detailed information about their regulatory status and oversight.

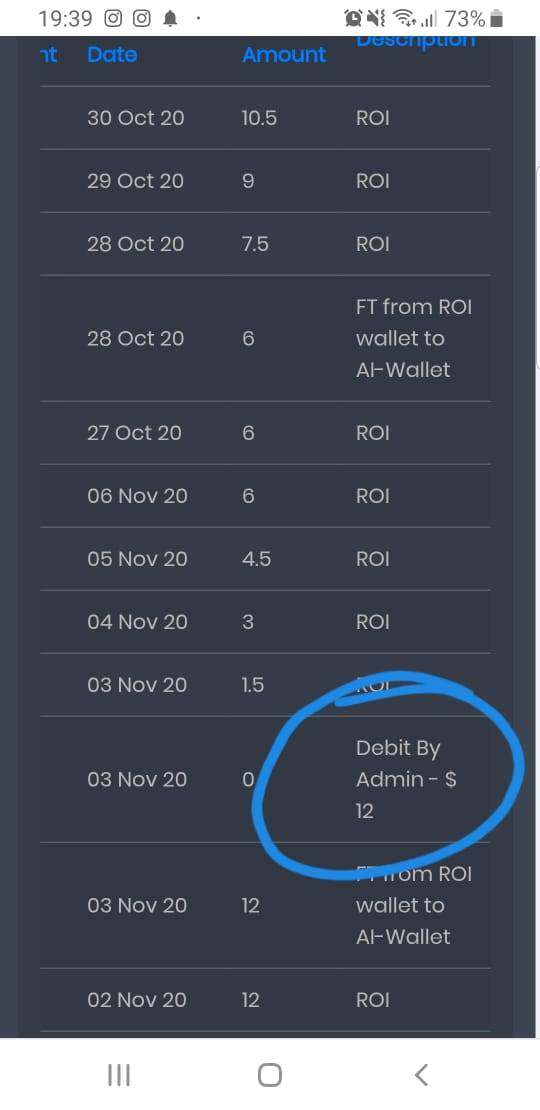

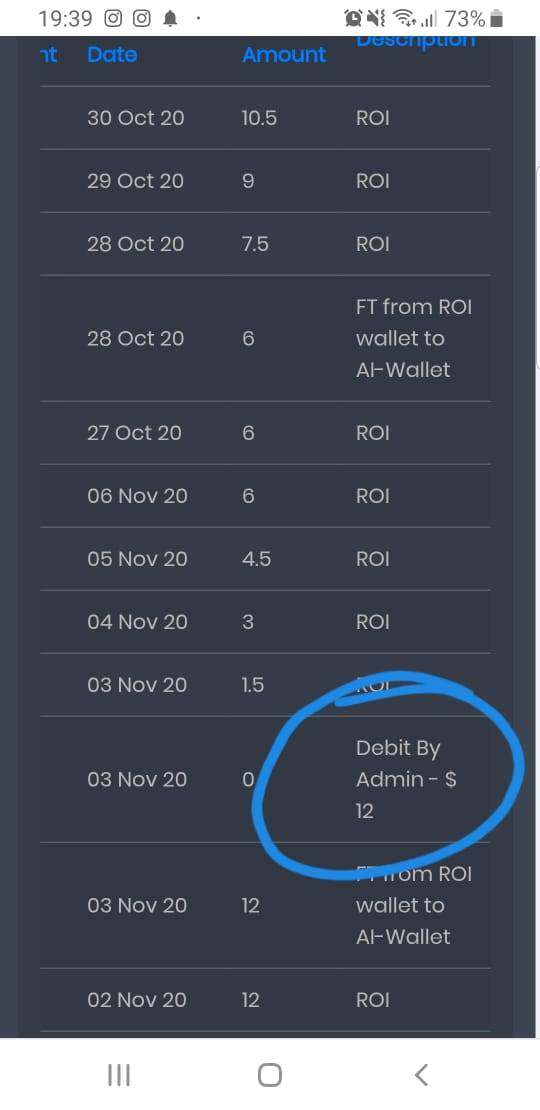

Fraud allegations and scam accusations from various sources create substantial concerns about the platform's legitimacy. The business model's emphasis on recruitment and investment promises, combined with direct referral commissions, has drawn scrutiny from industry observers. They question whether the focus is on legitimate trading services or primarily on recruitment activities.

The lack of transparency regarding fund security measures, segregated account policies, and investor protection mechanisms further undermines confidence in the platform's safety. Without clear regulatory oversight, users may have limited recourse in case of disputes or issues with fund withdrawals.

Third-party reviews and user discussions reveal mixed opinions about the platform's legitimacy. Some users express concerns about the company's business practices while others defend their experiences. However, the overall pattern of allegations and lack of regulatory clarity creates significant trust issues that potential users should carefully consider before engaging with the platform.

User Experience Analysis (6/10)

User experience receives an average rating based on mixed feedback from the trading community. Some users report positive experiences with FX-Farms, particularly appreciating the low minimum deposit requirements and educational resources. However, the overall user experience is impacted by concerns about transparency and conflicting reports about the platform's operations.

The platform appears to attract users who are interested in learning about forex trading and appreciate the accessible entry requirements. The educational focus resonates with beginners who value learning opportunities alongside their trading activities.

However, common user complaints center around concerns about investment return promises and questions about the platform's legitimacy. These issues create uncertainty and anxiety among users. This impacts the overall experience quality.

The user profile for FX-Farms appears to include both newcomers attracted by low barriers to entry and individuals interested in the educational aspects of the platform. However, the mixed feedback and ongoing controversies prevent the platform from achieving a higher rating in user experience.

For improvement, FX-Farms would need to address transparency concerns, provide clearer regulatory information, and strengthen customer support. This would enhance overall user satisfaction and confidence.

Conclusion

This comprehensive fx-farms review reveals a platform with both appealing features and significant concerns that potential traders must carefully weigh. FX-Farms offers attractive entry-level accessibility with its $25 minimum deposit and educational resources for beginners. The serious questions surrounding its regulatory status and fraud allegations create substantial risks that cannot be overlooked.

The platform may be suitable for beginners seeking low-barrier entry into forex education, but only with extreme caution and thorough understanding of the risks involved. The lack of regulatory oversight and transparency issues make it unsuitable for traders seeking reliable, regulated trading environments.

The main advantages include low minimum deposits and educational focus. Critical disadvantages encompass trust concerns, regulatory uncertainty, and limited transparency. Potential users should conduct extensive additional research and consider regulated alternatives before making any investment decisions with FX-Farms.