Fortfs 2025 Review: Everything You Need to Know

Executive Summary

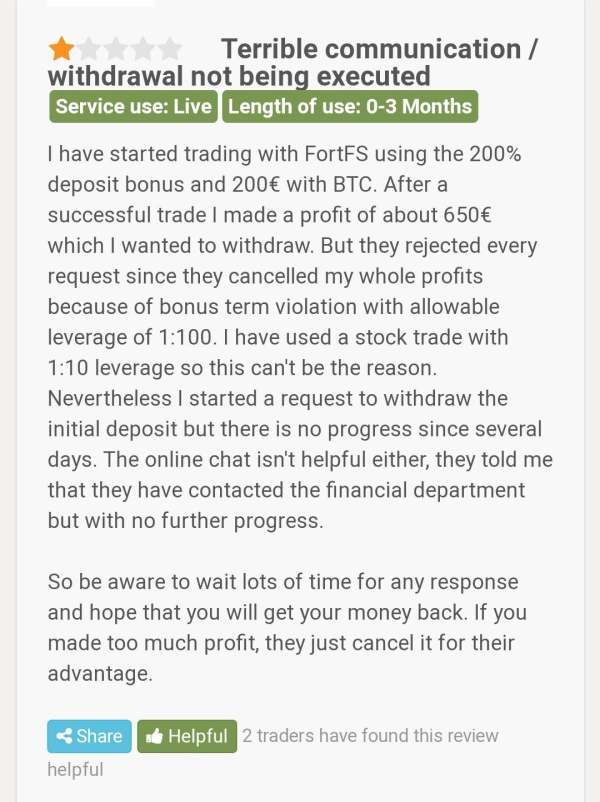

This Fortfs review shows mixed results for an established international financial broker that started in 2010. Fort Financial Services offers multi-asset trading solutions through the Fortex ECN platform, but user feedback raises serious concerns about service quality. Trustpilot gives the broker a disappointing rating of 1.6 out of 5 stars based on 64 reviews. This shows widespread customer dissatisfaction.

Fort Financial Services operates under license IFSC/60/256/TS/14 from the International Financial Services Commission of Belize. The company serves clients from more than 30 countries worldwide. Fort Financial Services positions itself as a comprehensive trading solution provider using the Fortex ECN platform for multi-asset trading capabilities. However, user experiences suggest potential challenges in account processes and overall service delivery.

The primary target audience appears to be international clients seeking diversified trading opportunities across multiple asset classes. Despite the broker's established presence in the market and regulatory oversight from IFSC, the consistently low user ratings and negative feedback patterns suggest traders should exercise caution. Traders should be careful when considering this platform for their trading activities.

Important Notice

Traders should know that Fort Financial Services may be subject to different regulatory frameworks depending on their location. The company operates under IFSC regulation with license number IFSC/60/256/TS/14 according to available information. Users should verify the regulatory status applicable to their region before opening an account.

This review is based on publicly available information and user feedback collected from various sources. Our evaluation methodology aims to provide an objective analysis of the broker's services, though individual experiences may vary. The assessment considers factors including user testimonials, regulatory compliance, and available service features.

Rating Framework

Broker Overview

Fort Financial Services was established in 2010 as an international financial broker. The company positioned itself in the competitive forex and multi-asset trading market. Fort Financial Services has built its reputation around providing comprehensive trading solutions to a global clientele, with operations spanning over 30 countries worldwide. As a privately held company, Fort Financial Services has maintained its focus on delivering multi-asset trading capabilities through advanced technological infrastructure.

The broker's business model centers on offering diverse trading opportunities across multiple asset classes. The company caters to both retail and institutional clients seeking international market exposure. Fort Financial Services emphasizes its commitment to providing clients with access to global financial markets through sophisticated trading platforms and comprehensive service offerings according to company information.

Fort Financial Services utilizes the Fortex ECN platform as its primary trading infrastructure. This platform serves as the foundation for delivering multi-asset trading solutions to its client base. The platform is described as "the most complete, most powerful multi-asset ECN trading solution on the planet" according to company materials. The broker operates under the regulatory oversight of the International Financial Services Commission of Belize, holding license number IFSC/60/256/TS/14, which provides a framework for its international operations and client protection measures.

Regulatory Jurisdiction: Fort Financial Services operates under the supervision of the International Financial Services Commission of Belize. The company holds license number IFSC/60/256/TS/14. This regulatory framework governs the company's operations and provides oversight for client protection measures.

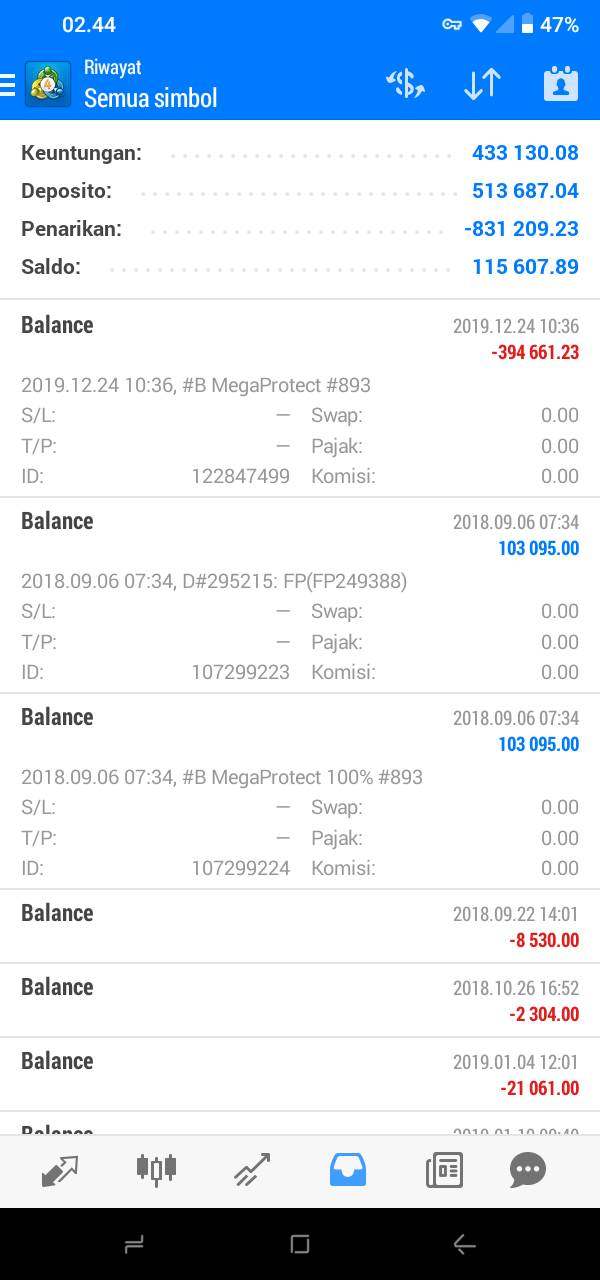

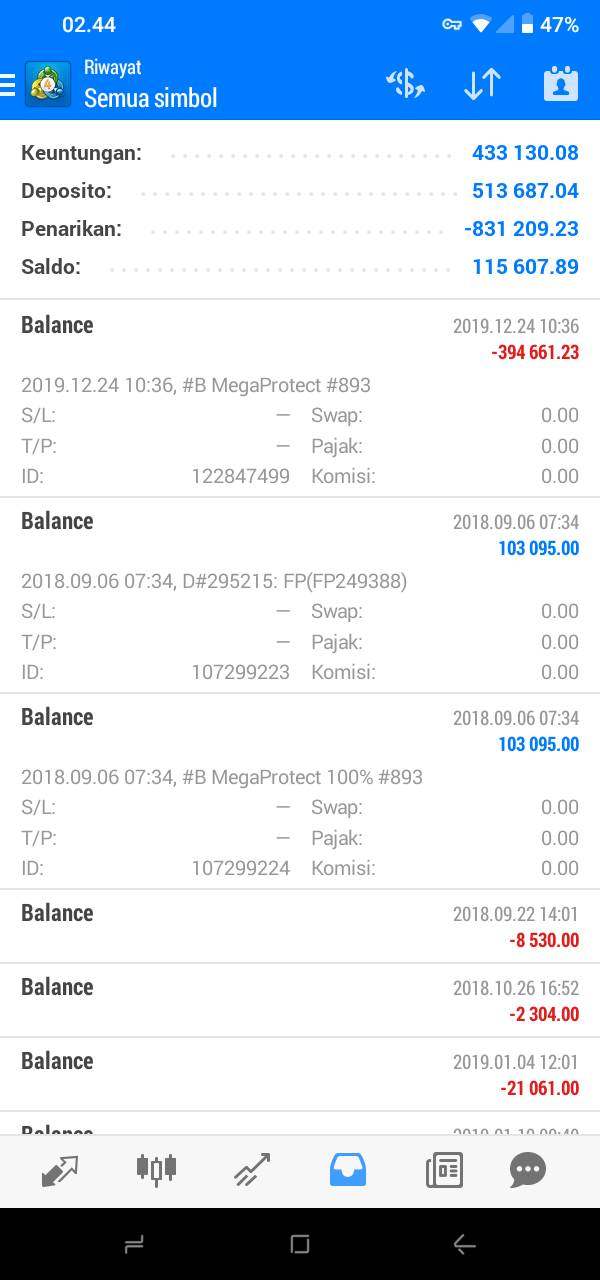

Deposit and Withdrawal Methods: Specific information regarding available deposit and withdrawal methods is not detailed in available materials. Prospective clients should contact the broker directly for comprehensive information about funding options and processing procedures.

Minimum Deposit Requirements: The exact minimum deposit requirements are not specified in the available documentation. Traders interested in opening accounts should inquire directly with the broker for current deposit thresholds and account tier requirements.

Bonus and Promotions: Available materials do not provide specific details about current bonus offerings or promotional campaigns. Potential clients should verify any promotional terms directly with the broker before making deposit decisions.

Tradeable Assets: Fort Financial Services offers multi-asset trading solutions. Specific asset categories and instrument details are not comprehensively outlined in available information. The broker appears to focus on providing diversified trading opportunities across various financial markets.

Cost Structure: Detailed information about spreads, commissions, and fee structures is not available in the current materials. This Fortfs review recommends that traders request comprehensive pricing information directly from the broker before committing to an account.

Leverage Ratios: Specific leverage offerings are not detailed in available documentation. Traders should contact the broker directly to understand available leverage options and any restrictions that may apply based on their jurisdiction or account type.

Platform Options: Clients utilize the Fortex ECN platform for their trading activities. This platform serves as the primary trading infrastructure for accessing multi-asset markets and executing trades.

Geographic Restrictions: The broker serves clients from more than 30 countries worldwide. This indicates a broad international reach with relatively few geographic limitations.

Customer Support Languages: Specific information about available customer support languages is not provided in current materials.

Detailed Rating Analysis

Account Conditions Analysis (Score: 4/10)

The account conditions at Fort Financial Services present several challenges that contribute to a below-average rating in this category. The broker offers multi-asset trading solutions, but the lack of transparent information about account types, minimum deposits, and specific features creates uncertainty for potential clients. Available materials do not provide detailed breakdowns of different account tiers or their respective benefits and requirements.

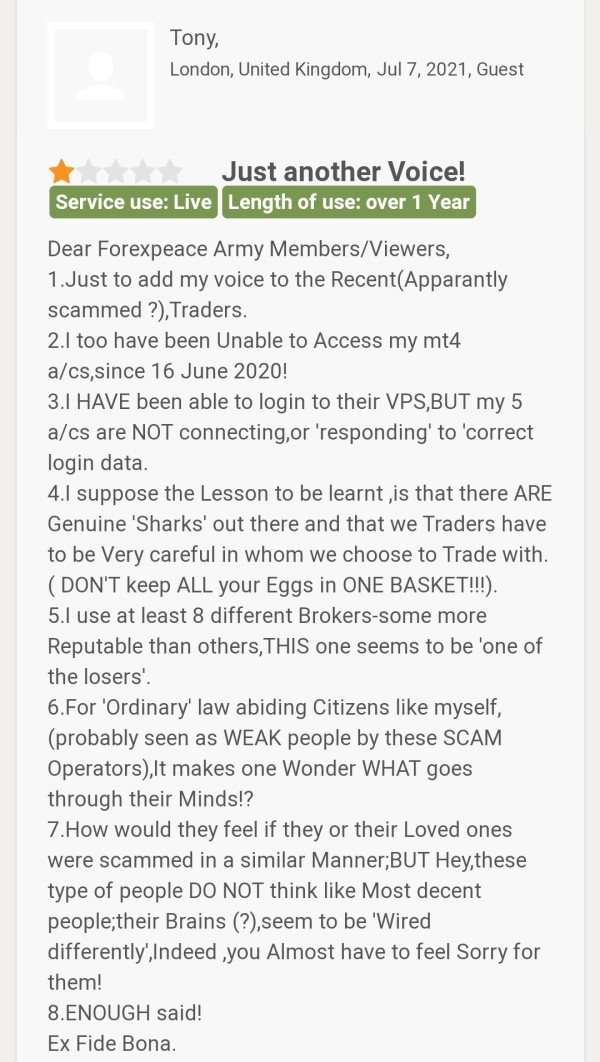

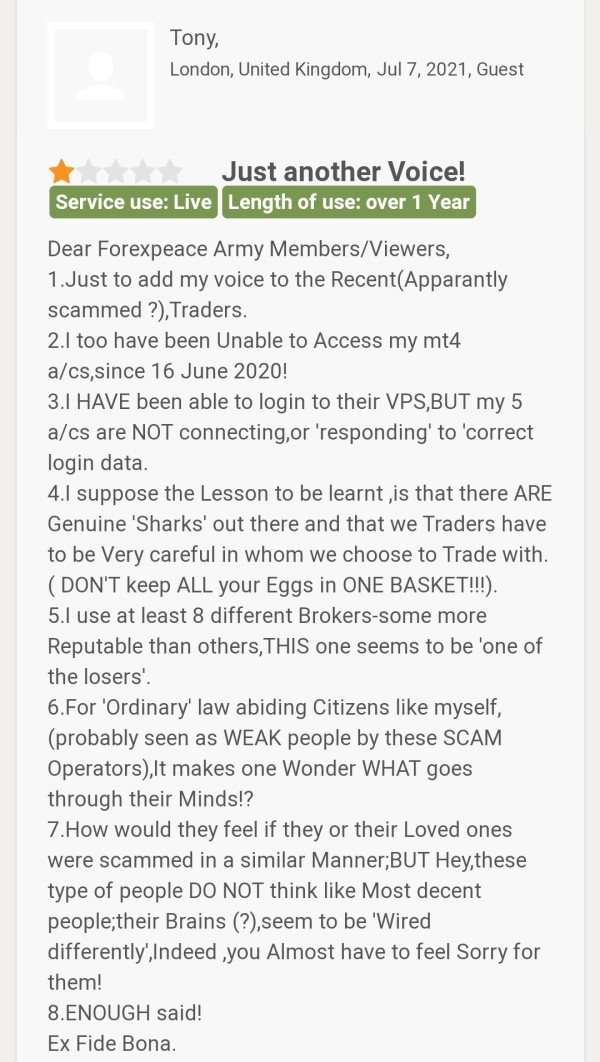

User feedback reveals significant concerns about the account process. A verified user review shows one client spent 2.5 years attempting to obtain an account, stating "I bought the account and I've been sparing 2.5 years just to get it. I know that you don't care about the fact that I'm really sad and that I had to work and spare 2.5 years." This testimonial highlights potential systemic issues with account opening procedures and client onboarding processes.

The absence of clearly defined account categories and their associated features makes it difficult for traders to understand what services and benefits they can expect. The lack of information about special account types, such as Islamic accounts or professional trading accounts, further limits the appeal for diverse trading communities. This Fortfs review notes that the complex account process appears to be a significant barrier for potential clients seeking efficient access to trading services.

Fort Financial Services provides access to trading tools through the Fortex ECN platform. The platform is positioned as a comprehensive multi-asset trading solution. The platform is described as offering end-to-end trading capabilities, suggesting a range of integrated tools and features for market analysis and trade execution. However, specific details about the available tools, their functionality, and user interface characteristics are not extensively documented in available materials.

The multi-asset nature of the trading solution implies access to various market instruments and potentially diverse analytical tools. The ECN structure of the platform suggests direct market access capabilities, which can be beneficial for traders seeking transparent pricing and efficient order execution. However, the lack of detailed information about research resources, market analysis tools, and educational materials limits the comprehensiveness of this evaluation.

Available documentation does not provide specific information about automated trading support, algorithmic trading capabilities, or advanced charting tools. The absence of detailed tool descriptions and feature lists makes it challenging for traders to assess whether the platform meets their specific trading requirements and analytical needs.

Customer Service and Support Analysis (Score: 3/10)

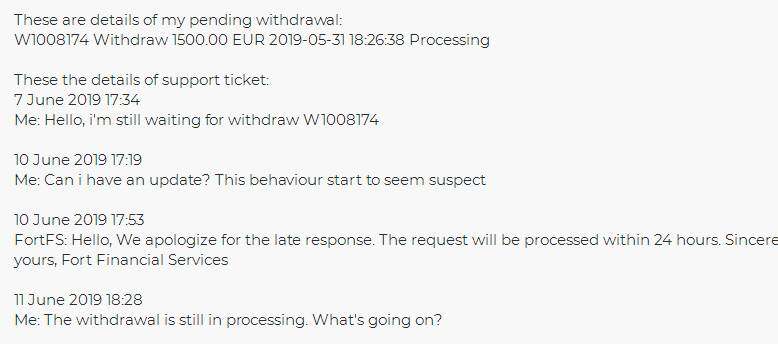

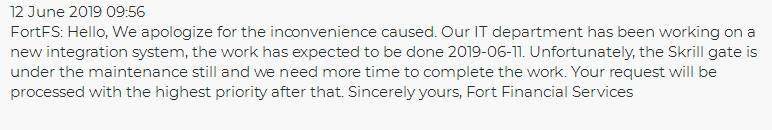

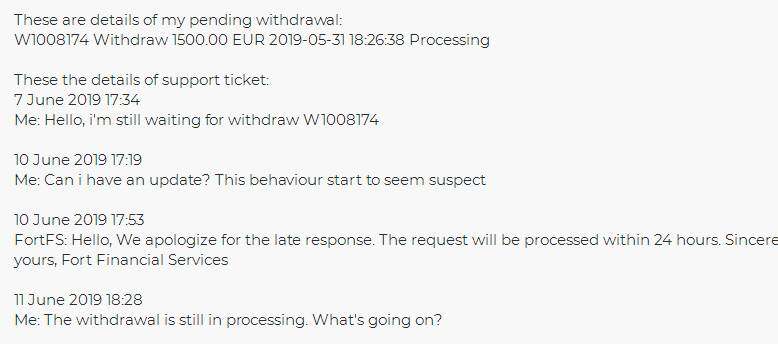

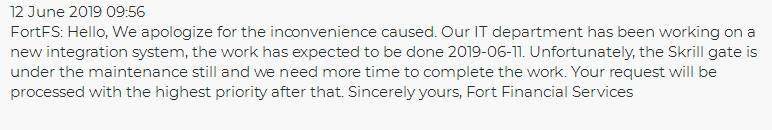

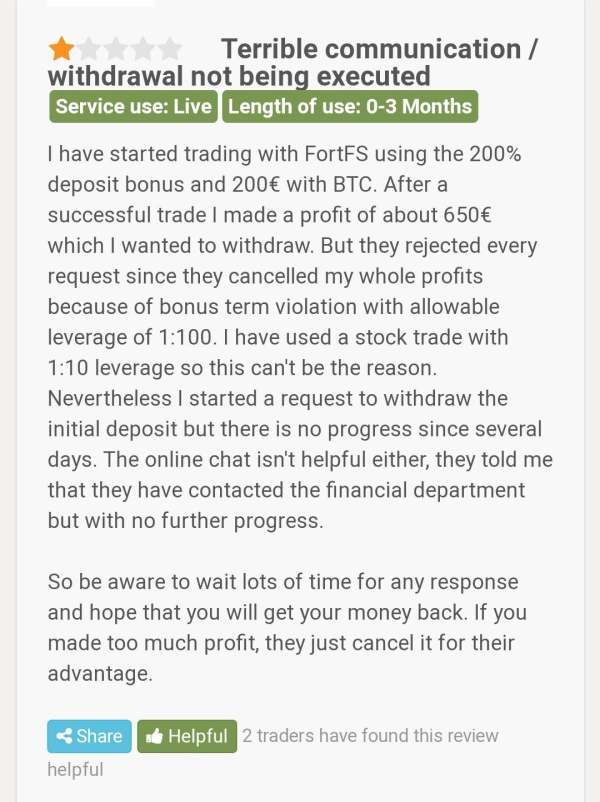

Customer service emerges as a significant weakness for Fort Financial Services based on available user feedback and the overall rating pattern. The poor Trustpilot rating of 1.6 out of 5 stars strongly suggests widespread dissatisfaction with customer support quality and responsiveness. User testimonials indicate frustration with service delivery and account management processes.

The extended account timeframe reported by users points to potential inefficiencies in customer service operations and client onboarding procedures. The emotional distress expressed by the user who spent 2.5 years attempting to obtain an account suggests inadequate communication and support throughout the process. This pattern indicates systemic issues with customer service protocols and response mechanisms.

Available materials do not provide specific information about customer support channels, availability hours, or response time commitments. The lack of transparency about support infrastructure, combined with negative user experiences, contributes to concerns about the broker's ability to provide timely and effective assistance to clients when needed.

Trading Experience Analysis (Score: 5/10)

The trading experience at Fort Financial Services is built around the Fortex ECN platform. This platform provides the technological foundation for multi-asset trading activities. The ECN structure potentially offers advantages in terms of market access and price transparency, though specific performance metrics and user experience data are not readily available in current materials.

The platform's positioning as a comprehensive multi-asset solution suggests capabilities for trading across various financial instruments and markets. The lack of detailed user feedback about platform stability, execution speed, and overall functionality limits the ability to provide a thorough assessment of the actual trading experience. Available materials do not include specific information about mobile trading capabilities or platform customization options.

This Fortfs review notes that while the underlying technology appears robust based on the Fortex ECN platform description, the absence of positive user testimonials about trading experience and the overall low satisfaction ratings raise questions about practical platform performance and user interface quality.

Trust and Reliability Analysis (Score: 4/10)

Fort Financial Services operates under IFSC regulation with license number IFSC/60/256/TS/14. This provides a basic regulatory framework for its operations. The International Financial Services Commission of Belize oversight offers some level of regulatory protection, though this jurisdiction may not provide the same level of security as top-tier regulatory bodies in major financial centers.

The company's establishment in 2010 demonstrates longevity in the market, which typically contributes to credibility. The consistently low user ratings of 1.6 out of 5 on Trustpilot significantly undermine confidence in the broker's reliability and service quality. This substantial gap between operational longevity and user satisfaction suggests ongoing issues with service delivery and client relations.

Available materials do not provide specific information about fund security measures, segregated account policies, or insurance coverage for client funds. The lack of transparency about financial protection mechanisms, combined with negative user feedback patterns, raises concerns about overall trustworthiness and operational reliability.

User Experience Analysis (Score: 3/10)

User experience represents one of the most concerning aspects of Fort Financial Services' operations. This is evidenced by the consistently low Trustpilot rating of 1.6 out of 5 stars. This rating, based on 64 reviews, indicates widespread dissatisfaction with various aspects of the service delivery and overall client experience.

The account process appears to be a significant source of user frustration, with documented cases of extremely lengthy waiting periods that have caused emotional distress to clients. The complexity and duration of the onboarding process suggest systematic issues with operational efficiency and client communication protocols.

User feedback patterns indicate disappointment with the overall service quality, though specific details about interface design, platform usability, and operational procedures are not extensively documented. The consistently negative sentiment expressed in user reviews suggests that the broker faces significant challenges in meeting client expectations and providing satisfactory service experiences across multiple touchpoints.

Conclusion

Fort Financial Services presents a complex picture as an established international financial broker with significant operational challenges. The company has maintained market presence since 2010 and offers multi-asset trading solutions through the Fortex ECN platform, but user feedback consistently indicates substantial issues with service quality and client satisfaction.

The broker may be suitable for traders specifically seeking multi-asset trading capabilities and those comfortable with IFSC regulatory oversight. Potential clients should carefully consider the documented challenges with account processes and the consistently low user satisfaction ratings before committing to this platform.

The primary advantages include the established market presence and multi-asset trading infrastructure. The main disadvantages center on poor customer service, complex account opening procedures, and widespread user dissatisfaction as reflected in the 1.6 out of 5 Trustpilot rating.