eobroker 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive eobroker review examines a financial services platform that has received mixed feedback in the trading community. The company started in 2014 and achieved significant recognition in 2020 when it became one of the top-3 most downloaded financial applications worldwide on Google Play, demonstrating its reach and accessibility to traders globally.

However, the platform's reputation shows a more complex picture. Based on available user feedback and third-party evaluations, eobroker maintains a moderate Trustpilot rating of 3 out of 5 stars from 23 user reviews as of 2025. The platform operates under a multiplatform business model and offers financial services across various channels, yet user experiences reveal concerning patterns regarding account management and customer support responsiveness.

The broker appears most suitable for experienced traders who can navigate potential service challenges independently. While the platform's widespread adoption suggests functional trading capabilities, prospective users should carefully consider the mixed user feedback, particularly regarding account security concerns and customer service limitations, before committing to this trading platform.

Important Notice

This evaluation is based on publicly available information and user feedback collected from various review platforms and official sources. Regulatory frameworks may vary significantly across different jurisdictions where eobroker operates, and specific regulatory information was not detailed in available sources.

Readers should independently verify current regulatory status, terms of service, and account conditions before making any trading decisions. This review represents an analysis of available information and should not be considered as financial advice or a recommendation to trade with any specific broker.

Rating Framework

Broker Overview

Eobroker entered the financial services market in 2014. The company positioned itself as a multiplatform trading solution designed to serve diverse trader needs across various financial markets. The broker experienced notable growth trajectory, culminating in its recognition as one of the three most downloaded financial applications globally on Google Play in 2020.

This achievement indicates substantial user adoption and suggests the platform's accessibility appeals to a broad international audience. The broker operates under a multiplatform business model, which theoretically allows traders to access markets through various channels and devices. According to available information, the platform serves over 30 million users worldwide, indicating significant market penetration.

The company emphasizes security standards and accurate quote delivery as core operational values, though specific implementation details of these commitments require further verification through user experience analysis. The platform utilizes the EO Broker trading system, though detailed specifications about underlying technology, supported order types, or advanced trading features remain unclear from available sources. This eobroker review finds that while the company projects growth and accessibility, transparency regarding operational specifics could be enhanced to better inform potential users about service capabilities and limitations.

Regulatory Status: Available sources do not specify particular regulatory jurisdictions or licensing authorities overseeing eobroker's operations. This information gap represents a significant consideration for traders prioritizing regulatory oversight and investor protection measures.

Deposit and Withdrawal Methods: Specific information regarding supported payment methods, processing times, and associated fees was not detailed in available sources. This requires direct inquiry with the broker for clarification.

Minimum Deposit Requirements: The platform's minimum deposit thresholds across different account types are not specified in accessible documentation. These may vary by region or account classification.

Promotional Offers: Details regarding welcome bonuses, trading incentives, or loyalty programs were not available in reviewed sources. This suggests either limited promotional activities or insufficient public disclosure.

Tradeable Assets: The range of financial instruments, including forex pairs, commodities, indices, or securities available through the platform, requires direct verification. This information was not comprehensively detailed in available materials.

Cost Structure: Specific information about spreads, commissions, overnight fees, and other trading costs was not available in reviewed sources. This represents a crucial information gap for cost-conscious traders.

Leverage Ratios: Maximum leverage offerings across different asset classes and account types were not specified. Direct inquiry is required for accurate information.

Platform Options: The broker utilizes the EO Broker platform. However, compatibility with popular platforms like MetaTrader 4 or 5 was not confirmed in available sources.

Geographic Restrictions: Specific jurisdictions where services are restricted or unavailable were not detailed in accessible information. Customer Support Languages: The range of languages supported by customer service teams was not specified in reviewed materials.

This eobroker review notes that the limited availability of detailed operational information may require potential users to conduct direct inquiries with the broker for comprehensive service understanding.

Detailed Rating Analysis

Account Conditions Analysis (4/10)

The account conditions evaluation for eobroker reveals several areas of concern that contribute to the below-average rating. Available information does not provide clear details about different account types, their respective features, or minimum balance requirements. This creates uncertainty for potential traders seeking to understand their options before committing to the platform.

User feedback indicates problematic experiences with account management, particularly regarding unexpected account restrictions or closures. One reviewer specifically mentioned that "EoBroker blocked both of my accounts without any prior warning," highlighting potential issues with account security protocols or communication practices. Such experiences suggest inadequate transparency in account terms or inconsistent application of account policies.

The absence of detailed information about account opening procedures, verification requirements, and ongoing maintenance conditions further complicates the evaluation. Without clear documentation of account features, trading conditions, and user obligations, traders cannot make informed decisions about account suitability for their specific needs. Additionally, the lack of information regarding specialized account types, such as Islamic accounts for Sharia-compliant trading or professional accounts with enhanced features, limits the platform's appeal to diverse trading communities.

This eobroker review finds that improved transparency and communication regarding account conditions would significantly benefit user confidence and platform credibility.

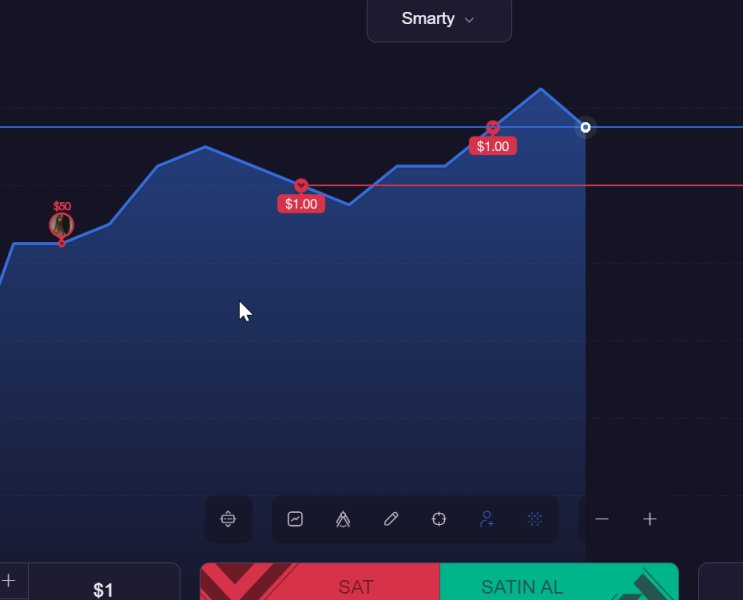

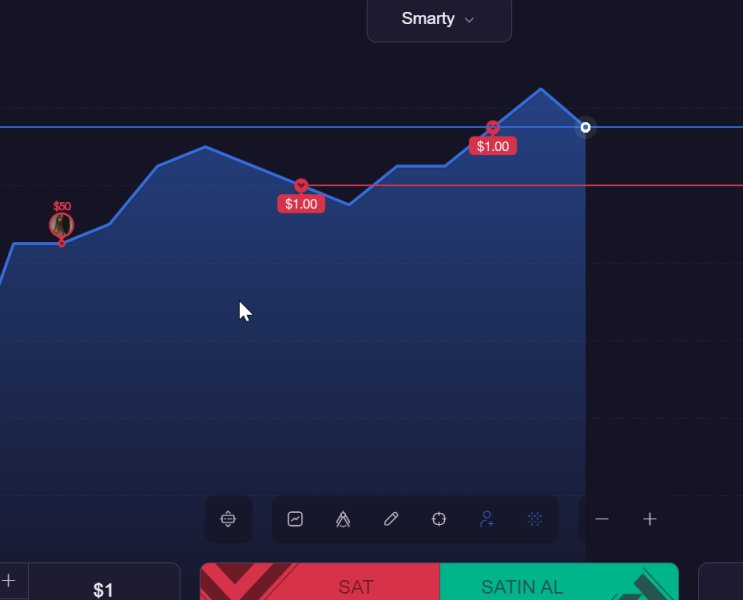

The evaluation of trading tools and resources available through eobroker presents a mixed picture. This is primarily due to limited detailed information about platform capabilities and educational offerings. While the broker operates the EO Broker platform, specific details about charting tools, technical indicators, market analysis features, and automated trading capabilities remain unclear from available sources.

The platform's achievement as one of the top-3 most downloaded financial apps suggests functional user interface design and basic trading capabilities that attract users. However, without detailed specifications about advanced trading tools, research resources, or market analysis features, it becomes difficult to assess the platform's suitability for sophisticated trading strategies or comprehensive market analysis. Educational resources, which are crucial for trader development and platform adoption, were not detailed in available information.

The absence of information about webinars, trading guides, market commentary, or educational materials represents a significant gap that could impact user experience and trading success. Furthermore, the lack of specific information about mobile trading capabilities, despite the high download numbers, leaves questions about feature parity between desktop and mobile platforms. Expert analysis tools, economic calendars, and real-time market news integration details were also not available in reviewed sources, limiting the comprehensive evaluation of the platform's analytical capabilities.

Customer Service and Support Analysis (4/10)

Customer service evaluation reveals concerning patterns that significantly impact the overall user experience with eobroker. User feedback indicates substantial issues with support responsiveness and problem resolution effectiveness, particularly regarding serious account-related concerns that require immediate attention and clear communication.

The most significant concern emerges from user reports of account restrictions without adequate explanation or warning. One user's experience of having "both of my accounts blocked without any prior warning" suggests either inadequate communication protocols or insufficient customer service follow-up when implementing account restrictions. Such situations require prompt, professional customer service intervention to maintain user trust and regulatory compliance.

Response time information for various support channels was not available in reviewed sources, making it difficult to assess service level commitments or expected resolution timeframes. The absence of detailed information about available support channels, including live chat, email support, phone assistance, or help desk ticketing systems, further complicates service evaluation. Multilingual support capabilities, which are essential for international brokers serving diverse user bases, were not specified in available information.

Given the platform's global reach with over 30 million users, comprehensive language support would be expected, yet confirmation of such capabilities requires direct verification. The lack of transparent customer service policies and procedures contributes to user uncertainty and potentially impacts problem resolution effectiveness.

Trading Experience Analysis (5/10)

The trading experience evaluation for eobroker presents challenges due to limited specific user feedback about platform performance, execution quality, and overall trading conditions. While the platform's widespread adoption suggests basic functionality meets user needs, detailed analysis of critical trading factors remains constrained by available information.

Platform stability and execution speed, which are fundamental to successful trading experiences, lack comprehensive user feedback in available sources. Without specific reports about system uptime, order execution delays, or platform responsiveness during high-volume trading periods, it becomes difficult to assess the platform's reliability under various market conditions. Order execution quality, including potential slippage, requotes, or rejection rates, was not detailed in user feedback or platform documentation.

These factors significantly impact trading profitability and user satisfaction, yet their absence from available information represents a crucial evaluation gap. The mobile trading experience, despite high download numbers, lacks detailed user reviews about functionality, feature completeness, or performance compared to desktop alternatives. Given the platform's mobile popularity, more comprehensive feedback about mobile trading capabilities would enhance evaluation accuracy.

Trading environment factors such as spread stability, market depth information, and available order types require direct platform evaluation, as these details were not sufficiently covered in available sources. This eobroker review notes that comprehensive trading experience assessment would benefit from more detailed user feedback and platform specifications.

Trust and Reliability Analysis (4/10)

Trust and reliability assessment for eobroker reveals several concerns that impact overall platform credibility and user confidence. The absence of clear regulatory information in available sources represents a significant transparency issue, as regulatory oversight provides crucial investor protections and operational standards that users rely upon when selecting trading platforms.

User feedback regarding unexpected account restrictions raises questions about platform reliability and communication practices. When users report account closures "without any prior warning," it suggests potential issues with risk management communication, compliance procedures, or customer notification systems that could impact user trust and platform reputation. The moderate Trustpilot rating of 3 out of 5 stars from 23 reviews indicates mixed user experiences, with some users expressing satisfaction while others report significant concerns.

This rating suggests inconsistent service delivery or varying user expectations that the platform may not consistently meet across its user base. Fund security measures, segregation of client funds, and insurance protections were not detailed in available information, representing crucial trust factors that remain unclear. Without transparent information about how client funds are protected and managed, users cannot adequately assess the safety of their trading capital.

The company's operational transparency could be enhanced through more comprehensive disclosure of business practices, regulatory compliance measures, and risk management procedures. While the platform serves millions of users globally, trust-building requires consistent transparency and reliable service delivery that current user feedback suggests may be inconsistent.

User Experience Analysis (5/10)

User experience evaluation for eobroker presents a balanced but concerning picture based on available feedback and platform performance indicators. The Trustpilot rating of 3 out of 5 stars from 23 reviews suggests moderate user satisfaction, with experiences varying significantly among different users and potentially different service aspects.

The platform's success in achieving top-3 download status globally indicates strong initial user attraction and basic functionality that encourages adoption. However, the moderate review scores suggest that while users may initially engage with the platform, ongoing satisfaction levels remain mixed, potentially due to service delivery inconsistencies or unmet user expectations. Interface design and usability information was not detailed in available sources, though high download numbers suggest acceptable user interface design that facilitates basic platform navigation and functionality.

However, without specific feedback about platform intuitiveness, feature accessibility, or learning curve considerations, comprehensive usability assessment remains limited. Account registration and verification processes appear to present challenges based on user feedback about account restrictions and communication issues. Smooth onboarding experiences are crucial for positive initial user impressions, yet available feedback suggests potential friction points that could impact user satisfaction from the beginning of the relationship.

Common user complaints center around account management and customer service responsiveness, suggesting that while basic trading functionality may be adequate, support services and communication practices require improvement to enhance overall user experience and satisfaction levels.

Conclusion

This comprehensive eobroker review reveals a trading platform with significant market reach but concerning service delivery inconsistencies that impact overall user satisfaction and platform reliability. While eobroker achieved notable recognition as one of the top-3 most downloaded financial applications globally in 2020, serving over 30 million users, the platform's moderate trust ratings and mixed user feedback suggest substantial areas for improvement.

The platform may be suitable for experienced traders who can independently navigate potential service challenges and conduct thorough due diligence regarding platform conditions and limitations. However, the absence of detailed regulatory information, limited transparency about account conditions and trading costs, and concerning user feedback about customer service responsiveness represent significant considerations for prospective users. Key advantages include widespread accessibility and proven user adoption, while primary disadvantages encompass limited operational transparency, inconsistent customer service quality, and moderate trust ratings that reflect mixed user experiences across the platform's service offerings.