ABSA 2025 Review: Everything You Need to Know

Summary

ABSA is a major financial services company based in South Africa. The company offers complete trading services for both stock and forex markets, making it a one-stop shop for many investors. This absa review shows mixed results from users - some people give 5-star ratings while others worry about certain company programs.

The broker focuses on investors who want to trade stocks and forex. ABSA positions itself as a full-service financial provider that can handle many different investment needs. According to user feedback we found, ABSA stays active on review sites like Trustpilot.

Customer discussions range from good trading experiences to worries about corporate campaigns and moving money around. The company offers online stock trading platforms and gives access to multiple types of investments, though exact details about trading conditions change depending on the source. While ABSA shows market involvement and keeps users in certain areas, the information we have suggests they could improve customer communication and service delivery.

The broker's South African location gives them regional knowledge. However, traders should know that different areas have different rules and regulations that might affect their trading.

Important Notice

This review relies mainly on user feedback and public information because we had limited specific details in our research sources. Traders should know that different regional offices may work under different legal and regulatory rules, and specific trading conditions may be different from what we describe here.

We have not tested the platform directly for this evaluation. Prospective clients should do their own research and check current terms and conditions directly with ABSA before making any trading decisions.

Rating Framework

Broker Overview

ABSA works as a leading financial services company based in South Africa. The company provides a wide range of financial products and services, including stock brokerage services that help people invest in markets. ABSA has built a strong position in the South African financial world by offering various investment solutions to meet different client needs.

While we don't have specific founding details in current sources, ABSA's presence in the financial sector shows long-term market involvement. The company's business model covers multiple parts of financial services, with a special focus on meeting different customer needs across various market areas. ABSA's approach mixes traditional banking services with modern trading solutions, making it a full-service financial provider in the South African market.

For trading infrastructure, ABSA offers an online stock trading platform that gives access to both stock and forex markets. The broker's asset coverage includes stocks and foreign exchange trading opportunities, though specific details about additional instruments are not detailed in available sources. Information about primary regulatory oversight and specific compliance frameworks is not fully covered in current research materials, making this an important area for potential clients to check directly with the broker.

This absa review shows that while the broker maintains market presence and user engagement, potential clients should get additional information about regulatory status and specific trading conditions before opening an account.

Regulatory Jurisdiction: Specific regulatory authority information is not detailed in available sources, though the broker operates from South Africa.

Deposit and Withdrawal Methods: Available sources do not specify the range of deposit and withdrawal options offered by ABSA.

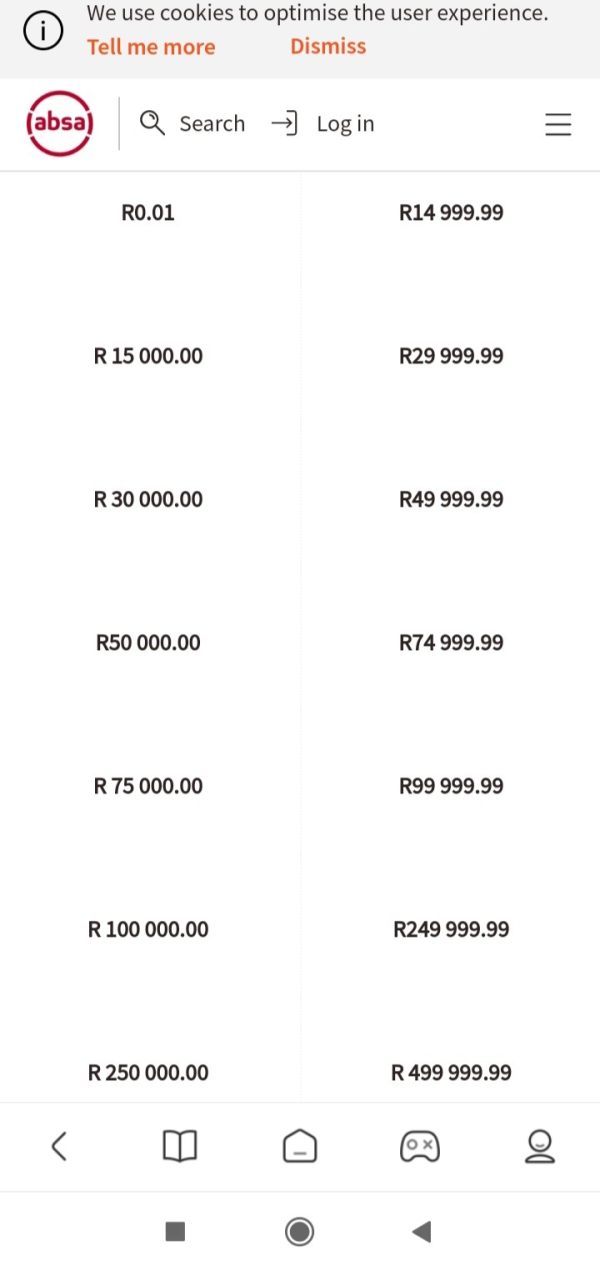

Minimum Deposit Requirements: Minimum deposit amounts are not detailed in current research materials.

Bonus and Promotions: Information about promotional offers and bonus structures is not available in current sources.

Tradeable Assets: The platform provides access to stock and forex markets. This gives investors opportunities across these key asset classes.

Cost Structure: Specific information about spreads, commissions, and other trading costs is not detailed in available materials.

Leverage Ratios: Leverage offerings and maximum ratios are not specified in current research sources.

Platform Options: ABSA provides an online stock trading platform for client access to markets.

Geographic Restrictions: Regional limitations and availability are not specified in available information.

Customer Support Languages: Language support options are not detailed in current sources.

This absa review highlights the need for potential clients to get complete information directly from ABSA about these important trading details.

Detailed Rating Analysis

Account Conditions Analysis

Account type variety and features are not specifically detailed in available research sources. This makes it hard to judge the range of options available to different trader types, from beginners to professionals. The lack of specific information about minimum deposit requirements prevents a thorough review of accessibility for various investor groups.

Account opening procedures and requirements are not outlined in current materials. This represents a big information gap for potential clients who want to understand the sign-up process. Without details about paperwork requirements, verification timelines, or approval procedures, potential users cannot properly prepare for account setup.

Special account features, such as Islamic-compliant accounts or professional trading accounts, are not mentioned in available sources. This lack of information makes it hard to determine whether ABSA serves specific religious requirements or advanced trader needs. User feedback specifically related to account conditions is not available in current research materials, preventing assessment of client satisfaction with account features, flexibility, or management tools.

Comparative information against other brokers is also not available. This limits the ability to position ABSA's account offerings within the broader market context. This absa review emphasizes the importance of direct broker consultation to understand available account types and their respective features and requirements.

Trading tool variety and quality information is not available in current research sources. This prevents assessment of the technical analysis capabilities, charting packages, or market scanning tools that may be available to ABSA clients. Without specific details about platform functionality, traders cannot evaluate whether the broker meets their analytical needs.

Research and analysis resources are not detailed in available materials. This makes it impossible to determine whether ABSA provides market commentary, economic calendars, or fundamental analysis to support client trading decisions. The absence of information about research quality and frequency represents a significant evaluation gap.

Educational resources and training materials are not mentioned in current sources. This prevents assessment of whether ABSA supports trader development through webinars, tutorials, or educational content. For newer traders, this information would be particularly valuable in broker selection decisions.

Automated trading support and algorithmic trading capabilities are not specified in available information. This limits assessment of the platform's suitability for traders who rely on automated strategies or expert advisors. User feedback regarding tool effectiveness and resource quality is not available in current research materials, preventing evaluation of client satisfaction with these important platform features.

Customer Service and Support Analysis

Customer service channels and availability are not detailed in current research sources. This makes it impossible to assess whether ABSA provides phone, email, live chat, or other support options. The absence of information about support accessibility represents a significant evaluation limitation for potential clients.

Response time expectations and service level commitments are not specified in available materials. This prevents assessment of how quickly clients can expect issue resolution or query responses. This information gap is particularly important for active traders who may require urgent assistance.

Service quality indicators and client satisfaction metrics related to customer support are not available in current research sources. Without user feedback specifically about support experiences, it's challenging to evaluate the effectiveness of ABSA's customer service operations. Multi-language support capabilities are not detailed in available information, making it difficult for international clients or non-English speakers to determine whether appropriate assistance would be available in their preferred language.

Customer service operating hours and timezone coverage are not specified in current sources. This prevents assessment of support availability for clients who may trade outside standard business hours or across different time zones.

Trading Experience Analysis

Platform stability and execution speed are not specifically addressed in available user feedback. This prevents assessment of the technical performance that traders can expect from ABSA's systems. Without performance data or user experiences, it's challenging to evaluate whether the platform meets the reliability standards required for active trading.

Order execution quality and slippage information are not detailed in current research sources. This represents a significant gap in understanding actual trading conditions. Fill rates, execution speeds, and price improvement statistics would be valuable for trader evaluation but are not available.

Platform functionality completeness and feature availability are not fully covered in available materials. This makes it difficult to assess whether ABSA's trading interface provides the tools and capabilities that modern traders expect. Mobile trading experience and app functionality are not detailed in current sources, preventing evaluation of how well ABSA serves traders who need to manage positions or monitor markets while away from desktop computers.

Trading environment data, including server locations, uptime statistics, or latency measurements, are not available in current research materials. This technical information would be particularly valuable for active traders but is not covered in available sources. This absa review indicates that potential clients should seek detailed information about platform performance and trading conditions directly from the broker.

Trust and Security Analysis

Regulatory credentials and oversight details are not fully covered in available sources. This represents a critical information gap for trader security assessment. Without specific regulatory numbers, compliance frameworks, or supervisory authority details, clients cannot fully evaluate the legal protections available.

Fund security measures and client money protection protocols are not detailed in current research materials. This prevents assessment of how ABSA protects client deposits and trading funds. Information about segregated accounts, deposit insurance, or compensation schemes would be valuable but is not available.

Company transparency regarding ownership, financial statements, or corporate governance is not addressed in available sources. This makes it difficult to assess the institution's openness and accountability to clients and regulators. Industry reputation and standing within the financial services sector are not specifically covered in current research materials, though the broker's South African presence suggests established market participation.

Negative event handling and crisis management approaches are touched upon in available sources. User discussions mention legal cases and fund transfer concerns, though specific details about resolution procedures are not provided.

User Experience Analysis

Overall user satisfaction presents a mixed picture. Some clients provide 5-star ratings while others express concerns about corporate initiatives and service delivery. The available feedback suggests satisfaction levels vary significantly across different client segments and service areas.

Interface design and platform usability are not specifically detailed in current research sources. This prevents assessment of how intuitive and user-friendly ABSA's trading platforms may be for different experience levels. Registration and verification processes are not outlined in available materials, representing an important information gap for potential clients seeking to understand onboarding requirements and timelines.

Fund operation experiences, including deposit and withdrawal procedures, are not detailed in current sources. However, user discussions suggest some concerns about fund transfer processes and resolution timelines. Common user complaints identified in available feedback include concerns about corporate campaigns, with some users describing ABSA's "Your Story Matters" initiative as feeling hollow or disconnected from actual service delivery.

These concerns suggest potential areas for improvement in customer communication and engagement strategies.

Conclusion

ABSA operates as an established South African financial services institution offering stock and forex trading services. However, this review reveals significant information gaps that potential clients should address through direct broker consultation. While some users provide positive ratings, mixed feedback suggests areas for potential improvement in service delivery and customer engagement.

The broker appears most suitable for investors seeking to participate in stock and forex trading within the South African market context. However, the lack of detailed information about trading conditions, regulatory status, and platform features makes complete evaluation challenging. Key advantages include the broker's established market presence and some positive user experiences, while potential concerns center around mixed customer feedback regarding corporate initiatives and limited publicly available information about important trading parameters.

Prospective clients should conduct thorough research and obtain detailed information directly from ABSA before making trading decisions.