360°capital 2025 Review: Everything You Need to Know

Executive Summary

This 360°capital review looks at an unregulated forex broker that creates big risks for potential investors. 360°Capital works as an introducing broker in the CFD and margin trading sector. The company is registered in Mauritius without proper regulatory oversight. The company started in 2019 and offers trading services across multiple asset classes including forex, commodities, indices, equities, and cryptocurrencies.

The broker claims over 15 years of combined experience in the financial sector, but the lack of regulatory authorization raises serious concerns about investor protection and fund security. The platform targets traders who want high leverage opportunities and diversified trading products. However, the absence of transparent fee structures, minimum deposit requirements, and comprehensive user feedback makes it difficult to assess the true quality of services offered.

Key characteristics include high leverage ratios and access to various financial instruments. These features come with substantial risks given the unregulated status. This review aims to provide a comprehensive analysis based on available public information to help traders make informed decisions about this broker.

Important Notice

Regional Differences: As an unregulated entity, 360°Capital may face varying legal restrictions and compliance issues across different jurisdictions. Traders should know that the broker's services may not be legally available in all regions. The lack of regulatory oversight means limited recourse in case of disputes.

Review Methodology: This evaluation is based on publicly available information and market analysis. Due to the absence of user reviews and limited transparency from the broker, this assessment focuses on verifiable facts and industry standards for comparison.

Rating Framework

Broker Overview

360°Capital emerged in the forex market in 2019 as an introducing broker specializing in CFD and margin trading services. The company positions itself as a bridge between retail traders and the broader financial markets. It claims to leverage over 15 years of combined experience from its team members across various financial sectors. Despite this claimed expertise, the broker operates without regulatory authorization, which immediately raises red flags for potential investors.

The broker's business model focuses on providing access to leveraged trading products across multiple asset classes. Their approach targets traders who seek high-risk, high-reward opportunities through CFD trading and spread betting. However, the lack of comprehensive public information about their operational structure, fee schedules, and client protection measures makes it challenging to assess their true market position and service quality.

This 360°capital review reveals that while the broker offers access to diverse financial instruments including forex pairs, commodities, stock indices, individual equities, and cryptocurrency CFDs, the absence of proper regulatory oversight significantly undermines the credibility of their services. The company's registration in Mauritius, a jurisdiction known for lighter financial regulations, further compounds concerns about investor protection and operational transparency.

Regulatory Status: 360°Capital operates without authorization from major financial regulatory bodies. The broker is registered in Mauritius, but this registration does not constitute proper financial services regulation that would provide investor protection.

Deposit and Withdrawal Methods: Specific information about funding options and withdrawal procedures is not detailed in available public materials. This is concerning for potential clients seeking transparency.

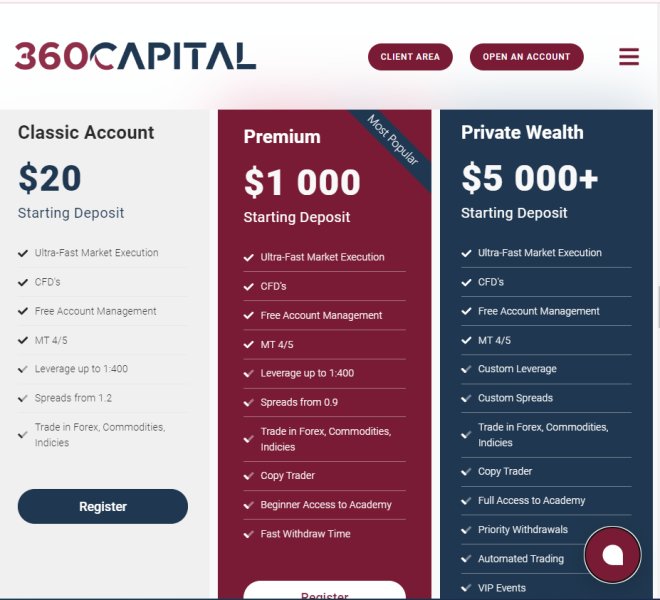

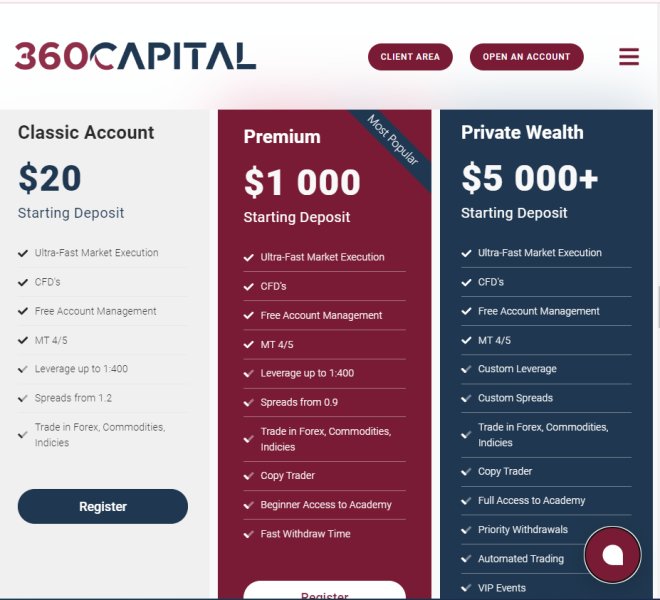

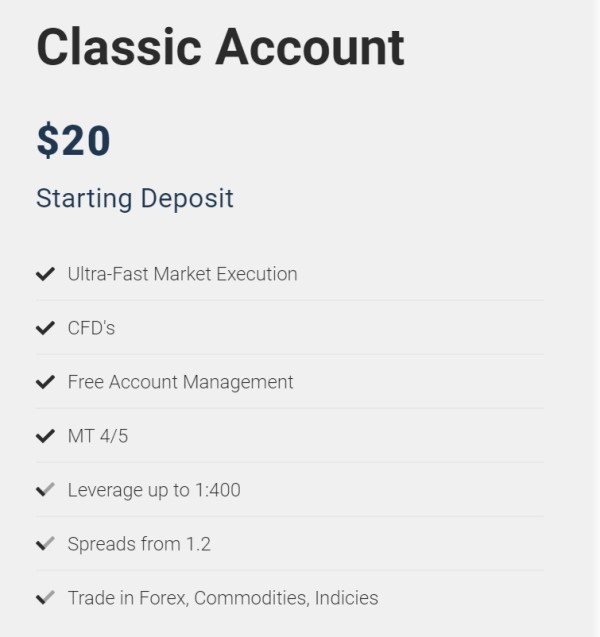

Minimum Deposit Requirements: The broker has not disclosed minimum deposit amounts in publicly available information. This makes it impossible to assess accessibility for different trader categories.

Bonuses and Promotions: No information about promotional offers or bonus schemes is available in public sources. This suggests either the absence of such programs or poor marketing transparency.

Trading Assets: The platform provides access to forex currency pairs, commodities trading, stock indices, individual equities, and cryptocurrency CFDs. It offers a diverse range of trading opportunities across different market sectors.

Cost Structure: Available information indicates that standard account spreads begin at 10 pips. This is significantly higher than industry standards. Commission structures and additional fees remain undisclosed in public materials.

Leverage Ratios: The broker offers leverage up to 1:400. This represents extremely high risk levels that could result in substantial losses exceeding initial deposits.

Platform Options: Specific trading platform information is not detailed in available sources. This leaves questions about technology infrastructure and trading tools.

Geographic Restrictions: Regional availability and restrictions are not clearly outlined in public materials.

Customer Support Languages: Language support options for customer service are not specified in available information.

This 360°capital review highlights the concerning lack of transparency across multiple operational aspects that are typically disclosed by reputable brokers.

Account Conditions Analysis

The account conditions offered by 360°Capital present significant concerns for potential traders. The broker has failed to provide clear information about account types, tier structures, or specific features that differentiate various account categories. This lack of transparency is particularly troubling in an industry where account conditions directly impact trading costs and overall profitability.

Minimum deposit requirements remain undisclosed. This prevents traders from understanding the financial commitment required to begin trading. Reputable brokers typically provide clear information about entry-level deposits to help clients make informed decisions about their investment capacity and risk tolerance.

The account opening process is not detailed in available materials. This raises questions about verification procedures, documentation requirements, and timeline expectations. Without clear guidance on these fundamental aspects, potential clients cannot adequately prepare for the onboarding experience.

Special account features such as Islamic accounts for Sharia-compliant trading, professional account categories, or institutional services are not mentioned in public information. This suggests either limited service offerings or poor communication about available options.

The absence of user feedback regarding account conditions makes it impossible to assess real-world experiences with account management, funding processes, or customer satisfaction levels. This 360°capital review emphasizes that the lack of transparency in account conditions represents a significant disadvantage compared to regulated competitors who provide comprehensive account information.

360°Capital's trading tools and resources present a mixed picture with significant information gaps that hinder proper evaluation. The broker has not provided detailed information about proprietary trading tools, third-party integrations, or analytical resources that would support trader decision-making processes.

Research and analysis capabilities appear limited based on available information. Professional traders typically require access to market research, economic calendars, technical analysis tools, and fundamental analysis resources to make informed trading decisions. The absence of detailed information about these essential services raises concerns about the broker's commitment to supporting trader success.

Educational resources, which are crucial for developing trading skills and understanding market dynamics, are not prominently featured in public materials. Reputable brokers typically offer webinars, tutorials, market analysis, and educational content to help clients improve their trading performance and risk management capabilities.

Automated trading support, including expert advisors, algorithmic trading tools, and copy trading services, is not detailed in available sources. These features have become increasingly important for modern traders seeking to optimize their trading strategies and execution efficiency.

The platform's charting capabilities, technical indicators, and analytical tools remain unclear from public information. Without comprehensive details about these fundamental trading resources, it becomes difficult for potential clients to assess whether the platform meets their analytical and execution requirements.

Customer Service and Support Analysis

Customer service quality represents one of the most significant unknowns in this 360°capital review. The broker has not provided comprehensive information about customer support channels, availability hours, or service quality standards that clients can expect when seeking assistance.

Available communication channels such as phone support, email correspondence, live chat functionality, or ticket-based support systems are not clearly outlined in public materials. This lack of transparency makes it impossible for potential clients to understand how they can access help when needed.

Response time expectations and service level agreements are not disclosed. This is concerning given the fast-paced nature of financial markets where timely support can be crucial for resolving trading issues or account problems.

Multilingual support capabilities remain unclear. This potentially limits accessibility for international traders who prefer to communicate in their native languages. Professional brokers typically provide support in multiple languages to serve diverse client bases effectively.

Customer service hours and availability across different time zones are not specified. This could impact traders operating in markets outside the broker's primary operational hours. The absence of user feedback about customer service experiences makes it impossible to assess actual service quality, problem resolution effectiveness, or overall client satisfaction with support services.

Trading Experience Analysis

The trading experience offered by 360°Capital remains largely unclear due to insufficient public information about platform capabilities and user feedback. Platform stability and execution speed, which are critical factors for successful trading, cannot be properly evaluated without access to performance data or user testimonials.

Order execution quality represents a fundamental concern given the lack of transparency about execution policies, slippage rates, and order processing procedures. Professional traders require reliable execution to implement their strategies effectively, but the absence of detailed information about these aspects raises questions about platform performance.

Platform functionality and feature completeness cannot be adequately assessed from available sources. Modern trading platforms typically offer advanced charting tools, multiple order types, risk management features, and customization options that enhance the trading experience.

Mobile trading capabilities, which have become essential for active traders who need market access while away from desktop computers, are not detailed in public materials. The quality of mobile applications and their feature parity with desktop platforms remains unknown.

The overall trading environment, including market depth information, price feeds quality, and trading conditions during high volatility periods, lacks proper documentation. Without user feedback about real trading experiences, it becomes impossible to assess how the platform performs under various market conditions and whether it meets professional trading standards.

Trust and Safety Analysis

Trust and safety concerns represent the most significant issues identified in this 360°capital review. The broker's unregulated status immediately raises red flags about investor protection and operational oversight. Operating without proper regulatory authorization means clients have limited recourse in case of disputes or operational problems.

Fund security measures are not adequately disclosed in public materials. This leaves questions about client money segregation, deposit protection schemes, and safeguarding procedures. Regulated brokers typically maintain client funds in segregated accounts and participate in compensation schemes that protect investor deposits up to specified amounts.

Corporate transparency appears limited based on available information about company structure, ownership details, and operational procedures. Reputable financial service providers typically provide comprehensive information about their corporate governance, regulatory compliance, and operational transparency.

Industry reputation cannot be properly assessed due to the absence of independent reviews, regulatory records, or industry recognition. The broker's relatively recent establishment in 2019 means limited operational history for evaluation purposes.

Risk management and negative event handling procedures are not detailed in available sources. Professional brokers typically have established protocols for managing operational risks, market disruptions, and client protection during adverse events. The absence of such information raises concerns about the broker's preparedness for handling challenging situations that could affect client interests.

User Experience Analysis

User experience evaluation proves challenging due to the complete absence of client feedback and testimonials in available sources. Overall user satisfaction levels cannot be determined without access to genuine user reviews or independent assessment platforms that track client experiences.

Interface design and platform usability remain unknown factors that significantly impact trading effectiveness. Modern traders expect intuitive interfaces, responsive design, and user-friendly navigation that supports efficient trading operations.

Registration and verification processes are not detailed in public materials. This makes it impossible to assess the convenience and efficiency of account opening procedures. Streamlined onboarding experiences are increasingly important for attracting and retaining clients in competitive markets.

Funding and withdrawal experiences represent critical aspects of user satisfaction, but specific information about transaction processing times, fee structures, and procedural requirements is not available in public sources.

Common user complaints and satisfaction patterns cannot be identified due to the absence of review data. This 360°capital review emphasizes that the lack of user feedback represents a significant limitation in assessing actual service quality and client satisfaction levels. Without independent verification of service claims and user experiences, potential clients must rely solely on limited public information when making decisions about this broker.

Conclusion

This comprehensive 360°capital review reveals significant concerns about this unregulated broker that potential investors should carefully consider. The absence of proper regulatory oversight, combined with limited transparency about operational procedures and service quality, creates substantial risks for traders considering this platform.

The broker offers high leverage ratios up to 1:400 and access to diverse trading instruments across multiple asset classes. However, these features cannot compensate for the fundamental safety and transparency issues identified in this analysis. The lack of user feedback, unclear fee structures, and absence of detailed service information make it difficult to recommend this broker to risk-conscious investors.

The platform may appeal to traders specifically seeking high-leverage opportunities and willing to accept significant regulatory risks. However, the majority of investors would benefit from choosing regulated alternatives that provide better investor protection and operational transparency.