Is Zaffex safe?

Pros

Cons

Is Zaffex A Scam?

Introduction

Zaffex is an online forex broker that positions itself as a multi-market trading platform, offering a range of financial instruments including forex pairs, CFDs, and cryptocurrencies. As the forex market continues to grow, traders must exercise caution when selecting brokers, as the industry is rife with scams and unregulated entities. This article aims to provide a comprehensive evaluation of Zaffex, exploring its regulatory status, company background, trading conditions, customer safety, user experiences, and overall risks. The investigation is based on a review of multiple online sources, including user feedback, regulatory databases, and financial analysis platforms.

Regulation and Legitimacy

The regulatory status of a broker is a crucial factor in determining its legitimacy and safety. Zaffex currently operates without valid regulatory oversight, which raises significant concerns for potential traders. Below is a summary of the regulatory information concerning Zaffex:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The absence of regulation means that Zaffex is not subject to the stringent oversight that protects traders from fraud and malpractice. Regulatory bodies typically enforce rules that ensure brokers maintain a certain level of transparency, segregate client funds, and adhere to fair trading practices. Without such oversight, the risk of encountering issues such as withdrawal problems, hidden fees, or even outright scams increases significantly. Furthermore, previous reviews indicate that Zaffex has not demonstrated a history of compliance with regulatory standards, making it imperative for traders to approach this broker with caution.

Company Background Investigation

Zaffex was established relatively recently, with its website and services becoming operational within the last year. The company is registered in an offshore jurisdiction, which is often a red flag for potential scams. The ownership structure of Zaffex is obscured, as the details of its founders and management team are not publicly available. This lack of transparency can be concerning for traders who prefer to deal with brokers that provide clear information about their leadership and operational practices.

The management team‘s background and professional experience are critical indicators of a broker’s credibility. Unfortunately, Zaffex does not disclose any information about its team, which raises questions about their expertise and commitment to ethical trading practices. The lack of information on the companys website further complicates the assessment of its reliability. As a result, potential clients are left without the necessary data to evaluate the broker's trustworthiness, which is essential when considering whether "Is Zaffex safe?"

Trading Conditions Analysis

When evaluating the trading conditions offered by Zaffex, it is essential to consider the overall cost structure. Zaffex claims to provide competitive spreads and a variety of account types, but the lack of transparency surrounding its fees is concerning. Below is a comparison of Zaffex's core trading costs against industry averages:

| Fee Type | Zaffex | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable (not disclosed) | 1-2 pips |

| Commission Model | Not specified | $5 per lot |

| Overnight Interest Range | Not specified | Varies widely |

The lack of specific information regarding spreads and commissions makes it challenging for traders to assess the true cost of trading with Zaffex. Additionally, the absence of a clear commission structure may lead to hidden fees that could significantly impact trading profitability. Given the importance of understanding trading costs, potential clients must carefully consider whether "Is Zaffex safe?" before committing funds.

Customer Funds Security

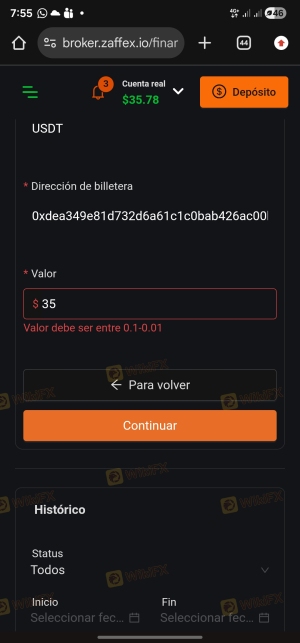

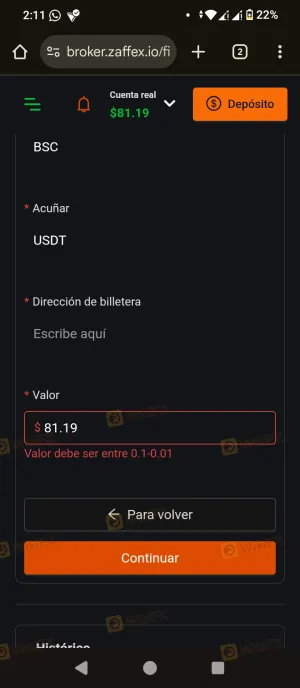

The safety of customer funds is a paramount concern when choosing a forex broker. Zaffex's website lacks clear information regarding its client fund protection measures. It is crucial for a broker to implement stringent security protocols, such as segregating client funds from company operating capital, to ensure that traders' money is safe from potential misuse or misappropriation.

Furthermore, there is no information available regarding investor protection schemes, which are typically provided by regulated brokers to safeguard clients in the event of insolvency. The absence of such measures raises significant red flags regarding the security of funds deposited with Zaffex. Historical data indicates that brokers operating without regulation often experience issues related to fund safety, further emphasizing the need for due diligence when assessing whether "Is Zaffex safe?"

Customer Experience and Complaints

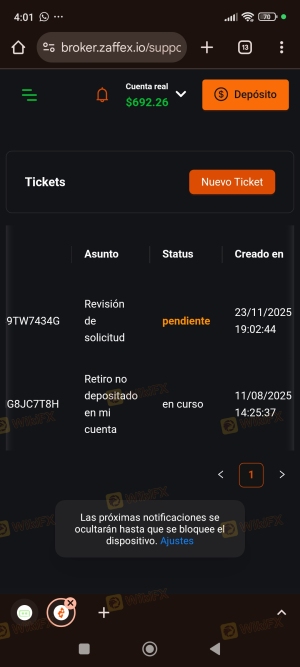

User feedback is an invaluable resource for assessing a broker's reliability. Reviews of Zaffex reveal a mixed bag of experiences, with several users reporting difficulties in withdrawing funds and receiving timely support. Common complaint patterns include:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Poor Customer Support | Medium | Inconsistent |

| Lack of Transparency | High | Unaddressed |

Two notable cases involve traders who experienced significant delays in fund withdrawals, leading to frustration and distrust in the platform. These complaints highlight a potential pattern of operational inefficiencies that could be detrimental to the user experience. As such, the question "Is Zaffex safe?" becomes even more pertinent when considering the experiences of current and former clients.

Platform and Trade Execution

The trading platform provided by Zaffex is reported to be user-friendly, featuring the popular MetaTrader 5 interface. However, there are concerns regarding the execution quality, including instances of slippage and order rejections. Traders have expressed dissatisfaction with the speed of order execution, particularly during volatile market conditions, which can significantly affect trading outcomes.

Signs of potential platform manipulation, such as frequent re-quotes and unexpected price changes, have also been reported, further raising concerns about the broker's integrity. As traders assess whether "Is Zaffex safe?", it is crucial to consider the execution quality and reliability of the trading environment.

Risk Assessment

Using Zaffex presents several risks that potential traders should be aware of. The following risk scorecard summarizes the key risk areas associated with this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No valid regulation |

| Financial Stability Risk | High | Lack of transparency in fund safety |

| Customer Service Risk | Medium | Inconsistent support response |

| Execution Risk | High | Reports of slippage and rejections |

To mitigate these risks, it is advisable for traders to conduct thorough research, start with small investments, and consider alternative brokers with a better regulatory standing and proven track record.

Conclusion and Recommendation

In conclusion, the evidence gathered raises significant concerns about the legitimacy and safety of Zaffex. The lack of regulation, transparency issues, and negative user experiences suggest that potential investors should exercise extreme caution. The question "Is Zaffex safe?" leans towards a negative response based on the available data.

For traders seeking reliable alternatives, it is recommended to consider brokers that are well-regulated, transparent about their operations, and have a history of positive user experiences. Brokers such as [insert reputable broker names here] may provide a safer trading environment for forex traders looking to navigate the complexities of the market.

Is Zaffex a scam, or is it legit?

The latest exposure and evaluation content of Zaffex brokers.

Zaffex Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Zaffex latest industry rating score is 1.26, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.26 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.