Is XPG Markets safe?

Business

License

Is XPG Markets Safe or Scam?

Introduction

XPG Markets is a forex and commodities broker that positions itself as a provider of trading services for both retail and institutional clients. As the financial landscape continues to evolve, traders are increasingly cautioned about the potential risks associated with unregulated brokers. This article aims to assess the safety and legitimacy of XPG Markets by examining its regulatory status, company background, trading conditions, customer fund security, and user feedback. The analysis is based on a thorough review of available online resources, including broker reviews and regulatory databases, to provide a comprehensive understanding of whether XPG Markets is safe or a potential scam.

Regulation and Legitimacy

When evaluating the safety of a forex broker, one of the most critical factors is its regulatory status. Regulation serves as a safeguard for traders, ensuring that brokers adhere to specific standards and practices designed to protect clients. Unfortunately, XPG Markets currently operates without valid regulatory oversight, which raises significant concerns about its legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Regulated |

The absence of a regulatory license from a recognized authority is a red flag. Brokers regulated by top-tier authorities, such as the FCA in the UK or ASIC in Australia, are subject to stringent rules and compliance checks. In contrast, brokers like XPG Markets, which are registered in jurisdictions like Seychelles or Bermuda, often face less oversight, increasing the risk of potential fraud or malpractice. Without a regulatory framework, traders have minimal recourse in the event of disputes or financial losses, making it essential to approach such brokers with caution.

Company Background Investigation

XPG Markets Limited, the entity behind XPG Markets, is registered in Seychelles, a location known for its lax regulatory environment. The company claims to offer various trading instruments, including forex pairs, commodities, and indices. However, the lack of transparency regarding its ownership structure and management team raises further concerns.

The absence of detailed information about the company's history, its founding members, and their professional backgrounds limits the ability to assess the broker's credibility. A transparent company typically provides information on its team, including their qualifications and experience in the financial industry. This lack of information can lead to doubts about the broker's operational integrity and commitment to ethical practices.

Trading Conditions Analysis

Understanding a broker's trading conditions is crucial for evaluating its overall value proposition. XPG Markets advertises low minimum deposits and high leverage options, which can be appealing to new traders. However, these features often come with hidden costs that can erode potential profits.

| Fee Type | XPG Markets | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | 1 pip | 1-2 pips |

| Commission Structure | None (Prime Account) | $5 - $10 per lot |

| Overnight Interest Range | Varies | Varies |

While the broker offers competitive spreads, the lack of clarity regarding other fees, such as withdrawal costs or inactivity fees, can be concerning. Traders should be wary of brokers that do not transparently disclose their fee structures, as hidden costs can significantly impact trading outcomes. Furthermore, the high leverage offered (up to 1:500) can amplify both gains and losses, increasing the risk for inexperienced traders.

Customer Fund Security

The safety of customer funds is paramount when choosing a broker. XPG Markets claims to implement measures such as fund segregation and negative balance protection; however, without regulatory oversight, the effectiveness of these measures cannot be independently verified.

A credible broker typically maintains client funds in segregated accounts, ensuring that they are kept separate from the broker's operating capital. This practice protects traders in case the broker faces financial difficulties. Additionally, negative balance protection is essential for preventing clients from losing more than their initial deposit. However, the lack of a regulatory framework raises questions about the enforceability of these protections.

Customer Experience and Complaints

User feedback is a valuable indicator of a broker's reliability. Reviews of XPG Markets reveal a mixed bag of experiences, with some users expressing satisfaction with the trading platform while others report issues with withdrawals and customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Inconsistent |

| Poor Customer Support | Medium | Slow Response |

| Misleading Promotions | High | Unaddressed |

Common complaints include difficulties in processing withdrawals, indicating potential issues with fund accessibility. Additionally, users have reported receiving limited support from customer service, which can be particularly frustrating for traders seeking assistance. These patterns of complaints suggest that while some traders may find success with XPG Markets, others may face significant hurdles, raising further questions about whether XPG Markets is safe.

Platform and Execution

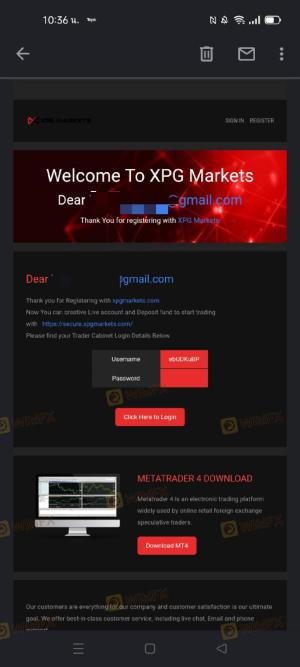

The trading platform offered by XPG Markets is based on the widely recognized MetaTrader 4 (MT4), known for its user-friendly interface and comprehensive trading tools. However, the platform's performance, including order execution quality and slippage rates, is critical for a successful trading experience.

Traders have reported varying experiences with order execution, with some noting instances of slippage during high volatility periods. Such occurrences can affect trading outcomes, especially for those employing scalping strategies. Additionally, the absence of clear information regarding the broker's handling of orders raises concerns about potential manipulation or unfair practices.

Risk Assessment

Using XPG Markets involves several risks that traders should be aware of. The absence of regulation, potential hidden fees, and customer complaints regarding fund accessibility contribute to a heightened risk profile.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No valid regulatory oversight |

| Financial Risk | Medium | Potential hidden fees and costs |

| Operational Risk | High | Complaints about withdrawals and service |

To mitigate these risks, traders are advised to conduct thorough research before engaging with XPG Markets. Utilizing demo accounts to test the platform and seeking reviews from multiple sources can provide valuable insights into the broker's operations.

Conclusion and Recommendations

In conclusion, the evidence suggests that XPG Markets is not a safe broker for traders. The lack of regulatory oversight, combined with customer complaints regarding withdrawals and service quality, raises significant concerns about its legitimacy. While some traders may find the trading conditions appealing, the risks associated with operating under an unregulated broker cannot be overlooked.

Traders seeking a reliable forex broker should consider alternatives that are regulated by reputable authorities, such as the FCA or ASIC. Brokers like IG, OANDA, or Interactive Brokers offer robust regulatory frameworks, transparent fee structures, and a commitment to customer security. In summary, while XPG Markets may present itself as a viable option, the potential risks far outweigh the benefits, making it advisable for traders to proceed with caution or seek more reputable alternatives.

Is XPG Markets a scam, or is it legit?

The latest exposure and evaluation content of XPG Markets brokers.

XPG Markets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

XPG Markets latest industry rating score is 1.51, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.51 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.