Is TWFX safe?

Business

License

Is Twfx Safe or a Scam?

Introduction

Twfx is a forex broker that positions itself within the competitive landscape of the foreign exchange market. As a trading platform, it claims to provide a variety of trading instruments, including forex, commodities, and indices, appealing to both novice and seasoned traders. However, the influx of new brokers in the market necessitates a careful evaluation by traders before committing their funds. Given the potential for scams and fraudulent activities in the forex sector, it is crucial for traders to assess the legitimacy and reliability of brokers like Twfx. This article aims to provide a comprehensive analysis of Twfx, focusing on its regulatory status, company background, trading conditions, customer experiences, and overall safety.

Regulation and Legitimacy

One of the primary factors to consider when evaluating a forex broker is its regulatory status. Regulation serves as a safeguard for traders, ensuring that brokers adhere to specific standards and practices designed to protect investors. In the case of Twfx, it lacks regulation from any prominent financial authority, which raises significant concerns about its legitimacy and safety.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unverified |

The absence of a regulatory license from reputable bodies such as the Financial Conduct Authority (FCA) in the UK or the Commodity Futures Trading Commission (CFTC) in the US indicates that Twfx operates outside the oversight of established financial regulations. This lack of regulation is a red flag, as it implies that there are no legal protections in place for traders. Without regulatory supervision, the risk of encountering fraudulent practices increases significantly, making it essential for potential clients to exercise caution.

Company Background Investigation

Twfx is operated by Target Winner Limited, a company that claims to be based in the United Kingdom. However, the lack of transparency regarding the companys ownership structure and operational history raises concerns. There is limited information available about the management team and their professional backgrounds, which is critical for assessing the broker's credibility. A reputable broker typically provides detailed information about its founders and executives, including their qualifications and experience in the financial sector.

Additionally, the company's transparency regarding its business practices and financial disclosures appears to be lacking. Investors should be wary of brokers that do not provide clear and accessible information about their operations, as this can be indicative of potential issues down the line.

Trading Conditions Analysis

When assessing whether Twfx is safe, understanding its trading conditions is crucial. The overall fee structure and trading costs can significantly impact a trader's profitability. Twfx offers various account types with different minimum deposits and spreads, but the absence of clear information about its fees is concerning.

| Fee Type | Twfx | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 1.0 pips | 0.5 - 1.5 pips |

| Commission Model | $10 - $20 | $5 - $10 |

| Overnight Interest Range | N/A | Varies |

The spreads offered by Twfx are on the higher end compared to industry averages, which can erode potential profits for traders. Furthermore, the lack of clarity regarding overnight interest rates and other potential fees is troubling. Traders should be cautious of any hidden fees that may not be disclosed upfront, as these can significantly affect their trading experience and financial outcomes.

Customer Fund Safety

The safety of customer funds is paramount when considering whether Twfx is safe. Brokers are expected to implement robust security measures to protect client deposits. Unfortunately, Twfx has not provided sufficient information regarding its fund security measures, such as whether client funds are kept in segregated accounts or if there are any investor protection policies in place.

The absence of negative balance protection is another critical concern. This policy ensures that traders cannot lose more money than they have deposited, providing a safety net against volatile market movements. Without such protections, traders may find themselves liable for debts exceeding their initial investments, which poses a significant risk.

Customer Experience and Complaints

Analyzing customer feedback is vital for understanding the overall reputation of a broker. Reviews of Twfx reveal a mixed bag of experiences, with some users reporting issues related to withdrawals and customer service responsiveness.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Customer Service Issues | Medium | Average |

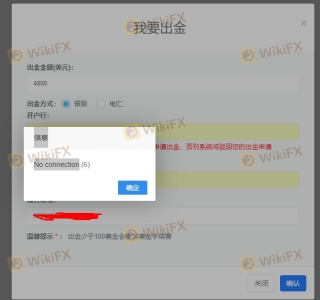

Common complaints include difficulties in withdrawing funds and inadequate customer support. In some cases, clients have reported waiting extended periods for their withdrawal requests to be processed, leading to frustration and dissatisfaction. The company's response to these issues has been described as lacking, which can further exacerbate concerns about its reliability.

Case Study

One notable case involved a trader who attempted to withdraw funds after a successful trading period. After multiple requests and a prolonged waiting period, the trader received minimal communication from Twfx, leading to a loss of trust in the broker. This situation highlights the importance of responsive customer service and timely handling of withdrawal requests.

Platform and Trade Execution

The performance of a trading platform is crucial for a seamless trading experience. Users have reported mixed experiences with Twfx's platform, with some citing stability issues during high-volatility periods. Additionally, concerns about slippage and order rejections have surfaced, indicating potential problems with trade execution quality.

Traders need assurance that their orders will be executed promptly and accurately, especially in fast-moving markets. Any signs of manipulation or unfair practices can significantly undermine trust in a broker.

Risk Assessment

Evaluating the overall risk associated with using Twfx is essential for potential customers.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulation from recognized bodies. |

| Financial Risk | High | Lack of fund protection measures. |

| Operational Risk | Medium | Mixed reviews on platform stability. |

The combination of high regulatory and financial risks makes Twfx a broker that traders should approach with caution. To mitigate these risks, potential clients are advised to conduct thorough due diligence and consider alternative brokers with established regulatory oversight and positive customer feedback.

Conclusion and Recommendations

In conclusion, the analysis indicates that Twfx raises several red flags regarding its safety and legitimacy. The absence of regulation, coupled with a lack of transparency and mixed customer feedback, suggests that traders should exercise extreme caution before engaging with this broker.

For those looking for safer alternatives, consider brokers that are regulated by top-tier authorities, offer transparent fee structures, and have a proven track record of customer satisfaction. Ultimately, ensuring the safety of your investments should be the top priority when selecting a forex broker.

Is TWFX a scam, or is it legit?

The latest exposure and evaluation content of TWFX brokers.

TWFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

TWFX latest industry rating score is 1.64, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.64 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.