Is TradeFTM safe?

Business

License

Is TradeFTM Safe or a Scam?

Introduction

TradeFTM is a forex broker that claims to offer a range of trading services and instruments, positioning itself as a competitive player in the forex market. Established in 2007 and based in London, TradeFTM provides access to various financial products, including forex, commodities, and CFDs. However, as with any trading platform, it is crucial for traders to conduct thorough due diligence before committing their funds. The forex market is fraught with risks, and choosing the wrong broker can lead to significant financial losses. This article aims to evaluate whether TradeFTM is safe or a potential scam by examining its regulatory status, company background, trading conditions, customer experiences, and overall risk profile.

Regulation and Legitimacy

The regulation of forex brokers is vital for ensuring the safety of client funds and maintaining market integrity. Regulated brokers are subject to strict oversight, which helps protect investors from fraud and malpractice. Unfortunately, TradeFTM operates without any valid regulatory licenses from recognized authorities such as the Financial Conduct Authority (FCA) in the UK. This lack of regulation raises serious concerns about the broker's legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | N/A | UK | Not Regulated |

| ASIC | N/A | Australia | Not Regulated |

| IFSC | N/A | Belize | Not Regulated |

The absence of regulation from reputable bodies like the FCA or ASIC means that TradeFTM does not adhere to the stringent standards required of regulated brokers. This includes capital adequacy requirements and the segregation of client funds, which are critical for protecting traders' investments. Furthermore, the lack of transparency regarding its regulatory status is a red flag for potential investors. Overall, the regulatory landscape surrounding TradeFTM suggests that it may not be safe for traders looking for a reliable broker.

Company Background Investigation

TradeFTM is operated by TradeFTM Limited, a company that claims to have been in operation for several years. However, the details surrounding its ownership and management team remain vague, which is concerning for potential clients. A reputable broker typically provides clear information about its management and ownership structure, including the backgrounds of key personnel.

The lack of transparency regarding the company's history and management raises questions about its credibility. Furthermore, the absence of any significant milestones or achievements in its operational history suggests that TradeFTM may not have a robust track record in the forex industry. This lack of a solid foundation can be a warning sign for traders considering whether TradeFTM is safe to trade with.

Trading Conditions Analysis

When assessing whether TradeFTM is safe, it is essential to understand its trading conditions and fee structure. TradeFTM offers various account types, each with different minimum deposit requirements and trading fees. However, the overall fee structure appears to be higher than the industry average, which can significantly impact traders' profitability.

| Fee Type | TradeFTM | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 2.4 pips | 1.0-1.5 pips |

| Commission Model | $10-$25 per lot | $5-$10 per lot |

| Overnight Interest Range | High | Moderate |

The spreads offered by TradeFTM, particularly for the micro account, start at 2.4 pips, which is considerably higher than many competitors in the market. Additionally, the commission structure varies significantly between account types, with some accounts incurring high fees that could deter traders. These unfavorable trading conditions may indicate that TradeFTM is not as competitive as it claims, raising further concerns about its safety and reliability.

Client Fund Safety

The safety of client funds is a paramount concern when evaluating a forex broker. Regulated brokers often provide protections such as segregated accounts and investor compensation schemes to safeguard client funds. Unfortunately, TradeFTM does not offer any such assurances. The lack of regulatory oversight means that there are no guarantees regarding the safety of client deposits.

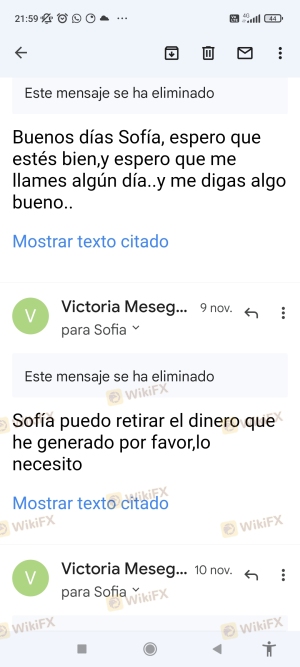

Moreover, there have been reports of withdrawal issues and complaints from clients regarding difficulties in accessing their funds. This is a significant concern, as it suggests that TradeFTM may not prioritize the security of client funds. Traders should be wary of any broker that does not have a solid framework in place for protecting their investments. As a result, the overall assessment of TradeFTM's safety is troubling.

Customer Experience and Complaints

Analyzing customer feedback is crucial in determining whether TradeFTM is safe. Reviews from users often reveal common complaints and issues that can significantly impact the trading experience. Many users have reported problems with withdrawals, citing delays and refusals from the broker.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Misleading Information | Medium | Average |

| Customer Support Delays | Medium | Poor |

These complaints indicate a pattern of dissatisfaction among clients, which is concerning for potential traders. Furthermore, the company's response to these issues appears to be inadequate, leading to frustration among users. Such a negative reputation raises questions about the overall reliability of TradeFTM, suggesting that it may not be a safe option for traders.

Platform and Trade Execution

The trading platform provided by TradeFTM is another critical aspect to consider. While the broker offers popular platforms like MetaTrader 4, there have been reports of performance issues, including slippage and order rejections. These problems can severely affect a trader's ability to execute trades effectively, leading to potential losses.

In evaluating the platform's performance, it is essential to consider the overall user experience and execution quality. Traders have reported instances of high slippage during volatile market conditions, which can be detrimental to trading outcomes. If a broker's platform does not perform reliably, it can significantly impact a trader's ability to succeed in the market.

Risk Assessment

When considering whether TradeFTM is safe, it is crucial to assess the associated risks. The following risk categories highlight key concerns for potential traders:

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No valid regulatory oversight |

| Fund Security Risk | High | No protections for client funds |

| Customer Service Risk | Medium | Poor response to customer complaints |

| Execution Risk | High | Issues with slippage and order rejections |

Given the substantial risks associated with trading through TradeFTM, it is advisable for traders to exercise caution. The absence of regulatory oversight and the lack of transparency raise significant concerns about the broker's reliability and safety.

Conclusion and Recommendations

In conclusion, the evidence suggests that TradeFTM is not a safe broker for traders. The lack of regulation, poor customer feedback, and issues with fund security raise serious red flags. Traders should be cautious when considering whether to engage with TradeFTM, as the potential for loss is significant.

For those seeking a reliable trading experience, it is advisable to explore alternatives that are regulated and have a solid reputation in the market. Brokers such as eToro, Plus500, and IG Markets offer robust protections and transparent trading conditions, making them safer options for traders.

Ultimately, the question of whether TradeFTM is safe is answered with a resounding no. Traders should prioritize their financial security and choose brokers that adhere to regulatory standards to ensure a safer trading environment.

Is TradeFTM a scam, or is it legit?

The latest exposure and evaluation content of TradeFTM brokers.

TradeFTM Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

TradeFTM latest industry rating score is 1.58, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.58 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.