Is PROFIT CINDA safe?

Business

License

Is Profit Cinda Safe or a Scam?

Introduction

Profit Cinda Limited is an online forex broker that has recently gained attention in the trading community. Positioned as a provider of trading services, it claims to offer a range of financial instruments, including forex, commodities, and cryptocurrencies. However, with the rise of online trading scams, it has become increasingly important for traders to carefully assess the legitimacy of any broker before committing their funds. This article aims to investigate whether Profit Cinda is a safe trading option or if it has characteristics that suggest it could be a scam. The investigation utilizes a combination of regulatory reviews, company background checks, trading condition analyses, and customer feedback to form a balanced assessment.

Regulation and Legitimacy

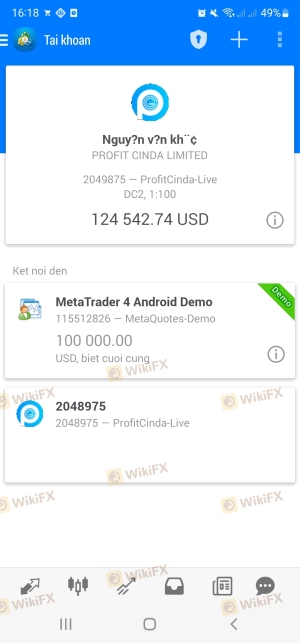

The regulatory status of a broker is crucial for determining its legitimacy and safety. A properly regulated broker is subject to oversight by financial authorities, which helps to ensure that it adheres to industry standards and protects clients' funds. Unfortunately, Profit Cinda is reportedly unregulated, which raises significant red flags. Below is a summary of the regulatory information for Profit Cinda:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

This lack of regulatory oversight means that Profit Cinda does not have to comply with the stringent requirements that regulated brokers must follow, such as maintaining segregated client accounts or providing negative balance protection. Furthermore, multiple sources have indicated that Profit Cinda has been blacklisted by various regulatory bodies, including Spain's Comisión Nacional del Mercado de Valores (CNMV), for providing investment services without authorization. This situation significantly undermines the broker's credibility and raises concerns about its operational practices.

Company Background Investigation

Profit Cinda Limited claims to operate out of the United Kingdom, but its lack of transparency regarding its ownership structure and company history is alarming. The broker does not provide clear information about its founding team or management, making it difficult for potential clients to assess their qualifications and experience. This lack of disclosure is a common trait among brokers that operate in a questionable manner. Moreover, the absence of a physical address or contact information adds to the uncertainty surrounding the company's legitimacy.

The company's website claims to offer various trading instruments and services, but without a proven track record or clear operational history, traders are left with little assurance of the broker's reliability. Transparency is key in the financial sector, and the failure to provide essential information raises concerns about whether Profit Cinda is a safe broker or a potential scam.

Trading Conditions Analysis

When evaluating whether Profit Cinda is safe, it is essential to analyze its trading conditions, including fees and commissions. A reputable broker typically has transparent fee structures and provides clients with clear information about trading costs. However, Profit Cinda has been criticized for its lack of transparency in this area. Below is a comparison of core trading costs:

| Fee Type | Profit Cinda | Industry Average |

|---|---|---|

| Spread for Major Currency Pairs | Not Specified | 1-2 pips |

| Commission Structure | Not Specified | $0-$10 per lot |

| Overnight Interest Range | Not Specified | Varies by broker |

The absence of specified fees raises concerns about hidden charges that could significantly impact trading profitability. Furthermore, unregulated brokers often impose unusual fees or withdrawal restrictions, which can lead to difficulties in accessing funds. This lack of clarity in trading conditions is a significant factor that contributes to the perception that Profit Cinda may not be a safe trading platform.

Client Fund Security

Client fund security is a vital aspect of any trading operation. Regulated brokers are required to keep client funds in segregated accounts, which helps protect them in the event of the broker's insolvency. Unfortunately, Profit Cinda does not provide any information regarding its fund security measures. The absence of segregated accounts and investor protection mechanisms suggests that client funds may be at risk.

Additionally, there have been reports of clients experiencing difficulties when attempting to withdraw their funds from Profit Cinda. Such issues are often indicative of a broker that does not prioritize client security and may engage in practices typical of scams, such as freezing accounts or imposing unreasonable withdrawal conditions. Given these factors, it is crucial for traders to be cautious and consider whether Profit Cinda is indeed a safe option for their investments.

Customer Experience and Complaints

Understanding customer experiences is essential for assessing a broker's reliability. Reviews and feedback from clients can provide valuable insights into the operational practices of a broker. Unfortunately, the feedback regarding Profit Cinda is predominantly negative. Common complaints include difficulties in withdrawing funds, lack of responsive customer service, and issues with account management. Below is a summary of the main complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Delays | Medium | Poor |

| Account Management Issues | High | Poor |

For instance, several users have reported being unable to access their funds despite multiple attempts to initiate withdrawals. This pattern of complaints is concerning and suggests that Profit Cinda may not prioritize customer satisfaction or financial integrity. Such issues further reinforce the notion that Profit Cinda may not be a safe trading platform.

Platform and Trade Execution

The trading platform's performance is another critical factor in assessing a broker's reliability. Profit Cinda claims to offer a trading platform with advanced features, but there is limited independent verification of its performance. Traders have reported issues with order execution, including slippage and rejected orders, which are significant concerns for active traders. If a broker's platform is unreliable, it can lead to substantial financial losses and a frustrating trading experience.

Furthermore, the lack of transparency regarding the platform's operational integrity raises questions about potential manipulation. If traders cannot trust the platform to execute trades fairly and efficiently, it undermines the entire trading process and increases the risk of loss. Thus, the performance of Profit Cinda's trading platform must be scrutinized further to determine whether it is a safe choice for traders.

Risk Assessment

Engaging with any trading platform carries inherent risks, especially when dealing with unregulated brokers. Profit Cinda presents several risk factors that potential clients should consider before investing. Below is a risk assessment summary:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated status poses significant risks. |

| Fund Security Risk | High | Lack of segregation and protection for client funds. |

| Withdrawal Risk | High | Numerous complaints regarding withdrawal issues. |

| Platform Reliability Risk | Medium | Concerns about execution quality and potential manipulation. |

Given these risks, it is advisable for traders to approach Profit Cinda with caution. Engaging with an unregulated broker can expose traders to substantial financial risks, and they should consider alternative options that offer more robust regulatory oversight and client protection.

Conclusion and Recommendations

After a thorough investigation, it is evident that Profit Cinda exhibits several characteristics that suggest it may not be a safe trading option. The lack of regulation, transparency issues, negative customer feedback, and concerns regarding fund security all point to a broker that could be engaging in questionable practices. Therefore, potential investors should exercise extreme caution when considering whether to engage with Profit Cinda.

For traders seeking a reliable and safe trading experience, it is advisable to explore regulated alternatives with a proven track record of client protection and transparent operations. Brokers that are regulated by reputable authorities, such as the FCA or ASIC, typically provide a safer environment for trading and greater peace of mind for clients. Always remember to conduct thorough research and due diligence before investing in any trading platform.

Is PROFIT CINDA a scam, or is it legit?

The latest exposure and evaluation content of PROFIT CINDA brokers.

PROFIT CINDA Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

PROFIT CINDA latest industry rating score is 1.48, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.48 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.