Is Neverminds Asset safe?

Business

License

Is Neverminds Asset Safe or a Scam?

Introduction

Neverminds Asset is a forex brokerage that has been gaining attention in the trading community. Positioned as a platform for both novice and experienced traders, it promises a variety of trading instruments and competitive conditions. However, with the rise of fraudulent schemes in the forex market, traders must exercise caution and thoroughly evaluate the legitimacy of brokers before committing their funds. The objective of this article is to assess whether Neverminds Asset is a safe trading environment or a potential scam. This evaluation is based on a comprehensive analysis of regulatory compliance, company background, trading conditions, customer experiences, and overall risk assessment.

Regulation and Legitimacy

The regulatory status of a brokerage is a critical factor in determining its legitimacy. A well-regulated broker is more likely to adhere to industry standards and protect client interests. In the case of Neverminds Asset, the following table summarizes its regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Not Registered | N/A | N/A | Not Verified |

As indicated, Neverminds Asset does not appear to be registered with any recognized regulatory authority. This lack of oversight raises significant concerns regarding the safety and security of traders' funds. Regulatory bodies such as the Financial Conduct Authority (FCA) in the UK or the Commodity Futures Trading Commission (CFTC) in the US impose strict requirements on brokers, including capital adequacy, client fund protection, and transparent reporting. The absence of such regulation for Neverminds Asset suggests that it may not be operating under the same level of scrutiny, increasing the risk for clients.

Furthermore, the importance of regulatory compliance cannot be overstated. Without a regulatory framework, there are fewer safeguards for traders, making it easier for unscrupulous practices to occur. Historical compliance issues or a lack of transparency can be red flags for potential scams. Given that Neverminds Asset lacks any regulatory backing, traders should proceed with caution and consider the implications of trading with an unregulated broker.

Company Background Investigation

An in-depth look at the company history and ownership structure of Neverminds Asset can provide valuable insights into its legitimacy. Unfortunately, detailed information about the companys background is sparse. The lack of transparency surrounding its ownership and management team raises questions about its credibility.

The management team is often a critical component of a brokerage's reputation. A team with extensive experience and a solid track record in the financial industry can enhance a broker's legitimacy. However, if the identities and qualifications of the individuals behind Neverminds Asset are not publicly available, it becomes challenging for potential clients to assess the broker's reliability.

Moreover, a broker's transparency in disclosing information, including financial reports and operational practices, is vital for building trust with clients. Brokers that are open about their operations and willing to share relevant information tend to foster a more secure trading environment. In contrast, the lack of such disclosures from Neverminds Asset can be seen as a significant red flag, suggesting that traders should be wary of engaging with this broker.

Trading Conditions Analysis

When evaluating whether Neverminds Asset is safe, it is essential to consider the trading conditions it offers. A clear understanding of the fee structure and trading costs can help traders make informed decisions. Below is a comparison of core trading costs associated with Neverminds Asset and industry averages:

| Cost Type | Neverminds Asset | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1.0 - 2.0 pips |

| Commission Structure | N/A | Varies by broker |

| Overnight Interest Range | N/A | 0.5% - 2.0% |

As shown in the table, specific details regarding the costs associated with trading on Neverminds Asset are not readily available. The absence of clear information about spreads, commissions, and overnight interest rates can be concerning for traders. In a competitive market, reputable brokers provide transparent pricing structures, enabling clients to understand the costs associated with their trades.

Furthermore, any unusual or hidden fees can be indicative of a broker's intentions. For example, if a broker imposes high withdrawal fees or charges excessive spreads, it may signal a lack of transparency and trustworthiness. Therefore, the absence of detailed information regarding trading conditions at Neverminds Asset raises questions about its legitimacy and whether it operates in the best interest of its clients.

Client Fund Safety

The safety of client funds is paramount when assessing the credibility of a forex broker. A trustworthy broker should implement robust measures to protect clients' investments. In the case of Neverminds Asset, it is crucial to examine the safety protocols in place for managing client funds.

Key aspects to consider include fund segregation, investor protection schemes, and negative balance protection policies. Segregating client funds from the broker's operational capital is a fundamental practice that ensures clients' money is safeguarded in the event of the broker's insolvency. Additionally, investor protection schemes, such as those provided by regulatory bodies, offer further security for clients' funds.

However, without proper verification of Neverminds Asset's practices, it is difficult to ascertain whether these safety measures are in place. The absence of any regulatory oversight, as previously discussed, further exacerbates concerns regarding fund safety. If historical incidents of fund mismanagement or disputes exist, they can serve as warning signs for potential clients.

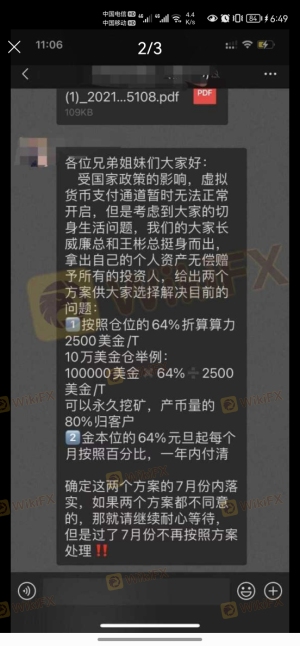

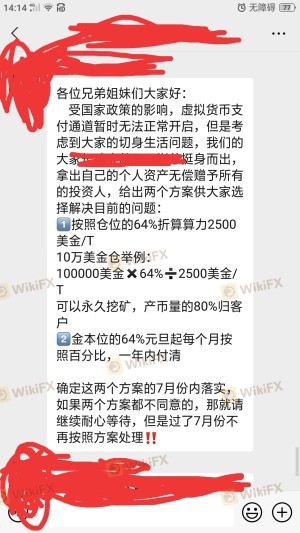

Customer Experience and Complaints

Understanding customer feedback and experiences is essential for evaluating the reliability of a broker. In the case of Neverminds Asset, the lack of accessible reviews and testimonials makes it challenging to gauge overall client satisfaction. However, common complaint patterns can provide insight into potential issues.

The following table summarizes the main types of complaints associated with Neverminds Asset and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Unknown |

| Customer Service Delays | Medium | Unknown |

| Misleading Promotions | High | Unknown |

The absence of a clear response from the company regarding these complaints can be indicative of poor customer service and a lack of accountability. A reputable broker should be responsive to client concerns and actively work to resolve any issues that arise. If Neverminds Asset fails to address customer complaints effectively, it may suggest a disregard for client welfare.

Additionally, specific case studies of clients who have experienced issues with Neverminds Asset could provide further context. For instance, if clients have reported difficulties withdrawing their funds or have faced unresponsive customer service, these experiences can serve as red flags for potential investors.

Platform and Execution

The performance and reliability of a trading platform are critical factors in ensuring a positive trading experience. Evaluating the stability and user-friendliness of Neverminds Assets platform is essential for potential traders. A reliable platform should offer seamless execution, minimal slippage, and no instances of order rejections.

Moreover, any signs of platform manipulation, such as sudden price changes or execution delays, can indicate underlying issues within the brokerage. Traders should be cautious of brokers that exhibit erratic platform behavior, as this can compromise their trading strategies and overall experience.

Risk Assessment

Using Neverminds Asset comes with inherent risks that traders must consider. A comprehensive risk assessment can help potential clients understand the potential pitfalls of trading with this broker. The following risk scorecard summarizes the key risk areas associated with Neverminds Asset:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status increases potential for fraud. |

| Fund Safety Risk | High | Lack of transparency regarding fund protection measures. |

| Customer Service Risk | Medium | Unclear responsiveness to client complaints. |

| Execution Risk | High | Potential for poor execution and platform manipulation. |

To mitigate these risks, traders should conduct thorough research and consider alternative brokers with established regulatory frameworks and positive customer feedback. Engaging with a regulated broker can significantly reduce the likelihood of encountering issues related to fund safety, execution quality, and customer service.

Conclusion and Recommendations

In conclusion, the assessment of Neverminds Asset raises significant concerns about its safety and legitimacy. The lack of regulatory oversight, transparency regarding trading conditions, and insufficient customer feedback all suggest that traders should exercise caution when considering this broker. The absence of clear evidence supporting its credibility raises red flags, indicating that Neverminds Asset may not be a safe environment for trading.

For traders seeking reliable alternatives, it is advisable to consider brokers that are well-regulated, transparent about their operations, and have a proven track record of positive customer experiences. Brokers such as [Alternative Broker 1] and [Alternative Broker 2] offer robust regulatory oversight and favorable trading conditions, making them safer options for forex trading. Ultimately, ensuring the safety of your investments should be the top priority when selecting a trading platform.

Is Neverminds Asset a scam, or is it legit?

The latest exposure and evaluation content of Neverminds Asset brokers.

Neverminds Asset Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Neverminds Asset latest industry rating score is 1.55, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.55 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.