Is Millinium safe?

Business

License

Is Millinium Safe or Scam?

Introduction

Millinium, a forex brokerage, has positioned itself within the dynamic landscape of the foreign exchange market. As an online trading platform, it offers a variety of trading options, including currencies, commodities, and cryptocurrencies. However, the surge in popularity of online trading has also attracted numerous unregulated and potentially fraudulent brokers, making it crucial for traders to thoroughly evaluate the legitimacy and safety of any broker before committing their funds. This article aims to assess the safety of Millinium by examining its regulatory status, company background, trading conditions, customer experiences, and overall risks associated with trading on this platform. Our investigation is based on a comprehensive review of multiple sources, including regulatory filings, user feedback, and expert analyses.

Regulation and Legitimacy

Understanding a broker's regulatory status is paramount in assessing its credibility. Regulation serves as a safeguard for traders, ensuring that brokers adhere to strict operational standards and provide a level of protection for client funds. In the case of Millinium, it is crucial to note that the broker operates without a valid regulatory license.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Not Applicable | N/A | N/A | Not Regulated |

The absence of regulation raises significant concerns regarding the safety of traders' investments. Many regulatory bodies, including the FCA in the UK and ASIC in Australia, enforce stringent requirements for brokers, such as maintaining segregated accounts for client funds and participating in compensation schemes. Millinium's lack of oversight from reputable authorities is a red flag, indicating that traders may be at risk of losing their investments without any recourse. Furthermore, warnings have been issued by various financial authorities against unregulated brokers operating in offshore jurisdictions, which often lack the necessary consumer protection measures.

Company Background Investigation

A thorough analysis of Millinium's company history reveals a lack of transparency about its ownership structure and management team. The company claims to operate in the forex market, but its registration details are often vague, with some sources indicating it is based in offshore locations known for lax regulatory environments. The absence of a clear corporate structure or information about the management team raises questions about the broker's legitimacy.

The credibility of a broker is often reflected in its leadership. A well-experienced management team with a history in financial services can enhance a broker's reputation. However, Millinium's lack of publicly available information about its management team and their qualifications can be a cause for concern. Transparency in corporate governance is essential for establishing trust, and Millinium's opacity in this regard is troubling.

Trading Conditions Analysis

When evaluating a broker, the trading conditions they offer can significantly influence a trader's experience. Millinium's overall fee structure and trading conditions appear to be less favorable compared to industry standards.

| Fee Type | Millinium | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | 2.5 pips | 1.0 – 1.5 pips |

| Commission Structure | None | Varies |

| Overnight Interest Range | High | Moderate |

The spreads offered by Millinium are notably higher than the industry average, which can eat into potential profits for traders. Furthermore, the absence of a clear commission structure raises concerns about hidden fees that may not be disclosed upfront. Traders should always be wary of brokers that do not provide transparent information about their fee structures, as this can lead to unexpected costs.

Client Funds Safety

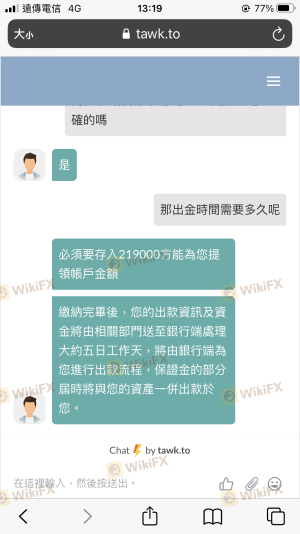

The safety of client funds is a critical aspect of any brokerage's operations. Millinium's lack of regulatory oversight means that there are no guarantees regarding the security of traders' funds. The absence of segregated accounts, which are essential for protecting client funds from being misused, is a significant concern.

Moreover, without investor protection schemes in place, traders may find themselves vulnerable in the event of the broker's insolvency or fraudulent activities. Historical incidents involving unregulated brokers often highlight the risks associated with trading on platforms like Millinium, where clients have reported difficulties in withdrawing funds and concerns over the mismanagement of their investments.

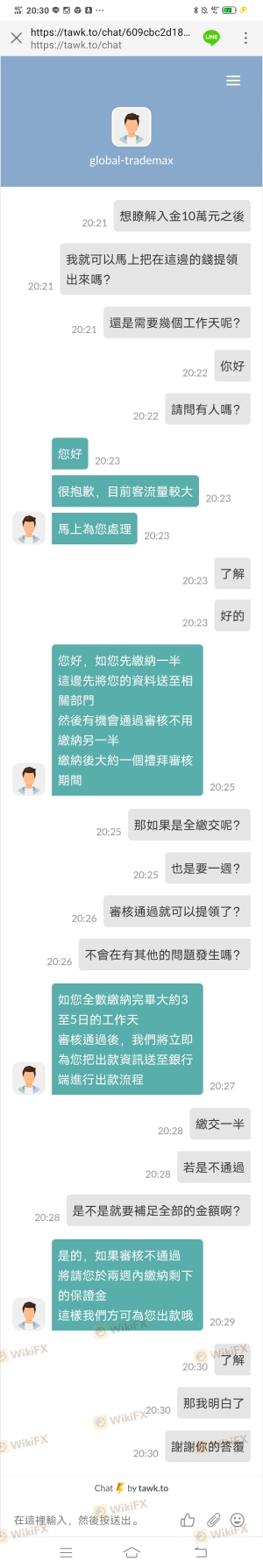

Customer Experience and Complaints

Analyzing customer feedback provides valuable insights into a broker's operational integrity. Reviews of Millinium indicate a pattern of negative experiences among users, with common complaints revolving around withdrawal issues, hidden fees, and poor customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Difficulties | High | Poor |

| Hidden Fees | Medium | Unresponsive |

| Customer Service Delays | High | Unresolved |

For instance, several users have reported being unable to withdraw their funds after making initial deposits, raising concerns about the broker's trustworthiness. Additionally, the lack of prompt responses from customer support exacerbates the situation, leaving traders feeling abandoned and frustrated.

Platform and Execution

The trading platform's performance is a crucial factor for traders, as it directly impacts their trading experience. Millinium offers a platform that may not meet the expectations of seasoned traders, with reports of sluggish performance and frequent outages.

Order execution quality is another area of concern, as traders have noted instances of slippage and rejected orders. Such issues can significantly impact trading outcomes and suggest potential manipulation or technical inadequacies within the platform.

Risk Assessment

Using Millinium entails various risks that traders must consider before engaging with the broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No oversight from reputable authorities. |

| Financial Risk | High | Lack of fund protection and high fees. |

| Operational Risk | Medium | Platform issues and execution problems. |

To mitigate these risks, traders are advised to conduct thorough research and consider using well-regulated brokers that offer greater transparency and security for their investments.

Conclusion and Recommendations

In conclusion, the evidence gathered raises serious concerns about the safety and legitimacy of Millinium as a trading platform. The lack of regulation, transparency issues, high trading costs, and negative customer experiences suggest that traders should approach this broker with caution.

For those seeking a reliable trading environment, it is advisable to consider alternative brokers that are well-regulated and have a proven track record of customer satisfaction. Options such as brokers regulated by the FCA or ASIC may provide a safer trading experience. In summary, the question remains: Is Millinium safe? The overwhelming consensus indicates that it is not, and traders should exercise extreme caution when considering this broker.

Is Millinium a scam, or is it legit?

The latest exposure and evaluation content of Millinium brokers.

Millinium Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Millinium latest industry rating score is 1.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.